Here's why you're only getting 1% cash back with the Apple Card

Now that you've got your Apple Card, you might be wondering why you've only been getting 1% back in Daily Cash. As it turns out, like most cards, there's a set of rules you'll need to follow to get the most cash back.

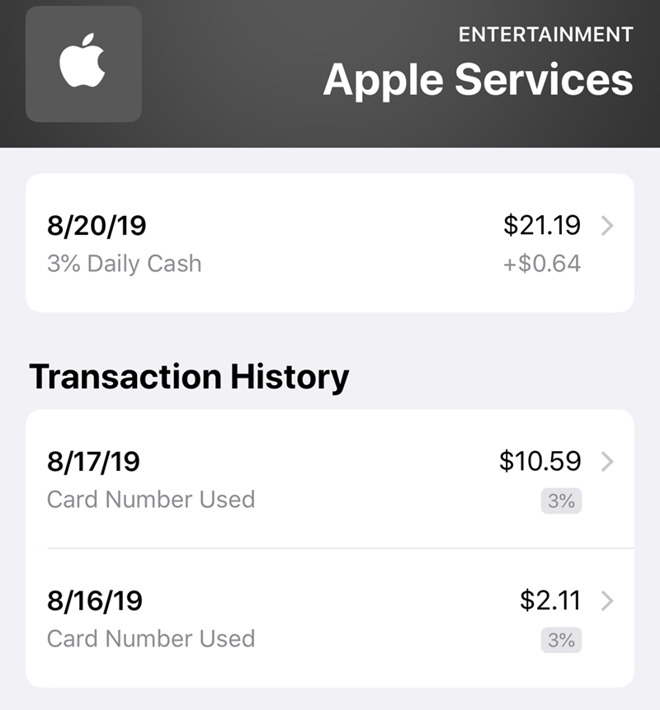

If you're looking to get the full 3% cash back from Apple Card purchases, you'll only be able to get that from buying something from Apple directly. Snagging yourself a new $1,299 MacBook Pro will get you just under $40 in Daily Cash, for example. Notably, purchases from both iTunes and the App Store, as well as your subscription to Apple Music, and likely Apple TV+ and Apple Arcade, will also get you 3% Daily Cash.

Using Apple Pay, on your iPhone or Apple Watch for instance, will net you back 2%. Not only is this great incentive for using Apple Pay, which is fast and convenient, it helps to keep your physical Apple Card in pristine condition.

You'll also still get Daily Cash if you use your physical Apple Card, but it will be reduced to 1%, rather than the 2% back you'll get for using Apple Pay. This includes online purchases that require you to enter in your card number. While you're still getting money back, you're getting significantly less back than you would if you were using Apple Pay. As follows, you want to use a different rewards card you own for these purchases, especially if they have a lower interest rate or offer more money for purchases like gas or groceries.

So, if you're planning on upgrading any of your Apple gear, especially larger purchases, it would be beneficial to make the purchase with the Apple Card. You'll be able to get a bit of money back, which is always a bonus when you're already spending that much money.

Otherwise, it's best to try to use your Apple Card exclusively with Apple Pay. Many retail outlets accept Apple Pay, which gives you the most amount of cash back for non-Apple purchases. The Apple Card has many benefits, but it's worth noting that like all credit cards, there are pros and cons to using it.

If you're looking to get the full 3% cash back from Apple Card purchases, you'll only be able to get that from buying something from Apple directly. Snagging yourself a new $1,299 MacBook Pro will get you just under $40 in Daily Cash, for example. Notably, purchases from both iTunes and the App Store, as well as your subscription to Apple Music, and likely Apple TV+ and Apple Arcade, will also get you 3% Daily Cash.

Using Apple Pay, on your iPhone or Apple Watch for instance, will net you back 2%. Not only is this great incentive for using Apple Pay, which is fast and convenient, it helps to keep your physical Apple Card in pristine condition.

You'll also still get Daily Cash if you use your physical Apple Card, but it will be reduced to 1%, rather than the 2% back you'll get for using Apple Pay. This includes online purchases that require you to enter in your card number. While you're still getting money back, you're getting significantly less back than you would if you were using Apple Pay. As follows, you want to use a different rewards card you own for these purchases, especially if they have a lower interest rate or offer more money for purchases like gas or groceries.

So, if you're planning on upgrading any of your Apple gear, especially larger purchases, it would be beneficial to make the purchase with the Apple Card. You'll be able to get a bit of money back, which is always a bonus when you're already spending that much money.

Otherwise, it's best to try to use your Apple Card exclusively with Apple Pay. Many retail outlets accept Apple Pay, which gives you the most amount of cash back for non-Apple purchases. The Apple Card has many benefits, but it's worth noting that like all credit cards, there are pros and cons to using it.

Comments

You have to manually update the payment method, though, as the ‘Make Default at Apple’ feature doesn’t reach Citizen One’s system.

I'm going to be using the AppleCard for payments that will pay 2 or 3%. Anything that earns 1% will go on our joint Costco card. We get 2% for activities like restaurants.

What separates it is the convenience of virtual.

I've found that there's more "understanding" if you have a problem and take it back to the Apple Store - and you bought it from Apple.

From my observation not just here at AppleInsider but on any Apple related discussion forum is that many people don't read the Apple marketing pages and really don't read the Goldman Sachs customer agreement (you know, the legal document that defines the cardholder-issuing bank's roles and responsibilities).

Ideally, people would read all of that stuff before asking questions about the Apple Card, but unfortunately we don't live in that world.

Sorry about that.

On the positive side it generates some cheap, low effort pageviews for AppleInsider.

You might as well say, "If I can get 4% rebate using my Costco charge card for fuel at Costco why would I settle for just 1-2% using the Apple card. Come on Apple; get with the program."

Use the card that works best for where you shop. Why was this not an issue before the Apple Card and now that it exists you and countless others are confused by having multiple cards that you shuffle for various purchase scenarios?

I have an Amex card that gives me a bunch of 6% and 3% returns. You have to hunt the full explanation down many links on their site. I wish they had such a simple graphic.

Also, your 5% doesn’t apply to the app store, itunes, icloud, upgrade program, etc. As usual, use the right card for the right job. Sounds like you like your Amazon card for Amazon purchases. Great.