Bumble warns Apple privacy push could hurt business in IPO filing

The dating app Bumble used its IPO filing on Friday to warn investors Apple's ongoing efforts to improve user privacy may hurt its bottom line in the long run.

On Friday, Bumble filed its IPO with the U.S. Securities and Exchange Commission, which reveals Bumble's plans ahead of selling stock to the public for the first time. Within the filing, which includes lists of things that could be a risk to the company's future existence, Bumble mentions Apple's Identifier for Advertisers (IDFA) and changes that will make it harder to use the code for advertising to users.

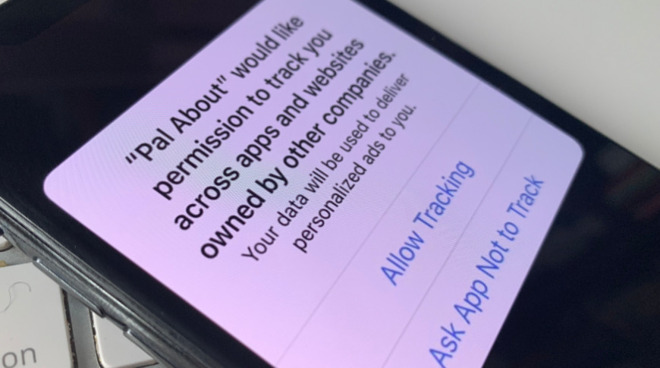

The IDFA is a string of characters used to refer to a specific user's iPhone, which can be used by advertisers to track a user and offer a more personalized and targeted advertising. As part of Apple's expansion of privacy protection, the company is requiring users to grant permission for an app to track them across apps and websites owned by third parties.

While the feature was delayed to give developers and advertisers more time to prepare, it has started to appear in betas for iOS 14.4, which means it could be included in a public-facing update in January or February.

Giving the option to opt-in or out of tracking to users on a per-app basis increases the chances the user will decline it, stopping the app and its third-party partners from tracking the user with the IDFA. In the Bumble IPO, CNBC reports the dating service believes it has poor prospects in using IDFA at all.

Bumble anticipates that the number of users that will agree to the opt-in tracking will be between 0% and 20%, with the vast majority opting out. To Bumble, this would make it harder for advertisers to "accurately target and measure their advertising campaigns at the user level," and could cause some apps to experience an "increased cost per registration."

For the entire year of 2019, Bumble had advertising expenses of $130.4 million. If the cost per registration increases as expected, this could increase the app's annual marketing cost, or at the same value, reduce its effectiveness by bringing in fewer new users.

The change also applies to Bumble's revenue, though at a lower level of impact. The bulk of its revenue is from subscriptions and in-app purchases, but some is also earned from advertising within the app.

While Bumble admits it has other methods to track users, such as those who link their Facebook profiles to their account, there's no guarantee that alternative ways to track a user will be available.

The IPO also mentions Apple about other fairly standard concerns, such as if it changed terms relating to the App Store, outages, and fees for payments.

Bumble is the latest company to anticipate problems with Apple following the introduction of its new iOS privacy features.

Apple's biggest critic on the matter is Facebook, which launched a full campaign against the feature, but ultimately admitted it had "no choice" but to comply with the change. Previously, Facebook estimated it would see a drop in advertising revenue of up to 60% once the change is implemented.

On Friday, Bumble filed its IPO with the U.S. Securities and Exchange Commission, which reveals Bumble's plans ahead of selling stock to the public for the first time. Within the filing, which includes lists of things that could be a risk to the company's future existence, Bumble mentions Apple's Identifier for Advertisers (IDFA) and changes that will make it harder to use the code for advertising to users.

The IDFA is a string of characters used to refer to a specific user's iPhone, which can be used by advertisers to track a user and offer a more personalized and targeted advertising. As part of Apple's expansion of privacy protection, the company is requiring users to grant permission for an app to track them across apps and websites owned by third parties.

While the feature was delayed to give developers and advertisers more time to prepare, it has started to appear in betas for iOS 14.4, which means it could be included in a public-facing update in January or February.

Giving the option to opt-in or out of tracking to users on a per-app basis increases the chances the user will decline it, stopping the app and its third-party partners from tracking the user with the IDFA. In the Bumble IPO, CNBC reports the dating service believes it has poor prospects in using IDFA at all.

Bumble anticipates that the number of users that will agree to the opt-in tracking will be between 0% and 20%, with the vast majority opting out. To Bumble, this would make it harder for advertisers to "accurately target and measure their advertising campaigns at the user level," and could cause some apps to experience an "increased cost per registration."

For the entire year of 2019, Bumble had advertising expenses of $130.4 million. If the cost per registration increases as expected, this could increase the app's annual marketing cost, or at the same value, reduce its effectiveness by bringing in fewer new users.

The change also applies to Bumble's revenue, though at a lower level of impact. The bulk of its revenue is from subscriptions and in-app purchases, but some is also earned from advertising within the app.

While Bumble admits it has other methods to track users, such as those who link their Facebook profiles to their account, there's no guarantee that alternative ways to track a user will be available.

The IPO also mentions Apple about other fairly standard concerns, such as if it changed terms relating to the App Store, outages, and fees for payments.

Bumble is the latest company to anticipate problems with Apple following the introduction of its new iOS privacy features.

Apple's biggest critic on the matter is Facebook, which launched a full campaign against the feature, but ultimately admitted it had "no choice" but to comply with the change. Previously, Facebook estimated it would see a drop in advertising revenue of up to 60% once the change is implemented.

Comments

Not one iota of empathy or concern for them or their investors and the bankers and brokers doing their IPO.

I have plenty of issues with Apple, but this is not one of them. On this matter Apples gets an 11 out of 10.

Zuckerberg should rot in hell for what he has done to all of us and our country. It is only appropriate he and those like him suffer significant economic consequences.

I could be wrong, but I can not find anywhere in the article where it says Bumble lost $100 MM. The reason I can't find it is because it doesn't say that and they didn't lose $100 MM. It doesn't mention any amount of financial losses.

From what I read, the article is about the effects Apple's new privacy policies could have on their business prospects moving forward.

I can't figure out who's the bigger moron here...

They present themselves as add-free and rather expensive pay-as-you-go dating service.

To charge, and to then on top of it track, spy on, and exploit users private data, is beyond reprehensible.

If it were a “free” service, that would be expected...

How web-stalking got to be a viable business model for anything in the free world is quite beyond me, but it should be made flatly illegal -- same as personal stalking.