Apple's $94B Q3 soundly beats Wall Street thanks to iPhone and China growth

In what is the last quarter where Apple will only take a minimal hit from grossly increased tariffs, the company posted $94 billion in earnings with a notably better-than-expected iPhone, growth in China, and strong Mac business segments.

Apple CEO Tim Cook [left], CFO Kevan Parekh [right]

Apple has published its quarterly financial results for Q3 2025, and it has beaten expectations once again. The quietest quarter in Apple's seasonally-affected financials schedule, the period is considerably better than first thought.

The results arrive ahead of the traditional conference call with analysts and investors, which is hosted by CEO Tim Cook and new CFO Kevan Parekh. During the call, the duo will discuss more details about the figures, as well as the impact of tariff changes against the business.

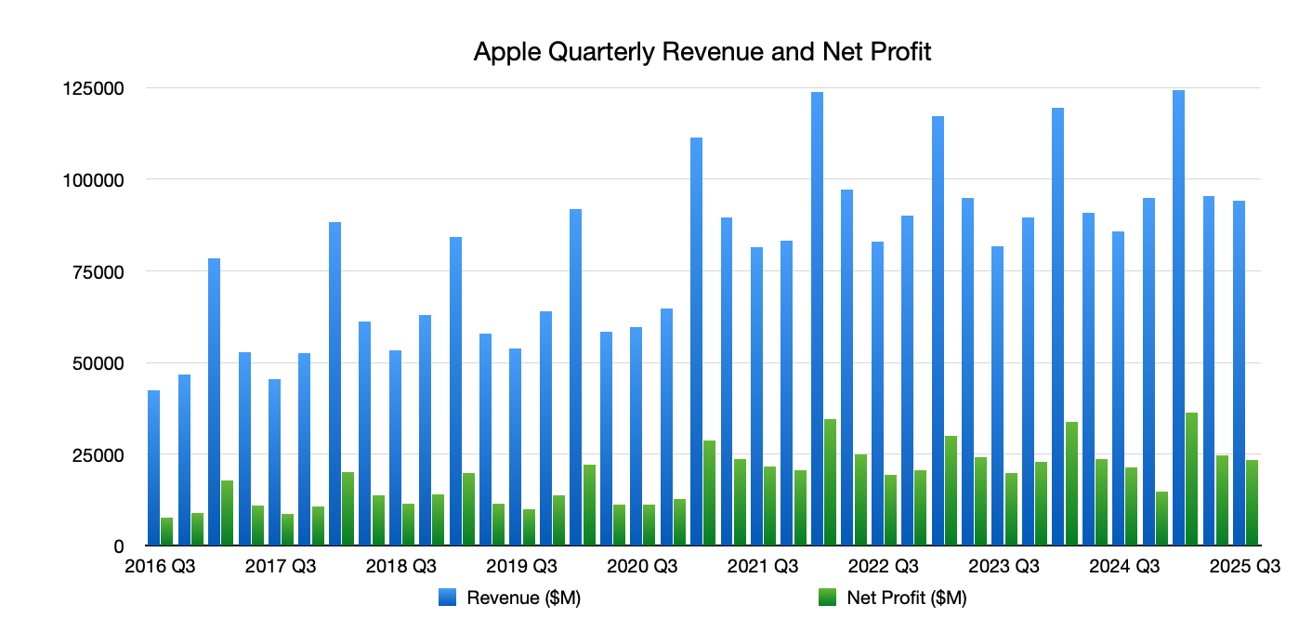

Apple quarterly revenue and net profit as of Q3 2025

For the second quarter, Apple's revenue reached $94.04 billion, up from the $85.78 billion reported in Q3 2024. The earnings per share of $1.57 is also up from the year-ago $1.40.

In pre-financials forecasts, the Wall Street consensus put revenue at around $89.1 billion, with a range between $92.1 as a high and $86.9 as a low. The EPS forecast was at $1.43, with a high of $1.54 and a low of $1.32.

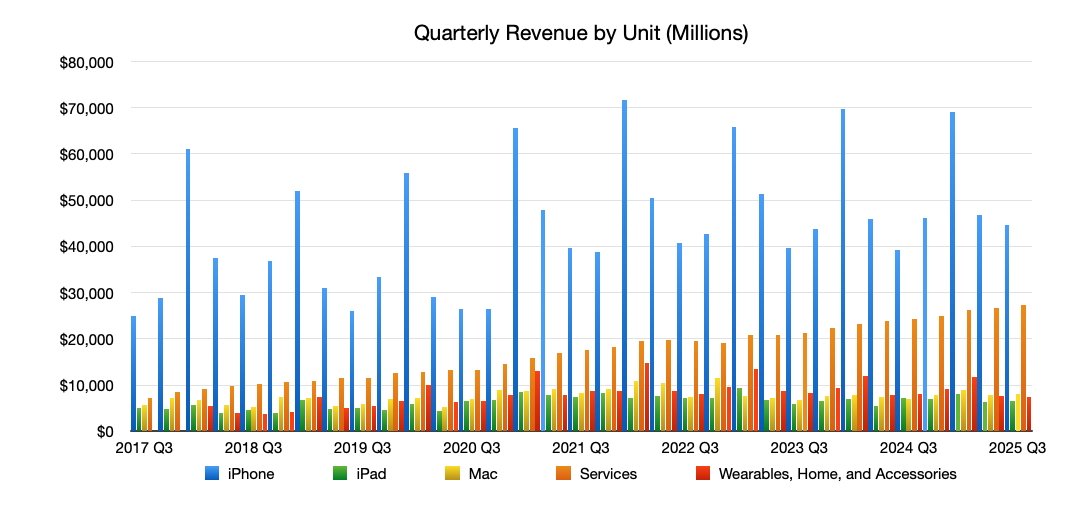

Apple's unit revenue, as per Q3 2025

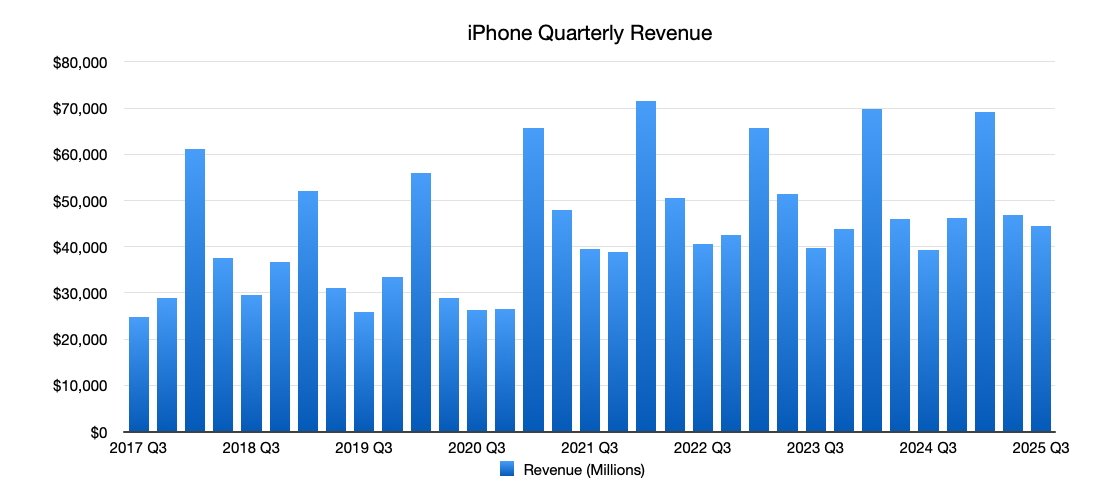

For the period, iPhone went from $39.3 billion in the year-ago quarter to $44.58 billion this time. Revenue from iPad at $6.58 billion is down from the $7.16 billion reported in Q3 2024.

Mac revenue grew from $7.01 billion to $8.05 billion. Wearables, Home, and Accessories moved from $8.09 billion last year to $7.4 billion this year.

Services continued its ever-ongoing upward growth trend, shifting from $24.2 billion for Q3 2024 to $27.4 billion for Q3 2025.

"Today Apple is proud to report a June quarter revenue record with double-digit growth in iPhone, Mac and Services and growth around the world, in every geographic segment," said Tim Cook.

Kevan Parekh said Apple is "very pleased" with its business performance for the June quarter, which generated earnings per share growth of 12%.

Apple's quarterly iPhone revenue, as of Q3 2025

Apple's install base of devices has also reached a new all-time high across all product categories and geographic segments. However, while Parekh doesn't state how much this is in the prepared statement, it may come up during the call with analysts.

Parekh does attribute this effect to "very high levels of customer satisfaction and loyalty."

Apple's board of directors has declared a cash dividend of $0.26 per share of the Company's common stock.

Read on AppleInsider

Comments

i am very positively surprised. Great job by the Apple team

The growth in services from Apple at 24% is impressive but Microsoft did even better at 34%.

Microsoft joined the 4 trillion club today while Apple is fighting tariffs, legal battles, brain drain, and a series of strategic misfires.

It will take years for Apple to nail. But customers are loyal and a few steps in the right direction can always change things.

So you like paying taxes... gotcha!

Oh wait… it must be because some randos were “panick-buying YEAR-OLD IPHONES or something…

*using tariffs as a retaliatory foreign policy tool completely disengaged from economics and trade (the Brazil tariffs intended to force Brazil to corruptly manipulate its justice system to aid an ideological ally)

*damaging the value of the USD, which has declined precipitously vs other currencies

*inflicting great damage on US automakers’ profits

*making China look increasingly more desirable as a trade partner. China’s leadership is rational, stable, and seems to understand economics. China doesn’t base its economic policies on personal grudges and capricious whims. China doesn’t whipsaw between radically different economic and foreign policy goals every four to eight years. China doesn’t make agreements and then capriciously throw them out the window shortly thereafter as Trump has done with a trade deal made with Canada in his first term.

I don’t expect any of these facts to influence the opinions of devoted Trump cultists, who will always find a way to displace the blame for the negative fallout from their messiah’s deeply irrational policies onto Hunter Biden’s laptop or Hillary Clinton or drag queens or whatever else is the right wing’s latest ginned-up enemy of All That Is Good And Right.

Apple did have an financial impact, as Cook said last quarter, because of tariffs that they wouldn't have had otherwise. It was $800 million that they paid that they wouldn't have had to. That'll be $1.2 billion next quarter.

So, $2 billion, that it didn't have to pay before the tariff revisions in April.

Had China not unexpectedly returned to growth, Apple would have had the bad quarter.