Five years later, the Apple Card is a huge but controversial success

On August 20, 2019, Apple officially launched Apple Card with any US citizen able to apply. Since then it's been a hit, but it's faced controversy over everything from low reward rates to alleged sex discrimination -- and Apple's partner wanting to pull out.

Apple Card

In every sense bar one, Apple Card is a typical Apple product. It was rumored for years, it launched to fanfare and criticism, plus it was even thought of first by Steve Jobs. The difference is that apart from its titanium card, it's not hardware, and apart from its app, it's not really software either.

When we all look back to see exactly when Apple really pivoted from being a hardware company to a services one, we're going to be sure it was 2019. It might even be March 25, 2019, when Apple eschewed its regular launching of new MacBooks, iPads or education products.

Instead, those products were hurriedly announced in press releases ahead of the event, so that the day itself could be devoted to services. Most of the event was the announcement of Apple TV+, but Tim Cook also confirmed that the rumored Apple Card was coming.

This is another departure from the Apple of old. It's now rare for the company to reveal anything and conclude with the words "available today," but most of this event left us waiting a long time.

While Apple News+ was announced and actually launched, Apple TV+, Apple Arcade, and Apple Card were all given the full launch treatment -- bar an actual date.

Apple Card pre-history

We would end up waiting 148 days before Apple Card was available. But in truth, we'd really been waiting for something more like 15 years.

Following the departure of the GE Capital Apple Credit Card, used to exclusively buy Apple products, Steve Jobs proposed an Apple-branded credit card. It wasn't a casual thought, either, as the company went very far down the line of making it a reality.

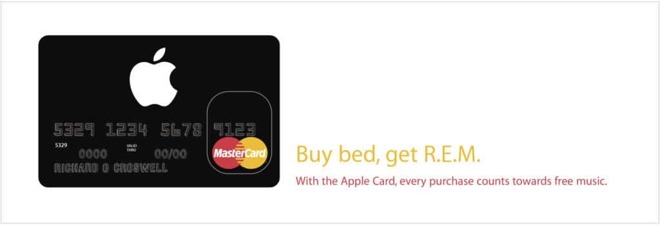

Original marketing materials for what would have been an Apple Card in 2004. Notice the name on the card: Richard O Croswell was an executive at MBNA at the time.

According to Apple's then advertising agent, Ken Segal, plans were sufficiently advanced that an ad campaign was mocked up and ready to go. Seemingly Jobs couldn't get the terms he wanted out of card companies like Mastercard, and he dropped the entire plan.

Tim Cook may not necessarily have got exactly the terms Apple wanted either, but he did negotiate a deal with Goldman Sachs that at least appeared to work for both companies.

While Goldman Sachs has worked with Apple since Steve Jobs returned to Cupertino, it appears to have specifically negotiated about a credit card since sometime in 2018. The key difference between then and 2004, though, is that there was now Apple Pay.

Goldman Sachs reportedly wanted a consumer product, instead of its business-to-business financial offerings, and Apple had this extremely successful payment system. Launched in 2013, Apple Pay sees transactions across the US and 50 countries.

Waiting to launch

Based on the existing wide reach and high adoption of Apple Pay, the one group that didn't wait for the actual launch of Apple Card was the financial press. Investment banks such as HSBC predicted that the "large potential captive market" would mean a windfall for Apple and Goldman Sachs.

Jennifer Bailey, Apple's Vice President of Internet Services, and Apple Pay, announcing Apple Card

Basing calculations on the idea that around half of Apple's then 146-million adult users in the US could qualify, HSBC predicted net income up to $300 million in the first year and up to $1.5 billion by 2025.

Those were guesses, but what we learned for sure shortly after launch was that Goldman Sachs' investment in Apple Card was serious, working out at $350 per user.

And Goldman Sachs specifically told its investors in October 2019 that Apple Card had gone quite well. It was "the most successful credit card launch ever," said the company.

Tim Cook said much the same in an Apple earnings call in July 2020. Asked about how buyers had adapted to the coronavirus lockdowns, Cook said that it was clear from Apple Card how things had moved.

"We saw changes in consumer spending as the shutdowns occurred and store closures occurred, we could we could see that across the Card," he said. "It affected the categories that you would guess the most like travel and, and entertainment etc."

"But overall," he continued, "if you sort of pull the lens out on the Apple Card, we're we're very happy with the number of people that have [one]."

"We believe based on what we've heard that it's the fastest rollout in the history of credit cards and so we feel very good about that," he concluded.

The controversies begin

Back when that rollout was beginning, Apple may have opened applications to all US citizens in August, but there were many people using it before then. They consisted of various trial runs, some Apple staff, and selected beta users. And some of them had problems.

Specifically, very shortly after the launch, they were already able to say that after a month's use, the titanium Apple Card showed wear. Apple's legion of support documents for Apple Card user quickly added one about how to take care of it -- and clean the titanium.

Speaking of titanium, though, it turned out that the card wasn't entirely made of that material, not absolutely entirely. For a start, the white finish is a coating, but people with a scanning electron microscope and not enough real work to do, dug further.

The University of Berkley reports that Apple Card is 90% titanium. The remainder is an alloy that chiefly comprises aluminum.

Vastly more serious was the controversy that began in November 2019 where Apple and Goldman were accused of sex discrimination. The first accusation came from David Heinemeier Hansson, then best known for creating Ruby on Rails, but now perhaps better known for complaining about the App Store and its treatment of his Hey email app.

The @AppleCard is such a fucking sexist program. My wife and I filed joint tax returns, live in a community-property state, and have been married for a long time. Yet Apple's black box algorithm thinks I deserve 20x the credit limit she does. No appeals work.

-- DHH (@dhh)

Although Apple promotes the card as having been "created by Apple," it's really curated by Goldman Sachs. That company, along with unspecified other partners, is the one that determines eligibility for the card and sets credit limits.

"We have not and never will make decisions based on factors like gender," responded Goldman Sachs Bank CEO Carey Halio said in statement. "In fact, we do not know your gender or marital status during the Apple Card application process."

As Goldman Sachs denied any gender bias in its credit ratings, Apple co-founder Steve Wozniak claimed to have seen a similar disparity between him and his partner. And then US Senators got on the case.

Goldman Sachs's Halio asked Apple Card holders to contact the company if they had received unexpected credit limits. "If you believe that your credit line does not adequately reflect your credit history because you may be in a similar situation, we want to hear from you," she said. "Based on additional information that we request, we will re-evaluate your credit line."

The New York Department of Financial Services announced in November 2019 that it would be formally conducting an investigation. In March 2021, it reported that the investigation "did not produce evidence of deliberate or disparate impact discrimination but showed deficiencies in customer service and transparency."

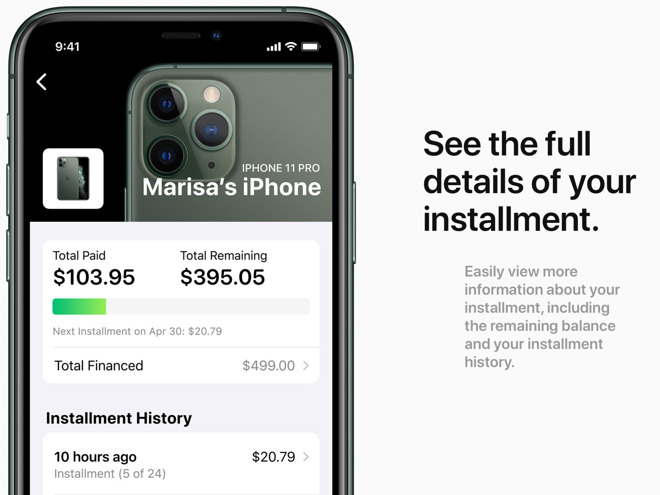

You can now pay for an iPhone in instalments using Apple Card

Positives and negatives

In good news about Apple Card, December 2019 saw Apple add the ability for users to buy iPhones on their cards and pay in instalments. Apple Card offers 3% Daily Cash on purchases made from Apple, and despite the instalment plan, buying an iPhone counts as one purchase.

So this was both a long term aid to spreading the cost of a new iPhone, and it was an immediate benefit, too. Then in June 2020, Apple extended the programme to mean you can buy almost any Apple devices this way, just not an Apple Watch or an iPod touch for some reason.

There was also the way that to help people during the COVID-19 situation, Apple allowed Apple Card users to defer their March 2020 payments. The company continued to do that through the next several months.

Similarly, depending on your point of view, Apple also launched a way to help people whose poor credit scores meant they were refused an Apple Card -- or Apple found a way to get more users. In July 2020, the company launched "Path to Apple Card," a program that helps them assess and improve their financial situation.

Included in the four-month program is advice that ranges from how reducing debt and paying on time helps. At the end of the program, users are invited to apply again for an Apple Card.

This launched alongside a new Apple Card financial health website. So there's definitely an educational element here, but arguably it was prompted by allegations that Apple and Goldman Sachs were accepting applicants with "sub prime" credit records.

Apple iterates on the Apple Card

We'll never know what changes or improvements Apple and Goldman Sachs may have done to their internal processes across the first year of Apple Card. However, as that year was coming to an end, Apple did launch a couple of new features that were surprisingly absent in the original release.

Specifically, it made some online changes. Whereas before, you could only pay off your Apple Card via your iPhone, from July 2020, Apple added a way to do it online.

Then Apple added a feature you could've sworn must've been there from the start. As of August 12, 2020, you can now use Apple Card to buy from the online Apple Store.

Apple Card 2.0

Although Apple could offer better rewards for using Apple Card, otherwise it's hard to see what could be added next.

Right now Apple Card appears to be working for potentially millions of people, perhaps undertaking billions of transactions. It's bringing those people some rewards, and some convenience, while presumably earning Apple a nice amount.

If it's only tenuously hardware, and tenuously software, this Apple Card service represents the new Apple in every way -- bar one.

Apple Card remains exclusively available in the United States. That's despite an early promise from Goldman Sachs, made before the card had even officially launched.

"We're going to start in the US," said Goldman Sachs International CEO Richard Gnodde, "but over time, absolutely, we will be thinking of international opportunities for it."

Tumbleweed and regrets

As it turned out, it took until 2023 before there would even be one rumor of Apple Card coming to any other country. Multiple sources then reported that Tim Cook held talks with banks in India while he was there for the opening of the country's first two Apple Stores.

There have been small adjustments to the terms and conditions of Apple Card, including one where buyers can only use its monthly instalment feature on iPhones that come with a carrier instead of simply being unlocked.

Much more welcome was the long delayed launch of a high yield savings account in April 2023. Apple Card users could use this account as a regular savings one, and also have their Daily Cash automatically go into it.

That saw $1 billion in its first four days, and then a total of $10 billion saved into it just over its first three months.

Not everyone wins

But even as all of this was seemingly going very well for Apple, it doesn't appear to have been great for Goldman Sachs. The company has pulled out of all its other consumer projects and while that's not all down to Apple Card, the costs of that were a contributor.

From around mid-2023, it started to be first rumored and then reported that Goldman Sachs wanted to get out of its Apple Card deal.

At one point, Apple issued a statement that was notable for taking quite a few words in order to say nothing.

"Apple and Goldman Sachs are focused on providing an incredible experience for our customers to help them lead healthier financial lives," said the company. "The award-winning Apple Card has seen a great reception from consumers, and we will continue to innovate and deliver the best tools and services for them."

Those tools and services would not, though, include a previously planned stock trading app. Apple and Goldman Sachs reportedly abandoned that plan in September 2023.

The future of Apple Card

As yet, there has not been an official announcement of Goldman Sachs and Apple parting ways. The two companies had a deal to continue working together until 2029, but it has been repeatedly reported that they are now aiming to stop by no later than the end of 2025.

That's based on reports from around November 2023 that the two firms were working on a 12- to 15-month plan for separating.

Neither company is likely to discuss the separation until it is complete. However, assuming that it is correct that Goldman Sachs will leave, and nothing happens to change that, Apple apparently has two options.

Apple could partner with another financial company -- or it could conceivably just back the whole project itself. It clearly chose not to do that when it launched Apple Card, despite presumably having the funds to do it, but five years on, things may have changed.

For when Apple Card came out, Apple had no experience in consumer credit. Yet since then, it has briefly launched a Buy Now Pay Later (BNPL) service.

Apple Pay Later, as it was called, rolled out in October 2023 and was reportedly a success. But presumably it wasn't enough of a hit, as Apple axed it less than a year later, in June 2024.

What might be significant for Apple's future financial offerings, however, is how its Apple Pay later service was funded. While Apple did use a third-party firm to manage the process, this time the whole operation was funded by Apple.

Even though it failed, this is a significant departure from its having had to partner with Goldman Sachs for Apple Card.

Then, too, it would seem likely that there would be no significant changes or expansion of Apple Card and its services if the two firms were busy parting ways. There certain was the abandonment of the stock trading app, and there is still no Apple Card outside the US.

But on the eve of its fifth anniversary, Apple Card launched a rather rare and presumably costly sign-up bonus of $300.

Apple Card had no such sign-up bonus when it began. Since then, chiefly because of competition, it has offered these up to $200. Describing the new offer as a welcome bonus, it means that Apple will deposit $300 in a new Apple Card user's account, under certain conditions.

Specifically, they have to be new users, have to be accepted by September 3, 2024, and then spend $1,500 on the card within the following 60 days.

That's typical for a sign-up bonus so it's not a radical departure for Apple. But it is a sign of Apple Card being invested in, of Apple Card having a future.

Despite the losses apparently felt chiefly by Goldman Sachs, and despite the failure to expand Apple Card beyond the US, the card is a hit. For the fourth year in a row, it has topped JD Power's survey of customer satisfaction ratings in its category.

So it's highly popular and it's a profitable hit for Apple, even though it isn't expanding beyond the US.

In two senses, then, Apple Card isn't going anywhere.

Read on AppleInsider

Comments

And Tim knows it, because it’s part of his bottom of the pyramid strategy targeted at all Joe Six-packs that need that pseudo-titanium status symbol.

What a great partner & self-interest icon is that.

And if people do carry the card because they like the way it looks, so the fk what? No different than carrying an AMEX platinum card or any other card with "pretty" graphics.

Hidden agenda? Yeah, Goldman-Sachs wants you not to pay the bill in full at the end of the month so they can charge interest and make money. Anyone with smarts will NEVER pay interest on a credit card. And I'm sure they collect data on your purchases, same as any other credit card.

The only time I don't use the Apple Card is when I'm purchasing from B&H, a giant electronics/computer/photography independent retailer in NY. They have a credit card in which they credit back the sales tax, which is currently 8.875%, so that's a much larger savings. So I would still buy Apple hardware from them, not from Apple.

Personally, I think your reaction borders on insanity. Do you really believe that only Joe Six Packs carry credit cards? Get over it. It's not a big deal either way,.

Also, what's stopping Apple from becoming a bank?

David Hannson is a white knight moron. Everyone gets different terms. If my wife gets better terms is Apple Card RacIsT Too Me?!?!

iPhone and iPad were also dismissed as toys but a CREDIT CARD?? How the hell is money a "toy"?

Or that he doesn’t have the same credit history as his wife.

I would, however, love for Apple to make the physical card a little less prone to scratching too easily and getting scuzzy (yes, I know I can request a replacement).

NZ wouldn't complain about "muh sexism' if we were the next country to get the card!