Apple suffers fourth consecutive quarter of declining sales, beat Wall Street anyway

Apple has reported its results for the fourth quarter of 2023, with its revenue of $89.5 billion a continued drop for four consecutive quarters.

Apple CEO Tim Cook

The last quarter of the fiscal year for Apple, the fourth quarter financial results were reported by Apple on Thursday, before its standard conference call with industry analysts.

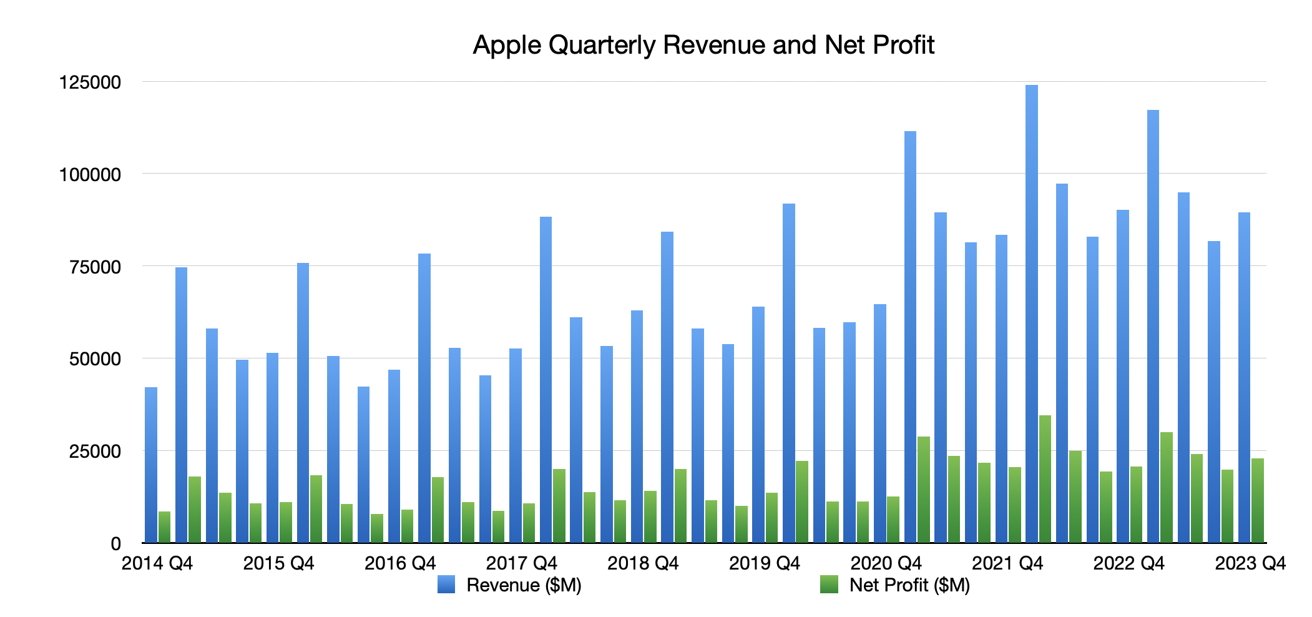

For the fourth quarter, Apple managed $89.5 billion of revenue, down from the $90.1 billion reported in Q4 2022. The reported earnings per share was declared to be $1.46.

Apple's quarterly revenue and net profit as of Q4 2023

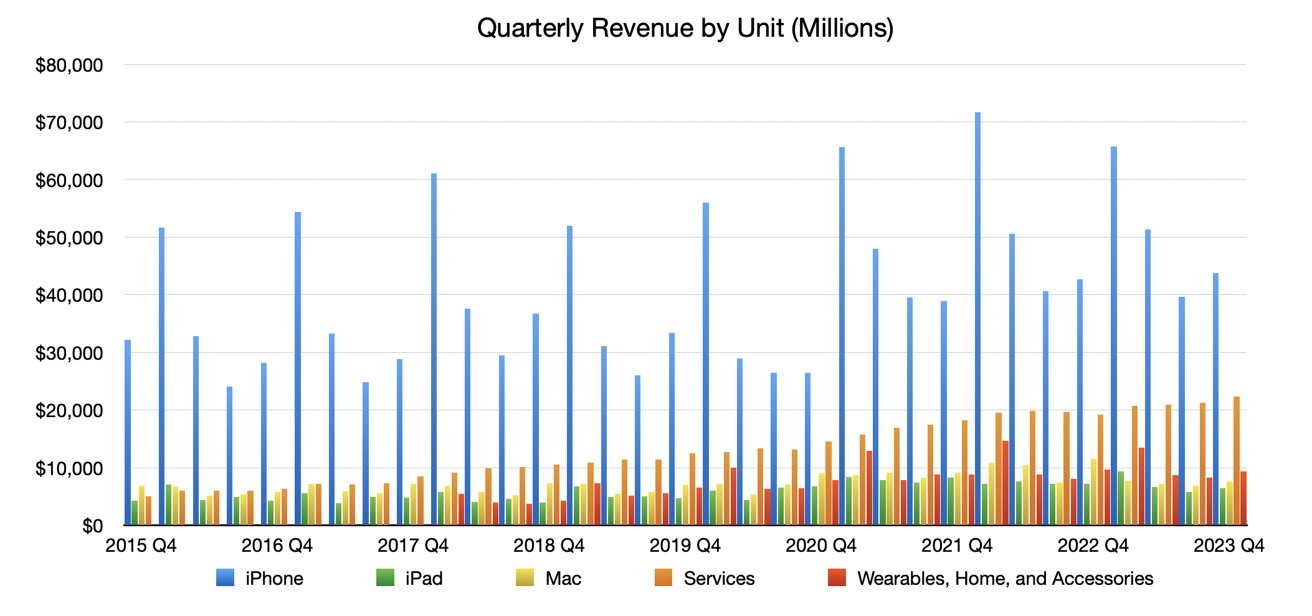

The iPhone revenue has gone from $42.6 billion in Q4 2022 to $43.8 billion in Q4 2023. Revenue from iPad is at $6.43, down from $7.17 billion in the year-ago quarter, while Mac revenue at $7.61 is down year-on-year from $11.5 billion.

The usually dependable Services arm saw its growth continue to $22.314 billion, up from $19.18 billion for Q4 2022, and Wearables, Home, and Accessories reached $9.32 billion, down year-on-year from $9.65 billion.

Apple quarterly revenue by unit

The fourth quarter would've been the first full quarter for sales from Apple's Q3 launches, including the M2 Max and M2 Ultra versions of the Mac Studio, the New Mac Pro with Apple Silicon, and the 15-inch MacBook Air.

Q4 period launches, including the iPhone 15 family of smartphones, the updated USB-C version of the AirPods Pro, USB-C EarPods, the Apple Watch Series 9, and Apple Watch Ultra 2 will have a small effect on the Q4 results. This is due to all of them being introduced in the last few weeks of the three-month period.

The next quarter, Q1 2024, will be the quarter that will benefit the most from Apple's annual iPhone update.

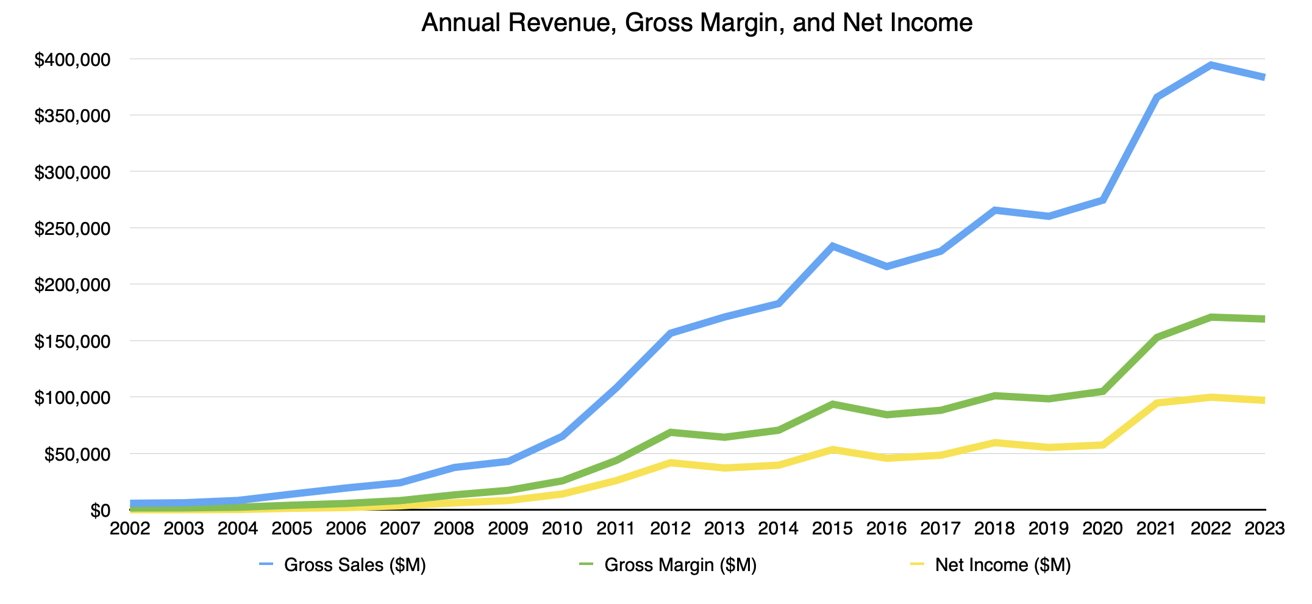

Apple's annual revenue, gross margin, and net income

In comments, Apple CEO Tim Cook said "Today Apple is pleased to report a September quarter revenue record for iPhone and an all-time revenue record in Services." He continued "We now have our strongest lineup of products ever heading into the holiday season, including the iPhone 15 lineup and our first carbon neutral Apple Watch models, a major milestone in our efforts to make all Apple products carbon neutral by 2030."

"Our active installed base of devices has again reached a new all-time high across all products and all geographic segments, thanks to the strength of our ecosystem and unparalleled customer loyalty," added CFO Luca Maestri.

Apple also advised of its full-year results, with annual revenue of $383.3 billion down year-on-year from $394.3 billion.

Read on AppleInsider

Comments

I think this might be a bit circular. Wall Street's need for constant EPS growth means that with iPhone sales plateauing and most hardware lines staying steady, getting more profit per user is the only way to grow that EPS. Higher ASPs, higher margins, loop you into more services etc.

The small decline in revenue was predominantly from iPad and Macs for which we are comparing Q 2022 that benefitted from M2 Mac launches and Q 2023 which did not. We saw new Macs just recently being announced. iPad refresh also has not happened yet in 2023. Best is yet to come.

Highest margin segments iPhone and Services grew. Home/Wearables was almost flat. This is a strong showing by Apple.

All of this to the backdrop of a killer macro economic climate and FX head winds. I mean the world is deep fried bananas.

The more I look at the numbers, the more confident I feel that Apple is riding the economic tectonic plates like a pro surfer. And this while investing heavily into new major product categories like Vision Pro.

Edited - The more I run the numbers in chatGPT data analysis the more I love this Q. Gross margin of services is up YoY (up ~0.5% points). Services represent ~25% of total sales but is ~40% of total gross margin. (2022 numbers were 21.3% and 35.5%). Installed base keeps growing and gooses the services volume. Good times.

Having said that I think your argument, at least when it comes to the iPhones, is flawed.

In 2009 the exchange rate hovered around $1.55 to £1 & VAT (sales tax to our US friends) stood at 15%.

It’s hard to get an exact price on the iPhone 3GS as back then it was all on contracts with a smaller amount upfront. Still, the base iPhone 3GS was $499 in the US, so we can use that.

Adjusted for inflation $499 would be $716 today. For a new iPhone 15 the cost is $799. Yes, Apple is making a bit more. Tim Cook is a greedy bastard, but then as CEO it’s his job to make as much money as possible and really you’re not paying that much more than you did back in 2009, at least not in dollar terms.

Yes, here in the U.K. we are worse off than 2009. But most of that is due to tax rises and a much stronger dollar and both of those items are outside of Apples control.

If we are in bad times, like some people keep saying the only thing Apple can do is what they are currently doing continue to make the best products and move on. I would also hope that more American companies (including Apple) would go down the path of Germany and Japan, and not the path that, the UK chose, which was not making anything in country, and guess what? that path probably will cost more.