Goldman Sachs regrets Apple Card, and is trying to escape the deal

Apple Card and Apple Savings are performing so poorly for Goldman Sachs, one executive has reportedly said that "we should never have done this f****** thing."

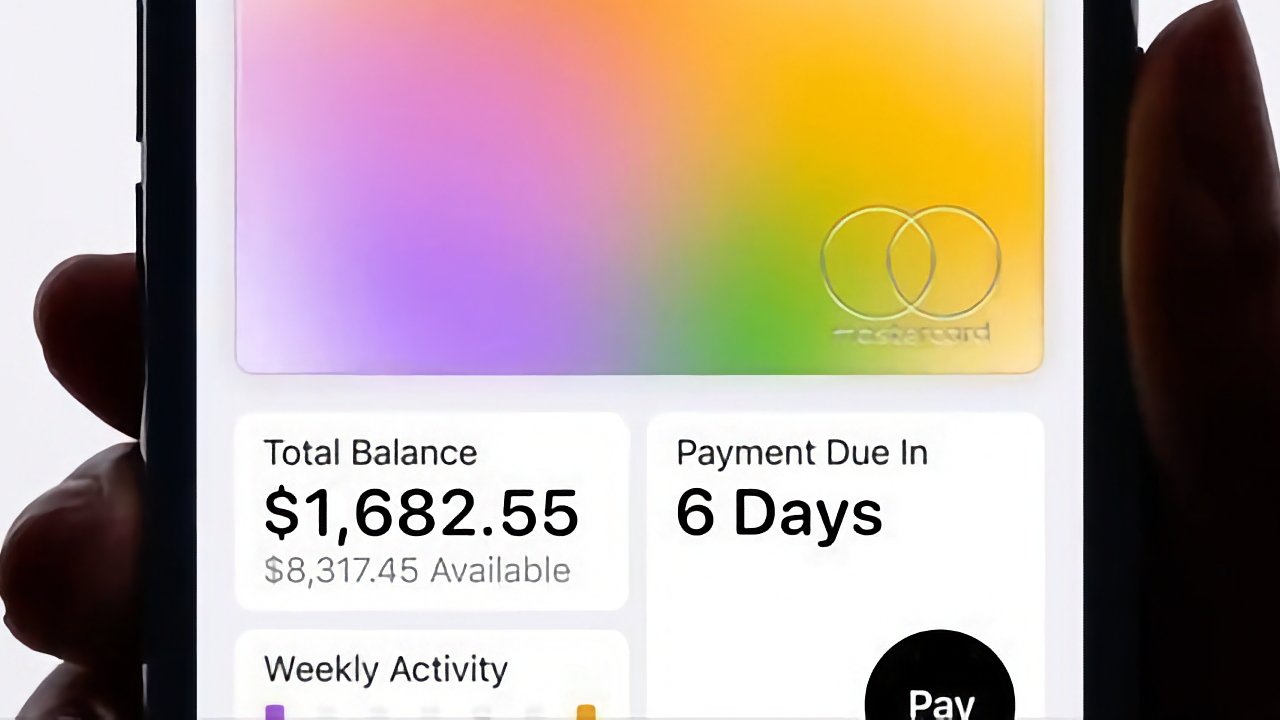

Apple Card

Goldman Sachs invested heavily in its consumer lending projects, most notably on the Apple Card but also in others such as a General Motors credit card. From the start, the company faced problems such as accusations of gender bias in its credit limit calculations -- which it has since been cleared of.

There was also just the fact that Goldman Sachs spent $350 for every new Apple Card user. In 2022, Goldman Sachs lost $1.2 billion, chiefly because of the Apple Card.

Add in later issues such as the Consumer Financial Protection Bureau investigating allegations of fraud, and the relationship between Apple and Goldman Sachs deteriorated severely.

Goldman Sachs regrets its Apple deal

Consequently, Goldman Sachs has been working to get out of all of its consumer-facing deals with other firms. One of its last efforts was the Apple Savings account, which despite doubts it would ever happen, finally launched in April 2023.

Now according to the Wall Street Journal, the finance company wants out of even that deal and has been negotiating to sell off all of its consumer products.

Reportedly, even as some Goldman Sachs executives were talking up the Apple Savings deal at launch, others were still against it. "We should never have done this f****** thing," one partner is said to have told colleagues.

Goldman Sachs has had talks with American Express, but AmEx is said to be concerned about issues such as the Apple Card's loss rates.

Apple taking over is not an option

The Wall Street Journal says that some Goldman Sachs executives have proposed that Apple itself take on more of the venture. One such possibility would be Apple taking on new card users, while Goldman Sachs maintains current ones.

However, some Goldman Sachs executives have said this option is not being considered. And at neither Goldman Sachs nor Apple has it been discussed at high levels.

According to the Wall Street Journal, some Goldman Sachs executives entirely blame Apple for problems with Apple Card. One example is that unlike other credit cards, all Apple Card bills go out at the same time, at the beginning of the month.

This is reportedly overwhelming customer service staff, and Goldman Sachs has been unable to persuade Apple to change to the normal rolling date.

Goldman Sachs is due to announce its next earnings on Tuesday, October 17, 2023. It is expected to comment on its plans for the consumer division.

Separately, in September 2023, it was revealed that Goldman Sachs and Apple had jointly decided to abandon creating an app for stock-trading investors.

Read on AppleInsider

Comments

EDIT: Love the card, love the customer service, love the Apple Cash/Savings, love the first of the month billing. The only reason I can fathom for so much whining is maybe b/c Apple customers pay their bills and GS isn't making "as much" from interest and fees?

For what it’s worth, I, too, have had zero problems with my Apple Card. Hope Apple can find a more competent, consumer-credit savvy home for it.

Apple Card accounts have a higher write-off rate at 2.93, meaning the account holder hits the trigger point of at least 6 months behind on payments, than the industry average. That rate of card write-offs is also worse than even sub-prime lenders experience.

Now couple that with the fact a whole lotta' Apple users have credit scores under 660, which resulted in nearly a quarter of the Apple Card accounts going to those with credit scores less than that. In an extraordinary and expanding economy, their ability to pay might be masked, but that's not what we have going on. I realize this goes against the prevailing wisdom that Apple-using folks are inherently good money managers. Surely many are, but a good percentage have no business buying $1200 smartphones and $2500 computers because they can't keep up with the payments.

So, with other companies unwilling to take on the Apple Card's risk, it is putting GS in a quandary of what to do to right the ship. Apple got their money when the sale occurred, and now Goldman Sachs is left to figure out how to get out of continuing to fund Apple stuff that's not being paid for.

Not sure it has much to do with purchasing Apple products. Only the tiniest percentage of my card use is for Apple purchases. It's my primary card for anything I need to charge.

and beginning page 43 of this doc:

https://www.goldmansachs.com/investor-relations/financials/10q/2022/second-quarter-2022-10-q.pdf

Oh, and chalk me up as another happy card user.

Interesting if true. I don't have an Apple Card. Never bothered to get one. I don't want a bunch of credit cards. I do have an Amazon Chase Card. So I get 5% normally Cashback on anything I buy from Amazon. But I have it automatically set to be paid off every month. I hate having to pay any interest. I live within in means. I drive a 20-year-old truck that has been long paid off. Clear coat is coming off and I just don't care! My only debt is my House Mortgage. Considering how much rent has shot up since I got my house, I'm glad I'm not paying into that more expensive money pit I wouldn't be able to afford. I'm in CA where the average house price is $600.000. My small house was nowhere near that price point when I got it during the housing market crash of 2012. Again to save money, better deal, and lower interest. Got a Lift Chair and a recliner chair for Ashly Furniture a little over a year ago. Got their 1 year Interest free loan. Worked out how much I'd have to pay each month to have it paid off in 1 year before I'd have to start paying Interest. I had it paid off in 1 year, so zero Interest.

I have a little money going into savings every week automatically. That is my Emergency Fund. When I had to replace the transmission in my truck, that was $3500. Years ago in the past when I was dumb, I'd have to put it on a credit card and slowly pay it off and by the time it's done I'd have paid $6000 for that transmission. Instead, I just paid for it outright from the emergency fund. I think it's better to put a little into savings every week. You do it every week, you get used to it, and don't miss it. This way when an emergency comes along, you're not going into debt and then having to pay interest on that debt. At some point in time, EVERYONE is going to have an emergency. Maybe your roof leaks. Or you have a hospital visit or stay that can get expensive. Do you really want to be putting that on a credit card? Live within your means. Not playing "Keeping up with the Joneses". Buying a new Big screen TV is not an Emergency!!! New Car payments these days are INSANE!!! Being stressed out on credit card debt and collection agencies is not fun. $20 a week into savings is $80 a month. So around $960 in a year. 10 years is $9600. That is just cutting back on a few Starbucks. Make your own coffee at home! Save a bundle of money and time waiting in line.

Make them pay for once.

But it is for this reason I don't think Apple wants to take on the danger of offering a credit card themselves. Let a partner shoulder the risk and Apple's contribution will be the prestige of Apple's name attached to it, and a list of Apple account contacts to make offers to.

More like "they didn't have to do business with Apple unless they had the knowledge necessary to know what were favorable terms for them - and not Apple - beforehand as well as the clout to insist on them and the lawyers good enough to hold Apple accountable should Apple try to change the terms of the deal beforehand."

In other words, be Samsung, who refuses to sign contracts with Apple unless they guarantee a large profit for Samsung.

Be Qualcomm, who had the legal resources to take on Apple and win when Apple tried to force Qualcomm to accepting significantly less per modem than both had mutually agreed to AND less than Qualcomm charges every other customer using some "you'll still be getting billions from us anyway so quit whining" nonsense logic.

At the very least, insist on a deal that gives you the same ability to walk away if it is not working out for you as Apple does.

Do not be like tons of companies who signed deals with Apple only to have Apple walk away with all the cash while their "partners" were left holding the bag. No other bank, credit card or lending company in the world would have agreed to Apple's terms. Goldman Sachs did because they were inexperienced in direct-to-consumer banking, wanted to get into it and figured that hopping onto the Apple infrastructure and brand name would lower their startup costs and risks. Goldman Sachs tried to use Apple to cut corners and got burned. So they don't deserve a lot of sympathy, if any. They should have hired Bain to review their deal with Apple, and if Apple didn't allow a reputable third party to review the deal they should have seen it as a red flag and walked away. Goldman Sachs should have put in the work to build up their own consumer division from scratch, or they should have just bought a smaller bank or lending company and built their own consumer division on top of it (similar to how Apple Music was built on top of Beats Radio). Now, thanks to all the money that they are going to lose on this deal, they can't do either.

But yes, stuff like this is exactly why there is no "Apple Car." Every single manufacturer they talked to knew that they would be locked into an extremely long deal that they couldn't get out of that would result in their investing tens of billions of dollars (or more) while Apple would walk away with the profits AND the IP. The partnering car company wouldn't even be able to say "buy a Nissan because we help Apple make the Apple car!" because ... that isn't a very effective advertising campaign.