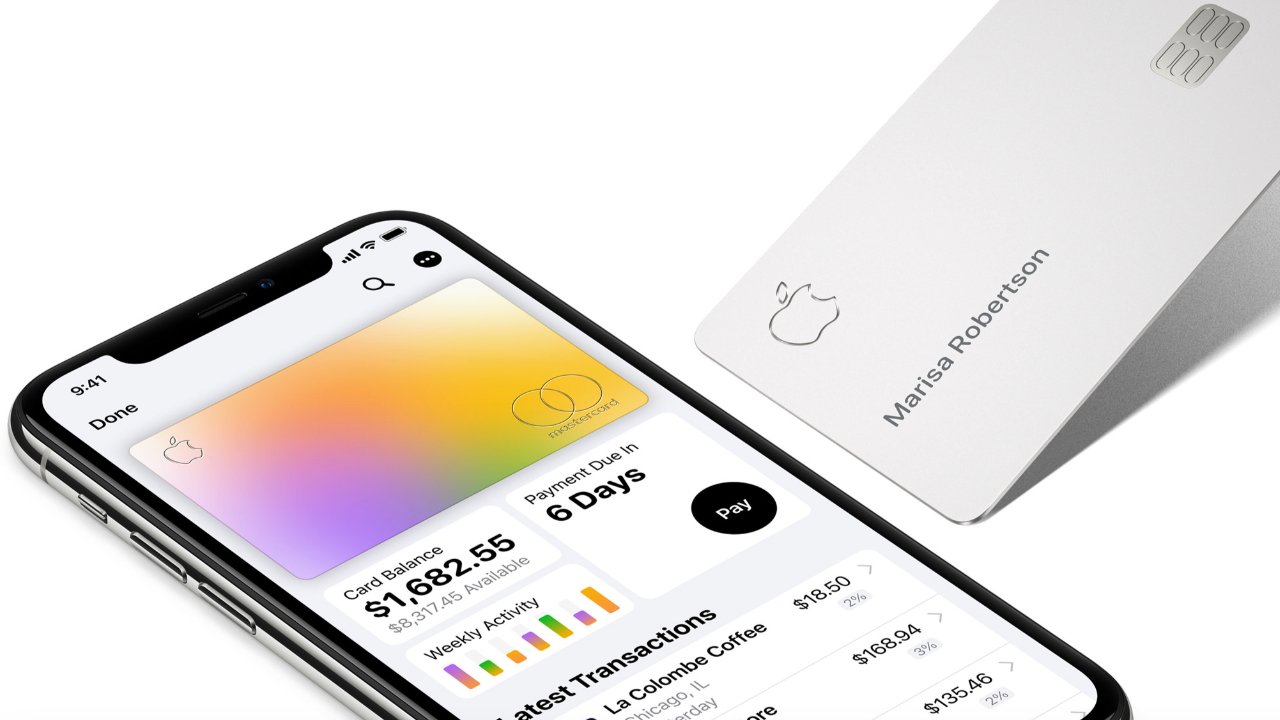

Apple Card's explosive growth blamed for Goldman Sachs troubles

The rapid expansion of Apple Card reportedly led to a wave of disputed transactions -- which Goldman Sachs says were mishandled by outside vendors.

Apple Card users complain of support issues at Goldman Sachs

Goldman Sachs is under investigation by the Consumer Financial Protection Bureau surrounding customer complaints about Apple Card. Customers report receiving conflicting information or long wait times when attempting to dispute a purchase or request a refund.

According to a CNBC report, people spoke anonymously about the issues surrounding Apple Card at Goldman Sachs and detailed how things evolved. The influx of customers seeking chargebacks was unexpected, and the company turned to automation and outside vendors to manage the crush.

"We were making the case that we have a seamless way to dispute transactions," one source said. "But we got no credit for the front end, and we had some failures on the back end."

These issues were compounded by the use of business process organizations, or BPOs. Goldman Sachs relied on three of these companies to manage customers, but the BPO industry is known for high turnover rates and undertrained employees.

Customers calling in to get help were getting inconclusive answers, and in some cases, requested refunds were denied inadvertently. In February, Apple reached out to users who had claims dismissed to give them a chance to resubmit the disputes.

Neither Goldman Sachs nor Apple commented officially on the report. However, internal sources say that Apple Card's rapid growth was a major factor in creating these issues. For instance, Apple Card users reportedly doubled to 6.4 million users by May 2021, and may have nearly doubled again since.

Read on AppleInsider

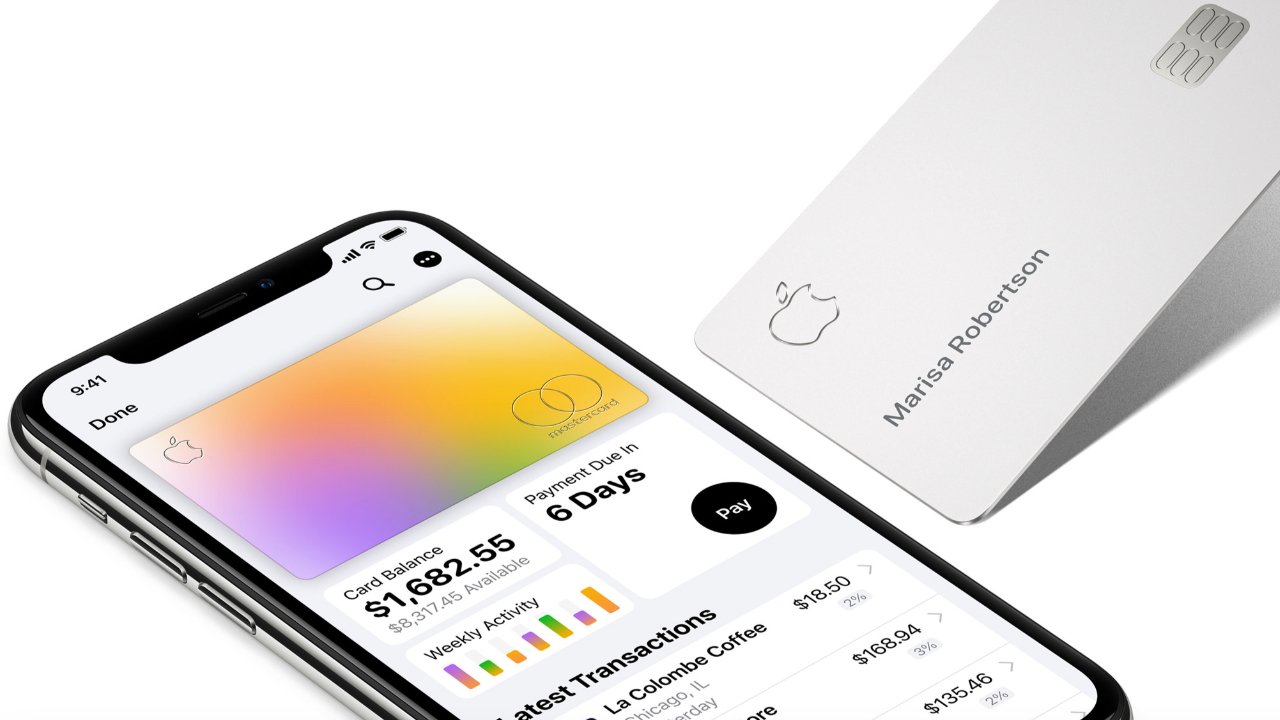

Apple Card users complain of support issues at Goldman Sachs

Goldman Sachs is under investigation by the Consumer Financial Protection Bureau surrounding customer complaints about Apple Card. Customers report receiving conflicting information or long wait times when attempting to dispute a purchase or request a refund.

According to a CNBC report, people spoke anonymously about the issues surrounding Apple Card at Goldman Sachs and detailed how things evolved. The influx of customers seeking chargebacks was unexpected, and the company turned to automation and outside vendors to manage the crush.

"We were making the case that we have a seamless way to dispute transactions," one source said. "But we got no credit for the front end, and we had some failures on the back end."

These issues were compounded by the use of business process organizations, or BPOs. Goldman Sachs relied on three of these companies to manage customers, but the BPO industry is known for high turnover rates and undertrained employees.

Customers calling in to get help were getting inconclusive answers, and in some cases, requested refunds were denied inadvertently. In February, Apple reached out to users who had claims dismissed to give them a chance to resubmit the disputes.

Neither Goldman Sachs nor Apple commented officially on the report. However, internal sources say that Apple Card's rapid growth was a major factor in creating these issues. For instance, Apple Card users reportedly doubled to 6.4 million users by May 2021, and may have nearly doubled again since.

Read on AppleInsider

Comments

They have a feature to chat to a representative, which first goes to Apple then GS. Luckily, I've not had any issues, yet.

For those travelling overseas, it is one of the best cards there is. There are no transaction fees, and the exchange rates used are close to par.

I use my Apple Card exclusively with the one exception of Costco which doesn't take Master Card. I've had no fraudulent or "phantom" charges. There was one instance of an online order that resulted in a $1 charge that was gone the next day. A week later that same company shipped my order and charged my card the full price. That $1 charge used to be a wide spread practice, but I rarely see it mentioned.

Every previous credit card has incurred at least one fraudulent charge. A phone call cleared each up, some more quickly than others. One of my favorite features is the Card's Advanced Fraud Protection function for online use, which changes the card's 3-digit security code periodically. I can't say to what extent it may be responsible for preventing fraud but I like it.

Growing pains are better than not growing. G-S has done ok by me and I'll expect they'll shore up their infrastructure. In the meantime it makes sense to raise the price of admission. So bring on all the investigations and let G-S learn and comply, and be the better for them.

Tone deaf on Apple’s part to use them since Goldman Sachs was right in the middle of the meltdown in the fall of 2008 and not in a good way.

I’ve lodged two disputes, one major and one relatively trivial, and both were handled expeditiously and with aplomb. (Neither had anything to do with fraudulent charges, in fact I’ve never seen one of those.)

Like @flipkal ;, I will say that the customer service the one time I needed it wasn't good. Especially when compared with my AMEX. In June last year my bill was made available shortly after the month's end and then for no explicable reason, they drafted my bank for the full balance due on July 6th without me electing for this in the Wallet app. I had set up to pay the full amount close to the due date, not immediately. Even after the erroneous payment cleared the scheduled payment was still scheduled. I called customer service, the Apple rep said it is a GS issue and transferred me. The GS rep said this must have been a bug in the app and transferred me back. The Apple rep then said that that was not possible and that all payments go through an checking process at GS that it was their issue. Ping-Pong.

GS escalated the issue to their level 2. The lady I got said that the system for payment processing has a two factor match to ensure this sort of thing doesn't happen, but in my case the system processed the draft even though the "match factor" that comes from the app when you authenticate (with FaceID or TouchID) was not logged in the system for the early payment and it was for the later payment. They specialist said that they would escalate to the "back office". I told her though, that I only wanted an explanation and did not want the payment reversed since the amount wasn't large and I would just cancel the scheduled payment to prevent a duplicate payment. I didn't want the payment to be reversed and then still be waiting on the money by the time the due date rolled around for an eventual second payment. No further contact from GS and then 3 days later I see in the app that my payment was reversed and a reason listed as "declined - dispute rejected". I then called GS back and they said that their system showed that I had claimed a payment was made in error and they just reversed the payment end of story and so I had to reschedule my payment. I asked if they agreed to reverse the payment why does it say on my app "dispute rejected". She had no explanation for that. Needless to say, I was not to happy with that whole mess.

I probably would have stopped using the card after that if it weren't such a hassle to switch my auto-billing over for multiple accounts. But, since this case didn't actually cause me any hardship in the end and I really like the Wallet app for managing the card, I kept using it for my couple of auto billing accounts and Apple purchases. Happily, it seems that it was "only" a one time issue and I've had nothing similar since. I could imagine though, many customers would have cancelled the card after an experience like that just out of principle.

There are cards that offer better deals than 2% but it's so easy with Apple Card. The only exceptions are my Costco Citi card and my Target Red Card, I always go for that 5% off thru their app. I might eventually work another card into rotation if it offers better cash back for certain transactions... but that takes some work to figure out which ones and then to change my spending habits... naaaaah for now Apple Card works great for me.

Only issue I had was some Alibaba charges being denied the first time I used it, as they're in China. Used the chat, let them know, and it worked the next time.