How to visit Singapore using Apple Pay, Apple Wallet, and zero cash

As travel restrictions finally ease, many are booking flights to destinations such as the tech-forward Singapore. Here's how to visit Singapore's top sights without having to shell out a single physical coin.

Using Apple Pay in Singapore is safe and convenient.

On a recent visit to Singapore, both my husband and I were able to go sightseeing around Singapore without any cash. We used Apple Pay to do things like buy hawker street food and ride the Mass Rapid Transport (MRT) system.

The benefits of cashless travel are numerous, such as removing the worries of pickpocketing or losing your wad of cash. As a bonus, you can skip shady currency exchange places.

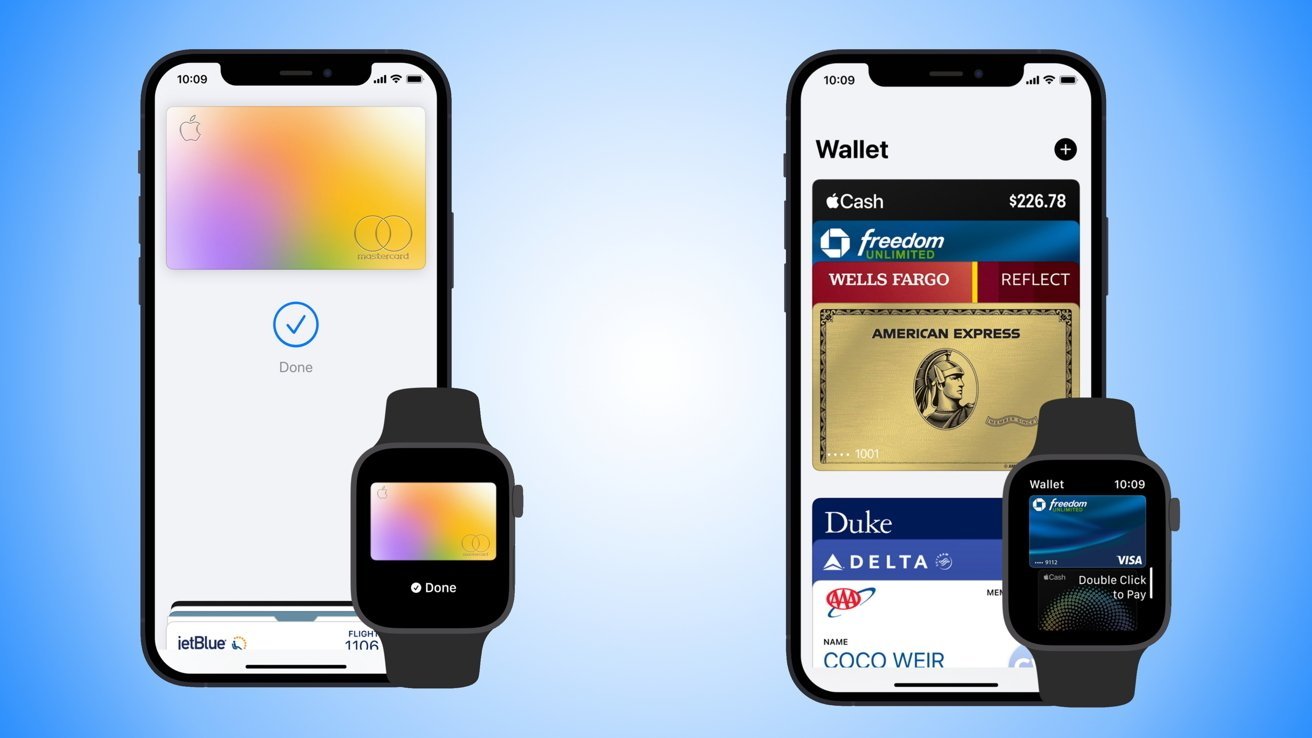

Set up your Apple Wallet before your trip

Singapore's MRT, accepts cards including MasterCard or Visa credit and debit cards and NETS contactless ATM cards. Check Singapore's Land Transport Authority SimplyGo for the latest accepted card payment list.

If you choose to purchase a rechargeable EZ-Link card to ride the MRT, add this to your Apple Wallet before your trip.

You could use any of the above cards for contactless payments by tapping the card at the train station, but loading them up on your Apple Wallet before your trip will save you from having to carry a physical card around town.

Before using Apple Pay abroad, confirm with your bank about any possible fees they may charge.

If possible, when adding a card to your Apple wallet or Apple Pay, use a card with zero foreign transaction fees. It's even better if this is a card that gives you extra points for travel and food transactions, as well as offering travel insurance.

Using Apple Pay for Singapore's MRT

Before entering the train platform, simply scan your Apple Watch or iPhone with Apple Wallet enabled. Once the card payment has been verified, you can go right through.

Besides the MRT, a popular way to get around Singapore is by Grab or Gojek, on-demand taxi services much like Uber or Lyft in the States.

To use this transportation option, simply enter your card information into the Grab or Gojek app. Your card will be deducted for the cost of the taxi ride, and once again you can do all of this without using any physical cash.

Apple Pay is available in many places in Singapore

Here is a list from Apple of the current participating banks and card issuers in Singapore.

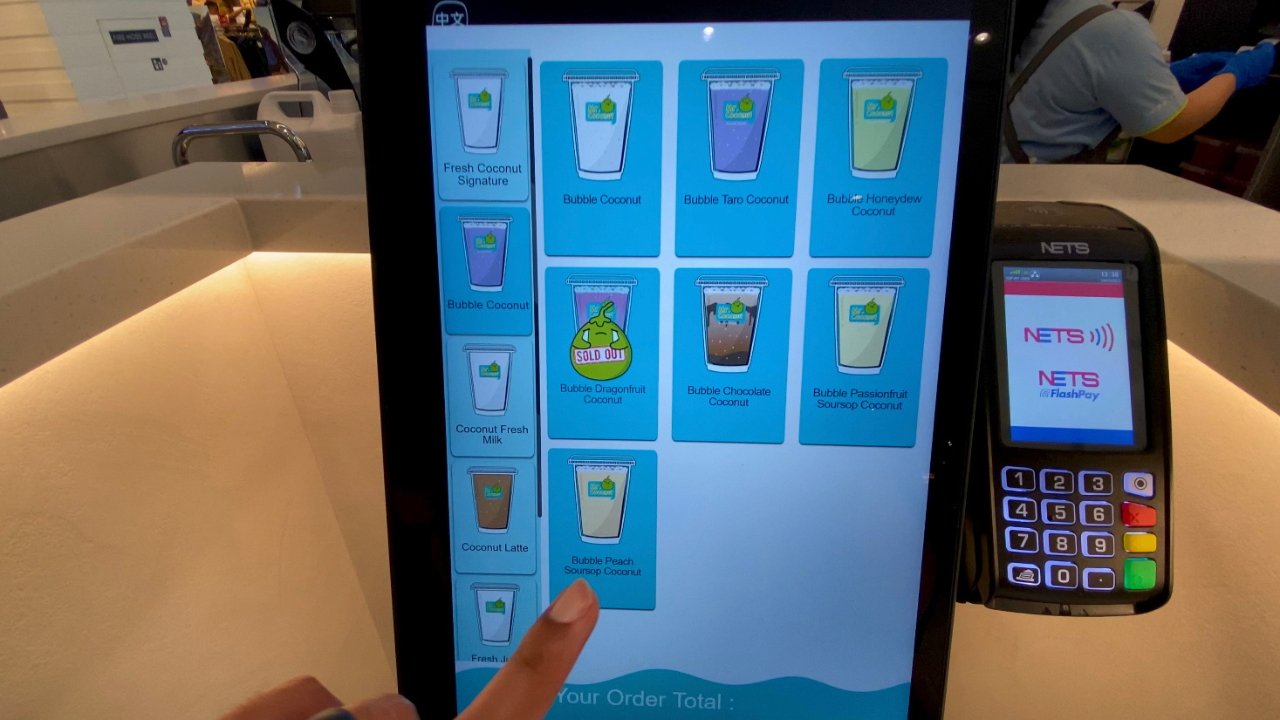

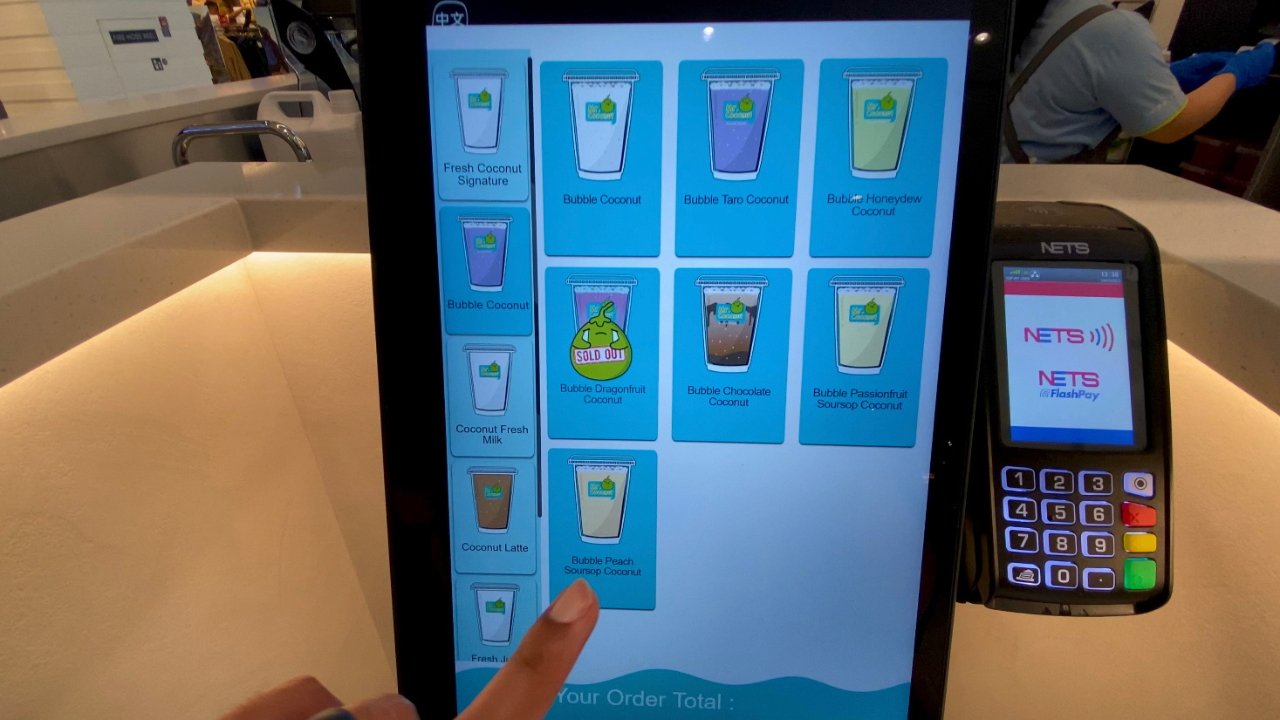

Using Apple Pay at the Marina Bay Sands food court.

You can use Apple Pay at places like BreadTalk, a popular bakery chain, or Uniqlo, a favorite clothing brand. When ordering at a food court, each stall will have its own payment options, so double-check before ordering.

This was our experience in Singapore, but your mileage may vary in other countries.

We loved using Apple Pay while exploring Singapore's top sights. We didn't have to hunt down currency exchange stalls or fumble with foreign currency, and we highly recommend going cashless when in Singapore.

Read on AppleInsider

Using Apple Pay in Singapore is safe and convenient.

On a recent visit to Singapore, both my husband and I were able to go sightseeing around Singapore without any cash. We used Apple Pay to do things like buy hawker street food and ride the Mass Rapid Transport (MRT) system.

The benefits of cashless travel are numerous, such as removing the worries of pickpocketing or losing your wad of cash. As a bonus, you can skip shady currency exchange places.

Prepare before your trip

Before your flight to Singapore, make sure to load your Apple Wallet with the cards you want to use.

Set up your Apple Wallet before your trip

Singapore's MRT, accepts cards including MasterCard or Visa credit and debit cards and NETS contactless ATM cards. Check Singapore's Land Transport Authority SimplyGo for the latest accepted card payment list.

If you choose to purchase a rechargeable EZ-Link card to ride the MRT, add this to your Apple Wallet before your trip.

You could use any of the above cards for contactless payments by tapping the card at the train station, but loading them up on your Apple Wallet before your trip will save you from having to carry a physical card around town.

Before using Apple Pay abroad, confirm with your bank about any possible fees they may charge.

If possible, when adding a card to your Apple wallet or Apple Pay, use a card with zero foreign transaction fees. It's even better if this is a card that gives you extra points for travel and food transactions, as well as offering travel insurance.

Apple Pay for transportation

Singapore's MRT system is built to handle cashless payments with the tap of a card. However, having your card preloaded onto your Apple Watch or iPhone makes it easier as it's one less thing to worry about.

Using Apple Pay for Singapore's MRT

Before entering the train platform, simply scan your Apple Watch or iPhone with Apple Wallet enabled. Once the card payment has been verified, you can go right through.

Besides the MRT, a popular way to get around Singapore is by Grab or Gojek, on-demand taxi services much like Uber or Lyft in the States.

To use this transportation option, simply enter your card information into the Grab or Gojek app. Your card will be deducted for the cost of the taxi ride, and once again you can do all of this without using any physical cash.

Apple Pay for top attractions

Many top attractions in Singapore accept Apple Pay. Before visiting, research the specific landmarks you want to visit and look for their accepted payments.

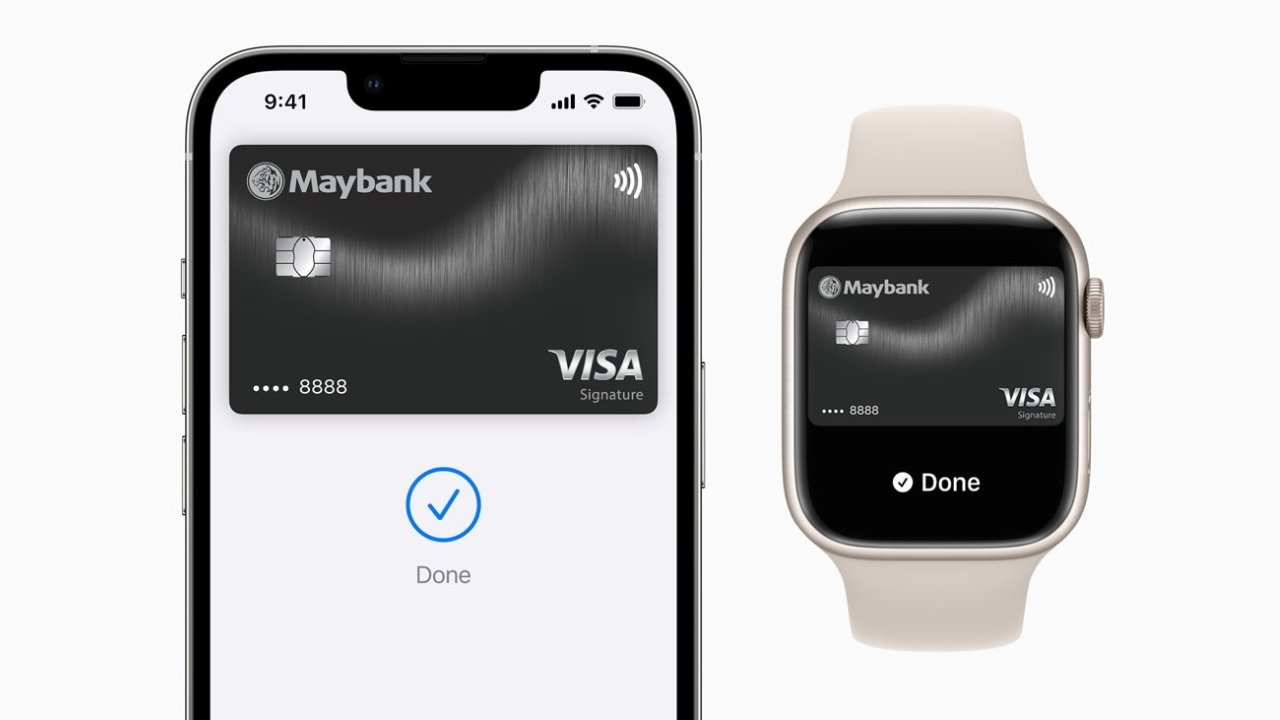

Apple Pay is available in many places in Singapore

Here is a list from Apple of the current participating banks and card issuers in Singapore.

- American Express (Bank-issued American Express cards aren't supported.)

- Citibank (Mastercard and Visa credit cards, Mastercard debit cards)

- DBS (Mastercard and Visa credit and debit cards)

- HSBC (Mastercard and Visa credit cards, Visa debit cards)

- Maybank (Mastercard and Visa credit and debit cards)

- OCBC (Mastercard and Visa credit and debit cards)

- POSB (Mastercard credit and debit cards)

- Singtel (Visa Prepaid Card)

- Standard Chartered Bank (Mastercard credit and debit cards, Visa credit cards)

- United Overseas Bank (Mastercard and Visa credit and debit cards)

- Wise

Apple Pay for Singapore street food

Visitors will be pleasantly surprised to find that even modest food vendors accept Apple Pay. For example, we used an Apple Watch to buy curry, naan, claypot rice, and iced Milo from three different vendors at the Marina Bay Sands food court.

Using Apple Pay at the Marina Bay Sands food court.

You can use Apple Pay at places like BreadTalk, a popular bakery chain, or Uniqlo, a favorite clothing brand. When ordering at a food court, each stall will have its own payment options, so double-check before ordering.

Using Apple Pay in Singapore

At the cashier, look for the Apple Pay logo on the card terminal, or simply ask the vendor if they accept Apple Pay. These vendors are comfortable with tourists and are happy to confirm payment options.This was our experience in Singapore, but your mileage may vary in other countries.

We loved using Apple Pay while exploring Singapore's top sights. We didn't have to hunt down currency exchange stalls or fumble with foreign currency, and we highly recommend going cashless when in Singapore.

Read on AppleInsider

Comments

If only companies thought about the stuff they're putting customers through sometimes...

My best guess is that the banks and the vendors do not want to spend the money on upgrading. Interestingly it is often the smaller businesses that have embraced technology faster using devices like Square since they provide a seamless process for payments.

About 4-5 years ago we finally got chips in credit cards. It took a while before vendors had consoles that could recognize them. Now most places can do contactless payments with a card in hand. Availability of payment via Apple Pay has improved significantly but it can be a bit kludgy sometimes. It is definitely easier to use it in Europe.

Having lived now in the States for over 30 years (previously from the UK) I would have to say that the reason for slow change is that the country is so huge. For organizations that are nationwide, making changes is hard as rolling out new systems is a lot of work. Also because of the size of the country, each region has its own way of doing things. Consider how diverse Europe is in its way of doing things in general. The US is the same size as Europe and in many ways is as diverse as Europe in how the various regions operate. Sure the language is the same but Californians live and think very differently from someone on the East Coast.

Been to the US a few times now I don’t understand why the swipe and pin technology is still in use. Mind you they’re still using feet and inches. 😂

Here’s the list of them

https://s3-ap-southeast-1.amazonaws.com/nets-rich-contents/go%20cashless%20promotions%20page%20-%20participating-food-centres-1522052689054.pdf

Actually you can’t add transit cards to your wallet app yet. If we could it would be a blessing