Apple didn't need AI -- but it did need China -- to beat analysts' doom and gloom

Apple has reported record revenues and done so with success in three key areas, none of which required Apple Intelligence, which analysts insisted the company needed to concentrate on. Here's how the quarter compares.

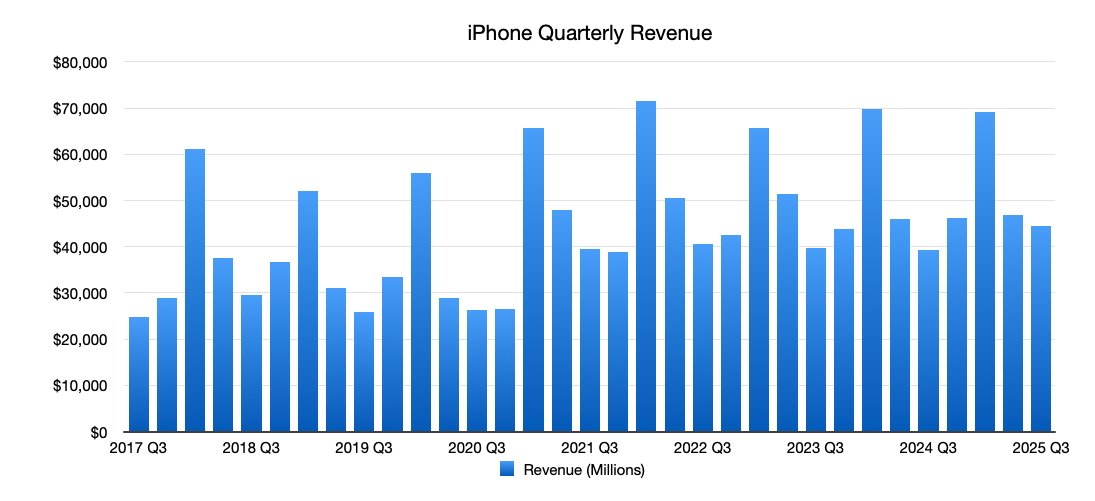

As ever, it was the iPhone's success that really drove Apple's earnings.

Tim Cook has previously said that after an earnings call, he talks a walk across Apple Park to decompress. This time, it's possible he skipped, because Apple reported earning $94 billion when analysts predicted a possible high of $92.1 billion, but also a possible low of $86.9 billion.

Perhaps those analysts all then went out for a drink together to discuss how they went so wrong. But they're very rarely perfectly right, and every analysts' report seen by AppleInsider since the results has had a "yeah, but" tone.

The most extreme is Wedbush, which like all of them says they were right that AI is crucial and Apple should still be doing better, or else. Like a couple of them, it called AI the elephant in the room, but then it went further.

"The AI Revolution is the biggest technology trend in 40 years," said Wedbush analysts, "and right now Apple is watching this from a park bench drinking lemonade while every other Big Tech company is racing ahead like F1 drivers building out its AI strategy and monetization plan."

Before the earnings report, it was common for analysts to say that Apple cannot do well in the quarter without a better AI offering. Now it's that Apple cannot continue to do well without one.

At least they're consistent.

Although to be fair, TD Cowen has now repeated how it has said before that it believes Apple has 18 months to get back ahead on AI.

Where Apple went right -- iPhone

While the overall earnings figure is impressive enough by itself, it's the breakdown that gives more of an idea about Apple's future.

Such as with iPhones, where sales were up 13.5% compared to the same time in 2024. That's the highest quarterly growth in iPhone sales since 2021.

How the latest iPhone sales compare to previous years

"This strong, broad-based performance was driven by the incredible popularity of the iPhone 16 family," Tim Cook said during the earnings call, "which was up strong double digits year over year as compared to the 15 family."

Cook did not dwell, though, on how there is a significant difference between this period in 2025 and the same a year before. The difference is the iPhone 16e, as although it launched in the year's first quarter, there was no modern equivalent to it at this time in 2024, as the last iPhone SE model was showing its age.

Plus there was the unexpected rise this quarter of sales in China, after years of decline. China's government helped there by introducing subsidies to stimulate its economy.

Then Apple's tariff bill came in at $800 million instead of the $900 million Cook had expected.

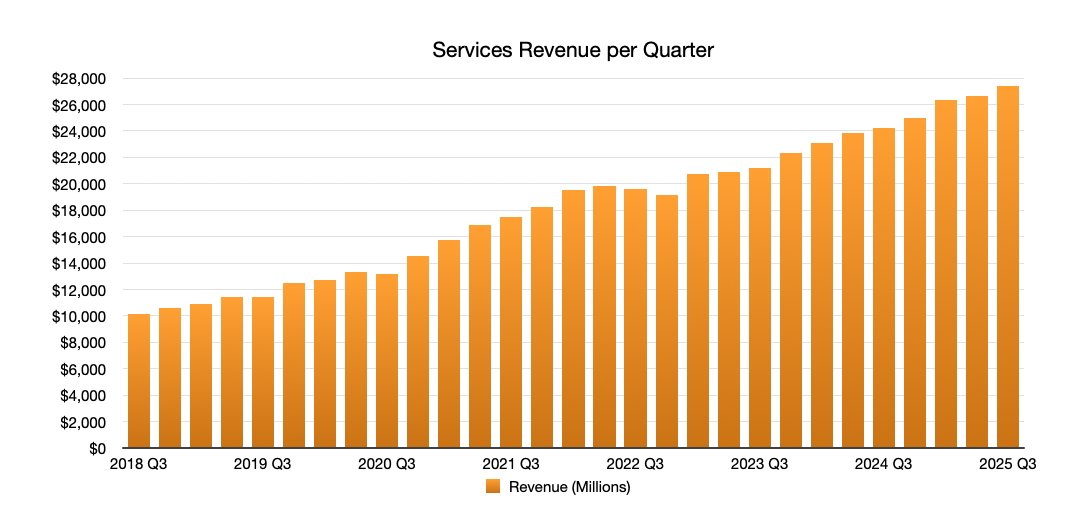

Where Apple went right -- Services

Services ranging from iCloud storage to Apple TV+ were expected to rise because they always do. Services has been a steadily more important contributor to the company's revenues, but in this quarter there was reason to doubt its success.

That's because during this quarter, Apple was forced to make changes to its App Store in response to the long-running dispute with Epic Games.

Apple Services just never stop growing

But as Cook reported, Services "revenue for the June quarter was $27.4 billion, up 13% from a year ago, and an all-time record."

The changes were implemented during the last couple of months, so there hasn't been a full quarter under the new arrangements yet. Still, it's possible that Apple's App Store earnings did take a hit even at this early stage, but it was masked by the overall growth in services.

These new arrangements will presumably continue on for at least the next quarter, if not for the foreseeable future. In which case there will be an impact, but there will never be a mass developer jump from the App Store to third-party alternatives.

Where Apple went right -- upgrades

Naturally Apple cherry-picks the most favorable results from its now extraordinarily wide range of products and services. But one where there wasn't a particularly notable rise in Wearables, there was still reason to raise it -- and to consider it a sign for the future.

Specifically, all wearables including the Apple Watch, brought in $7.4 billion. But the key figure was that Apple claimed to have seen "a June quarter record for upgraders to Apple Watch."

That's not as good as getting brand-new users, and Apple would have certainly boasted if there had been a significant number of switchers from rival smartwatches. But it does mean that existing users are still engaged enough, still enjoying the device that they keep upgrading to new versions.

So there's still that demand for Apple Watch. Although it's likely that there was again an element of buying early to avoid tariff price hikes, too.

Apple plays the long game, and it tends to see that reflected in people switching to its devices, and in customer satisfaction scores leading to device replacements and upgrades.

This time, it also saw it in the much higher than expected revenue report.

Apple isn't doomed. It may never be in all of our lifetimes. It's not as if Apple would have collapsed if it had a bad quarter, and even had the earnings been as "terrible" as analysts said that they'd be would still mean billions in profits.

Breaking records now, in a slow part of the year, while facing literally unprecedented tariffs suggests that the company is on the right track.

The F1 track, that is, with no lemonade in sight.

Read on AppleInsider

Comments

The concerns about AI are not about earnings next quarter or even next year. It's about 18 months and further out.

One thing I'm very confident of -- Apple leadership is not as myopic as the fanboy base. They've known for a while now that they've got a problem, they just haven't solved it yet. One way or another, I'm pretty confident the problem will be solved. But it won't be solved by pretending it doesn't exist.

Apple will do what it very nearly always does, which is what the analysts in question always, always fail to see -- Iterate until they have something that they like. No visibility as to what Apple is doing does not mean that Apple is not working on it.

So much for it being the end-all.

Wrong.

If Apple does not solve the AI lack of maturity for Siri, it will be an issue.

I know that AI is more than Siri. Devices from Apple have always been based on AI as I consider Machine Learning as AI.

But analysts want to see Siri working as our voice assistant.

It is what it is. Apple showed it at WWDC 2024. I will believe their good progress when the well progressed Siri is on my iPhone. Stay tuned. I hope they can fix it.

It’s like the old saying that Apple is doomed. People keep saying they should lower their hardware prices like HP or Dell to increase their market share. Or they say Apple isn’t selling any iPhones in China. But here’s the thing: there’s no moat around AI. The future is likely to be many small, customizable AI agents, not one big, company supercomputer serving everyone.

Apples approach is right on target they don’t need to do buy some AI company for $40 billion dollars (Wall Street’s solution), Apples needs to build from the ground up kinda like Apple TV content when Wall Street was suggesting that Apple buy one of those boondoggle movie studios for billions, turns out Apples approach was the right one when Apple announced Apple Intelligence, and they said they weren’t giving OpenAI a penny, that was the right approach going forward.

Yes, that approach takes longer, however, like building that Apple modem (despite much crying and derision) in the end, it will prove to be a much much better solution going into the future for Apple.

No one has yet identified a serious revenue stream from the software side and all deployments on the software side are either running at a loss or are bundled with another revenue stream.

Regardless of what the analysts say LLMs are not yet a hygiene factor where you will lose the sale if you don’t have it and to be blunt I don’t see them bracing so very quickly.

With all that in mind Apple are absolutely right to ignore a bunch of analysts who don’t have a clue what is really going on.

But @blastdoor is right in the sense that AI is holding Apple back. While Apple delivered 24% growth in services then MS hit 34%. Microsoft is also less exposed to tariffs. The series of strategic blunders and product misfires from Apple caused this, and the quarter just expanded it to nearly a trillion gap.

And Apple might be heading towards another strategic miscalculation. Apple is trying to keep AI on-device. It will increase the cost of devices and expose them to tariffs while the quality of AI on-device remains limited by storage, battery, memory, and processing power. MS is mostly doing AI as services delivering tariff free recurring income with constantly updated models.

Apple is betting on on-device to the point where we have a datacenter gap (thanks Dr. Strangelove). The Environmental Progress Report from Apple is showing 6.7% growth in data centers from 2023 to 2024. Microsoft is growing 33% per year (both numbers based on energy consumption). This gap can define what Apple is capable of doing when looking ahead.

One of the things I like about what Apple is doing with Apple Intelligence is they're not only doing it on device to make it more secure/private, but I think they're also using it in a way to where it can just work in the background and make people's lives easier without them even knowing its Apple Intelligence doing all of the work. Apple is very very clear in saying Apple Intelligence is not and never will be a chatbot like say ChatGPT is for exmaple. There's so many different ways AI can be implemented and it seems like everyone just assumes AI is just a chatbot when it can be used to do all kinds of different things for your everyday life. This is what I think Apple is actually doing a pretty good job at right now. What they're doing is not easy and there aren't many other companies do what Apple is doing.

This is a very immature technology and I don't think any company has really figured out AI yet to its true potential.

I think analysts are too focused on the immediate future and not a long term strategy so if they see Apple not doing well short term with AI then they assume Apple isn't innovative anymore and is falling behind when in reality they're again doing something that really not a lot of companies are doing and its so much harder to do it all on device than pointing to an AI server farm to get answers on everything and then god knows where your data went during and after that request.

I agree, in many cases people don't know what they want and Apple is fairly good at telling people what they want and then everyone goes in that direction.

Very easy all of the same doom and gloom noise about Apple.

Note: If you are a shareholder long Apple, you are used to discounting the noise, however if you were a casual retail investor, you are bombarded and confused and the same applies to many other people on some of the non Apple Tech sites.

No wonder Apple stock goes through the same repeating pattern of stalling before earnings reports and after and then slowly crawls up over-time a wash rinse and repeat pattern.

https://www.siliconvalley.com/2025/05/19/how-apple-fell-behind-in-the-ai-race/

https://www.forbes.com/sites/timbajarin/2025/06/19/apples-ai-approach-innovation-criticism-and-the-road-ahead/

https://www.iclarified.com/97352/why-apple-still-cant-catch-up-in-ai-and-what-its-doing-about-it-report

https://www.creativebloq.com/design/apples-ugly-and-embarrassing-ai-debacle-is-causing-tension-in-the-company

https://www.reuters.com/business/apple-earnings-under-pressure-tariffs-slow-ai-roll-out-2025-07-30/

https://www.ainvest.com/news/apple-ai-struggles-tech-giant-struggling-pace-ai-race-2504/

https://seekingalpha.com/article/4788607-apple-risks-from-every-direction-plague-this-legacy-giant

https://www.businessinsider.com/apple-tariff-uncertainty-china-iphone-exemption-trump-2025-4?op=1

https://finance.yahoo.com/news/apples-150-billion-meltdown-tariffs-184825581.html

https://fortune.com/2025/07/16/apple-tim-cook-leadership-shakeup-ai-analyst-note/

https://www.fool.com/investing/2025/05/07/sorry-but-tariffs-least-of-apple-stock-problems/

The number of sites are legion…..