Apple thrives in India, China for Q2 despite COVID-19 effects

The iPhone was the most popular premium smartphone in India for the second quarter of 2020, according to IDC, but while the smartphone market in China slumped as a whole, Apple continued to see growth in the important market.

Sanlitun Apple Store in Beijing, China

The onset of the COVID-19 pandemic early in 2020 caused many problems for Apple across the board, including impacting both its supply chain and retail operations. The social distancing measures and socioeconomic issues generated by national lockdowns also had an effect on consumer demand, but according to research from analysts at IDC, it seems that Apple is still doing well in two important countries.

The smartphone market in India has, for the most part, slumped in terms of year-on-year growth for Q2 2020, with the market enduring an average year-on-year decline in shipments of 50.6%. For the top five vendors, the most popular Xiaomi saw its shipment volumes slashed from 10.4 million units in Q2 2019 to 5.4 million for Q2 2020, with second-place Samsung faring similarly, going from 9.3 million down to 4.8 million.

While Apple wasn't in the top five vendors in India, IDC did call out some of Apple's successes in specific segments.

For the mid-premium segment, for devices between $300 and $500, Apple's iPhone SE reboot was among the top models, though the group as a whole saw a decline of 4.8% overall. In the premium category, classed as smartphones valued at $500 or more, the group declined by 35.4% year-on-year, but Apple still held on to a 48.8% share of the market.

The iPhone 11 and iPhone XR accounted for approximately 28% of premium smartphone shipments in the period.

Apple's fortunes in India follow at a time when it is looking to increase its manufacturing capability in the country, as part of India's $6.6 billion Production-Linked Incentive Scheme. There has also been the suggestion that Apple was moving six iPhone production lines to India, in a bid to diversify its production capabilities from a China-centric system.

For the top five vendors, Apple resides in fifth place, though it has seen the best improvement in the group. For Q2 2020, Apple enjoyed a year-on-year growth in shipments from 6.6 million units to 7.3 million. Apple did score the highest growth out of the top five, with the popular Huawei seeing 9.5% growth year-on-year while Vivo, Oppo, and Xiaomi shipments shrank by 18%, 22.7%, and 21.9% respectively.

The iPhone SE contributed 10% of overall shipments in the period, and IDC reckons it helped to stimulate off-season shipments. There was also additional support brought on by the "618" shopping festival and better "offline-channel incentives" for iPhone purchases.

In its quarterly results, Apple revealed it hard earned $9.3 billion from the greater China region, up 1.9% year-on-year and with the iPhone 11 being Apple's best-selling phone for the market.

It remains to be seen if this success will continue, as escalating tensions between the United States and China over TikTok and other subjects may cause some backlash from consumers or the Chinese government, which could impact Apple's future sales.

Sanlitun Apple Store in Beijing, China

The onset of the COVID-19 pandemic early in 2020 caused many problems for Apple across the board, including impacting both its supply chain and retail operations. The social distancing measures and socioeconomic issues generated by national lockdowns also had an effect on consumer demand, but according to research from analysts at IDC, it seems that Apple is still doing well in two important countries.

The smartphone market in India has, for the most part, slumped in terms of year-on-year growth for Q2 2020, with the market enduring an average year-on-year decline in shipments of 50.6%. For the top five vendors, the most popular Xiaomi saw its shipment volumes slashed from 10.4 million units in Q2 2019 to 5.4 million for Q2 2020, with second-place Samsung faring similarly, going from 9.3 million down to 4.8 million.

While Apple wasn't in the top five vendors in India, IDC did call out some of Apple's successes in specific segments.

For the mid-premium segment, for devices between $300 and $500, Apple's iPhone SE reboot was among the top models, though the group as a whole saw a decline of 4.8% overall. In the premium category, classed as smartphones valued at $500 or more, the group declined by 35.4% year-on-year, but Apple still held on to a 48.8% share of the market.

The iPhone 11 and iPhone XR accounted for approximately 28% of premium smartphone shipments in the period.

Apple's fortunes in India follow at a time when it is looking to increase its manufacturing capability in the country, as part of India's $6.6 billion Production-Linked Incentive Scheme. There has also been the suggestion that Apple was moving six iPhone production lines to India, in a bid to diversify its production capabilities from a China-centric system.

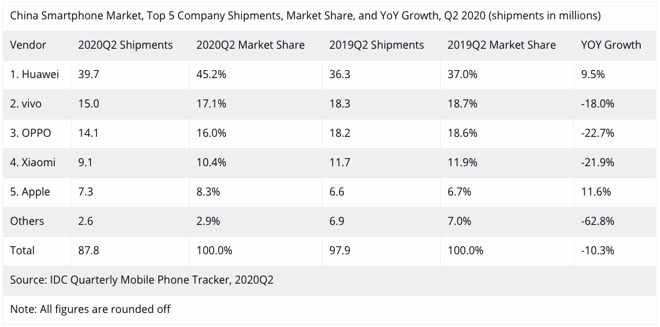

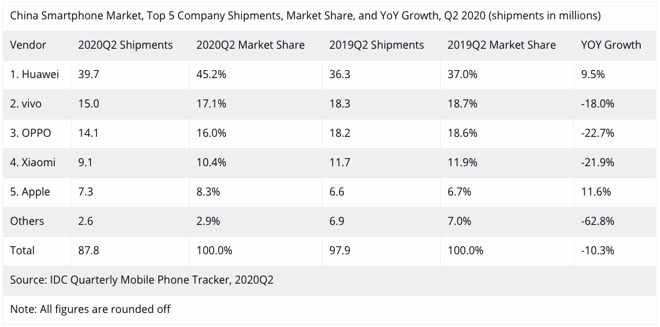

China growth while rivals decline

In China, the smartphone market also saw reduced shipments compared to the same period last year, with an overall decline of 10.3%. The decline is narrower than the 20.3% decline seen for the previous quarter, and brings the overall contraction for the first half of 2020 to 14.9%.

For the top five vendors, Apple resides in fifth place, though it has seen the best improvement in the group. For Q2 2020, Apple enjoyed a year-on-year growth in shipments from 6.6 million units to 7.3 million. Apple did score the highest growth out of the top five, with the popular Huawei seeing 9.5% growth year-on-year while Vivo, Oppo, and Xiaomi shipments shrank by 18%, 22.7%, and 21.9% respectively.

The iPhone SE contributed 10% of overall shipments in the period, and IDC reckons it helped to stimulate off-season shipments. There was also additional support brought on by the "618" shopping festival and better "offline-channel incentives" for iPhone purchases.

In its quarterly results, Apple revealed it hard earned $9.3 billion from the greater China region, up 1.9% year-on-year and with the iPhone 11 being Apple's best-selling phone for the market.

It remains to be seen if this success will continue, as escalating tensions between the United States and China over TikTok and other subjects may cause some backlash from consumers or the Chinese government, which could impact Apple's future sales.

Comments

Of the almost 88 million handsets shipped during Q2, just over 7 million went to Apple.

The reasons for this are many (trade war, COVID-19, Huawei) but this point is crucial IMO:

"In 2020Q2, almost half of the smartphones in China were shipped with 5G connectivity – ahead of other regions or countries"

Given the accelerating push on 5G in China, not having a 5G iPhone is clearly a limiting factor.

Apple's record-breaking quarter was fine. Apple reported record users in all categories.

I'm starting to think you're the only person who cares about 5G.

We are not talking about other areas nor anything non-iPhone related.

Keep that in mind.

https://www.businesswire.com/news/home/20200728005390/en/Smartphones-Sold-China-Q2-2020-5G-Phone

But hey, Huawei sold 60% of those, so break out the vino and celebrate!

There are a shit ton of cheap phones sold in China, and given that Apple is a few months out from selling 5G phones, as you suggested, with the latest modem from Qualcomm, I'm not too worried about iPhones sales. More to the point, I would guess that there are very few Chinese iPhone owners that wouldn't wait for this fall's iPhone refresh.

And this is not about the the iPhone 12 either.

It's about Q2.

No need to think that strategy or its outcome will be any different in India or China.

You know, I know, and the Chinese know, that iPhone 12 is coming, with few delays, according to the latest reports. Any sales before that are with the knowledge that a number of 5G models are coming out, and yet, Apple's shipments improved YOY.

I told you to celebrate Huawei's great victory, but it's just one quarter after another in the end.

Apple adjusted prices downwards worldwide but allowed Chinese retailers to add further discounts. This even before COVID-19 struck.

China has been a problem for Apple and its strategy wasn't really moving the needle there. Now we have another stab at a low cost iPhone (SE) while competitors move into Apple's preferred territory. This from the IDC article linked here:

"Huawei continued to capture a higher market share at 45.2% with its strong brand image and well-rounded product portfolio. The vendor successfully targeted the US$300-600 segment with its Huawei nova 7 and Honor 30 series, and enhanced its premium position with the Huawei P40 Pro series"

That is a two pronged assault that has reaped rewards.

And an that well-rounded product portfolio obviously includes something for everyone, including 5G.

From September onwards there will be severe market distortion because Trump is trying to cut off Huawei's chip supply and that will obviously aide Apple (if China doesn't go into tit for tat mode and pull the rug out from under Apple) combined with finally having 5G on board.

Of course, we will know in late January, won't we, when Apple announces its quarterlies, but Huawei will be in much more pain than Apple will be, mostly because China needs Apple. Push Apple out, and China has just thrown the switch on full blown disengagement from the West. Not good for Xi Jinping's rule for life.

Acually, China throwing that switch would be okay with me. China is a Authoritarian state that needs to feel the pain of world isolation, and before you go "but Trump", the odds are that we will have a new President in January, and I doubt that the U.S. will ever be going back to placating China for cheap goods.

Looking at the figures presented, do you think Apple is thriving?

The IDC comments also specifically highlight the non-cheap angle regarding the best performer in that market.

But how wonderful Huawei is doing on its home turf. You should be so proud, and you are.

In spite of that I celebrate the steps Apple has taken but that isn't what is being presented by IDC, is it?

What do you actually disagree with in what I said? You can, it is an opinion, after all.

Discounting is typical among Android vendors. It is not typical for iPhone sales. Apple notorious for trying to keep discounting very much under strict control.

For one, Android handsets are refreshed far more frequently because of intense competition. That led to new features coming thick and fast and over the last few years especially has left Apple to catch up.

So, when Apple does discount, it is indicative of something going wrong in the plan. It is part of a correction. That is not the case on Android.

Huawei is very much competing with Apple. You do not need a demonstration of that.

Ponds are only so big. The market for high end phones is also only so big. The more players in that pond, the more sales are shared out. Huawei is absolutely on Apple's ultra premium turf and each successive year has seen its premium sales increase. Huawei is definitely having an impact on Apple in China. Worldwide, the 'duopoly' is gone. It is now a three horse race and Huawei has impacted both Samsung and Apple.

Stop being so full of yourself.

What is a discussion forum for if not to discuss? If you start writing without even reading what you are replying to, you are not doing yourself any favours.

That's your call though.