Services buoy slumping iPhone sales in record-breaking holiday quarter earnings

Apple has reported its financial results for the first quarter of 2025, with the holiday sales boosting revenue to a record $124.3 billion in the first results call with new CFO Kevan Parekh.

Apple CEO Tim Cook [left], CFO Kevan Parekh [right]

The first quarter of Apple's fiscal year is typically the biggest across all periods, following the usually intensive holiday shopping period and iPhone launches. The Q1 2025 results follow exactly the same pattern.

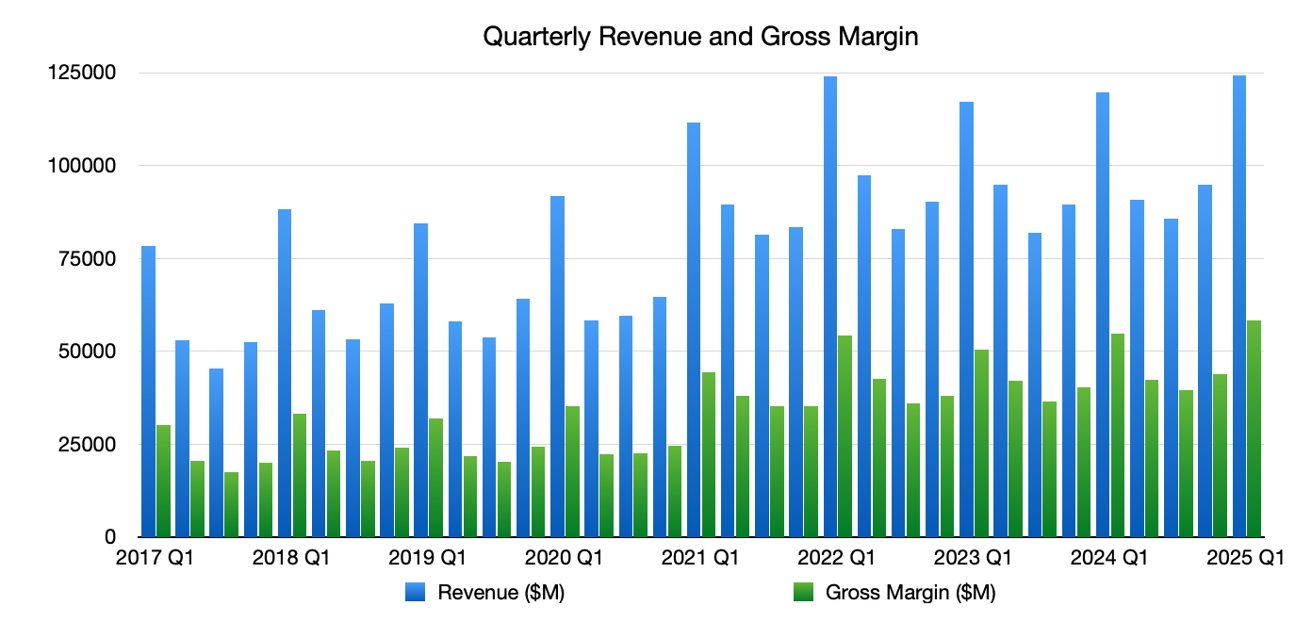

In the first quarter, Apple's revenue hit $124.3 billion, up from $119.58 billion reported one year ago in Q1 2024.

AAPL quarterly revenue and gross margin

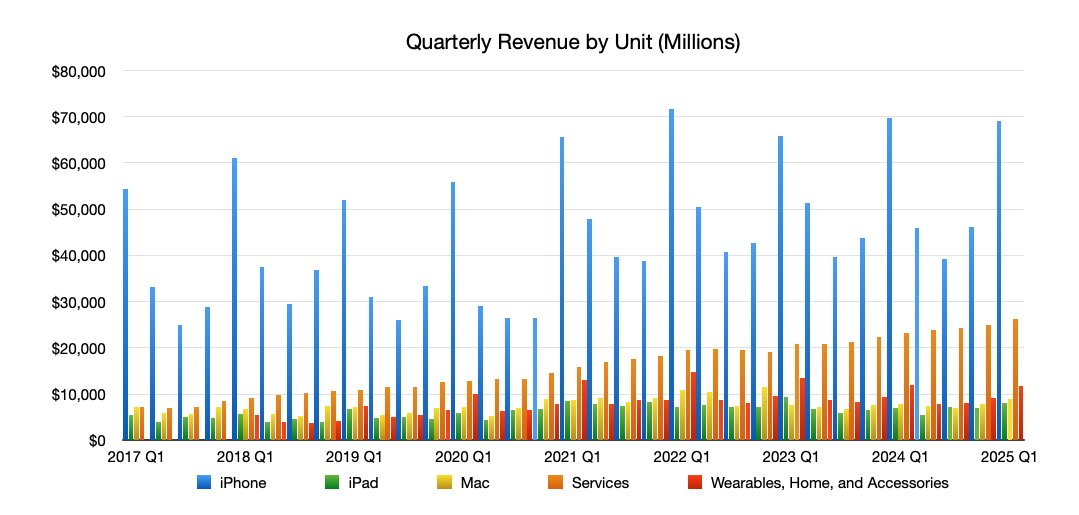

Broken down to units, iPhone revenue reached $69.1 billion, marginally down from $69.7 billion in Q1 2024. iPad revenue went up from $7.02 billion last year to $8.088 billion this time.

Mac revenue was largely static in Q1 2024 at $7.78 billion, while in Q1 2025, it rose to $8.987 billion. Wearables, Home, and Accessories managed to hit $11.747 billion, down from $11.95 billion in Q1 2024.

Services, the very reliable sector for the company, continued its positive growth streak. The $26.34 billion in Q1 2025 is up from $23.12 billion recorded in Q1 2024.

Apple's board of directors declared a cash dividend of $0.25 per share of common stock. The Earnings Per Share is listed at $2.41.

During the period, Apple benefited from quite a few preceding product launches. The Q4 launches of the iPhone 16 range, AirPods Max with USB-C, the Apple Watch Series 10, and the black Apple Watch Ultra 2 all enjoyed a full quarter of holiday shopping sales.

AAPL Units Revenue

As usual, the results are followed by the conference call with investors and analysts. Tim Cook will be in attendance as CEO, but so will Kevan Parekh, who is replacing Luca Maestri as CFO.

Maestri stepped down in January, allowing the VP of Financial Planning and Analysis to take over his role.

"Today Apple is reporting our best quarter ever, with revenue of $124.3 billion, up 4 percent from a year ago," said Tim Cook, Apple's CEO. "We were thrilled to bring customers our best-ever lineup of products and services during the holiday season.

"Our record revenue and strong operating margins drove EPS to a new all-time record with double-digit growth and allowed us to return over $30 billion to shareholders," said Kevan Parekh. "

On a regional basis, revenue from the Americas grew from $50.4 billion one year ago to $52.6 billion. Europe similarly saw an improvement from $30.4 billion to $33.9 billion.

Greater China revenue dipped from $20.8 billion to $18.513 billion, while Japan grew from $7.7 billion to $10.3 billion. Rest of Asia Pacific rounds out the list with $10.291 billion, a marginal improvement over Q1 2024's $10.162 billion.

Read on AppleInsider

Comments

Good one. More in line with the text itself “marginal”.

and the Mac surged by a billion. Or around 11% growth, contributing to 20% of the overrall 5b gain over last year. Nice.

Remember the rumors that sales of the M4 iPad Pro were not good, primarily sourced from Ross Young or Ming Chi Kuo who said the Tandem OLEDs weren’t driving sales, and manufacturing for this or that Tandem OLED part was being reduced or shut down?

So. Who is bullshitting who here?

It could be all sales of the iPad 10 and iPad mini? That would be really good news. There would be 2x to 3x more iPads in the market as iPP ASP is about 2x and 3x that of the iPad 10 and mini.

Likely, just status quo, with all products getting 10% to 20% more sales YoY in the holiday quarter?

600 million less sales revenue for the iPhones probably means Apple iPhone sales in China and USA were flat in both countries.

1) The genius of Cook's leadership and vision in successfully guiding Apple to a place where it no longer lives or dies on the performance of iPhone. Phone sales were down over 11% in China and somewhat soft overall, and the stock went up 3%. Why? One word: Services.

2) Cook's Services Division continues its explosive growth: revenue up 15% for the quarter, YOY, to a stunning $26.34 billion for Q1. Did I mention this is a business with nearly 80% margins? With Services, Cook is about as close as legally possible to a business that prints money.

3) Solid performance all around. The continued iterations and evolution across the product lines continue to drive robust sales.

4) Strong growth in iPad sales reveals stupidity of much tech commentary and rumors. "The new iPad Mini is a worthless upgrade!" "Nobody's buying the iPad Pros." Blah, blah blah. Turns out the Mini and Air were prime drivers of growth (no surprise, they're two key mainstream models) and you simply don't post this kind of revenue growth if your two most expensive, top-of-the-line models are tanking. Even better was that half of all iPad purchases were made by new buyers.

Apple definitely should be looking to create and sell more powerful M4, M5, M6 Ultras, with UMA memory combined with big bandwidth, Apple seems to be in a very good position at the right time in comparison to their competition. Intel, AMD, and the high unsustainable in time 1000 wattage Nvidia all appear to be lagging.

The M2 Studio Ultra runs everything at 107 watts, and the M4 Studio Ultra promises to be even more fuel efficient and faster if the M4 iPad Is any indication.

Mac trucks have to be made Apple can’t keep leaving billions on the table. Apple is uniquely in the right place with Apple Silicon, to sell computer solutions that don’t use the energy of a nuclear power plant i.e. Nvidia which is unsustainable in the long run, the moat Nvidia has built will break apart like the one OpenAI, Microsoft, and Google who thought they had in AI until DeepSeek came along (the jury is out, but it’s not looking too good for the moat builders particularly OpenAI).

Everyone who can afford an iPhone has one. Any changes in unit sales are subject to small little changes, both up and down. Macroeconomics, political-social changes, etc. There isn't any more growth at the high end of the market. The only way Apple can sell more iPhones is to sell cheaper ones at $150 to $300 MSRP.

Apple isn't going to do that outside having a killer service with killer service revenues. It's a vicious circle at the low-end. That part of the market doesn't have a lot of free-flowing cash, and therefore won't be spending much on services either. Its end up as a no-margin business, and Apple doesn't do that.