Amazon maintains massive lead over Apple in US smart speaker market

Amazon's share of the U.S. smart speaker market is expected to contract slightly in 2020 and 2021, according to new research from eMarketer, but the dip is unlikely to faze the e-tailer whose popular Alexa-powered Echo devices enjoy a commanding lead over segment competitors Google and Apple.

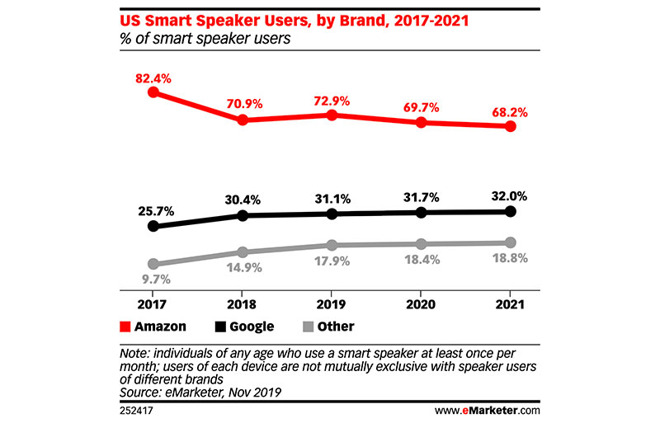

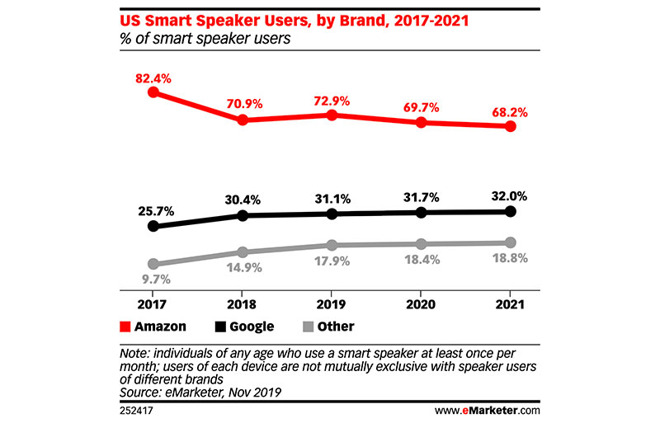

The latest estimates from eMarketer, released on Monday, put Amazon's U.S. marketshare at 72.9% in 2019, up 2% from the year prior. That figure is expected to decline to 69.7% in 2020 and 68.2% in 2021 as more consumers buy into the market, loosening the online retailer's stranglehold.

Still, Amazon's current and predicted marketshare more than doubles that of its closest challenger Google, which held a 31.1% piece of the pie in 2019. The search giant is expected to see its stake increase to 31.7% and 32% in 2020 and 2021, respectively.

Google's estimated growth mirrors that of "other" manufacturers and individual product lines, a group of smaller players that includes Apple's HomePod, Harmon Kardon's Invoke and Sonos One. Last year, some 17.9% of smart speaker users owned a device that falls into the catchall category, a figure expected to increase to 18.4% in 2020 and 18.8% in 2021, according to eMarketer.

"Since Amazon first introduced the Echo, it has built a convincing lead in the U.S. and continues to beat back challenges from top competitors," said Victoria Petrock, a principal analyst at eMarketer. "We had previously expected Google and Apple to make more inroads in this market, but Amazon has remained aggressive. By offering affordable devices and building out the number of Alexa skills, the company has maintained Echo's appeal."

In the U.S., eMarketer sees the smart speaker market to grow to 83.1 million users this year, up 13.7% year-over-year. Growth is anticipated to fall into the single digits in 2021.

CIRP in a report last year also estimated Amazon to command roughly 70% of the U.S. smart speaker segment on the back of a wide range of Echo offerings. Apple, which fields one premium product in HomePod, accounted for an estimated 6% of the market.

The latest estimates from eMarketer, released on Monday, put Amazon's U.S. marketshare at 72.9% in 2019, up 2% from the year prior. That figure is expected to decline to 69.7% in 2020 and 68.2% in 2021 as more consumers buy into the market, loosening the online retailer's stranglehold.

Still, Amazon's current and predicted marketshare more than doubles that of its closest challenger Google, which held a 31.1% piece of the pie in 2019. The search giant is expected to see its stake increase to 31.7% and 32% in 2020 and 2021, respectively.

Google's estimated growth mirrors that of "other" manufacturers and individual product lines, a group of smaller players that includes Apple's HomePod, Harmon Kardon's Invoke and Sonos One. Last year, some 17.9% of smart speaker users owned a device that falls into the catchall category, a figure expected to increase to 18.4% in 2020 and 18.8% in 2021, according to eMarketer.

"Since Amazon first introduced the Echo, it has built a convincing lead in the U.S. and continues to beat back challenges from top competitors," said Victoria Petrock, a principal analyst at eMarketer. "We had previously expected Google and Apple to make more inroads in this market, but Amazon has remained aggressive. By offering affordable devices and building out the number of Alexa skills, the company has maintained Echo's appeal."

In the U.S., eMarketer sees the smart speaker market to grow to 83.1 million users this year, up 13.7% year-over-year. Growth is anticipated to fall into the single digits in 2021.

CIRP in a report last year also estimated Amazon to command roughly 70% of the U.S. smart speaker segment on the back of a wide range of Echo offerings. Apple, which fields one premium product in HomePod, accounted for an estimated 6% of the market.

Comments

I would not be surprised if a lot of them sold were stereo pairs at Christmas.

The Echo is a device with exceptional voice interaction that also happens to play audio. Primary emphasis is voice interaction performance.

Frankly, I could not be happier than to be able to put an Echo device in just about every room of my house, including the garage and utility spaces. I can listen to podcasts, radio stations, and my Apple Music with reasonably decent (inexpensive boom box level) audio quality while I work or do household chores. When I want to kick back and immerse myself into my personal music collection, it's time for the HomePod or headphones. When you really care about how it sounds, the HomePod rules. If it's background filling audio, the Echo (especially the larger ones) are perfectly fine. Having access to Apple Music across both families of devices is totally awesome.

Alexa: “Do you mean Hue white lamp 5?”

Me: Grrr..!!!!!!

Only reason I use Alexa at all is because of price. I suspect most people who buy Echo devices buy for that same reason. $25 gets you a voice assistant/smart speaker for every room. I can’t afford to put $300 HomePods in all the rooms of my house. Even if the HomePod Mini was still $99, that would be low enough for me to ditch Alexa.

It's like a Fitbit is a competitor to Apple Watch because they both occupy wrist space and are digital devices.

Siri should be much better and more capable then it is. The HomePod, to my ear, needs a little work in the form of an equalizer. It's sound it just to bass heavy for my taste. There needs to be more presence, more mid, and more highs.

Even though it's supposed to auto-adjust frequency balance for a room's sonic vagaries, the Apple provided baseline favors bass more than I like, at the expense of mid and upper clarity. My echo Show is also bass heavy, even for voice, which is all I use it for outside of home automation.

While the Echo line and HomePod are two different product categories, they do have commonalities that can't escape comparison. They are not an either or for me. I'd never have a HomePod in the kitchen, but the Dot is right at Home. I'd never listen to music on an Echo unless I added some decent speakers, and that's not why I have them. News, weather, podcasts are fine on it, when I'm not near my HomePod.

But a HomePod mini? I think those will sell only to those already having good or better experiences with HomePod(s). I wonder what percentage of HP owners fall into that group.

I just don't think that Apple Music and AirDropping your iDevice to an HP is rewarding enough on its own. It isn't for me, but I've got one and it's a pain for me to sell off kit. Not that I hate to get rid of it- the selling process in a PITA.

Personally, we love HomePod. It sounds great and interacts beautifully and effortlessly with all the other Apple stuff we have.

For example, with the new lyric feature in Apple Music, one of our favorite things is to play music from the Apple TV with the HomePods as a source. This is also a great setup for Music Videos. I can adjust playback from any iPhone or iPad in the house or even Apple Watch. This kind of integration is awesome!

But if I was, there is no way I'd have one of those Amazon listening devices in my home.

Use the living room HP to listen to Tv and movies. Music when I'm cooking, reading and just generally chilling out.

To repeat the comment above, no way in hell I would have a Google or Amazon device in my device when they've shown to be spying on their customers. Sorry. No wait, not sorry.

The “smart” speaker is in nearly every Apple device. The only reason the Echo is what it is is because the Fire phone failed and Amazon wanted Alex in peoples home at the cheapest price possible. Never mind google assistant and Siri already on everyone’s phones.

Was it a successful pivot from Fire Phone to Echo Speaker? We know that Amazon barely makes any profit on them given they are never NOT on sale. I’m sure they bring in a fair amount of revenue, but they definitely aren’t profit drivers.

Why?