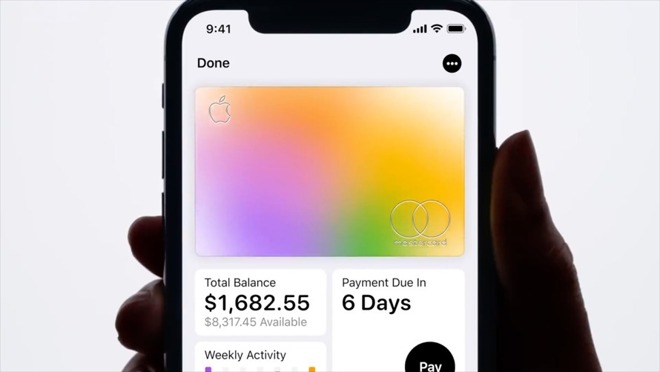

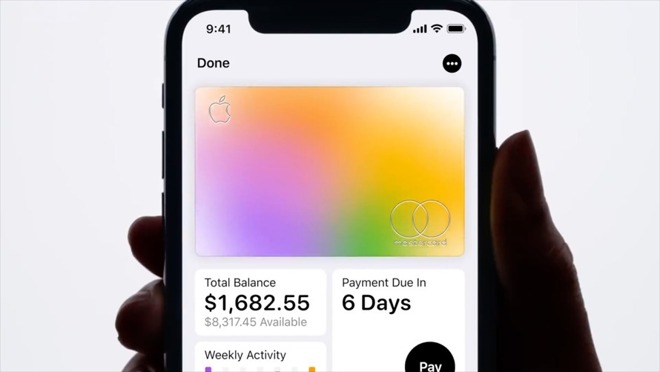

Apple Card starts credit file reporting to Experian

Owners of Apple Card are reporting Apple is finally expanding the number of credit reference agencies it will report to, with claims the Apple-branded credit card is starting to appear on credit reports generated by Experian.

So far, Apple has limited its reporting of consumer balances to one credit bureau, TransUnion, while no reporting was being made to either Experian or Equifax. While this has been the case for months, it now seems that the reporting is being made to more agencies.

An email from an AppleInsider reader who uses an Apple Card reveals they have spotted a change made to their Experian credit report, appearing when they checked their report on July 19. Searches on Reddit indicates it is affecting a number of users, with posts on the r/AppleCard subreddit indicating other users of the site as having seen the details in their report since July 18.

Discussion about the credit reporting practices of Apple Card intensified in October, when a report claimed Apple was rolling out reporting to other agencies. However, a source within Apple corporate not authorized to speak on behalf of the company advised to AppleInsider that the story was "not accurate," and that the reporting mechanism was effectively done. The source added that reporting was being done for some customers, but "everything will be reported" once it was fully deployed.

While credit card companies do typically provide reports to credit reference organizations, there is no requirement to do so, except to provide data to a system that credit card companies rely on. In December, Apple Card partner Goldman Sachs confirmed it reports back to TransUnion, a credit bureau named within Apple's support documents relating to the card, but without seemingly referencing other major agencies.

The claims of Apple Card appearing on Experian reports suggests Apple is finally rolling out the facility to other bureaus, but it is unclear if the same reporting is being performed with Equifax at this time.

The reporting may make an impact on the customer's credit score, as it will effectively be an extra creditor added to a list the customer may already have. The customer's history with Apple Card, such as payments and how much is used as well as the age of the account, is likely to force Experian to make changes to the user's score, though depending on the circumstances, it may be either a positive or a negative effect.

So far, Apple has limited its reporting of consumer balances to one credit bureau, TransUnion, while no reporting was being made to either Experian or Equifax. While this has been the case for months, it now seems that the reporting is being made to more agencies.

An email from an AppleInsider reader who uses an Apple Card reveals they have spotted a change made to their Experian credit report, appearing when they checked their report on July 19. Searches on Reddit indicates it is affecting a number of users, with posts on the r/AppleCard subreddit indicating other users of the site as having seen the details in their report since July 18.

Discussion about the credit reporting practices of Apple Card intensified in October, when a report claimed Apple was rolling out reporting to other agencies. However, a source within Apple corporate not authorized to speak on behalf of the company advised to AppleInsider that the story was "not accurate," and that the reporting mechanism was effectively done. The source added that reporting was being done for some customers, but "everything will be reported" once it was fully deployed.

While credit card companies do typically provide reports to credit reference organizations, there is no requirement to do so, except to provide data to a system that credit card companies rely on. In December, Apple Card partner Goldman Sachs confirmed it reports back to TransUnion, a credit bureau named within Apple's support documents relating to the card, but without seemingly referencing other major agencies.

The claims of Apple Card appearing on Experian reports suggests Apple is finally rolling out the facility to other bureaus, but it is unclear if the same reporting is being performed with Equifax at this time.

The reporting may make an impact on the customer's credit score, as it will effectively be an extra creditor added to a list the customer may already have. The customer's history with Apple Card, such as payments and how much is used as well as the age of the account, is likely to force Experian to make changes to the user's score, though depending on the circumstances, it may be either a positive or a negative effect.

Comments

Kinda like what they did.

U get it*

This is weird: One would think that credit card companies like GS/Apple, who are on the hook for fraud, would want to protect themselves by protecting their customers. But apparently not.... A few years back I opened a Discover credit card and, even though I have credit monitoring, I have yet to be notified that that account was opened!

One would think so. But it sounds like they are competitors rather than partners.

They collect your spending data and sell it to lenders. More specifically, they accumulate data on how you pay back your debts. They don't care if you spent $500 on a new TV set or which brand it is. They care about how you pay off that $500 credit card charge. Your monthly utility bills. Auto loan. Student loan. Mortgage payment.

It's similar to what Google, Yahoo, Facebook, etc. do. They all basically know what you do on the Internet. Google sells your online history to various advertisers.

Same thing with credit reporting agencies. They all accumulate how you spend money and pay off loans. They sell this information to lenders: credit card issuing banks, apartment landlords, cellular companies, mortgage lenders, etc. When a lender pulls your credit report, they are paying for it. It's not free to them.

What do you think a credit score is?

It's a numerical value that attempts to quantify the likeliness that you will pay your debts on time. If you are lender, you would rather lend money to someone who is going to pay it back more than someone who won't. For the latter, you change the terms so they pay more interest, you give them a smaller loan or both.

For the consumer credit card industry, there's a sweet spot for credit card issuing banks. They prefer customers who will pay their monthly bills on time but not pay their entire balance in full. This results in finance charges. Sure, they will lend money to people who pay their entire balance due but that's definitely not their ideal audience.

I'm one of those people who immediately pays off my credit card balances in full, never ever paying a finance charge. The credit card industry has a derisive term for people like me. They call us "deadbeats."

"Clearly there are several people here that are clueless to what advertising placement companies do".

By the way credit reporting agencies count far more customers than just banks and credit card companies. You only imagine you know what they do, what they sell, and to who, some of it anonymized and much of it not.

https://www.experian.com/marketing-services/targeting/data-driven-marketing/consumer-view-data

and the other two of the big three:

https://www.transunion.com/product/all-products

https://www.equifax.com/business/customer-segmentation/