Apple is the world's biggest company at $3 trillion -- again

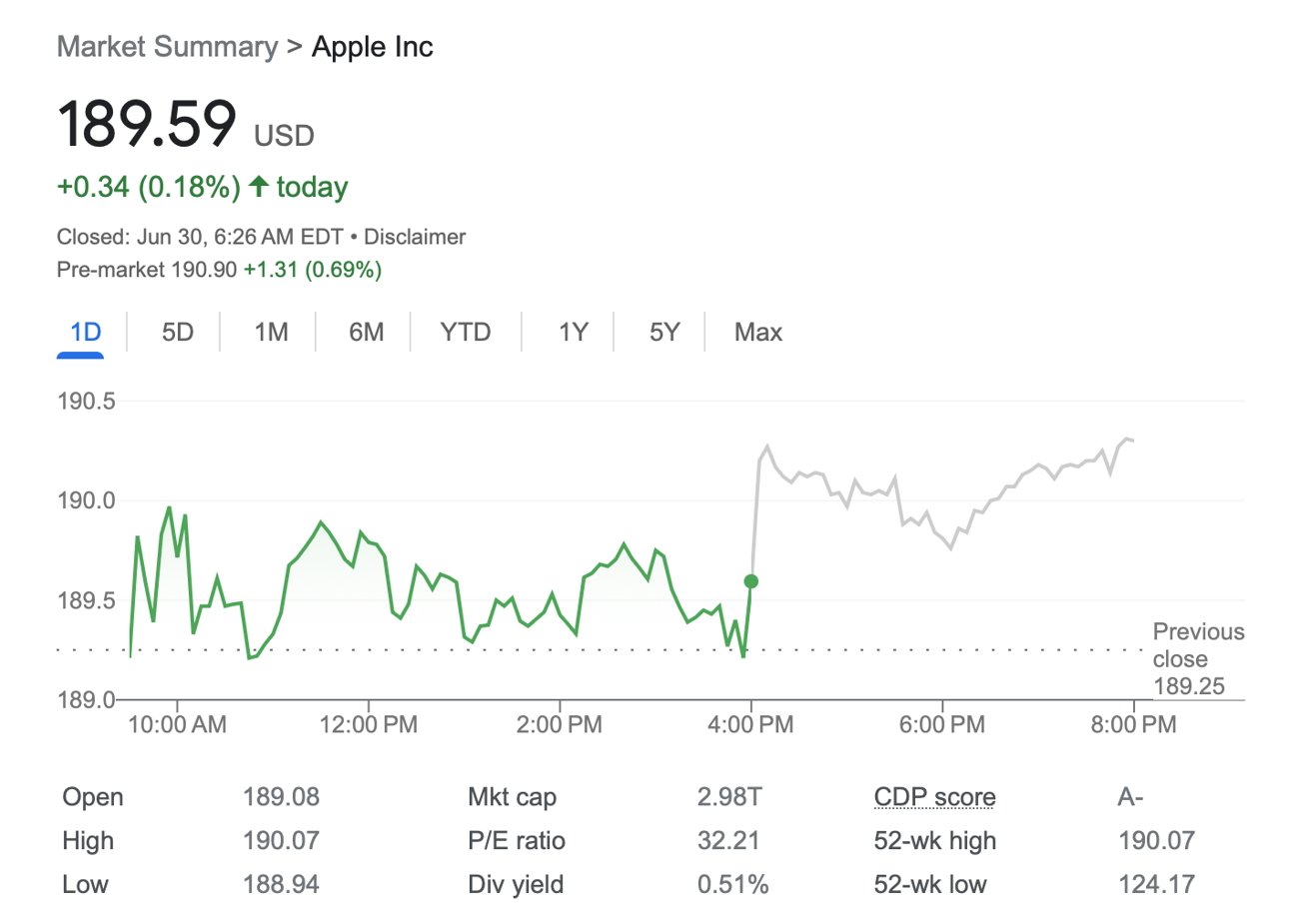

Following a flurry of overnight trading, and in the wake of the WWDC announcements, Apple has returned to a $3 trillion market capitalization.

When the NASDAQ opens, it will be official -- Apple has touched $190.73 in pre-market trading, and returned to a $3 trillion market capitalization.

In January 2022, Apple became the first company in the world to be valued at $3 trillion by the market. Over the following year, however, its valuation fell to under $2 trillion after what was believed to be investor jitters.

The drop coincided with months of supply chain problems that had affected Apple's most lucrative devices. During the typically highest sales period for iPhones, for example, the iPhone 14 Pro saw huge delays because of production problems in China.

Those problems were related to COVID, though, and since the end of 2022, production has returned to normal. Plus Apple has been working to decrease its dependence on China and instead produce more iPhones in places such as India.

It has returned to this rareified air while the number of shares have been decreasing. Apple has continuously been buying back stock for the last seven years, and retiring most of it, which reduces the total number of shares available.

It is also about to roll into its most profitable period of the year. The iPhone 15 is expected in the fall, and it is also just part of a raft of products Apple is expected to release by the end of 2024.

"Apple [is] playing chess while others play checkers," said Wedbush analysts in a note seen by AppleInsider. "In FY24 the Cupertino stalwart is on pace to approach $100 billion of annual services revenue growing double digits which is a jaw dropping trajectory vs. the roughly $50 billion+ of services revenue that Apple was delivering only in FY20."

"We believe Apple's fair valuation could be in the $3.5 trillion range," says Wedbush, "with a bull case $4 trillion valuation by FY25."

Part of the reason for Wedbush's growth prediction is a belief that the App Store for the new Apple Vision Pro is "another expansion of the App Store moat down the road."

It's not clear if the market forces will sustain that $3 trillion valuation for the day, nor does the figure mean anything tangible for users that do not hold Apple stock.

Read on AppleInsider

Comments

I happened to be looking at the Stocks app when it hit that number this past week. Got a screen shot of it and also of the calculator showing the exact worth of my shares at that price. It closed above that and has stayed above it. It's in my retirement account... but one of the few silver linings of being in my late 50s is that in about 15 months I can start drawing on it - if I wish - without early withdrawal penalty. It's not my only significant asset but it's been key to my financial security for years: knowing that my retirement is secured has freed up my work and investment income for other useful purposes. I've got an amazing job I love at a world-class institution that I will never lose so long as I don't do either of two things that are very easy to not do. I'm pretty much set for life thanks to a very modest investment I made in AAPL 23 years ago.

It happened to be an outstanding day for me for other reasons, such as the intel fed to me about the latest laughably bad life choices my clueless, triumphant ex is making. It seems a couple of her friends whom she mistakenly trusts too much share my disappointment in her and are eager to spill the T for their own reasons.

I'll remember 6/27/23 for quite a while.

In the EU, the bureaucrats are doing all they can to make regional Apple devices a reality. Tim Cook probably really is the best CEO in the world to navigate through all the headwinds most of which are put up by the various governments around the world, notice Apple customers are happy, but no one in government cares about them not really……

I can't think of many other areas which generate confusion.

We're all very comfortable with media consumption.

Healthcare demystification could be huge if done correctly

Eventually, we must draw a line between what one has and how much it is deserved.

Their greed knows no bounds.

Additionally, if you feel that success and business efficiency equates to greed then why are you on this forum and not instead supporting companies that are failing since that equals to philanthropy in your mind?

Maybe the currency has significantly weakened vs the dollar since the last price rise? No, actually, it’s improved.

Hmmm, so. Inflation is out. Currency fluctuation is out, what does that leave us? Oh, yes. Greed.