iPhone Christmas sales hit by 15% over production problems & weak demand

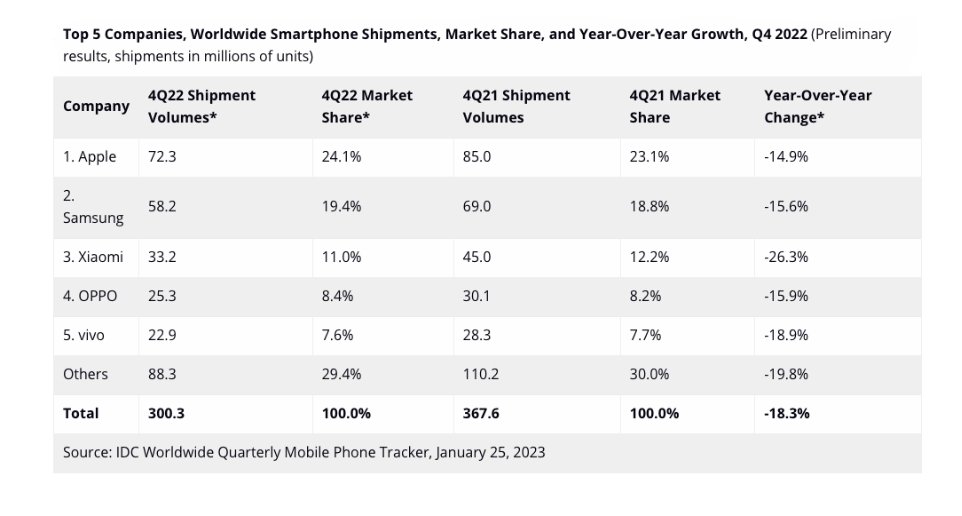

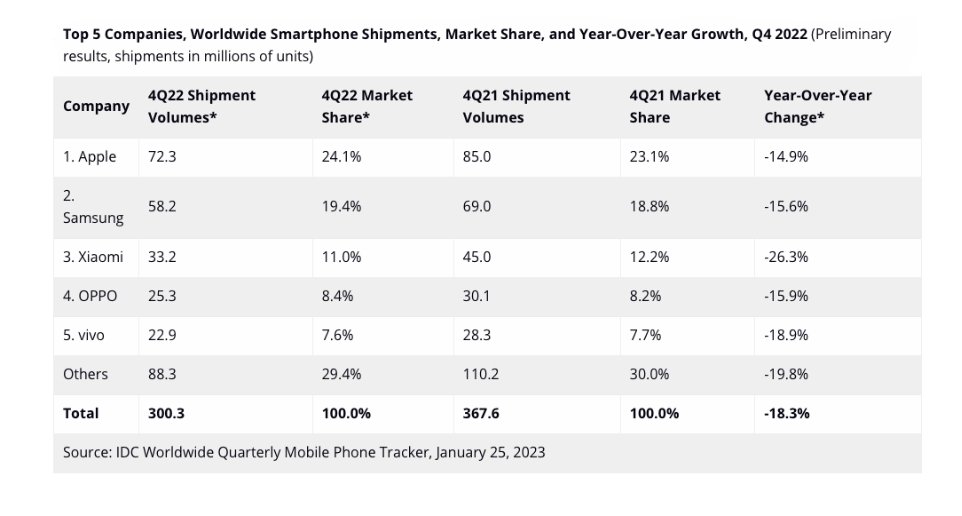

The latest smartphone sales estimates from analyst firm IDC says the December 2022 quarter saw the largest-ever decline, with Apple selling around 12 million fewer iPhones than in same period in 2021.

iPhone 14 Pro box

UBS recently forecast that Apple will have sold 79 million iPhones in what will be the company's Q1 2023 results, and that this is only just under the 80 million that, on average, the rest of the market expects. Now IDC reports that the figure is probably 72.3 million, which is below even the "street low" prediction of 74 million.

For the same period last year, iPhone sales were 85 million, so the new figures represent at 14.9% drop. That's still better than the whole worldwide smartphone market, which in total saw shipments drop 18.3%, just over 300 million devices int he quarter.

"We have never [before] seen shipments in the holiday quarter come in lower than the previous quarter," wrote IDC research director Nabila Popal. "However, weakened demand and high inventory caused vendors to cut back drastically on shipments."

Source: IDC

"Heavy sales and promotions during the quarter helped deplete existing inventory rather than drive shipment growth," continued Popal. "Even Apple, which thus far was seemingly immune, suffered a setback in its supply chain with unforeseen lockdowns at its key factories in China."

IDC believes that the figures reflect consumer concern over rising inflation, which may "push out any possible recovery to the very end of 2023."

It's not clear where IDC sources its data. Apple has not reported iPhone sales volumes in many years.

Read on AppleInsider

iPhone 14 Pro box

UBS recently forecast that Apple will have sold 79 million iPhones in what will be the company's Q1 2023 results, and that this is only just under the 80 million that, on average, the rest of the market expects. Now IDC reports that the figure is probably 72.3 million, which is below even the "street low" prediction of 74 million.

For the same period last year, iPhone sales were 85 million, so the new figures represent at 14.9% drop. That's still better than the whole worldwide smartphone market, which in total saw shipments drop 18.3%, just over 300 million devices int he quarter.

"We have never [before] seen shipments in the holiday quarter come in lower than the previous quarter," wrote IDC research director Nabila Popal. "However, weakened demand and high inventory caused vendors to cut back drastically on shipments."

Source: IDC

"Heavy sales and promotions during the quarter helped deplete existing inventory rather than drive shipment growth," continued Popal. "Even Apple, which thus far was seemingly immune, suffered a setback in its supply chain with unforeseen lockdowns at its key factories in China."

IDC believes that the figures reflect consumer concern over rising inflation, which may "push out any possible recovery to the very end of 2023."

It's not clear where IDC sources its data. Apple has not reported iPhone sales volumes in many years.

Read on AppleInsider

Comments

We will find out next week, but I don’t think the quarter was as bad as analysts are thinking and I wonder if they have ulterior motives for these spurious predictions (driving down the price of the stock for short term gain).

I waited for my phone for 6 weeks. If demand so weak, I would be able to get it next day

makes no sense

The IDC estimate is for the 4th calendar quarter of 2022 which would have started in October. Some of the other numbers - e.g., the UBS projection - are for Apple's fiscal quarter which would have started September 25th and ran through the end of the calendar year. This is one of those years where Apple's 1st fiscal quarter was 14 weeks long. It included almost a full extra week as compared to the calendar quarter, and that week was soon after the new iPhones were released. So the disparity - between around 72 million and around 79 million - lines up pretty well.

That said, most of the projections for Apple's FY2023 Q1 compare unfavorably with its FY2022 Q1. They generally forecast reduced revenue and EPS even though this last quarter included a full extra week.

That said, Apple didn't issue guidance for this quarter - it hasn't been issuing guidance for a while. So there isn't anything for it to revise. I suppose if the numbers were off bad enough it might issue some type of warning, but there would probably have to be some major issue. Apple isn't likely to issue a warning just because its numbers are going to come in below what others are expecting. When it issued a statement in early 2019, that was because it was going to report numbers meaningfully below its own guidance.

Go back and look for yourselves: compare their estimates to what actually happened. They're always wrong -- it's simply a matter of "off by how much" with them.