Analysis: Apple Vision Pro sells well, but needs more content faster

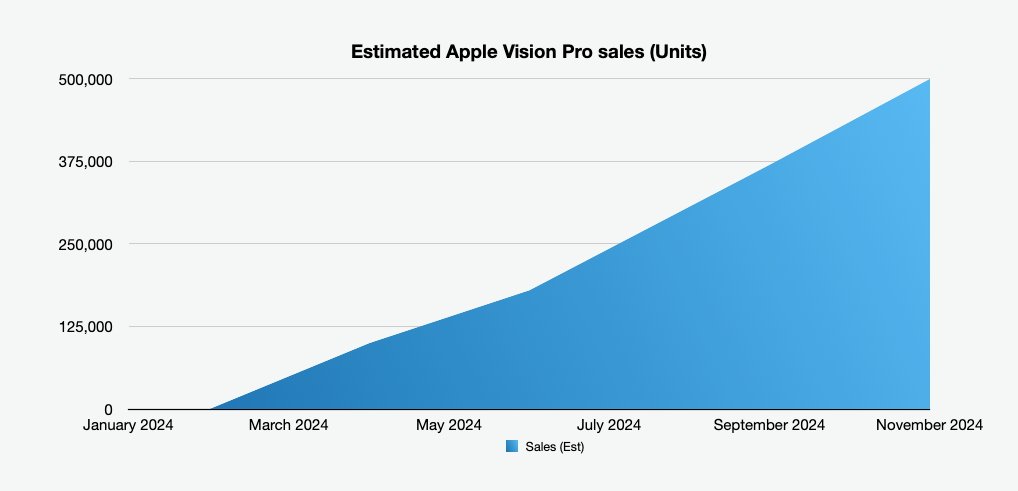

The Apple Vision Pro is often referred to as a "flop" in media reports, but by the end of 2024, it will have sold around 500,000 units.

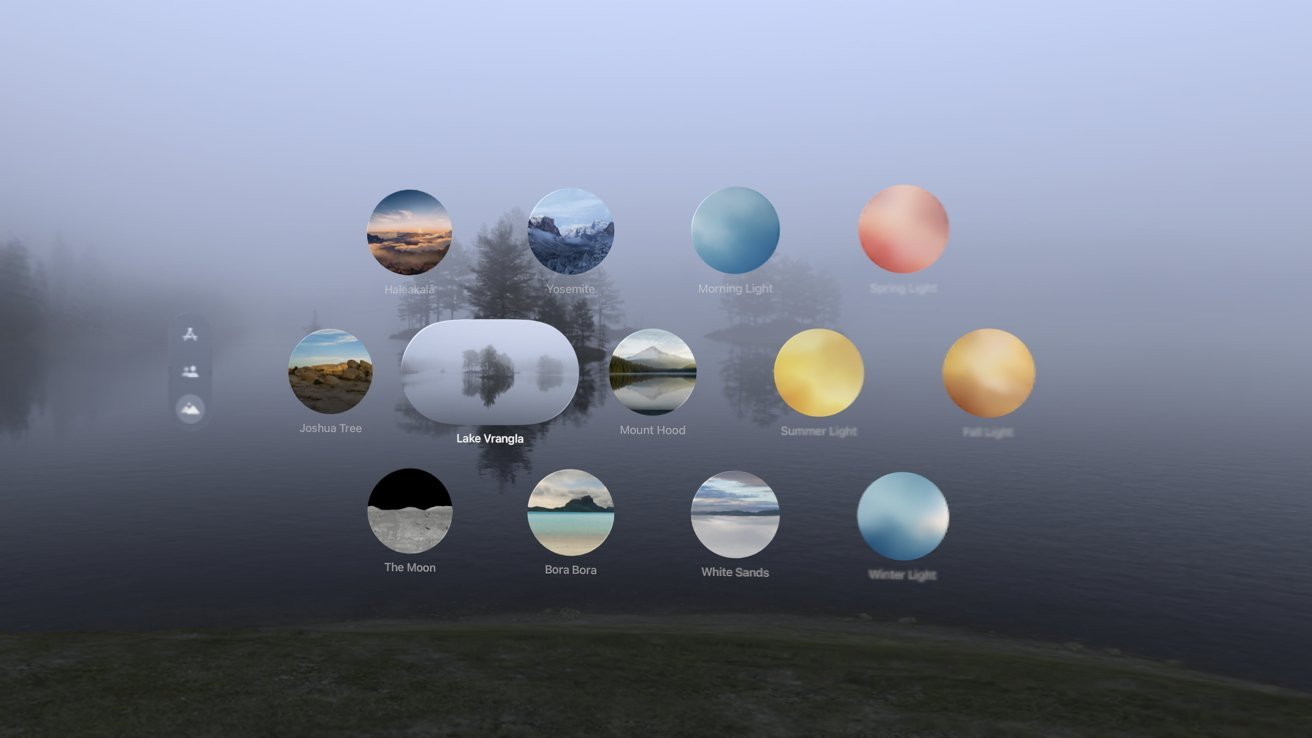

Apple Vision Pro features stunning immersive environments and content.

For context, that Wall Street estimate matches almost exactly the money Apple made from the iPhone in 2008, its first full calendar year of sales. While 500,000 units seems small compared to current iPhone or Mac sales, it's impressive for a first, albeit expensive, foray into VR.

In terms of gross revenue, the Apple Vision Pro is projected to bring in as much in its first 11 months as the proposed cost of a new state-of-the-art sports stadium currently being built in Las Vegas. For its first five months, the Apple Vision Pro was only available to purchase in the US.

Across June of 2024, Apple expanded sales to Australia, Canada, China, France, Germany, Hong Kong, Japan, Singapore, and the UK. In November, it debuted in South Korea and the UAE.

While the Apple Vision Pro sells reasonably well for a AR/VR device, its high retail price of $3,500 prevents it from finding a more mainstream audience. The Meta Quest 3, a gaming-focused competing headset, starts at $399 - and sales are in the millions.

Sales of the Apple Vision Pro headset over the past year, based on data from The Information.

Apple's approach will generate some $1.75 billion in revenue, ahead of its first anniversary in February.

More content on the way

Apple has made some effort to bring more content to its VR headset in recent months. Recently it debuted a new virtual concert series with spatial audio called "Concert for One" that featured The Weeknd.

UK recording artist RAYE will star in the second installment of the series. In October, the company released a 16-minute submarine drama, Submerged, also shot in immersive video and spatial audio.

Games and other software have also been rolling out slowly to the Apple Vision Pro, such as the fantasy strategy sim "The Elder Scrolls: Castles." Disney+ contributed a new immersive environment, "Iceland," for the headset.

Early adopters of the Apple Vision Pro have expressed some frustration with the slow rollout of content, but Apple and Blackmagic Design have started using the latter company's 8K immersive video cameras at sporting events and other locations, suggesting more virtual experiences are on the way.

So far, Apple has made its own produced content available for free to maintain enthusiasm for the product and its potential. Nearly a year into it, however, more third-party software and immersive media content need to be produced to keep the Apple Vision Pro viable for the long term.

Read on AppleInsider

Comments

If Sony can make more microOLED displays, they would be cheaper to Apple, and the AVP could be priced cheaper and therefore sell more. It's basic economics and marketing. Apple targeted the $3500 price point for a pretty obvious set of reasons.

There are only 3 points in this plot. With a nice round 500k number for November, I wonder what type of survey data the Information is using here? Direct leak from an Apple VP? A mole inside Sony? A mole inside the lens maker?

Uh, if Meta sells 5m units per year of the Meta Quests devices with an ASP of $400, that's $2b per year in revenue. Wouldn't you know it, Apple's 500k unit sales of the AVP at $3500 ASP is $1.75b per year. Guess who is doing better here? Apple!

Meta loses about $1000 for every $400 Meta Quest headset they sell. It's just craziness. If there was a thing the DOJ should be investigating, this is one of those. Meta, by subsidizing the sales of their VR hardware has effectively nuked any kind of VR hardware competition they could have, as nobody else has a sugardaddy set of businesses to continually to funnel money to, while any independent VR company will find it impossible to compete on price.

Apple obviously never competes on price. They always go for "value" for high prices.

Yup, it's a long game.

The media discussion always gets it backwards imo. Developers never set the virtuous cycle started. It's always the OEM who must provide the initial sales trajectory, with the right features to get customers to buy. When there is a market of users who are willing to pay for apps, the virtuous cycle can start, where availability of 3rd party apps can drive device sales. First and foremost, Apple has to come up with a set of features, price, workflows to get people to buy.

It's pretty clear it is not possible to make an AVP for $1000, and ostensible consumer price, and it's a multiyear waiting game for the microOLEDs, lens, and sensors to come in price. The weight also has to come down by half. That has to be a big priority. As it stands, the AVP is a niche device waiting on technology to cone down in price.

https://www.reuters.com/article/us-apple-macworld-iphone-idUSN1551882120080116/

This was announced at WWDC 2008:

https://www.youtube.com/watch?v=_X5xOI_qu9I&t=5010s

(Sam Altman of OpenAI showed off an app early in this video)

The iPhone launch price was $499 (fully subsidized).

In their 2008 annual report in November, Apple reported 11.6m units:

https://d1lge852tjjqow.cloudfront.net/CIK-0000320193/f4e66939-3f5e-4751-8206-ae4c372faf6b.pdf

They reported iPhone 'net sales' as $1.8b, which is unusual as this works out to $155 per iPhone but maybe to do with how it was paid for via the carriers and initial revenue sharing.

In 2009, the unit sales were 20.7m with net sales of $6.7b, which is $323 per iPhone.

Today the lowest iPhone is $429 and highest $1599.

The most expensive iPhone is nearly $2000 less than the lowest priced Apple Vision Pro.

The year 1 revenue of the iPhone was 6m x $499 (+ carrier monthly fees) = $3b+.

If the AVP were to follow a similar unit sales trajectory to the iPhone, it would need to sell 1.5m units in year 2. This would be unlikely if it retains a $3500 entry price point. If it can reach a sub-$2000 price point, this is perfectly feasible. I think they can sell 3m units/year at $1999 ($6b revenue) and 5m units at $1499 ($7.5b revenue).

This unit sales estimate of 0.5m units in a year is probably overly high, this was how many units Apple produced before cutting back on production due to unsold supply. This year's wearables revenue was reported in November as $37b, down from $39b in 2023 and $41b in 2022, AVP revenue would have propped this up if it was near the sales estimate:

https://d18rn0p25nwr6d.cloudfront.net/CIK-0000320193/c87043b9-5d89-4717-9f49-c4f9663d0061.pdf

So... with no great marketing answers to "Why buy a VP now if you've passed up to the this point?" I expect sales will remain really slow--certainly below 2024 levels--and Apple will need to make it financially worthwhile for developers to develop for VisionOS. I feel like it shouldn't have taken a year for Apple to realize this, but it's fortunate that Apple has the cash to pay for its mistakes and course-correct... but I don't think new and compelling apps that leverage VP's unique and powerful capabilities are developed quickly.

I don't see apps or large numbers of games being the big selling point with AVP, same as with other VR platforms. VR games hardly have any users, peak users are a few thousand with 30m+ hardware units:

https://steamdb.info/charts/?category=54&sort=peak

compared to non-VR games, around 100x higher:

https://steamdb.info/charts/?sort=peak

If Apple has a few good evergreen games like Beat Saber for fitness, maybe some social game or MMO like Skyrim VR, that would be good enough for interactive content. They don't need a library with dozens of VR games, just a handful of good quality games that people will play regularly.

Movies are the big feature. A $1499 personal cinema would sell millions of units and people would play normal 2D games on it like Nintendo Switch.

so now you’re saying it’s sold only 500k after USA plus global launch to date?

“iPhone moment” indeed. it’s a flop.

No matter how hard the spin, it’s not a success.

Now... Vision Pro undoubtedly has capabilities well beyond any offering from Meta. And $3500 is surely not a mass market price tag, as Apple well knows, it was simply the price tag necessary to deliver a v1 product worthy of the ambition behind it. I think the real issue for VP is a broader range of use cases for its unique capabilities to help motivate/drive sales. Let's imagine that on Jan 1, Apple dropped the VP price to $1999. Does that boost sales? Sure. Does it boost them enough to make VP a hit product? I'd say no. Because two grand is still a lot of money, an amount that for most people requires a very good answer to "Why do I need this?" and I don't think there are enough sufficiently good answers to that question yet. In Mark Gurman's latest newsletter, what jumped out at me most was that Apple's internal data shows that current owners of the Vision Pro are only using it on a fairly limited basis. That VP is not highly engaging the people who paid $3500 to get it is indicative of the problem that Apple needs to solve first.

https://www.emarketer.com/content/meta-captures-90-of-vr-headset-market-share

https://store.steampowered.com/hwsurvey/vr

They are an ad company like Google. Google spends $20b/year to be the default search on iPhone. Meta can spend $20b/year to be the primary VR platform.

It may never pay off the huge losses but all the tech companies see spatial computing as the next big platform. It takes away the last physical constraint that computers place on people.

Ad companies try to get the most users first, even if there's little revenue or losses to begin with (Gmail, SnapChat, WhatsApp, Instagram etc), then they figure out how to make money from the users, typically via ads and they cut operating costs.

It's expensive but also still bulky and heavy. Making it more comfortable to wear will improve usage.

A $2000 price point won't make it a hit product but it takes the userbase from thousands to millions. Then it starts getting interesting for content providers because they can make money too. The Wii U failed because it had so few users (~10m) that 3rd parties didn't bother supporting it.

Apple TV has the same issue with fewer subscribers than Amazon Prime Video, Netflix and Disney+ and they can't get the deals the larger platforms get.

What definitely won't make it a hit product is continuing to sell it at $3500. A revision 2 with M4/5 at $3500 would probably sell the same numbers as the initial version because it's not lacking processing power or memory with M2, it's failing in initial sales primarily.

Sub $2k price + more comfortable form factor will increase user base to the millions and people will use them more. The inherently lower usage of VR headsets is why they might be better focusing on audio first and have the video optional. People wear headphones for hours at a time when working. If a visor was a swivel away, people don't have to use it all the time but it's always available without having to go get the headset and get the fit comfortable.

There are already low priced AR sunglasses:

These latest ones offer 1080p OLED with built-in motion tracking, plug into a device and it mirrors the screen and this is priced at $500 at a profit:

https://us.shop.xreal.com/products/xreal-one

These glasses leak light in the sides so it's best to have blockers. Apple could have something that is a level above this. Given that 4K displays are too expensive just now, maybe they have variable resolution screens or tiled screens where the resolution is higher in the middle so the yields are better. Then work with this form factor and build it out into a visor that is secure on the head. It can use an A18 chip to bring costs down and will cut power draw in half vs M2.

If a small company can sell a product like this at a profit for $500, Apple with its huge resources can build a much better implementation of this and sell it at $1499-1999.

That’s one thing Steve Jobs learned upon his return to Apple. It’s being able to make and sell new product that sells at a profit, after all that is what the original iMac did it sold at a profit, which in turn allowed Apple to continue on as a company, being as big as Microsoft or Intel at that time was not the point the point was being able to create a new product that made a profit for each unit sold.

The Apple Vision is but a new software/hardware ecosystem a new branch on the Apple tree a branch that their competitors cannot match not at a profit.

So using your "analysis", the iPod was an ever bigger flop. Totally checks out right? The iPod is basically the poster child for failed products.

https://www.linkedin.com/pulse/xreal-announces-usd-60m-strategic-fundraising-round-ahead-air-wvjfc

"Beijing, China, Jan. 29, 2024 -- XREAL today reinforced its mission to bring spatial computing to global consumer markets, announcing that is has secured an additional USD $60 million in funding in a new strategic round. This brings XREAL's life-to-date fundraising to USD $300 million. ... Earlier in January, XREAL announced it had shipped an industry leading 350,000 AR glasses to date."

Assuming an ASP of $500, that's $175m in revenue, while they have raised $300m. I have not seen how much cash in hand they have, but needing to continue to raise money implies they are underwater, need further funding rounds, and need another 5x to 10x in sales to be able to self-fund from those sales.

AR glasses that have a pair of microOLEDS, lens/waveguides, and a custom chip probably has a BOM of $400 to $500. Hard to believe it would be in the low hundreds. My basic rule of thumb for a profitable product is BOM x 3. If the BOM is $500, they need to sell for $1500. 33:33:33. A third for the BOM. A third for the cost of selling and supporting. A third is the gross margin. So, XREALs ASPs likely have to double while driving down BOM, or other ratio to get an actual profit margin.

One disappointing thing about all these AR and VR devices is that they are effectively 3 to 4 layers in front of your eyes, and stick out a lot. The XREAL glass only stick out a little less than an AVP, maybe 0.3 inches? For me, I would likely need to get the clip on Rx lens, then there is the triangular (in profile) waveguide+lens, and then the outermost shade layer. All this stuff will be resting on nosepads. Just does not sound pleasant.

AVP is Rx lens if needed, lens, microOLEDs, chips, outer OLED. 5 layers in front of your eyes! But the weight is more distributed across your face.

How when all these layers get combined so that they don't stick out so much, only as much as eye glasses or swimming goggles, sounds like a long long, long, road yet to come. So get used to the bulkiness. Moreover, there needs to be variable focus lens, like 1 ft, 3 ft and infinitely, and this surely will add more bulk.

The Mac today wouldn't exist if its entry price was $3500+. The majority of Mac sales are below $2000. The majority of iPhone sales are below $1000.

None of these products are sold at a loss or built with cheap parts. The Mac mini is $500 and is a high quality product.

BOM of AVP is estimated around $1700 for a $3500 retail price. $700 just for the displays. Let's say they start with 1080p displays ($50 each), take a single 4K display and slice it into 4 tiles ($350 / 4 = $88). Cut out the middle of the 1080p display and put a 1/4 4K tile in the middle. Then you get a $50 + $88 display = $138. It's like a hardware foveated display, 4K when looking forward into the middle 50% of the display, 1080p when looking sideways (not turning head) and cuts $400 off the cost.

Then drop from M-series chips to iPhone chips where A18 will be roughly the same performance as M2 but half the power and $100 less, maybe fanless.

Cut out the EyeSight feature to save another $100 and drops the weight and size.

Then the BOM is $1700 - $400 - $100 - $100 = $1100, retail price is $2200.

Squeeze some margins a little, adjust other costs like cameras and they can hit $1999. Then they sell 3m units ($6b) with gross profit of around 40% like all their other products.

Still highly profitable but now it's a platform that 3rd parties can invest in.

A new company has to raise capital to build the products. If it's $400 BOM for a $500 product, they can only make gross profit of 350k units x $100 = $35m but to manufacture this many units, they need 350k x $400 = $140m plus staff costs, marketing etc.

They should probably increase prices if they want to be able to self-fund their operation but having investors cover costs initially is a standard way to go. Amazon made losses for over 15 years and had investors cover the costs and it worked out eventually.

https://www.ibtimes.com/amazon-nearly-20-years-business-it-still-doesnt-make-money-investors-dont-seem-care-1513368

XREAL isn't a service or ad company. I was questioning your statement that XREAL was making a profit off their $500 AR glasses. That's really doubtful. They use microOLEDs and lens/waveguides. The BOM for those 4 things alone may be $500. If they were making a profit, the necessity for another funding round in 2024 becomes much less needed, and to me that is evidence there gross margins are currently negative.

Sony's PSVR2 is $550, and it is probably breakeven to making single digit profit margins (after a million units?), but it uses OLEDs with about a quarter of the AVP resolution, Fresnel lens rather than pancake lens, has a lower sensor count, and doesn't have the equivalent of a MBP14 with M2 Pro in it. It does have hand controllers as part of that $550 though. Probably $20 to $30 BOM for each controller.

Just seems impossible that any company can make a competent AR or VR headset for a profit at $500, and they all need to be $1000, minimum.

https://www.uploadvr.com/meta-quest-3-apple-vision-pro-production-cost-estimate/

This is component and assembly cost that doesn't include R&D, software etc. Quest 3 production cost is estimated at $430, AVP is $1700.

Meta Quest 3 is sold close to break-even or at a loss. It has more advanced components than the Xreal product.

The same point about low profits could be made about any low priced product. How does Apple sell an iPad at a profit at $349:

https://www.apple.com/ipad-10.9/

This would imply a production cost under $220. But they've managed to pull it off.

This isn't enough profit per unit for a small company to build the next product iteration. They need $140m+ of operating capital. But they don't need to sell an AR product at $1000 minimum to be profitable, same way iPads, smartwatches, iPhones don't need to be $1000 minimum.

Similarly, Apple's AVP build costs can come way down to make a profitable device under $2k.