Apple Pay keeps growing, but can't catch Visa or Paypal

New research says that Apple Pay is only the fifth most popular payment platform in the US, despite previous claims that it was beating MasterCard.

Apple Pay in use

In 2022, researchers claimed that Apple Pay had surpassed MasterCard in the annual dollar value of transactions, and by a long way. Where MasterCard processed around $4.8 trillion worth of transactions, Apple Pay was seeing over $6 trillion.

Now according to comparison service Merchant Machine, Apple Pay is significantly less popular than MasterCard. The key word there is "popular," though, as it appears the research is based on the number of transactions, rather than the total dollar value of them.

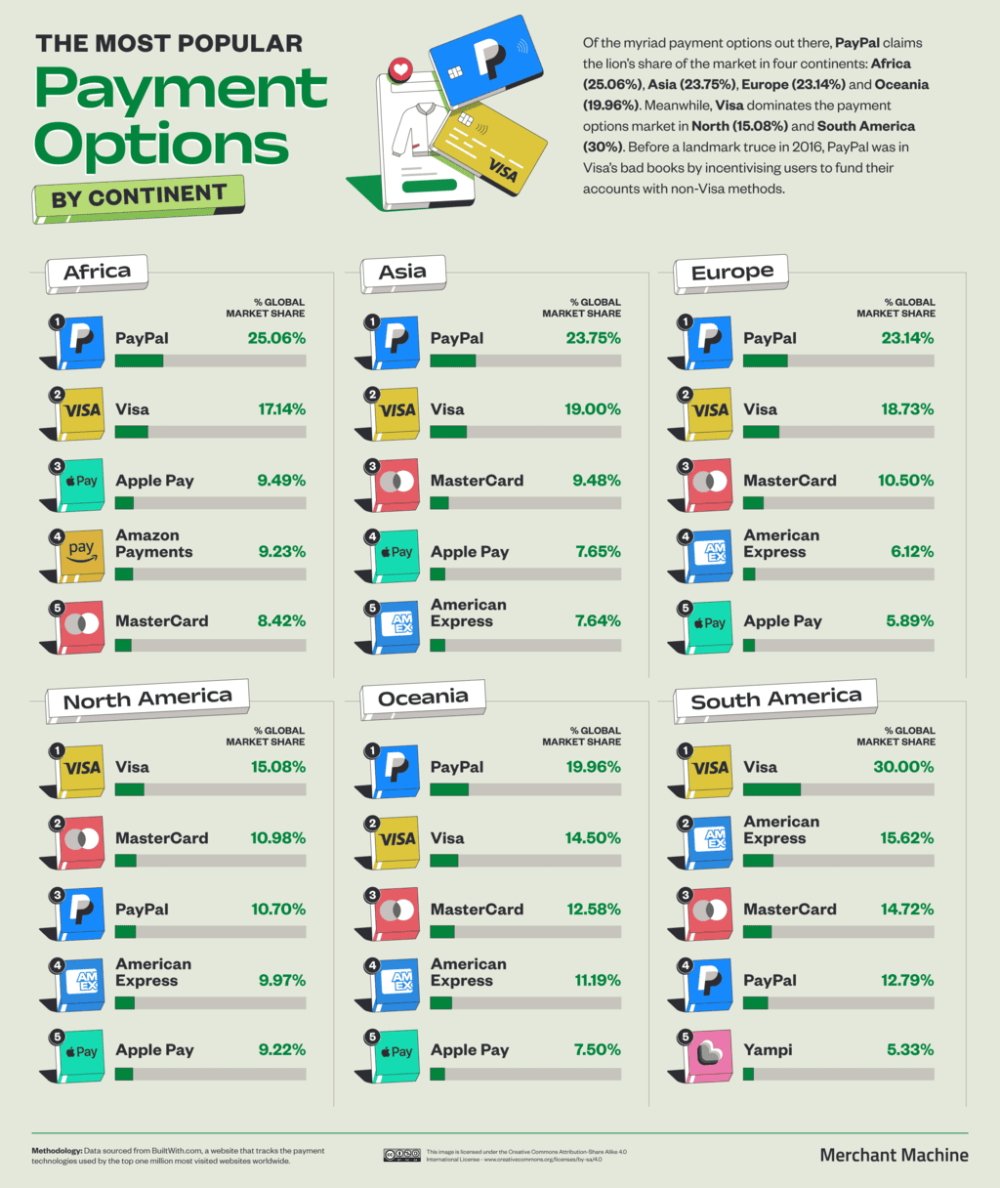

Nonetheless, by this measure, the list of the top five payment platforms in the US -- and their percentage of market share globally, is:

- Visa (15.08%)

- MasterCard (10.98%)

- PayPal (10.7%)

- American Express (9.97%)

- Apple Pay (9.92%)

PayPal tops the list in Africa, Asia, Europe, and Oceania. Visa tops the bill in North America and South America.

Apple Pay's worldwide popularity is similar

It's not fully clear what Merchant Machine means by the word "globally," though, as it's also produced a list of the most popular payment methods worldwide -- and the figures are different. Or rather, the percentage market share figures are wildly different, yet the ranking still sees Apple at number 5:

- PayPal (20.53%)

- Visa (15.67%)

- MasterCard (10.49%)

- American Express (8.77%)

- Apple Pay (7.37%)

Apple Pay is also fifth when only figures from Europe are considered. Or Oceania.

In South America, Apple Pay drops out of the top five entirely. But for Asia it is in fourth place, while in Africa it comes in third.

Most popular payment platforms arranged by continent (Source: Merchant Machines)

Comparing Apple Pay to Google and Amazon

Where Apple Pay is reportedly the fifth most popular payment method in the world, Amazon is behind it in sixth place. But Apple's 7.37% is rather better than Amazon Payments 6.04%.

Lagging behind them is Google Pay in eighth position (below Shopify Pay). It has a 4.3% global market share.

Merchant Machine believes that none of these Big Tech payment systems will beat debit cards and PayPal. But it bases that on a survey of the UK, and that survey was conducted by the controversial YouGov firm.

The research also covered the prevalence of Buy Now, Pay Later (BNPL) services. Apple launched its own BNPL in June 2022. While the research does not rank BNPL by popularity, it doesn't even mention Apple Pay Later at all.

This research was reportedly based on data from BuiltWith, and the payment platform used when buying from the top one million most-visited sites worldwide.

Merchant Machines recently promoted itself with research about how often Apple products are seen in films and TV.

Read on AppleInsider

Comments

Apple does not process payments. It relies on these networks for the actual transaction

Why is this so hard to understand?

75% of transactions are in-person

But not in the future, the traditional technophobic middleman will be left by the wayside. On another front if the Apple’s Vision Pro takes with the new front row seat technology it just may, put a dent in Ticketmaster’s concert/special event monopoly no more worries about getting the cheap seat way in the back, Messi isn’t playing in North America for nothing, how many of those games are being filmed with the new technology that Apple created? That is bigger than AAA games, because the audience is potentially most of the human race, instead of a few geeks in the basement playing Fortnite.

Imagine being at the local Internet bar with your friends and you’re all wearing a Apple’s Vision Pro’s and you’re attending some concert/or event halfway around the world, without Ticketmaster getting in the way, hmm…. That would suggest that Apple had better get into the server/router business again?

Also PayPal is online only. ApplePay can be used in shops and online.

I've been thinking about why Goldman Sachs is losing money on the AppleCard. I think it is because the app on the phone makes it easy to pay off the balance to avoid late charges and interest. That means Sachs only make money off transaction fees.

'Online' payments will never outstrip 'in person' payments.

EMV was introduced years ago. Whether you like it or not there is nothing technophobic about it. What was Apple doing back then and on what scale?

Even today, Apple Pay and Apple Card depend on those same banking entities.

Apple simply produces a last hop solution.

It can use technology to improve that last hop because that technology is already on the device. It's also very expensive.

That isn't an option when you are looking for a solution that can distributed worldwide cheaply and to virtually any developed nation and people that don't use phones.

Apple Pay integrates the cards from traditional card issuers.

Apple Card depends on a third party.

On all Apple devices, Apple Pay is the middleman. A middleman that is forced on all iPhone purchasers (Apple doesn't allow competition) but a middleman that nevertheless depends on those card issuing banks and systems like EMV.

On going technology improvements is why they the old guard are crying for government help, we need access we need access. Please help us…..

The so-called vanguards of capitalism want government help no surprise….