Apple's third quarter 2024 results show return to growth, with Wall Street beat

Apple's third-quarter financial results have improved considerably compared to 2023, with sales figures across every aspect of the company beating Wall Street expectations.

Apple CEO Tim Cook

Apple has disclosed its quarterly financial results for Q3 2024, and it has beaten expectations by a considerable margin. Typically the quietest quarter in the year, the figures have been buoyed by the prospect of Apple Intelligence, among other inbound changes this fall.

The figures landed ahead of the usual conference call with investors and analysts, hosted by CEO Tim Cook and CFO Luca Maestri. The pair are anticipated to offer more detail about the numbers and its global business.

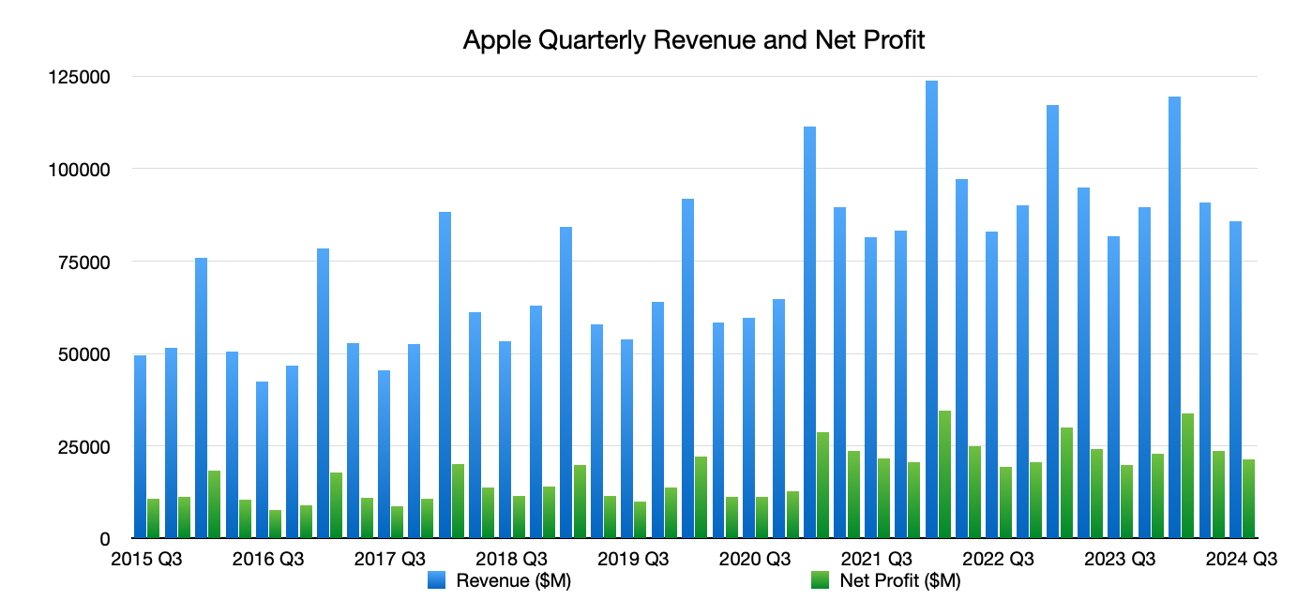

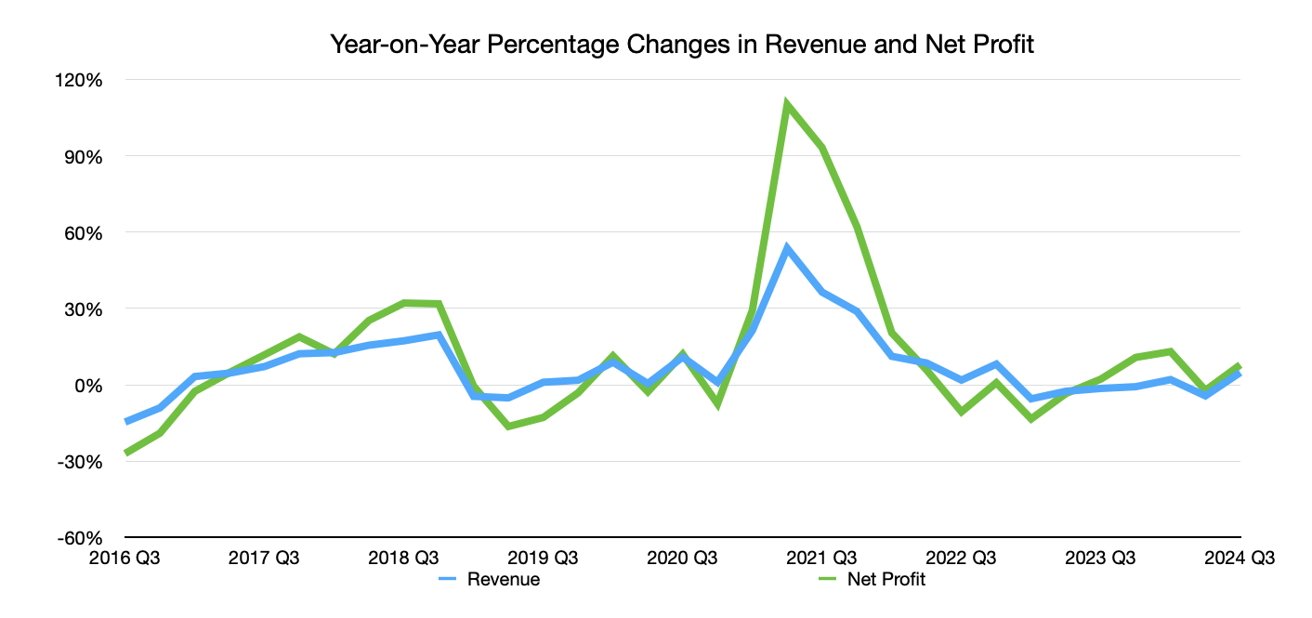

For the third quarter, Apple's revenue hit $85.78 billion, up from the $81.80 billion it reported for the same quarter one year ago in Q3 2023 and beating Wall Street expectations of $84.54 billion. The earnings per share of $1.40 is up from the year-ago $1.26.

Apple quarterly revenue and net profit

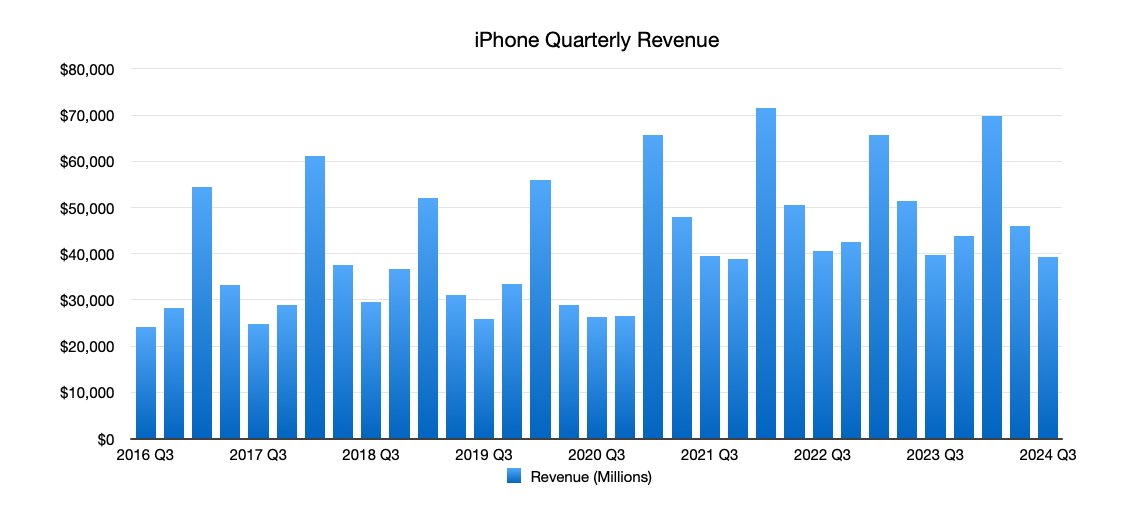

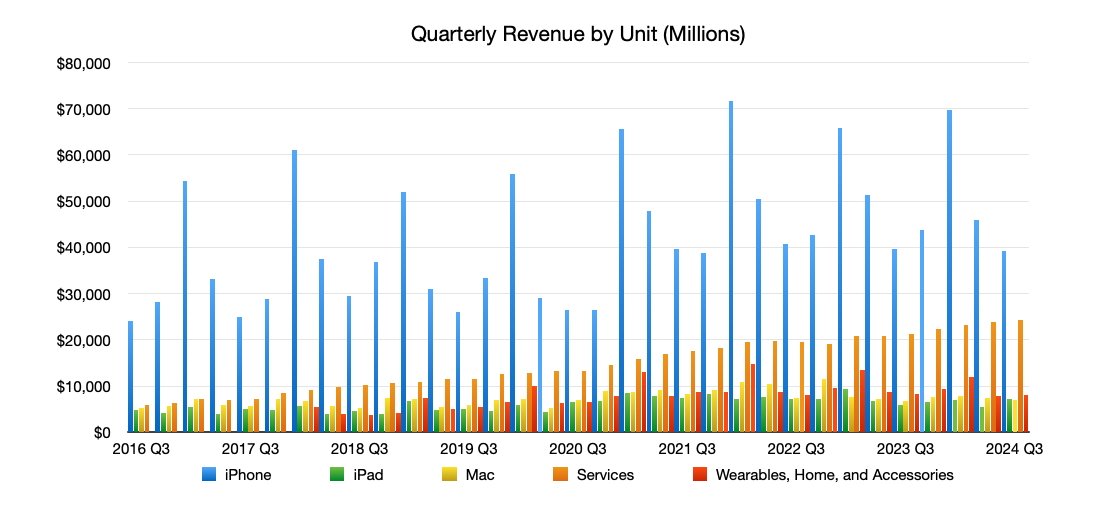

In the quarter, iPhone brought in $39.3 billion, down from $39.67 billion this time last year,, but beating Wall Street's guess of $38.81 billion. Meanwhile iPad at $7.16 billion is up from $5.79 billion one year ago, as well as Wall Street's $6.61 billion forecast.

Apple's quarterly iPhone revenue

revenue moved from $6.84 billion in Q3 2023 to $7.01 billion, narrowly short of Wall Street's oddly close $7.02 billion estimate.

Apple's unit revenue for Q3 2024

Wearables, Home, and Accessories saw a shift down from $8.28 billion in the year-ago quarter to $8.09 billion. Services continued its growth, moving to $24.2 billion from $21.21 billion in Q3 2023, also beating Wall Street's $24.01 billion estimate.

Year-on-year percentage change in revenue and net profit

"During the quarter, we were excited to announce incredible updates to our software platforms at our Worldwide Developers Conference, including Apple Intelligence, a breakthrough personal intelligence system that puts powerful, private generative AI models at the core of iPhone, iPad, and Mac.," said Tim Cook.

He continued "We very much look forward to sharing these tools with our users, and we continue to invest significantly in the innovations that will enrich our customers' lives, while leading with the values that drive our work."

Apple's board of directors has declared a cash dividend of $0.25 per share of the Company's common stock.

Read on AppleInsider

Comments

Microsoft Amy Hood confirmed some of the problems in the Earnings call

https://www.windowscentral.com/microsoft/microsoft-reports-dollar647-billion-fy24-q4-revenue-the-seventh-consecutive-surface-decline-and-big-jumps-for-xbox-and-cloud

"Though most of the report is positive, it does show a sizable 42% reduction in Xbox hardware revenue, indicating that Microsoft's Xbox Series X|S console sales have slowed. There's also an 11% decline for devices revenue, which encompasses Microsoft's Surface products. Notably, this is the seventh consecutive quarter in which devices revenue has fallen, signaling that the company is struggling to grow its Surface user-base."

Microsoft needs to fix their OS kernel, AI and the Surface need to take a back seat Nadella is caught between three rocks.

https://www.msn.com/en-us/money/other/microsoft-says-that-a-cyberattack-triggered-the-hours-long-outage-impacting-azure-customers/ar-BB1qXMMz

In AI Apple doesn't appear to be behind, in fact in most of the important computing areas today Apple is ahead or right on time.

Microsoft seems to have solid growth, in everything other than hardware, and it sounds like the current Xbox market is nearing saturation.

The fact that Mac is below 2022 is OK as the MBA M2 and MBP M2 were launched in 2022 Q3. That is hard to beat for MBA M3.

And iPhone... no SE, no new color, and only 15 Pro is AI-ready (if consumers are aware).

Seems services is once again the winner. Guess $1.5b is Music. No wonder Apple is worried about DOJ, EU, and others demanding changes to app-distribution. It is for now the only major source of growth at Apple.

But I get it you’re probably one of those people on this board who insisted that Apple should never build their own CPUs or SOC’S in other words Apple should stay in their lane under the wing of Intel, what’s your stance on Apple working towards replacing Qualcomms modem?

Qualcomm decided to not get into the phone business and its CEO was asked that question (with Huawei as a reference) and his answer was along the lines of "at the time...". He did not rule out getting into the smartphone business though.

Strategically, having your own homebrew modem makes sense. The problem with Apple is that this was a decision that should have been taken around 2019 for it to have real value. It was never a strategic decision. It was the result of Intel failing to deliver and starting a legal battle with Qualcomm.

They literally had no other option but to go it alone and that's why they are so far behind now and relying on Qualcomm (the arch enemy). They will also be paying Huawei and Qualcomm et al patent royalties for the privilege.

6G should see them catch up a bit or at least have a say in future standards. Purchasing the Intel division plus patents was an important step up but had little to do with strategy and more to do with necessity.

Something similar happened on the data center/AI inference/training side. They have scrambled to sort that out too when realistically they are five or six years late to market.

In the meantime, a huge investment in a car project was wound down and the investment in streaming seems to be getting clipped a bit.