Apple's valuation will fall to less than $3 trillion for the worst reasons

If the current stock price holds until opening, and it is likely to, Apple will fall below the $3 trillion valuation after reaching it in the last hours of June, because more than half of the firms giving advice to investors don't know enough about the company, what it sells, and how it does business.

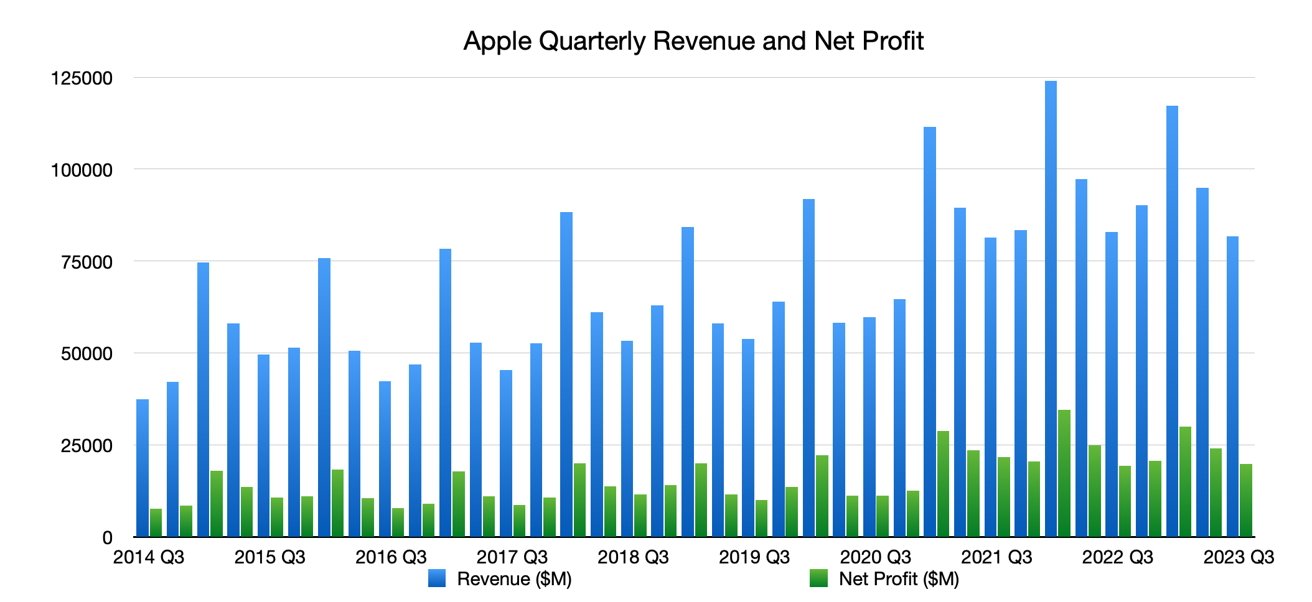

Despite Services doing very well and hitting a record high, Wall Street wasn't pleased with Apple missing the arbitrary sales targets it set for the iPhone. It may have been disappointed with iPad sales too, as that missed Wall Street's mark like it normally does.

After a flurry of buying pre-earnings statement, investors and funds sold the stock, like they nearly almost always do. As a result, Apple will -- on paper -- fall below the $3 trillion valuation that it hit on June 30.

And, in all likelihood, the actual valuation has been a bit less for some time. Apple nearly continuously buys back shares, and it is not required to update the total shares available more than once a quarter.

So, at some point in July, it probably dipped below that valuation, before Friday's imminent limbo under the line.

Thursday and Friday's stock price and valuation saga is not Apple's first dance over and under the line. It most certainly won't be its last.

$3 trillion, take two

In January 2022, Apple became the first company in the world to be valued at $3 trillion by the market. Over the following year, however, its valuation fell to under $2 trillion after what was believed to be investor jitters.

The drop coincided with months of supply chain problems that had affected Apple's most lucrative devices. During the typically highest sales period for iPhones, for example, the iPhone 14 Pro saw huge delays because of production problems in China.

The last quarter was about the same as the 2018 holiday quarter. Cue analyst panic.

Those problems were related to COVID, though, and since the end of 2022, production has returned to normal. Plus, Apple has been working to decrease its dependence on China and instead produce more iPhones in places such as India.

It returned to this rarified $3 trillion air on June 30 while the number of shares have been decreasing. Apple has continuously been buying back stock for the last seven years, and retiring most of it, which reduces the total number of shares available.

iPhone 15 is coming in early September

Apple is also about to roll into its most profitable period of the year. The iPhone 15 is expected in the fall, and it is also just part of a raft of products Apple is expected to release by the end of 2024.

"Apple [is] playing chess while others play checkers," said Wedbush analysts in a note seen by AppleInsider in June. "In FY24 the Cupertino stalwart is on pace to approach $100 billion of annual services revenue growing double digits which is a jaw dropping trajectory vs. the roughly $50 billion+ of services revenue that Apple was delivering only in FY20."

"We believe Apple's fair valuation could be in the $3.5 trillion range," says Wedbush, "with a bull case $4 trillion valuation by FY25."

Part of the reason for Wedbush's growth prediction is a belief that the App Store for the new Apple Vision Pro is "another expansion of the App Store moat down the road."

Less data, and bad models

Every time I write an article like this, I get emails saying "not me, I got this right." If you're emailing me to complain that you got it right, I trust that you did. Nice work.

There are good analysts, and there are bad ones. Some analysts get it right, most don't, and that impacts the "Wall Street Consensus."

So, don't take it up with me. Take it up with your fellow analysts that don't see the company as a holistic whole. Take it up with Apple, that doesn't give sales volumes for hardware, and hasn't for years.

Instead of those solid sales numbers, Wall Street relies on "supply channel checks" instead. And, this reliance is despite the fact Apple CEO Tim Cook has said on multiple occasions that they aren't a reliable indicator of what the company is doing.

I'm not a stock analyst, nor do I own any Apple stock, for reasons that should be clear to anybody reading this and knowing where I work. But what is crystal-clear to me is something Katy Huberty pointed out about five years ago.

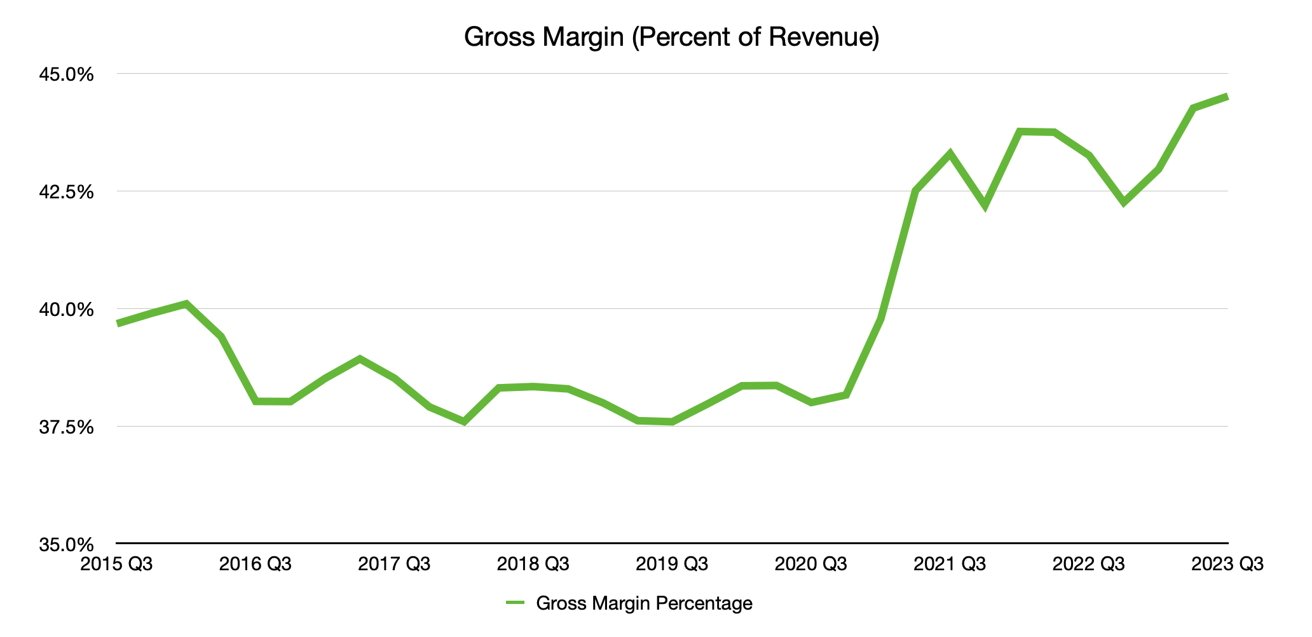

Apple is shifting away from being completely reliant on iPhone, and towards Services as a revenue generator. Services keep climbing, and there is no end in sight.

If any financial quarter proved that, it's this last one. And for some reason, despite beating the street's estimates for revenue, and profit margin, investors are penalizing the company's stock because of that very small drop in iPhone sales.

You're reading it right. Apple hit a record high Gross Margin in the quarter.

If this was straight statistical data collection, the drop in iPhone sales are well within the margin of error for data collection. This should be just a blip, a shrug, and folks move on.

And as far as those iPad sales, I don't think Wall Street understands the category. Their sales dollar estimates continue to miss the mark, quarter after quarter, year after year.

If the misses are that bad, maybe the math that investors are using needs to be tailored, instead of sticking to the same old treatises that don't work. The iPad is on the same replacement cycle as a Mac, and is much longer than an iPhone. For some reason, Wall Street doesn't seem to see it this way.

Other than last year, this is the second-highest dollar-value of iPhone sales sold in this quarter, ever.

And, as always, the $3 trillion mark means nothing for Apple other than investor excitement, nor does it do anything tangible for users that do not hold Apple stock. It's not going to make devices faster, unlock any features, or inspire the next big thing.

Apple's continuing revenue and cash on-hand management are more important factors by far, than Wall Street's line or guesswork about how much money Apple will make or many devices will be sold as it makes that money.

The iPhone miss has restarted another perennial drama from investor firms. The hue and cry today from market analysts and talking heads on CNBC and the like, is that because the iPhone is weakening, they are concerned what Apple's next billion-dollar business will be, and don't see one.

They should see that Services is that business, and has been for years, before they start worrying about the next big thing.

Apple stock has been one of the best investments of the last 20 years. The company will continue to be a financial juggernaut.

The smart investors and analysts will hold. Sell Apple stock at your financial peril.

Read on AppleInsider

Comments

And the growth in services has definitely slowed. Just a couple years ago, I think that segment was growing at 20%? I think they said in the last quarter it was 8%.

So with iPhone sales slowing, services revenue growth slowing, and no new growth drivers on the horizon for several more years (until Vision Pro becomes a set of affordable glasses people would actually want to wear), analysts are coming to the realization that Apple doesn't deserve its current 32 P/E valuation.

think Apple is a great company - we have every conceivable Apple device and are happy inhabitants of Apple's walled garden - but I agree with the analysis that AAPL doesn't deserve its current valuation. It would have been a different story if the Vision Pro announcement had been more compelling than the technical tour-de-force it was and previewed something that could actually take iPhone's place as the next major growth driver.

Just looking at this past quarter, Services accounted for 26% of Apple's revenue and 41% of its gross margin.

I will add that longtime AAPL investors tend not to care what analysts think and being longterm investors these little ebbs and flows mean nothing.

Apple's continuing revenue and cash on-hand management are more important factors by far, than Wall Street's line or guesswork about how much money Apple will make or many devices will be sold as it makes that money."

As for the stock price, it's up to investors like Berkshire-Hathaway to decide what they're willing to pay. For the rest of us, we're just going along for the ride.

Then there's the cult-like devotion to corporate "growth" that imagines a three-generation family-owned, locally iconic business that still operates at a single location to be a failure, and a five-year, highly leveraged rapid expansion of a franchise to be a success. This, even though the local business has always maintained a rainy-day fund and is preparing to continue for a fourth generation, while the franchise will likely collapse if its quarterly earnings don't meet analysts' overhyped projections more than once in a year. Also, you can guarantee that if both things are in a business like, say, making pizza, the local business' offerings are consistently delicious and handmade from fresh ingredients, while the franchise sells a gimmicky, salty chemical facsimile extruded from machines that untrained and underpaid labor can operate without deviating the resulting "product."

While Apple plays the game as required for its quarterly calls and reports, it's truly fascinating that many analysts remain so hyper-focused on the quarterly data that they truly have no idea that Apple operates on the basis of years-long planning and pipelines, not these Wall Street pro-formas.

Maybe the reader actually should make investment decisions based on honestly provided information, rather than on the prevailing ethics-optional Wall Street pundits who have hidden agendas and/or are riding in herds of short-sighted lemmings.