Apple shatters its own holiday financial record, hitting $123.9 billion in revenue on the ...

Apple's hardware and services generated $123.9 billion in revenue for the first quarter of 2022, breaking not just its own holiday quarter records, but beating Wall Street consensus as well.

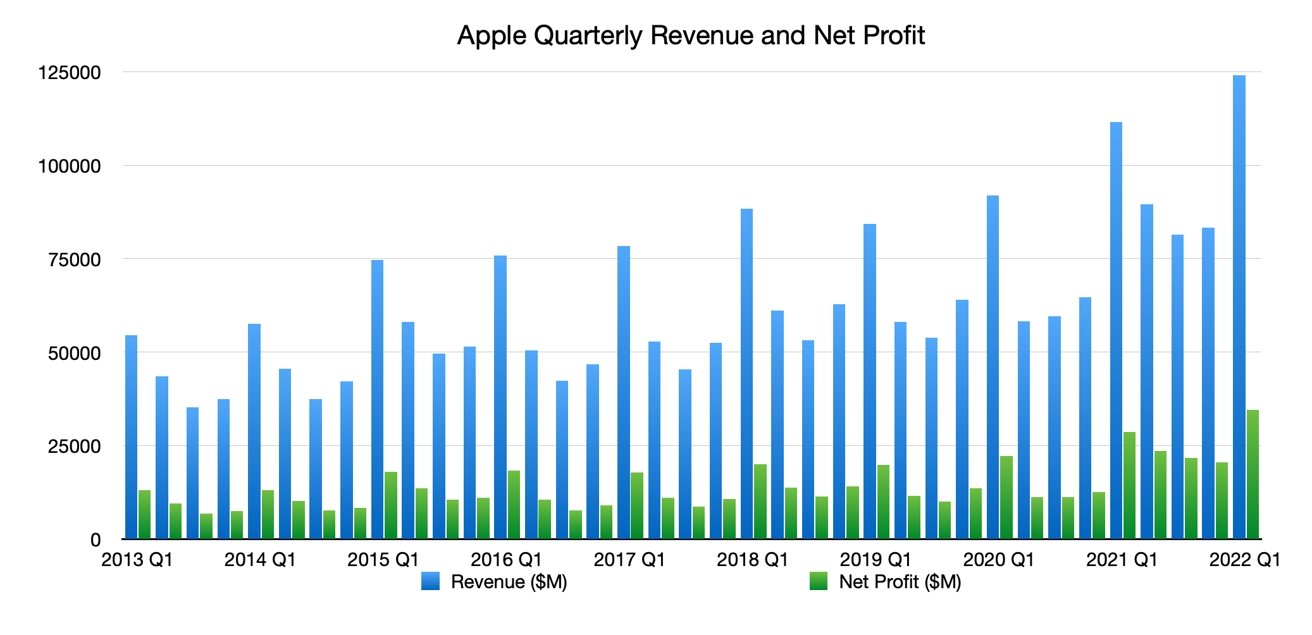

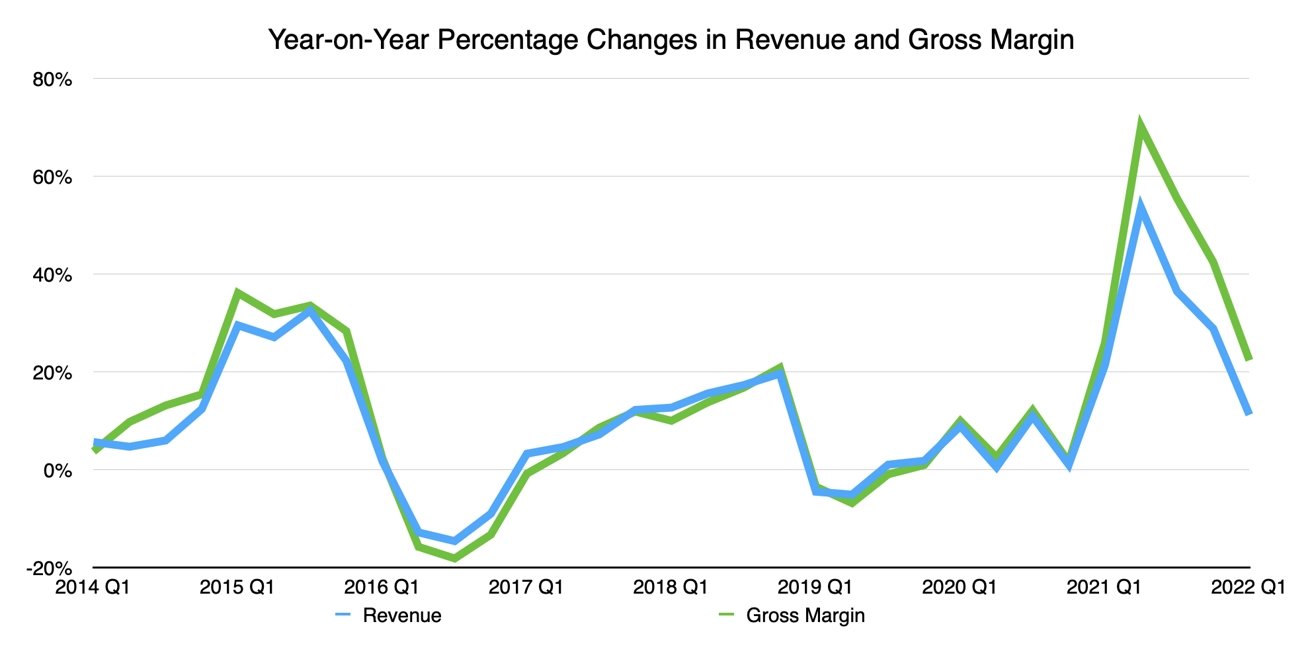

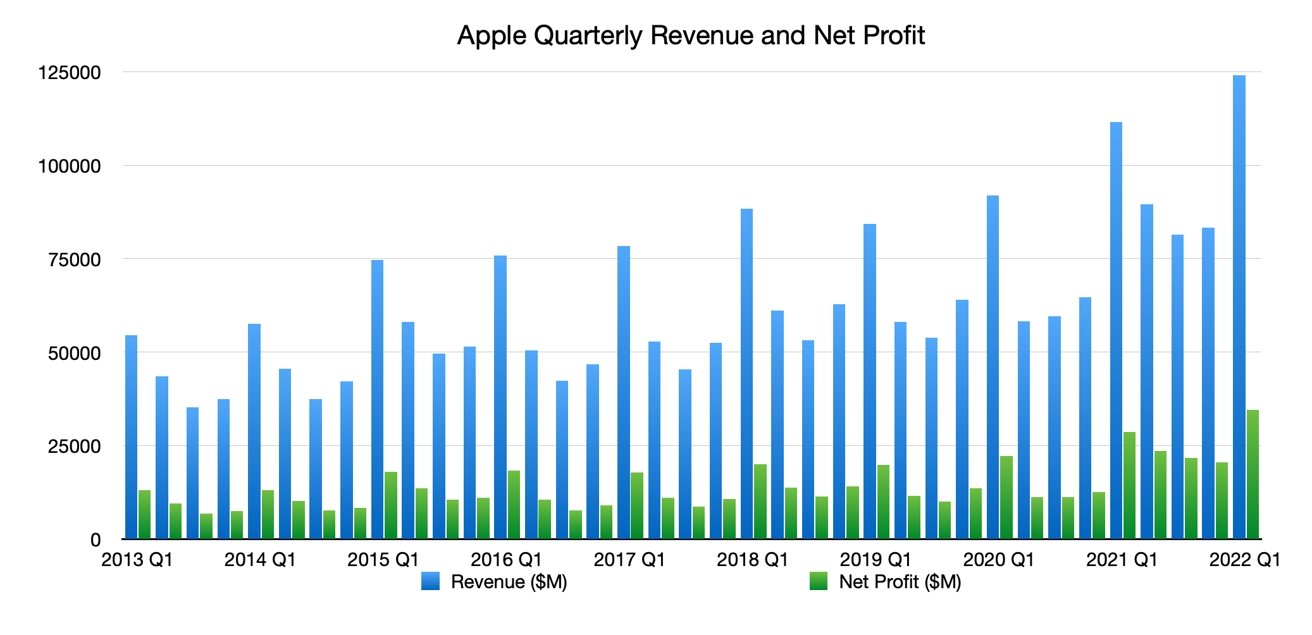

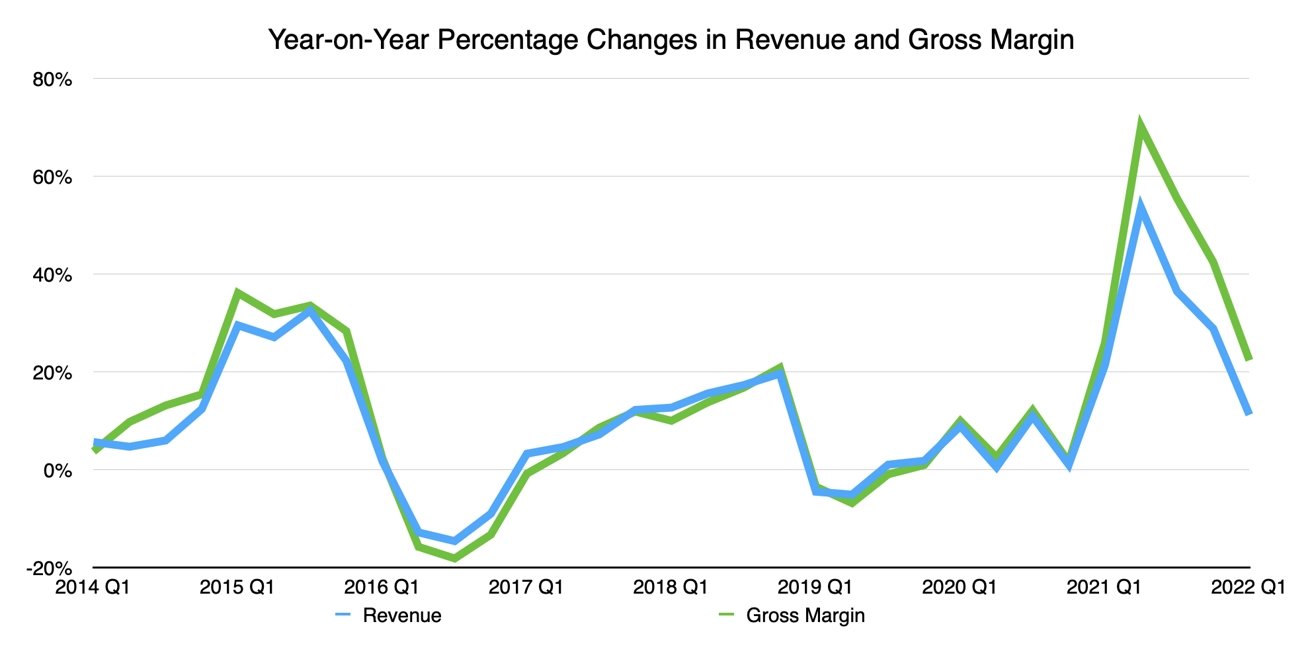

Announced on Thursday ahead of Apple's customary analysts call, Apple's revenue of $123.9 for the quarter ending December 2021 equates to a year-on-year annual growth/decline from the then-record-setting $111.4B reported one year ago. Apple's earnings per share is $2.10 for the quarter, up from $1.68 in the Q1 2021 results.

The gross margin for the quarter of $54.2 billion is up from one year ago's figure of $44.3 billion, and operating expenses of $12.7 billion are up from the year-ago $10.8 billion. Net Profit is pegged at $34.6 billion, also up from $28.8 billion in the same quarter last year.

The quarter's results follows the excellent $83.4 billion in revenue seen in Q4 2020.

The Wall Street consensus for the quarter predicted that Apple would report revenue of $118.3 billion and an EPS of $1.89 for Q1 2022.

"This quarter's record results were made possible by our most innovative lineup of products and services ever," said Apple CEO Tim Cook. "We are gratified to see the response from customers around the world at a time when staying connected has never been more important. We are doing all we can to help build a better world -- making progress toward our goal of becoming carbon neutral across our supply chain and products by 2030, and pushing forward with our work in education and racial equity and justice."

The holiday quarter, as usual, benefitted from numerous product launches that took advantage of the holiday sales period. This includes the Apple Watch Series 7, third-generation AirPods, the 14-inch MacBook Pro and 16-inch MacBook Pro, new color options for the HomePod mini, and the infamous Apple Polishing Cloth.

Launches from the previous quarter are also great contributors to Apple's revenue, with Q1 being the first full quarter of availability for them. This includes the headline iPhone 13 generation, as well as the ninth-generation iPad and the sixth-generation iPad mini.

Apple's iPhone brought in $71.6 billion in revenue during the December quarter, up from $65.5 billion in the year-ago quarter. The new revenue was likely driven by iPhone 13 and iPhone 13 Pro models despite ongoing supply constraints.

Mac revenues also rose year-over-year to $10.8 billion, up from $8.6 billion the year prior. On the other hand, iPad revenue dropped from $8.4 billion in Q1 2021 to $7.2 billion in Q1 2022.

The company's Wearables, Home, and Accessories segment reached $14.7 billion in revenue, up year-over-year from $12.9 billion. The company's Services revenue also increased significantly to $19.5 billion from $15.7 billion in the year-ago period.

Apple's Board of Directors declared a cash dividend of $0.22 per share payable on Feb. 10, 2022. Shareholders of record at the close of Feb. 7, 2022 will receive the payout.

As usual for Apple's quarterly results since the outset of the pandemic, Apple has declined to offer detailed guidance in its quarterly results, so it is unknown if the figures meet or exceed the company's own expectations. While such details aren't provided, some color will be provided by Cook and CFO Luca Maestri during the earnings call.

Read on AppleInsider

Announced on Thursday ahead of Apple's customary analysts call, Apple's revenue of $123.9 for the quarter ending December 2021 equates to a year-on-year annual growth/decline from the then-record-setting $111.4B reported one year ago. Apple's earnings per share is $2.10 for the quarter, up from $1.68 in the Q1 2021 results.

The gross margin for the quarter of $54.2 billion is up from one year ago's figure of $44.3 billion, and operating expenses of $12.7 billion are up from the year-ago $10.8 billion. Net Profit is pegged at $34.6 billion, also up from $28.8 billion in the same quarter last year.

The quarter's results follows the excellent $83.4 billion in revenue seen in Q4 2020.

The Wall Street consensus for the quarter predicted that Apple would report revenue of $118.3 billion and an EPS of $1.89 for Q1 2022.

"This quarter's record results were made possible by our most innovative lineup of products and services ever," said Apple CEO Tim Cook. "We are gratified to see the response from customers around the world at a time when staying connected has never been more important. We are doing all we can to help build a better world -- making progress toward our goal of becoming carbon neutral across our supply chain and products by 2030, and pushing forward with our work in education and racial equity and justice."

The holiday quarter, as usual, benefitted from numerous product launches that took advantage of the holiday sales period. This includes the Apple Watch Series 7, third-generation AirPods, the 14-inch MacBook Pro and 16-inch MacBook Pro, new color options for the HomePod mini, and the infamous Apple Polishing Cloth.

Launches from the previous quarter are also great contributors to Apple's revenue, with Q1 being the first full quarter of availability for them. This includes the headline iPhone 13 generation, as well as the ninth-generation iPad and the sixth-generation iPad mini.

Apple's iPhone brought in $71.6 billion in revenue during the December quarter, up from $65.5 billion in the year-ago quarter. The new revenue was likely driven by iPhone 13 and iPhone 13 Pro models despite ongoing supply constraints.

Mac revenues also rose year-over-year to $10.8 billion, up from $8.6 billion the year prior. On the other hand, iPad revenue dropped from $8.4 billion in Q1 2021 to $7.2 billion in Q1 2022.

The company's Wearables, Home, and Accessories segment reached $14.7 billion in revenue, up year-over-year from $12.9 billion. The company's Services revenue also increased significantly to $19.5 billion from $15.7 billion in the year-ago period.

Apple's Board of Directors declared a cash dividend of $0.22 per share payable on Feb. 10, 2022. Shareholders of record at the close of Feb. 7, 2022 will receive the payout.

As usual for Apple's quarterly results since the outset of the pandemic, Apple has declined to offer detailed guidance in its quarterly results, so it is unknown if the figures meet or exceed the company's own expectations. While such details aren't provided, some color will be provided by Cook and CFO Luca Maestri during the earnings call.

Read on AppleInsider

Comments

”Ever since Jobs died Apple stopped innovating”

”Tim Cook is just a bean counter”

...the bigger question to me is do mac users really want reinventing (and paying for) workflow changes and the debugging annually to contribute to such numbers...?

Vertical apps I license have narrowed sanctioned functionality to single versions of macOS (monterey remains unsupported), and if apps don't align what then...?

Are some now better off shareholders than mac professionals day to day...?

On October 6, 1997 Michael Dell said of Apple, "I'd shut it down and give the money back to the shareholders," before a crowd of several thousand IT executives.

https://www.cnet.com/news/dell-apple-should-close-shop/

On that day, AAPL was worth $0.18 per share. AAPL closed at $159.22 or merely 88,355% higher at today's close, just prior to the Q1 '22 earnings report.

If you'd bought both a crystal ball and AAPL on 10/6/97 and sold around three weeks ago at the stock's all-time high of $182.94, the return would have been 101,533.33%.

#gloating

If I could bet on how AAPL end on Friday when the markets open, I think it could top the 5% figure by a half-point.

Too bad it's Microsoft and not Apple that's buying ABK.

If playing games on your computer is the main reason you use a computer, then you should have switched to a PC over a decade ago. However playing game is something you do every once in awhile, just to kill time or for a little entrainment, then by all means buy an Xbox (to get Microsoft Game Pass) and you can keep on using your Mac. (For the money, an Xbox is much more powerful than a PC at the same price.) So why would you have to leave Apple, when you buy an Xbox? Is there some hidden rule than in order to own an Xbox, one must own a PC? Do you have problem chewing gum and walking at the same time?