Before China iCloud spy chip allegations, Bloomberg published these five incorrect stories...

Media personalities have been bending over backward to find a way to square the claims made by Bloomberg in its "China Hack" story with a series of strongly worded denials from Amazon and Apple insisting that the report was "wrong and misinformed." However, there is solid evidence that Bloomberg has previously published a series of false claims before, either from a lack of research coupled with bad perspective, or possibly to simply craft a dramatic narrative.

Bloomberg has played fast and loose in its reporting on Apple

A much simpler explanation is that Bloomberg rushed to publish information that was wrong, in part because its journalists didn't really understand what they were writing about, and in part because they didn't need to care whether their report was absolutely true or not. There is copious evidence of this in what Bloomberg has chosen to print about Apple over just the last two years.

In February 2017, Bloomberg printed "Apple Struggles to Make Big Deals, Hampering Strategy Shifts," a story so transparently bad that John Gruber of the Daring Fireball noted that "the entire story consists of quotes from investment bankers arguing that Apple should hire investment bankers to make more large acquisitions. Really, that's it."

In one of its longer reports, Daring Fireball dismantled this Bloomberg story on Apple's acquisitions

While disparaging Apple's ability to "make big deals," the reality is that Apple has been incredibly successful in turning its acquisitions into top features, services, and products that are extremely profitable. Either Bloomberg writers didn't know enough about acquisitions to be writing about Apple's, or it didn't care if its sources were accurate or not.

It portrayed Apple as a fumbling clown in TV set-top boxes, despite the reality, as noted by Consumer Intelligence Research Partners, that among Apple product buyers Apple TV is used by more than one in five, roughly in line with the adoption of much cheaper boxes like Amazon's Fire TV or Roku.

Beyond that, Apple TV is also seeing adoption in the enterprise for digital signage and with custom corporate apps as a remotely managed device, something other consumer TV box can't match.

Rather than being a failure, CIRP noted that Apple TV is about as popular as much cheaper TV boxes

While disparaging Apple TV as a hardware product, Bloomberg also belittled Apple's entire strategy of "turning the television set into a giant iPhone: a cluster of apps with a store," suggesting it was a loser idea that "Apple has essentially settled for."

In reality, Apple's Services segment focused on apps and subscriptions -- including Apple's own iCloud and Apple Music, as well as income gleaned from Netflix, HBO Now and Hulu, all targeting Apple TV -- is one of the most closely watched growth areas for the company and is doing phenomenally well. That division pulled in $9.5 billion in last quarter alone.

That was factually wrong: Apple didn't unveil new low-cost iPads. It instead improved its existing entry model and began offering it with the $99 Apple Pencil that actually increased its overall price. Yet Bloomberg didn't present its prediction as a possibility -- it served it up as fact confirmed by "sources."

Further, Bloomberg wasn't just wrong in its prediction. It also intentionally obscured facts that refuted its wildly misleading portrayal of the education market and falsely claimed iPad was doomed to fail just because Apple's tablet competitors were. This all despite the fact that Apple has been growing its iPad sales as Android and Windows tablets continue to shrink globally.

Apple wasn't forced to cheapen its iPads--its tablets are growing in a shrinking market

Channel check stories are regularly incorrect, but in this case the reporting by Bloomberg was particularly irresponsible because it failed to note that Apple had multiple companies contracted to produce HomePods.

Inventec had been given a small production run in January, but Foxconn was also producing the product. Bloomberg made a blind guess about demand while again withholding facts that undermined its claims.

Sales of HomePod are reportedly accelerating, rather than demanding drastic production cuts.

Bloomberg selectively reported an order cut for HomePod without mentioning that multiple suppliers were building HomePods

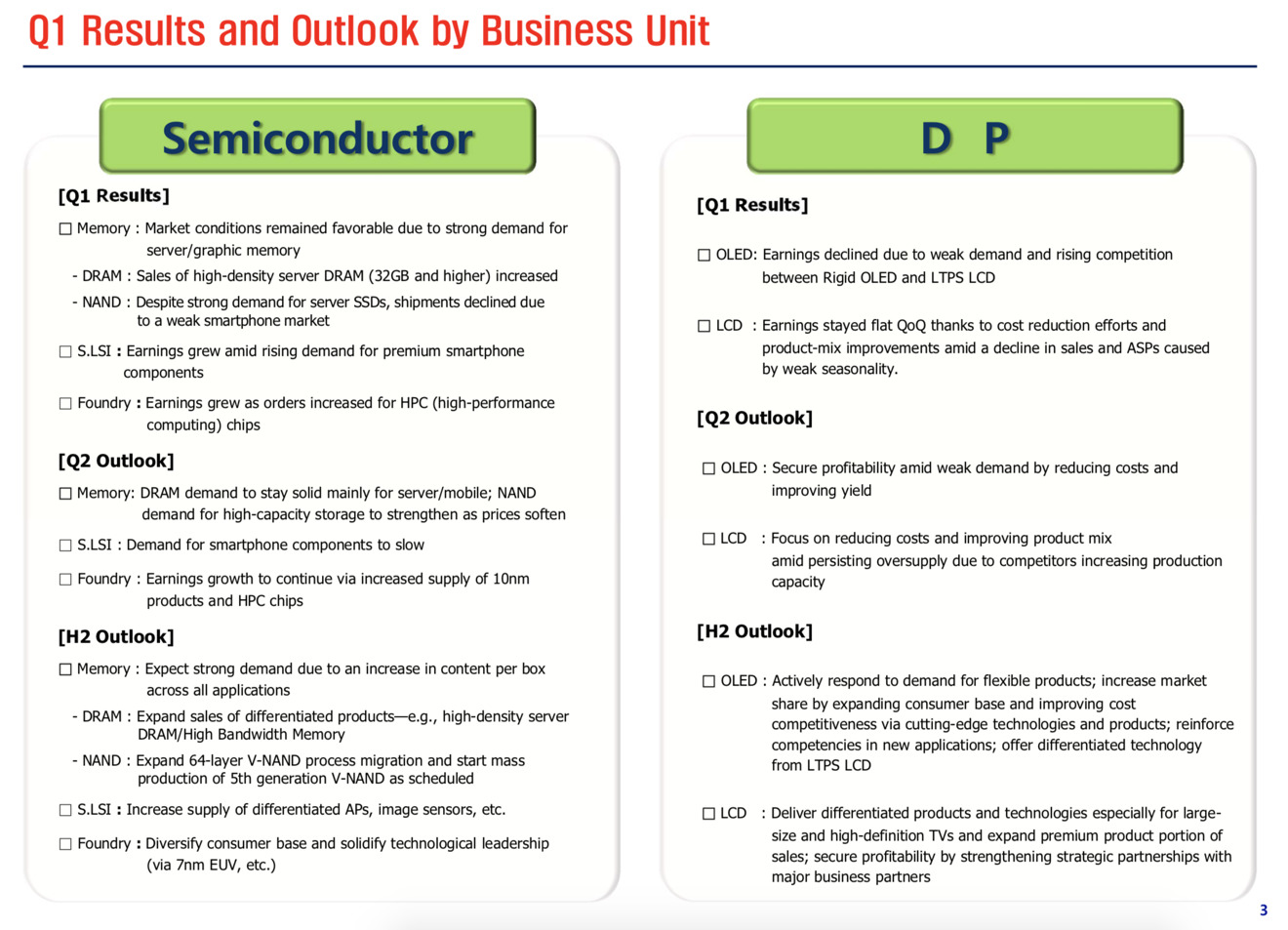

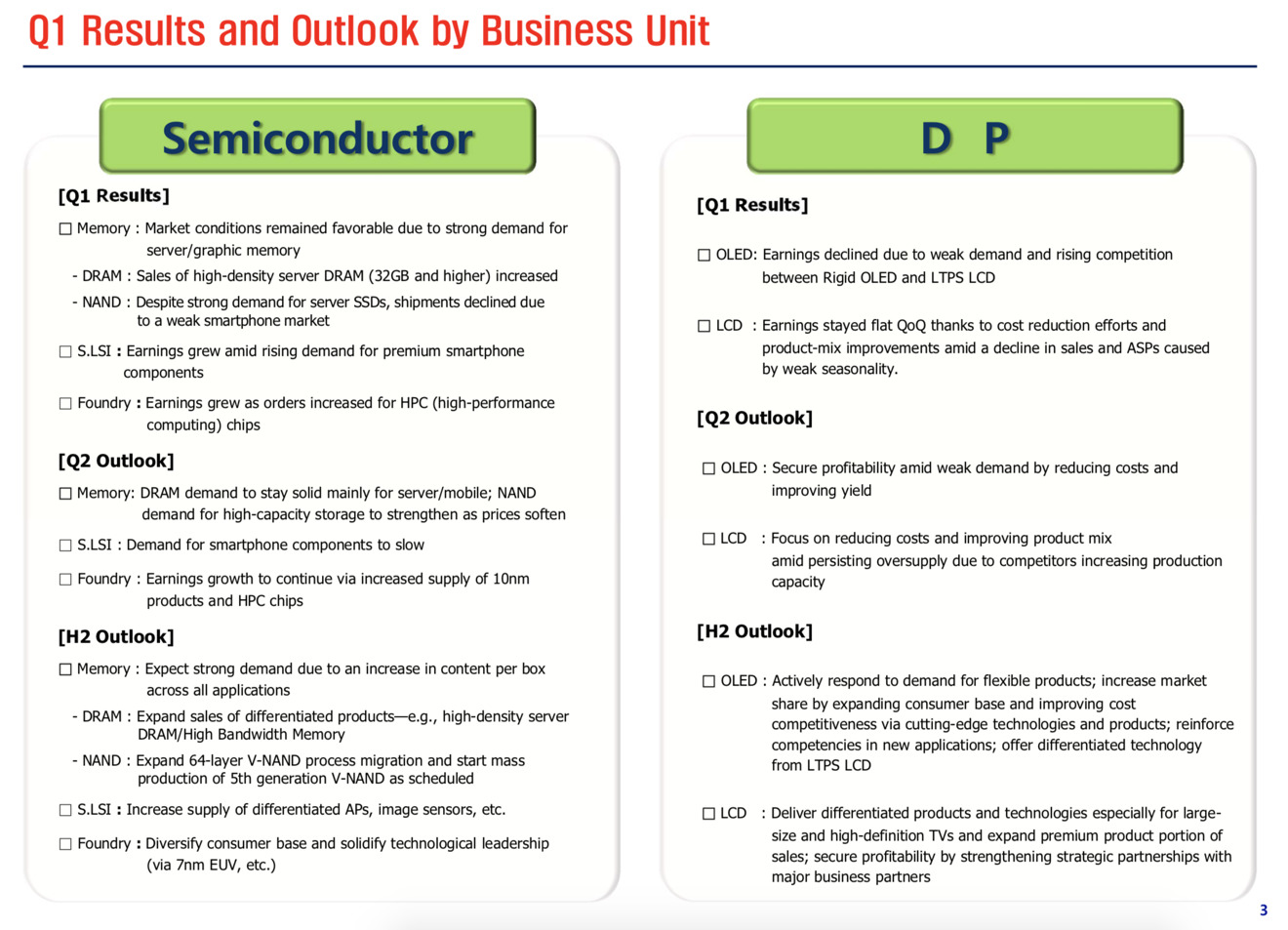

Bloomberg should have known it wasn't true, because the same report from Samsung that it used to invent the idea that iPhone X must be weak also included a warning from Samsung that it was internally experiencing "stagnant sales of flagship models amid weak demand" as the Galaxy S9 (which also uses OLED screens) was increasingly falling below expectations. Bloomberg chose not to report that.

Samsung didn't blame iPhone X for its slow OLED growth--Bloomberg invented that story

Further, it wasn't just growth in Samsung's OLED panels that was slowing. The company actually portrayed its entire Display Panel unit as being hammered in profitability during the quarter due to intense competition both from other panel suppliers and from other, cheaper screen technologies, and from weak demand and a decline in sales in general, across both OLED and LCD panels.

Bloomberg ignored all of these facts to invent the sensationalized story that iPhone X was selling poorly. It could not have been more wrong as iPhone X remained the world's most popular smartphone model.

Later that same month, Bloomberg doubled down on its story of "lackluster iPhone sales," stating unequivocally, "Apple Inc. earnings this week will confirm what most investors have finally accepted: The iPhone X didn't live up to the hype."

Instead, Apple's earnings made it clear that Bloomberg and the sources it believed as being "familiar with the matter" were as wrong as one could be about the biggest product of the year-- a massive hit that had been selling in huge volumes every week since it had gone on sale.

Bloomberg wasn't just wrong, it was spectacularly wrong. It had reached cocksure conclusions it reported with supreme confidence despite having been materially wrong about Apple's performance in the past, over and over.

And, the manner in which it repeatedly "neglected" to report facts that directly undermined its stories makes it hard to rationalize its repeatedly incorrect reports as simply minor, accidental errors.

Either Bloomberg is reporting factually incorrect things about Apple because it doesn't know enough about the subject matter to recognize what the truth is, or it is simply stringing together stories without any concern about whether they are true or not.

Apple subsequently delivered a letter to the U.S. Congress written by its Vice President of Information Security George Stathakopoulos. It stated that the allegations about a spy chip were made by a single source, and not by Bloomberg's claim of 17 corroborating sources.

And on Monday, security researcher Joe Fitzpatrick-- one of the few sources actually named in Bloomberg China Hack story, noted in an interview that he had previously detailed various "proof-of-concept" scenarios with the journalist working for Bloomberg, only to find that "100 percent of what I described was confirmed by [anonymous] sources."

Yet, Fitzpatrick explained that the story Bloomberg told of adding a chip to sensitive hardware "doesn't really make sense," adding "there are so many easier ways to do this. There are so many easier hardware ways, there are software, there are firmware approaches. There approach you are describing is not scalable. It's not logical."

Particularly in regard to its writing about Apple, Bloomberg doesn't deserve the benefit of the doubt. It has demonstrated repeatedly that it will omit salient facts and jump to unfounded conclusions without much concern for whether they are accurate or not.

Bloomberg has played fast and loose in its reporting on Apple

Truth versus imagination of possibility

The tantalizing idea -- as if ripped from the pages of a spy novel -- that Chinese hackers had implanted chips into servers used by Apple and others to harvest data and spy on their users' activities was instantly lapped up by Apple's critics as rich dirt for seeding skepticism of Apple's competence in security. The story has also already begun sprouting conspiracy theories that imagined further out into the realm of possibility that perhaps China was using this silicon hardware bugging to turn defense contractors against America.A much simpler explanation is that Bloomberg rushed to publish information that was wrong, in part because its journalists didn't really understand what they were writing about, and in part because they didn't need to care whether their report was absolutely true or not. There is copious evidence of this in what Bloomberg has chosen to print about Apple over just the last two years.

Bloomberg ridicules Apple acquisitions

Bloomberg has printed a series of reports about Apple that have been fantastically wrong or seriously misinformed. Each story portrayed Apple as an incompetent bunch of buffoons, despite the company's real-world performance.In February 2017, Bloomberg printed "Apple Struggles to Make Big Deals, Hampering Strategy Shifts," a story so transparently bad that John Gruber of the Daring Fireball noted that "the entire story consists of quotes from investment bankers arguing that Apple should hire investment bankers to make more large acquisitions. Really, that's it."

In one of its longer reports, Daring Fireball dismantled this Bloomberg story on Apple's acquisitions

While disparaging Apple's ability to "make big deals," the reality is that Apple has been incredibly successful in turning its acquisitions into top features, services, and products that are extremely profitable. Either Bloomberg writers didn't know enough about acquisitions to be writing about Apple's, or it didn't care if its sources were accurate or not.

Bloomberg disparages Apple TV and Services

Days later, Bloomberg published "Apple Vowed to Revolutionize Television. An Inside Look at Why It Hasn't," a hit piece on Apple TV that included a series of factually false claims and misleading statements.It portrayed Apple as a fumbling clown in TV set-top boxes, despite the reality, as noted by Consumer Intelligence Research Partners, that among Apple product buyers Apple TV is used by more than one in five, roughly in line with the adoption of much cheaper boxes like Amazon's Fire TV or Roku.

Beyond that, Apple TV is also seeing adoption in the enterprise for digital signage and with custom corporate apps as a remotely managed device, something other consumer TV box can't match.

Rather than being a failure, CIRP noted that Apple TV is about as popular as much cheaper TV boxes

While disparaging Apple TV as a hardware product, Bloomberg also belittled Apple's entire strategy of "turning the television set into a giant iPhone: a cluster of apps with a store," suggesting it was a loser idea that "Apple has essentially settled for."

In reality, Apple's Services segment focused on apps and subscriptions -- including Apple's own iCloud and Apple Music, as well as income gleaned from Netflix, HBO Now and Hulu, all targeting Apple TV -- is one of the most closely watched growth areas for the company and is doing phenomenally well. That division pulled in $9.5 billion in last quarter alone.

Bloomberg predicts low priced iPads

This March, Bloomberg printed a scathing report on the heels of Apple's education-focused iPad Event, citing "people familiar with the matter," who "asked not to be identified" in claiming that Apple would "introduce new low-cost iPads" because of new competition from Google Chromebooks and low-priced PC netbooks.That was factually wrong: Apple didn't unveil new low-cost iPads. It instead improved its existing entry model and began offering it with the $99 Apple Pencil that actually increased its overall price. Yet Bloomberg didn't present its prediction as a possibility -- it served it up as fact confirmed by "sources."

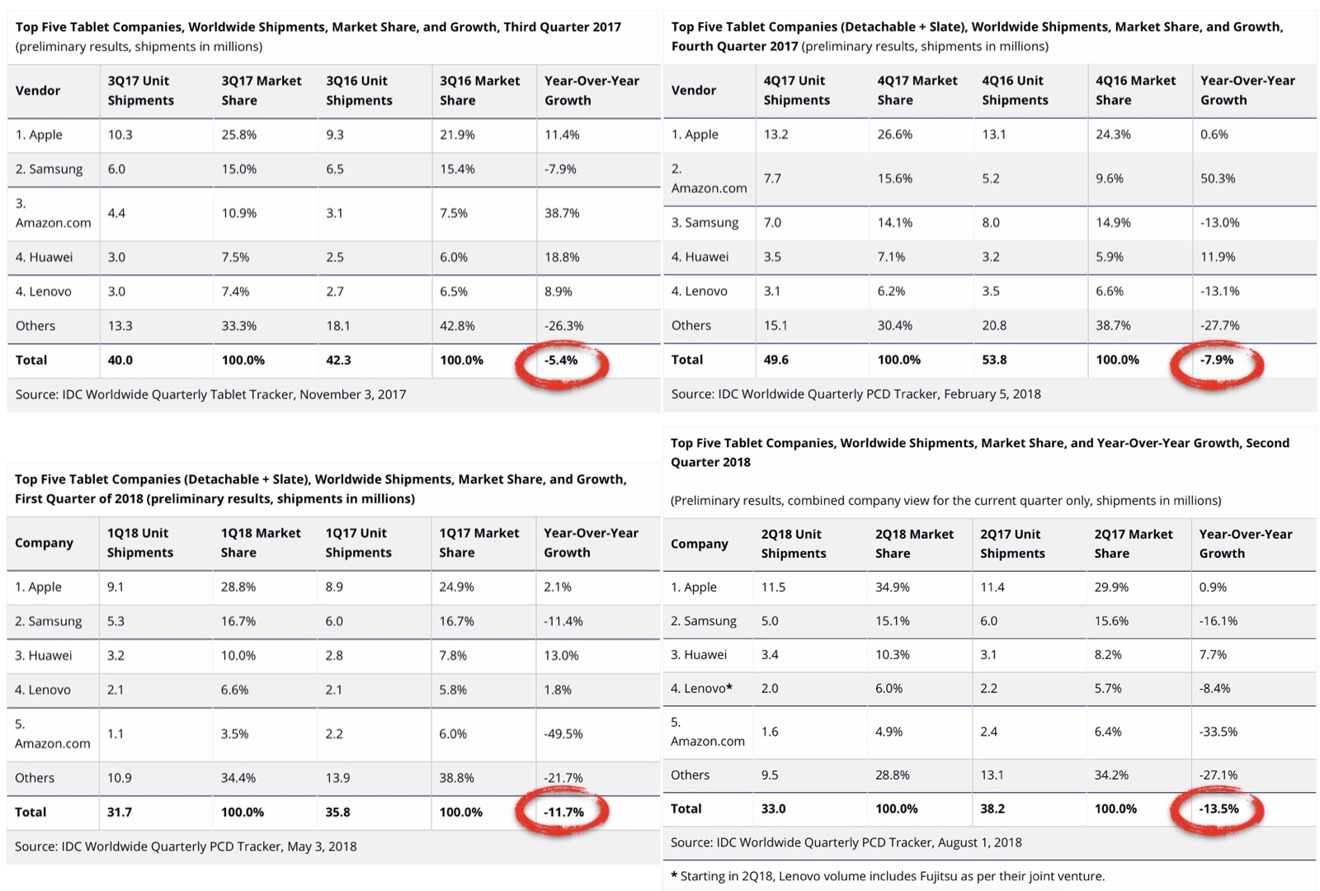

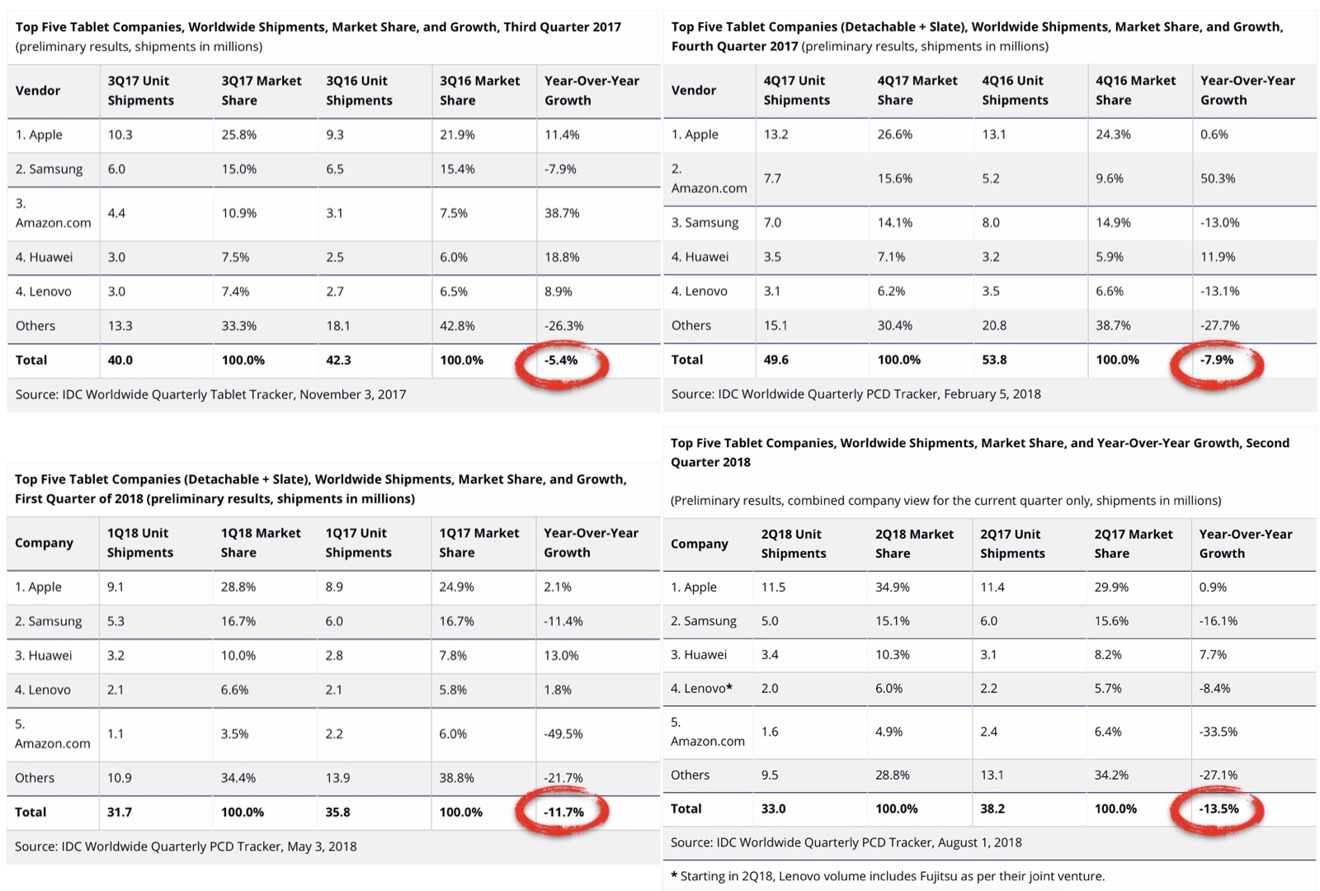

Further, Bloomberg wasn't just wrong in its prediction. It also intentionally obscured facts that refuted its wildly misleading portrayal of the education market and falsely claimed iPad was doomed to fail just because Apple's tablet competitors were. This all despite the fact that Apple has been growing its iPad sales as Android and Windows tablets continue to shrink globally.

Apple wasn't forced to cheapen its iPads--its tablets are growing in a shrinking market

Bloomberg reports slashed orders for HomePod

In April, Bloomberg printed a story claiming that Apple had cut Inventec's production orders for HomePod, citing "sources familiar with the matter," and implying this was because of poor sales.Channel check stories are regularly incorrect, but in this case the reporting by Bloomberg was particularly irresponsible because it failed to note that Apple had multiple companies contracted to produce HomePods.

Inventec had been given a small production run in January, but Foxconn was also producing the product. Bloomberg made a blind guess about demand while again withholding facts that undermined its claims.

Sales of HomePod are reportedly accelerating, rather than demanding drastic production cuts.

Bloomberg selectively reported an order cut for HomePod without mentioning that multiple suppliers were building HomePods

Bloomberg insists iPhone X sales were weak

Later in April, Bloomberg took aim at iPhone X, insisting that data from Samsung indicating slow growth in its OLED panel sales had to mean that Apple's sales of iPhone X were "weak." That was simply not true.Bloomberg should have known it wasn't true, because the same report from Samsung that it used to invent the idea that iPhone X must be weak also included a warning from Samsung that it was internally experiencing "stagnant sales of flagship models amid weak demand" as the Galaxy S9 (which also uses OLED screens) was increasingly falling below expectations. Bloomberg chose not to report that.

Samsung didn't blame iPhone X for its slow OLED growth--Bloomberg invented that story

Further, it wasn't just growth in Samsung's OLED panels that was slowing. The company actually portrayed its entire Display Panel unit as being hammered in profitability during the quarter due to intense competition both from other panel suppliers and from other, cheaper screen technologies, and from weak demand and a decline in sales in general, across both OLED and LCD panels.

Bloomberg ignored all of these facts to invent the sensationalized story that iPhone X was selling poorly. It could not have been more wrong as iPhone X remained the world's most popular smartphone model.

Later that same month, Bloomberg doubled down on its story of "lackluster iPhone sales," stating unequivocally, "Apple Inc. earnings this week will confirm what most investors have finally accepted: The iPhone X didn't live up to the hype."

Instead, Apple's earnings made it clear that Bloomberg and the sources it believed as being "familiar with the matter" were as wrong as one could be about the biggest product of the year-- a massive hit that had been selling in huge volumes every week since it had gone on sale.

Bloomberg wasn't just wrong, it was spectacularly wrong. It had reached cocksure conclusions it reported with supreme confidence despite having been materially wrong about Apple's performance in the past, over and over.

Bloomberg is reporting factually incorrect things about Apple because it doesn't know enough about the subject matter to recognize what the truth is, or it is simply stringing together stories without any concern about whether they are true or not

And, the manner in which it repeatedly "neglected" to report facts that directly undermined its stories makes it hard to rationalize its repeatedly incorrect reports as simply minor, accidental errors.

Either Bloomberg is reporting factually incorrect things about Apple because it doesn't know enough about the subject matter to recognize what the truth is, or it is simply stringing together stories without any concern about whether they are true or not.

No room for error in China Hack account

After Bloomberg initially published its story last Thursday alleging that servers used by nearly 30 tech firms including Apple and Amazon were compromised as part of an elaborate Chinese intelligence operation uncovered in 2015, Apple issued a statement that categorically denied all of assertions in the Bloomberg story, offering point-by-point rebuttals to specific facts and figures.Apple subsequently delivered a letter to the U.S. Congress written by its Vice President of Information Security George Stathakopoulos. It stated that the allegations about a spy chip were made by a single source, and not by Bloomberg's claim of 17 corroborating sources.

And on Monday, security researcher Joe Fitzpatrick-- one of the few sources actually named in Bloomberg China Hack story, noted in an interview that he had previously detailed various "proof-of-concept" scenarios with the journalist working for Bloomberg, only to find that "100 percent of what I described was confirmed by [anonymous] sources."

Yet, Fitzpatrick explained that the story Bloomberg told of adding a chip to sensitive hardware "doesn't really make sense," adding "there are so many easier ways to do this. There are so many easier hardware ways, there are software, there are firmware approaches. There approach you are describing is not scalable. It's not logical."

Particularly in regard to its writing about Apple, Bloomberg doesn't deserve the benefit of the doubt. It has demonstrated repeatedly that it will omit salient facts and jump to unfounded conclusions without much concern for whether they are accurate or not.

Comments

The tendency of AppleInsider to zealously defend Apple at all costs doesn’t do much for your own credibility and objectivity although it does make good click-bait I suppose.

...Curious as to the author's assessment if this Bloomberg "inaccuracy"/"BS" is limited to one or just a couple of authors, or if it is a bigger Bloomberg issue with Apple or tech, or even any topic...

thanks.

Stirring the pot, here are some baseless speculations of my own, gathered together from my experience with the Apple market over the last 25 years:

Q1) Could Bloomberg be involved in AAPL stock manipulation?

I ask this because manipulating AAPL in the news was common practice circa 2014 - 2017. I personally called these manipulative reports Apple Bear BS. In statistics, correlation is next to useless in establishing cause and effect. But I did correlate this period of time with Carl Icahn's activist stockholder behavior regarding Apple. Once Mr. Icahn sold off his Apple stock, I correlated that the Apple Bear BS came to a halt. I have to wonder if there is a manipulation factor at work within Bloomberg. But this speculation is of course baseless.

Q2) Are stories written and published at Bloomberg being driven by their marketing division?

I call the ascendance of marketing executives into management 'Marketing-As-Management.' It is common among aging companies. The overall effect is demoralization of the productive members of a company as well is irrational business decisions. In the case of Bloomberg, their marketing may either have an irrational bias toward Apple, one of the most productive companies in history. Or it might be the case that their Marketing-As-Management doesn't provide the scrutiny required for the reporting of the highly complex technology sector. But this speculation is of course baseless.

Q3) Is Bloomberg overly intent and dependent upon the youth factor in their reporting and in their intended target audience?

Q4) Are there other sources of bias within Bloomberg I haven't imagined?

Q5) Is this just an ordinary and all too common case of bad technology journalism?

In any case, I hope the current concern of hardware hacking is sorted out and that Bloomberg can get back to what I consider to be professional quality reporting.

For those that don’t know, the only byline you should read from Bloomberg regarding Apple is Mark Gurman. He’s maybe 50/50, but he has a long time track record regarding Apple product rumors, and you should only concentrate on the one or two sentences of information, and ignore everything else. Don’t know if Bloomberg will make him stupid, but time will tell. Everyone else seems to be stock market analyst rumormongering, ie, people who don’t really live in reality, but an echo chamber trying to divine whether a stock price will go up or down based on goat entrails.

Dilger’s articles kind of serve as a reminder that our “news” aren’t really facts, they are stories which only sometimes reflect the facts. Sometimes. It’s an institutional character flaw since they are a business that needs to make money, and they have a desperate need to make it an entertaining story to get more eyeballs.

These rumor stories are really not that different from gossip rags on grocery store aisles, but since this is about “business”, people give it more credibility than they really should. In this day an age of voluminous input, 24x7x60x60 seconds a week, our skepticism meters have to be dialed up in concert with the increased amount of input.

The Bloomberg nonsense is beyond speculation of a naturally curious public. It’s a specific set of detailed allegation, without any evidence or named sources. It rightly deserves skepticism, especially in light of Bloomberg’s crummy track record.

Sounds like we have a hater. The problem with trolls is they aren’t capable of discerning the difference between zealously defending, vs pointing out all the holes and logic failings used by haters. There’s a reason Apple is the most successful company in human history, and trolls are anonymous nobodies. If anything, being a staunch critic of Apple at all costs is indicative of the person less able to apply reason.

Yellow journalism isn’t in our vernacular because of the color of notepads or something. It’s as old as language itself. The only difference is speed, volume and reach. Back when yellow journalism was Yellow Journalism, Hearst, Pulitzer were spreading innuendo, lies, and propaganda in their newspapers, sensationalizing crime, politics, war, and propaganda for war. Sound familiar doesn’t it.

Big difference to today is speed of spread and reach. Social media will only be a net negative on society until they are regulated, just as there are some checks on media of old from spreading lies. It (laws against fakes, libel, slander, verbal abuse) only should be more stringent today because today’s reach of information is billions strong within seconds. That the social media companies don’t address the harm they are causing is a testament to their moral and ethical bankruptcy.

AppleInsider does tend to defend Apple but - hey - the proof of the pudding is in the eating. AppleInsider's track record is rather good. Not perfect, but very good. As the article points out, Bloomberg's record is much less so, even to the point where some posters raise questions concerning attempts at market manipulation.

And in this case [the Supermicro servers], it's not even about some secret Apple thingie.

IOW: You made an wrong, excremental and entirely ignorable statement. Please get involved with the actual Apple user community and figure us out for yourself.

Now back to the REAL news...

Given how prevalent the negative articles are, I'd say that it's the editorial staff, and not just the specific authors. I have to say the consistent negativity of the articles have stuck out to me.

This is what I see as the key to understanding this particular story. What it sounds like to me, based on Fitzpatrick's comments, and backed up by the letter to Congress from Apple, is that Bloomberg had one unnamed source tell them that SuperMicro boards had been tampered with at the factory. They then went to a number of other sources, let's say about 17 of them, and asked how this might be done. I suspect all of them said things similar to Fitzpatrick: this isn't the way to do it, but if you insist on doing it that way, etc... Then 16 of them refused to have their names assoiciated with wild speculation. So 17 unnamed sources (including the original) and Fitzpatrick, who staunchly denies the implications of the report.

Some might think that Fitzpatrick was foolish in allowing his name to be linked to the report, assuming of course that he had any say in the matter, but I think it's actually a good thing that he was named in the piece so that we got to find out what he actually said versus what Bloomberg reported he said. (Unless he's now lying to cover his own arse which is also a possibility, but I'm inclined to believe him.)