Apple's iPad dominates shrinking tablet market & Mac creeping up on rivals

New research claims that Apple sold almost double the number of tablets of its nearest rival, but iPad growth comes as overall market shrank in the US.

Apple CEO Tim Cook has said that iPad sales were constrained by shortages, but new figures say US sales were still up on previous years.

According to research firm Canalys, Apple ended 2021 with 19.1 million iPads shipped. Amazon came in second place with almost half that number at 10.9 million, while Samsung sold 7.9 million tablets.

However, Apple's sales represented a 17% drop compared to 2020. Comparing Q4 2021 the same period the year before, tablet sales dropped by 31% to 12.7 million.

Cook has previously said that Apple had managed a "very strong performance" despite "larger than expected supply constraints."

"The supply constraints were driven by the industry wide chip shortages that have been talked about a lot, and COVID-related manufacturing disruptions in Southeast Asia," he said.

Canalys, however, attributes the dramatic fall in tablet sales to the reduced demand after customers bought more during the coronavirus pandemic. Chromebook fared worse than tablets for this reason, with a 74% drop in the year since WQ4 2020.

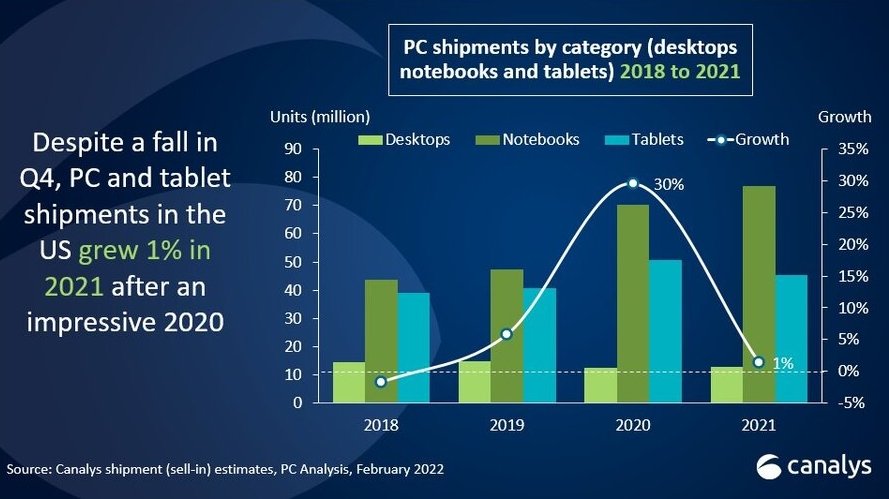

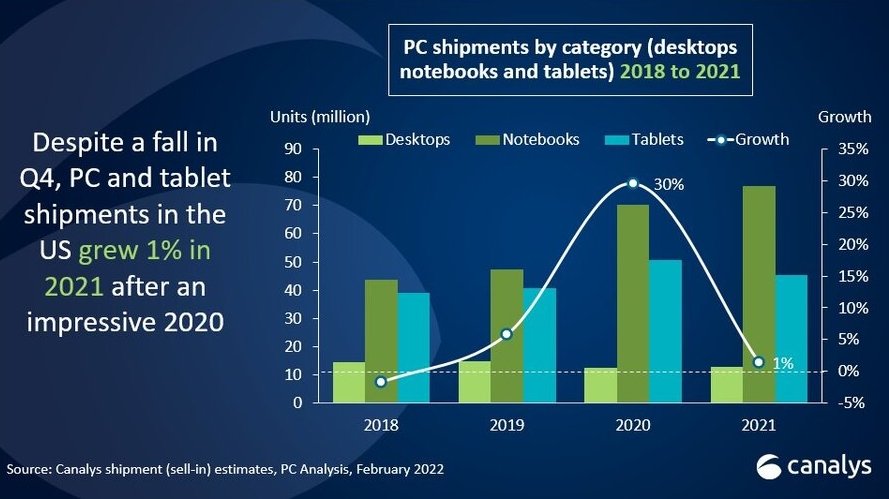

Overall, the PC industry, including Apple, reportedly grew by 1% during 2021. Canalys says HP came top with 25.9 million PCs sold, where Apple came in fourth with 10 million Macs.

That represents an annual growth for Apple of 12%. However, across Q4, Apple's Mac sales declined 3.1% compared to the previous quarter.

Source: Canalys

None of this data is confirmed by Apple. The company does not reveal detailed sales breakdowns, so comparative information depends on being gathered from multiple third-party sources.

Canalys nonetheless predicts that, based on its data, device sales will continue at a higher rate than before COVID.

"The US PC industry's overall growth in 2021 highlights the long-term potential of the demand initially created by the pandemic," said Brian Lynch. "While Q4 2021 showed less impressive performance than the year overall, the market is well positioned to continue providing significant opportunities, especially from a revenue perspective, for the coming year amid strong business demand."

Read on AppleInsider

Apple CEO Tim Cook has said that iPad sales were constrained by shortages, but new figures say US sales were still up on previous years.

According to research firm Canalys, Apple ended 2021 with 19.1 million iPads shipped. Amazon came in second place with almost half that number at 10.9 million, while Samsung sold 7.9 million tablets.

However, Apple's sales represented a 17% drop compared to 2020. Comparing Q4 2021 the same period the year before, tablet sales dropped by 31% to 12.7 million.

Cook has previously said that Apple had managed a "very strong performance" despite "larger than expected supply constraints."

"The supply constraints were driven by the industry wide chip shortages that have been talked about a lot, and COVID-related manufacturing disruptions in Southeast Asia," he said.

Canalys, however, attributes the dramatic fall in tablet sales to the reduced demand after customers bought more during the coronavirus pandemic. Chromebook fared worse than tablets for this reason, with a 74% drop in the year since WQ4 2020.

Overall, the PC industry, including Apple, reportedly grew by 1% during 2021. Canalys says HP came top with 25.9 million PCs sold, where Apple came in fourth with 10 million Macs.

That represents an annual growth for Apple of 12%. However, across Q4, Apple's Mac sales declined 3.1% compared to the previous quarter.

Source: Canalys

None of this data is confirmed by Apple. The company does not reveal detailed sales breakdowns, so comparative information depends on being gathered from multiple third-party sources.

Canalys nonetheless predicts that, based on its data, device sales will continue at a higher rate than before COVID.

"The US PC industry's overall growth in 2021 highlights the long-term potential of the demand initially created by the pandemic," said Brian Lynch. "While Q4 2021 showed less impressive performance than the year overall, the market is well positioned to continue providing significant opportunities, especially from a revenue perspective, for the coming year amid strong business demand."

Read on AppleInsider

Comments

That's a pretty optimistic opinion. It seems were are in the tail end of the pandemic buying wave. People are headed back into the office. The market is saturated. There's a good chance unit sales will head back to 2019 unit sales numbers in a year.

I guess desktop sales will level out eventually. Laptops are so powerful now that desktops don't have much appeal on the performance side but they will always have the bigger displays.

Adding a big display to a laptop is pretty cheap though:

An M1 Macbook Air 8GB/256GB = $999, a 34" LG is $349 ( https://www.amazon.com/LG-34WN650-W-34-Inch-UltraWide-DisplayHDR/dp/B087JB656Q ). Total is $1348.

24" M1 iMac with 8GB/256GB is $1299.

I could easily see desktops going down to under 5% eventually. New generations are growing up with tablets and then laptops in school. Offices are all laptops now with remote work.

And yup, Apple stopped selling monitors at the wrong time. They should have made a 27" Thunderbolt 3 display to accompany the 4th gen MBP models in 2016. That they have drug their feet in selling a 27" Thunderbolt 3 display is a mystery of mysteries. Really curious how product marketing decisions were made with Macs and iPads in the period from 2014 to 2018.

With Apple Silicon, Apple is using the same chips they use for laptops across the entire Mac lineup. The incremental cost of designing, qualifying and serving a desktop using these same chips should be less than what they did with Intel chips. This should really viewed as an opportunity to have more variety. An MBA13 at $900, an MBA14 at $1500, a workstation laptop with a "M1 Max Duo", a 35" 21:9 iMac, a Mac Half Pro with up to a "M1 Max Duo", a full sized Mac Pro with up to "M1 Max Quad" would all be using the same set of chips used in their laptops. It should enable to do more varied hardware. Then, 24", 27", 32" and 35" 21:9 monitors should all be their as branded accessories.