Senators Elizabeth Warren & Sherrod Brown push for Apple Card probe by CFPB

Senators Elizabeth Warren and Sherrod Brown are amping up their attacks against Apple Card partner Goldman Sachs' alleged gender bias for applicants, pushing the director of the Consumer Financial Protection Bureau to examine the claims for violations of fair lending laws.

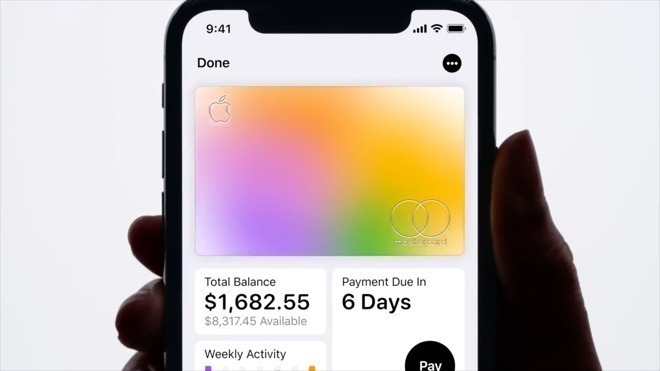

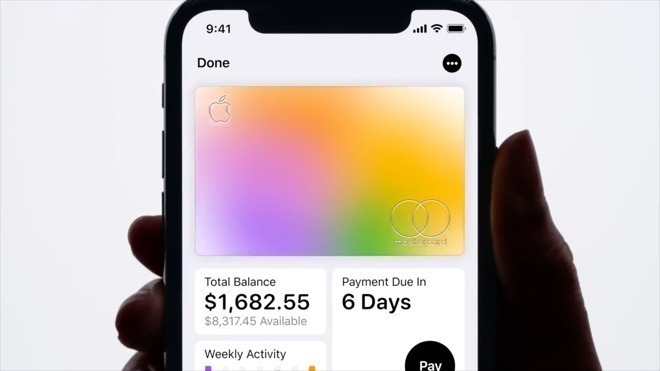

Shortly after stories claiming there to be an algorithmic issue with Goldman Sachs' credit limits for Apple Card, Senators publicly objected to the perceived bias which led to men being offered limits multiple times the size of those provided to women. In a letter to the CFPB, Senators Warren and Brown double down on the matter, and call for the entity to look into matters.

Shortly after the reports surfaced, Goldman Sachs issued a statement claiming all scores were individually calculated, but that it would also reevaluate credit line limits for customers who expected higher offers.

The letter recaps the reports of Apple Card's launch, including Goldman Sachs CEO David Solomon's description of Apple Card as "the most successful credit card launch ever," before discussing how women were offered lower credit terms than men with similar circumstances. The letter highlights Apple co-founder Steve Wozniak's claim he received an offer for ten times the credit limit of his wife, despite sharing the same assets and accounts, and with his wife having a better credit score.

Pointing out the New York State Department of Financial Services has deemed the complaints warrant an investigation into the Goldman Sachs algorithm and whether the decisions it makes "violates state law on the basis of sex," Warren and Brown suggest the CFPB should do the same due to the Equal Credit Opportunity Act it enforces making it unlawful to discriminate "on the basis of race, color, religion, national origin, sex or marital status, or age."

The reports "underscore the importance of the CFPB adequately monitoring the lending practices of financial institutions, including those like Goldman Sachs, that are new to the consumer lending space," the letter states. However, it is unclear how the CFPB evaluates risks for new products and lenders, due to how it "determines its examination schedule based on an assessment of the risks to consumers."

The letter goes on to question about regulatory changes under the Trump administration "have hobbled its role enforcing fair lending laws," such as the stripping of enforcement powers for its fair lending office in 2018. The move "substantially undermined the ability of the Bureau to enforce fair lending laws and has resulted in an opaque structure that leaves it unclear as to who in the Bureau is responsible for handling matters," the senators claim.

"We're concerned that this new structure, where many offices have varying degrees of authority, may allow new potentially discriminatory products to get to market without adequate oversight," the two suggest, before accusing CFPB Director Kathleen Kraniger of allowing the bureau to show "little willingness to fulfill its statutory mandate to enforce lending laws."

Warren and Brown then ask a lost of questions to determine "whether Apple Card faced adequate scrutiny before going to market and in the wake of the allegations related to the Apple Card's terms," as well as how regulatory changes have affected the effectiveness of the bureau.

Shortly after stories claiming there to be an algorithmic issue with Goldman Sachs' credit limits for Apple Card, Senators publicly objected to the perceived bias which led to men being offered limits multiple times the size of those provided to women. In a letter to the CFPB, Senators Warren and Brown double down on the matter, and call for the entity to look into matters.

Shortly after the reports surfaced, Goldman Sachs issued a statement claiming all scores were individually calculated, but that it would also reevaluate credit line limits for customers who expected higher offers.

The letter recaps the reports of Apple Card's launch, including Goldman Sachs CEO David Solomon's description of Apple Card as "the most successful credit card launch ever," before discussing how women were offered lower credit terms than men with similar circumstances. The letter highlights Apple co-founder Steve Wozniak's claim he received an offer for ten times the credit limit of his wife, despite sharing the same assets and accounts, and with his wife having a better credit score.

Pointing out the New York State Department of Financial Services has deemed the complaints warrant an investigation into the Goldman Sachs algorithm and whether the decisions it makes "violates state law on the basis of sex," Warren and Brown suggest the CFPB should do the same due to the Equal Credit Opportunity Act it enforces making it unlawful to discriminate "on the basis of race, color, religion, national origin, sex or marital status, or age."

The reports "underscore the importance of the CFPB adequately monitoring the lending practices of financial institutions, including those like Goldman Sachs, that are new to the consumer lending space," the letter states. However, it is unclear how the CFPB evaluates risks for new products and lenders, due to how it "determines its examination schedule based on an assessment of the risks to consumers."

The letter goes on to question about regulatory changes under the Trump administration "have hobbled its role enforcing fair lending laws," such as the stripping of enforcement powers for its fair lending office in 2018. The move "substantially undermined the ability of the Bureau to enforce fair lending laws and has resulted in an opaque structure that leaves it unclear as to who in the Bureau is responsible for handling matters," the senators claim.

"We're concerned that this new structure, where many offices have varying degrees of authority, may allow new potentially discriminatory products to get to market without adequate oversight," the two suggest, before accusing CFPB Director Kathleen Kraniger of allowing the bureau to show "little willingness to fulfill its statutory mandate to enforce lending laws."

Warren and Brown then ask a lost of questions to determine "whether Apple Card faced adequate scrutiny before going to market and in the wake of the allegations related to the Apple Card's terms," as well as how regulatory changes have affected the effectiveness of the bureau.

Comments

Just gonna grab my popcorn and watch this one unfold.

16 year old boys crash cars more often.

Where’s the stat that says women are worse at paying off credit cards?

Gee, I never would have guessed they'd throw that in there.

Unfortunately, I fear there will be more political points scored on this than actual substantive discussion and progress.

https://www.foxbusiness.com/features/credit-card-debt-is-a-bigger-problem-for-women-vs-men

Oddly, late payments (but paying it off) is much more profitable to the CC issuer than on time but defaulting.

The computer code for these decisions should be open sourced.

At this point, I'd suggested none of us know. We're just pulling stuff out of the air.

Analysis of this would likely lead to diagnosing implicit biases as we've seen reported on recently regarding health care criteria.

All these potential biases need to be outed, especially as they are being incorporated into "deep learning" and automated systems.

Numbers are numbers and some females will have worse credit scores than males and vice versa.

Not everything in life is going to end up equal for everybody and nor should they. Men and women are not identical and nobody should expect their credit ratings to be identical either.

Women currently owe more than men in a number of key categories, including the following:

https://www.usatoday.com/story/money/personalfinance/2018/10/17/wage-gap-debt-gap-women-income-disparity/38145305/

Credit worthiness should be judged on numbers alone and if a woman's numbers suck, then they shouldn't complain about it because fair is fair and people must face the consequences for all of their decisions and habits.

Your total credit exposure across all lenders, as well as your percentage of debt against that total line of credit, are not insignificant factors in applying for additional credit