Apple shares shrug off war threat as analysts scramble to raise their targets

Apple shares rebounded in pre-market and regular session trading on Wednesday as investors appeared to shrug off the potential of escalating tensions between the United States and Iran.

On Tuesday, Apple stock fell from a new high near $300 on concerns that a protracted war might erupt. In after-hours trading, Apple fell even further, down to $292, on news of a retaliatory missile strike by Iran. That wild but temporary drop in after-hours trading represents the increased volatility-- and often irrationality-- in the low volume trading that occurs outside of the market's ordinary trading session.

But the resilience of Apple shares-- even in response to serious threats to the health of the global economy-- demonstrates one of the benefits the company has realized from its massive share buyback program that has taken place across the last decade.

In using its cash to buy back its shares and retire them, Apple has concentrated the value of its remaining shares for its investors. The buyback program has also had the effect of taking shares away from traders willing to sell on negative news. That appears to have significantly eliminated the weak hands remaining among the company's investors, resulting in less irrational fluctuations.

Analysts who formerly appeared capable of knocking billions of dollars off of Apple's valuation by simply issuing a fearsome report speculating about competitive pressures are now seeing a very limited response to their warnings. In part, that may likely be due to their widespread failures to predict or interpret the direction of the market.

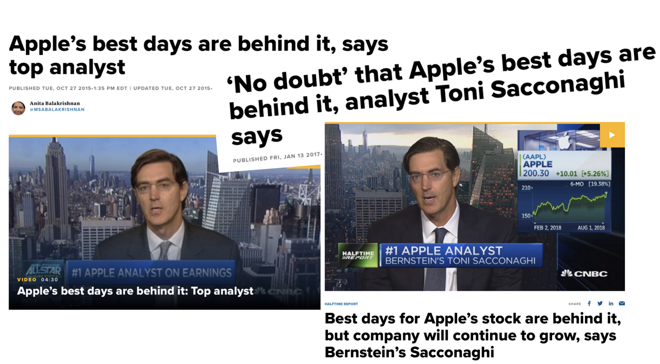

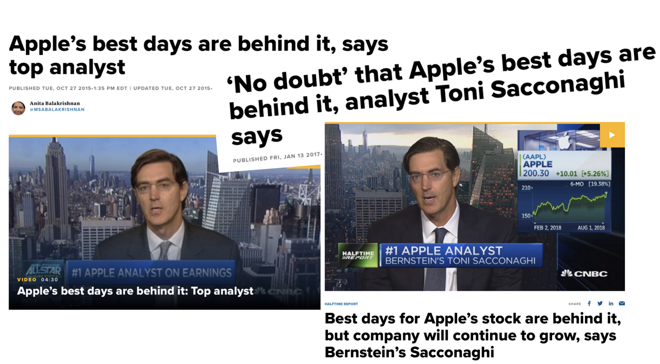

For some reason, this fundamentally incorrect portrayal of Apple was branded by CNBC as the insight of a "top analyst." The network even framed Sacconaghi as being the "#1 Apple Analyst," indicating that the network has no better grasp of qualitative valuations than Sacconaghi.

CNBC touted Toni Sacconaghi as a top Apple analyst but he was dramatically wrong

In December, Sacconaghi finally admitted-- on CNBC no less-- that "We have been neutral on Apple this year and it's been the wrong call. We missed it."

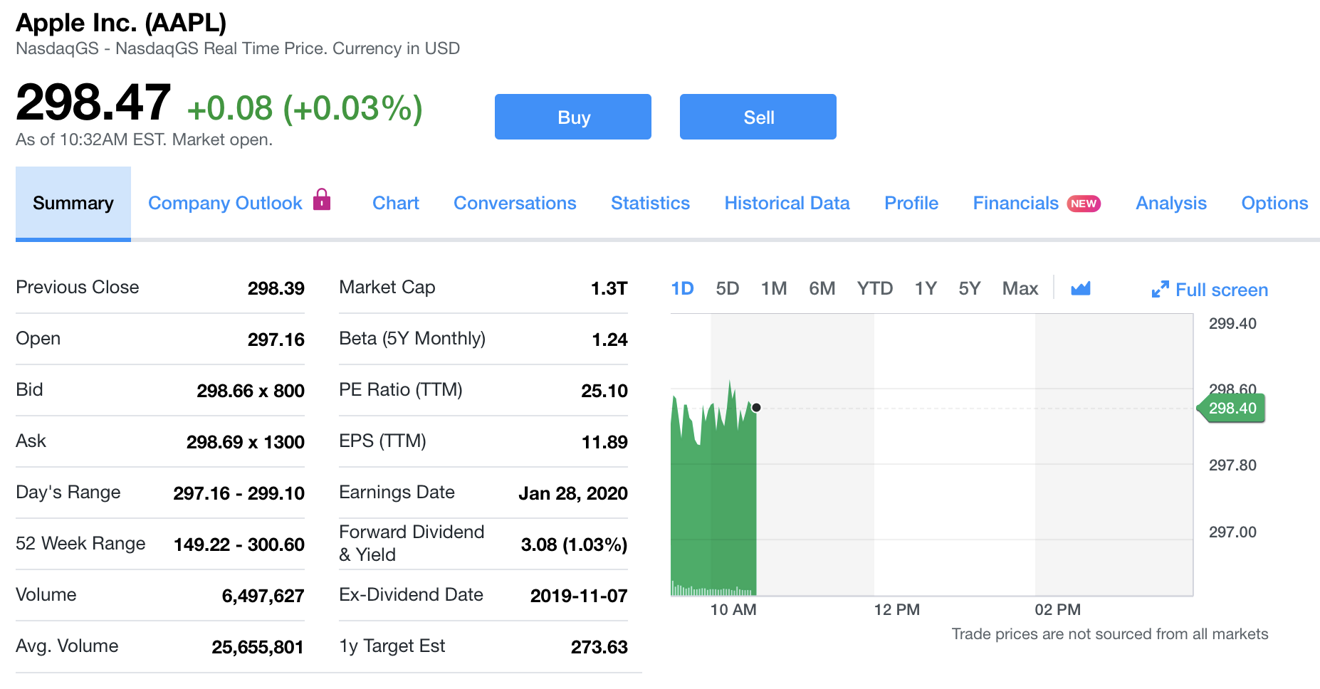

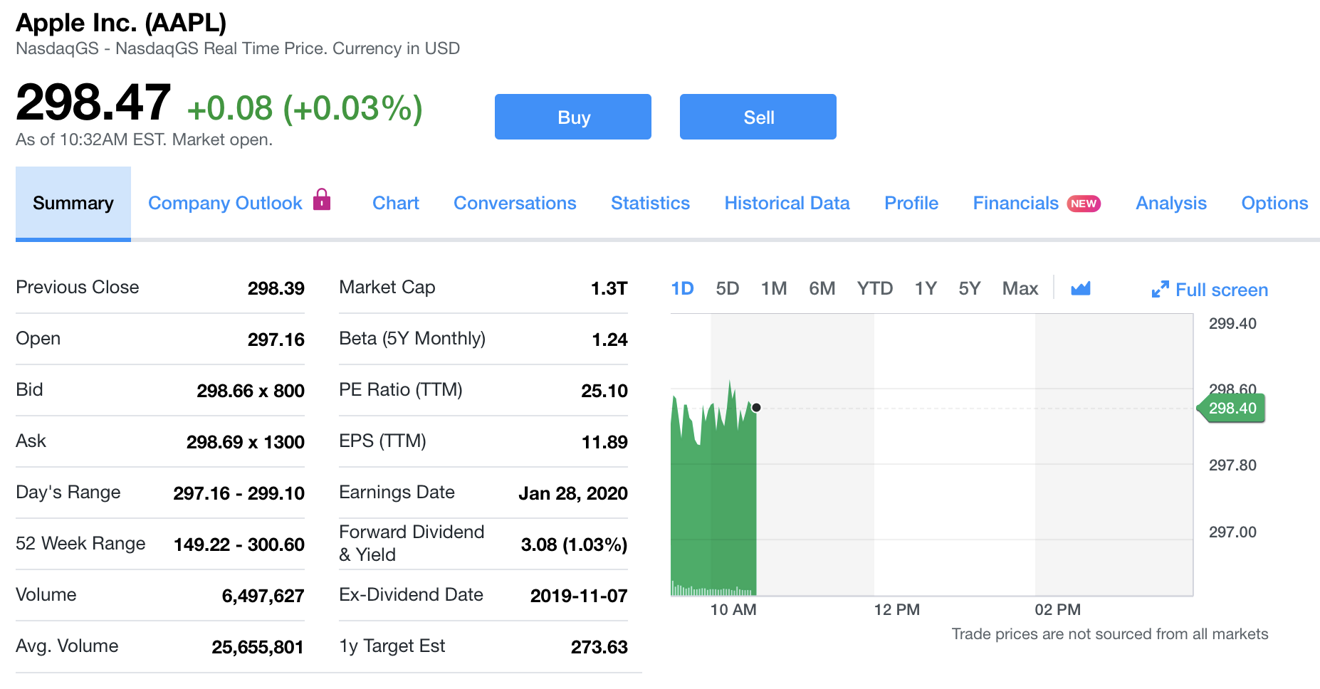

But that mea culpa occurred only after Apple's share price rocketed into record territory as it marched toward its current valuation near $300, increasing by 86% within the last year as it reached a market cap of $1.3 Trillion-- the highest achieved by any tech company, ever.

Philip Elmer-DeWitt of Apple 3.0 recently reported that Sacconaghi was joined by more than a dozen other analysts who "have been scrambling to keep up with the stock all quarter long."

Every one of those stories was wrong. And it was easy to outline why they were wrong at the time they were being promoted as factual. AppleInsider repeatedly did, detailing why supply chain reports were not only unreliable, but had regularly been proven wrong year after year.

Bloomberg, in particular, kept generating reports that appeared grounded in fact, when they were just cherry-picking ideas that supported its narrative of a fading, failing Apple while intentionally excluding material facts that contradicted the story.

It certainly appears possible that the incessantly false reporting targeting Apple has exerted significant negative pressure on the company's share price, meaning that rather than currently being inflated with irrational exuberance, its recent climb is merely a correction of its historical repression by incorrect, ignorant, and occasionally even malicious reports that blinded investors to what was really happening.

Earlier this week, Deutsche Bank analyst Jeriel Ong increased his price target for Apple to $280 but warned investors that "the stock is unlikely to come close to repeating last year's returns."

But performing the math on that means only that Apple is "unlikely" to reach significantly above $550 by the end of 2020, hardly something investors need to be cautioned about.

On Tuesday, Apple stock fell from a new high near $300 on concerns that a protracted war might erupt. In after-hours trading, Apple fell even further, down to $292, on news of a retaliatory missile strike by Iran. That wild but temporary drop in after-hours trading represents the increased volatility-- and often irrationality-- in the low volume trading that occurs outside of the market's ordinary trading session.

But the resilience of Apple shares-- even in response to serious threats to the health of the global economy-- demonstrates one of the benefits the company has realized from its massive share buyback program that has taken place across the last decade.

In using its cash to buy back its shares and retire them, Apple has concentrated the value of its remaining shares for its investors. The buyback program has also had the effect of taking shares away from traders willing to sell on negative news. That appears to have significantly eliminated the weak hands remaining among the company's investors, resulting in less irrational fluctuations.

Analysts who formerly appeared capable of knocking billions of dollars off of Apple's valuation by simply issuing a fearsome report speculating about competitive pressures are now seeing a very limited response to their warnings. In part, that may likely be due to their widespread failures to predict or interpret the direction of the market.

CNBC's "Top #1 Analyst" was totally wrong

Toni Sacconaghi, the "Bernstein Bear" on Apple, has repeated appeared on CNBC to claim that "Apple's best days are behind it," in 2015, 2017, and 2018.For some reason, this fundamentally incorrect portrayal of Apple was branded by CNBC as the insight of a "top analyst." The network even framed Sacconaghi as being the "#1 Apple Analyst," indicating that the network has no better grasp of qualitative valuations than Sacconaghi.

CNBC touted Toni Sacconaghi as a top Apple analyst but he was dramatically wrong

In December, Sacconaghi finally admitted-- on CNBC no less-- that "We have been neutral on Apple this year and it's been the wrong call. We missed it."

But that mea culpa occurred only after Apple's share price rocketed into record territory as it marched toward its current valuation near $300, increasing by 86% within the last year as it reached a market cap of $1.3 Trillion-- the highest achieved by any tech company, ever.

Philip Elmer-DeWitt of Apple 3.0 recently reported that Sacconaghi was joined by more than a dozen other analysts who "have been scrambling to keep up with the stock all quarter long."

Media narratives were as bad as the analysts

Across the same series of years, prominent talking heads recited many of the same narratives contributing to the idea that "Apple's best days were behind it." They were incessantly claiming--as Bloomberg blogger Mark Gurman and the typically anonymous reports from Japan's Nikkei--that few would buy the premium-priced iPhone X, that customers in all markets were really more interested in cheap Androids, and that any problem occurring anywhere in Apple's supply chain could only mean that demand for iPhones was drying up and that nothing else that Apple was doing could possibly make up for a lack of growth in iPhone unit sales.Every one of those stories was wrong. And it was easy to outline why they were wrong at the time they were being promoted as factual. AppleInsider repeatedly did, detailing why supply chain reports were not only unreliable, but had regularly been proven wrong year after year.

Bloomberg, in particular, kept generating reports that appeared grounded in fact, when they were just cherry-picking ideas that supported its narrative of a fading, failing Apple while intentionally excluding material facts that contradicted the story.

It certainly appears possible that the incessantly false reporting targeting Apple has exerted significant negative pressure on the company's share price, meaning that rather than currently being inflated with irrational exuberance, its recent climb is merely a correction of its historical repression by incorrect, ignorant, and occasionally even malicious reports that blinded investors to what was really happening.

Earlier this week, Deutsche Bank analyst Jeriel Ong increased his price target for Apple to $280 but warned investors that "the stock is unlikely to come close to repeating last year's returns."

But performing the math on that means only that Apple is "unlikely" to reach significantly above $550 by the end of 2020, hardly something investors need to be cautioned about.

Comments

I'm more surprised CNBC finally admitted a mistake more than anything else.

And let’s not get started on all the armchair analysts who regularly pontificate here in these forums about Apple’s impending demise. FIRE TIM COOK!!!!!!!

Well, that’s how the stick market works... fear and greed, end of story.

Who was that one [female] analyst that was making bold claims years ago about Apple never possibly hitting $200? That was amusing.... and that was before the stock split!

Haters gonna hate.

Not worth worrying about stuff like that. You don't owe your buddy anything.

Also:

This. And the cherry on top is that Apple paid an average of about $155/share, and in the process removed a third of the shares they had outstanding from about 7 years back. This buyback process was belittled for years, and deemed a "gimmick". But that just kept the stock artificially undervalued for more years. Meanwhile Apple, which knew its own value far better than these armchair quarterbacks, just kept salting away all that cheap stock.

This year, it appears that enough investors have finally awakened to the genius of Apple's buybacks to create a "run" on what is now a much-reduced pool of available stock - and one that Apple itself is still competing for! And why not? How long will it take, even if Apple buys back at the present valuations, before its average buyback price even gets to $200/share, let alone the $300/share it's presently going for?

Meanwhile, those of us who have also salted away AAPL can watch our percentage ownership of Apple increase as Apple removes more and more shares from the market with its enormous and growing cash flow, now surpassing $55 billion in net profit yearly. Heck, they are working hard just to get the cash they already have down to the point where income balances outflow, and that's going to take a couple of years, no matter what!

The irony is that this has been talked about openly for years by those of us who aren't "professionals"....

I don't shortsell, but if I did, I would bet against crappy companies, and certainly not anything like Apple. It seems like a risky and dumb move to make and it goes against common sense.

When I first got into stocks some years ago, I was clueless about it and I would often read news reports and see what others were saying about the stock. I would follow the stocks every day.

Now, I do none of that. I couldn't care less about what any "analyst" has to say about any stock, including Apple, and I've been doing good in the stock market ever since I stopped paying attention.

I'm going to be holding my AAPL shares for a long time, I couldn't care less if WWIII starts tomorrow. Not touching my shares.

I once lost a bet to someone on this forum. I tried to pay up and they wouldn't[t take it so I donated the money in their name. It wasn't a lot (maybe $20?) and I have no idea for whom the bet was made.