Apple reportedly in talks with multiple Japanese automakers over 'Apple Car'

With "Apple Car" rumors heating up, a report on Thursday claims Apple is in discussions with at least six Japanese automakers over potential production and supply partnerships.

Citing an executive at an automotive parts supplier, Nikkei reports Apple is negotiating deals with a number of Japanese companies that could result in contributions to a much-rumored "Apple Car."

"At least six companies are in negotiations," the person said.

Apple is said to be pushing for contracts that would see Japanese auto firms join the effort under a horizontal division of labor model, a strategy Apple has used to great success in the production of iPhone, iPad and other consumer products. The tech giant plans to develop and design a so-called "Apple Car" and outsource production to third-party manufacturers, specifically automotive companies, according to the report.

The Japanese firms are not exactly jumping at the chance to work with Apple, the source said, noting automakers face a difficult decision in joining an "Apple Car" supply chain. Apple is notoriously demanding of its suppliers and while being part of the brand's supply chain typically drives profit, it also requires major changes that could include diverting important resources.

Japanese companies are also wary of being relegated to the role of subcontractor, a worry shared by another rumored "Apple Car" partner. A report last week claimed Hyundai executives are "agonizing" over a potential collaboration, saying that while a partnership might initially boost brand image, those benefits could quickly fade.

Today's report counters previous claims that Apple is on the verge of finalizing a deal with Hyundai to manufacture the vehicle at Kia's U.S. facilities. With negotiations ongoing on multiple fronts, Apple appears to be entertaining a variety of options as it works toward a contract.

"I don't know if it will be decided by the Korean manufacturer. We are in the process of negotiating where (Apple) will make it," one Japanese supply executive said.

The report claims Apple's research facility in Yokohama, which is said to focus on materials, vehicle and health segments, acts as a point of contact with domestic vehicle manufacturers and parts producers.

"Apple Car" rumors have accelerated over the past few weeks, with reports in the U.S. and South Korea suggesting Apple is closing in on a manufacturing deal with Hyundai and its Kia subsidiary. The South Korean automaker in January confirmed it was in talks to produce the vehicle before quickly walking those statements back.

On Wednesday, South Korean news outlet Dong-A said Apple plans to ink a 4 trillion won deal with Kia on Feb. 27 to secure access to the automaker's U.S. plant in Georgia. That report cited a 2024 start date and claimed initial capacity would be set at 100,000 cars per year with the potential to increase output to a maximum of 400,000 units a year.

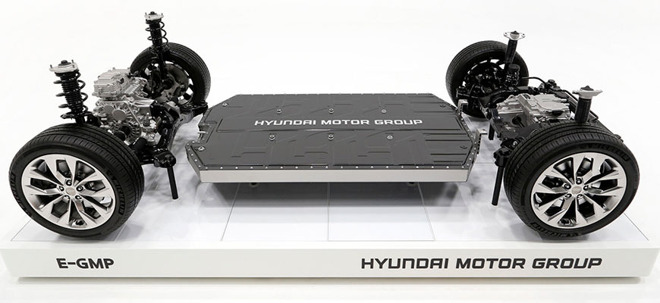

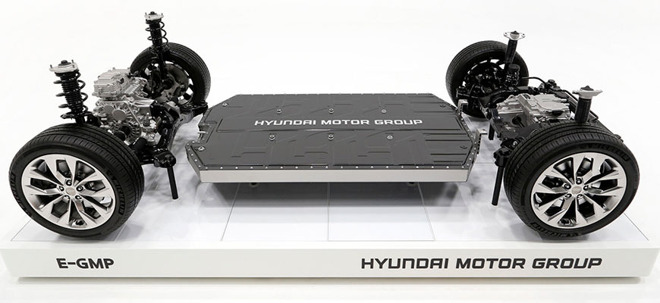

Earlier in the week, analyst Ming-Chi Kuo predicted Apple to tap Hyundai's E-GMP electric vehicle platform, with Hyundai Mobis offering assistance with component design and production. Kuo also believes Apple will be in charge of self-driving hardware and software, semiconductors, battery technologies, form factor and user experience, with other -- arguably a bulk --of duties handed off to Hyundai/Kia.

Most recently, CNBC sources confirmed that Apple is nearing a deal with Hyundai to produce a fully autonomous vehicle designed to be operated without a driver. That report suggests "Apple Car" might be marketed as an enterprise mobility vehicle before being sold to consumers.

Citing an executive at an automotive parts supplier, Nikkei reports Apple is negotiating deals with a number of Japanese companies that could result in contributions to a much-rumored "Apple Car."

"At least six companies are in negotiations," the person said.

Apple is said to be pushing for contracts that would see Japanese auto firms join the effort under a horizontal division of labor model, a strategy Apple has used to great success in the production of iPhone, iPad and other consumer products. The tech giant plans to develop and design a so-called "Apple Car" and outsource production to third-party manufacturers, specifically automotive companies, according to the report.

The Japanese firms are not exactly jumping at the chance to work with Apple, the source said, noting automakers face a difficult decision in joining an "Apple Car" supply chain. Apple is notoriously demanding of its suppliers and while being part of the brand's supply chain typically drives profit, it also requires major changes that could include diverting important resources.

Japanese companies are also wary of being relegated to the role of subcontractor, a worry shared by another rumored "Apple Car" partner. A report last week claimed Hyundai executives are "agonizing" over a potential collaboration, saying that while a partnership might initially boost brand image, those benefits could quickly fade.

Today's report counters previous claims that Apple is on the verge of finalizing a deal with Hyundai to manufacture the vehicle at Kia's U.S. facilities. With negotiations ongoing on multiple fronts, Apple appears to be entertaining a variety of options as it works toward a contract.

"I don't know if it will be decided by the Korean manufacturer. We are in the process of negotiating where (Apple) will make it," one Japanese supply executive said.

The report claims Apple's research facility in Yokohama, which is said to focus on materials, vehicle and health segments, acts as a point of contact with domestic vehicle manufacturers and parts producers.

"Apple Car" rumors have accelerated over the past few weeks, with reports in the U.S. and South Korea suggesting Apple is closing in on a manufacturing deal with Hyundai and its Kia subsidiary. The South Korean automaker in January confirmed it was in talks to produce the vehicle before quickly walking those statements back.

On Wednesday, South Korean news outlet Dong-A said Apple plans to ink a 4 trillion won deal with Kia on Feb. 27 to secure access to the automaker's U.S. plant in Georgia. That report cited a 2024 start date and claimed initial capacity would be set at 100,000 cars per year with the potential to increase output to a maximum of 400,000 units a year.

Earlier in the week, analyst Ming-Chi Kuo predicted Apple to tap Hyundai's E-GMP electric vehicle platform, with Hyundai Mobis offering assistance with component design and production. Kuo also believes Apple will be in charge of self-driving hardware and software, semiconductors, battery technologies, form factor and user experience, with other -- arguably a bulk --of duties handed off to Hyundai/Kia.

Most recently, CNBC sources confirmed that Apple is nearing a deal with Hyundai to produce a fully autonomous vehicle designed to be operated without a driver. That report suggests "Apple Car" might be marketed as an enterprise mobility vehicle before being sold to consumers.

Comments

It makes a lot more sense for Apple to outsource production and assembly as that's how they operate for all their other devices. It's more an issue of finding the right manufacturing partners who are willing to work on Apple's terms.

The main focus of this entire article (and others like it) are on the car companies and if they are willing to work with Apple.If Apple can find the right manufacturing partners I'm sure it will work well for Apple. If this will be true for the established vehicle brands will be up to them to decide.

Also, are we looking at an exchange program like the iPhone?

I realize I'm getting way ahead here but just thinking out loud.

"PC guys aren't just going to walk in" etc

You should really read the other posts on this subject from the past week. A lot fo this has been covered and you clearly haven't read any of the stuff regarding utilizing existing drivetrains, manufacturing partners, hiring chassis designers from Porsche, etc.

This patent maybe suggests Apple knows how to design moving parts? This is a more recent of one of dozens and dozens of car-related patents they have on all sorts of moving parts of a vehicle:

https://www.patentlyapple.com/patently-apple/2021/02/apple-wins-a-second-project-titan-patent-today-covering-a-next-gen-active-suspension-system.html

Engineering 100 year old technology shouldn't be all that hard -- or expensive. Which is one reason why American manufacturers (and others) have been dragging their feet on releasing EVs: they want to milk that cow for every drop before moving on to modern technology. Plus, they have had to deal with the fact that their engineers probably didn't have a clue on how to build a modern car.

I am not seeing this at all. Apple is purely looking for component suppliers. They'll probably end up doing their own chassis design (Porsche VP of chassis design they just hired). And if they use chassis from competitors expect them to modify the chassis design to an unrecognisable degree. Apple knows what they are up against and understand the standards to beat are high and are heating up.

As some people here seem to get while others are oblivious, cars are not phones. @cg27 is right - a car has thousands of moving parts exposed to the environment. The only moving part in an iphone is the switch. You wouldn’t expect Ford or Toyota to march in and make a great smart phone, why do we expect Apple to march in and make a great car? Ostensibly, that is exactly why Apple would partner with a car company. Apple could focus on the tech and interface and leave the manufacturing tech to the car company.

Design is important, too. Not the Jonny Ive design, but designing the components so they can be efficiently and reliably assembled. Apple has experience designing phones that Foxconn can assemble, not cars that an assembly line can assemble.

Finally, does apple realize that ‘right to repair’ already exists in the automotive world?

1- There is a vast amount of overcapacity in the car/truck business and many/most existing makers are the recipients of considerable subsidy or tax advantage in their home countries. Anything that impacts that is a political third rail. There will be a shakeout in the business, but governments will fight tooth and nail to keep incumbents in the game. Government Motors and Chrysler are US examples of that.

2- These days many carmakers outsource considerable portions of the design to component suppliers, giving guidance but letting them handle the guts of a door assembly or such things. I am not sure the anal retentive control freaks of Apple are willing to do that with the supplier firms and going it alone greatly complicates the process.

3- The manufacturing process and supply chain involved in making cars and trucks is not something an outsider just jumps into and does well. Tesla started with a legacy GM/Toyota plan in California, hired experienced Auto industry people and and still struggled mightily with production bottlenecks and quality.

The weak point among legacy manufacturers is software and user interface. That is where Apple has a natural competency and partnering with an existing player like Volkswagen would make sense. The new VW ID 3 and 4 are very well done but they are still working the kinks out of the software and responsiveness of the interface.