Apple to lower iPhone pricing in key markets after sluggish December quarter

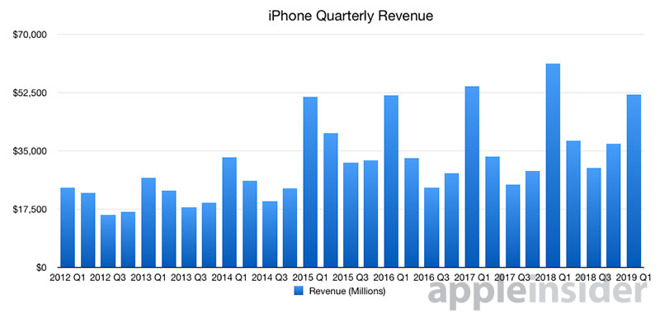

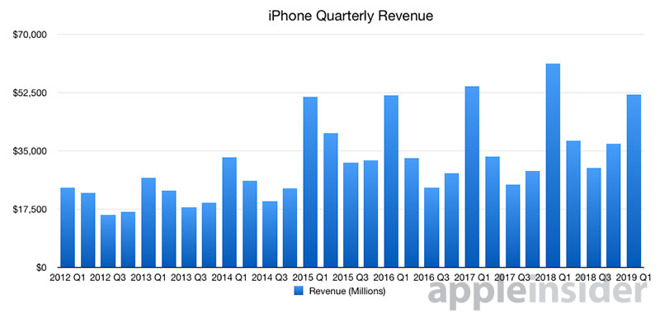

Following the release of Apple's earnings report on Tuesday, CEO Tim Cook revealed the company is planning price changes for iPhones overseas to goose sales of the device after sluggish sales in China and other regions during the important holiday quarter.

In an interview with Reuters, Cook said that he believes the current trade tension between the United States and China has improved, suggesting an exacerbation of a contracting major economy might soon ease.

However, he also said that Apple is rethinking how it prices iPhones overseas after recent economic conditions in other markets. Apple in recent years has set the price of iPhone based on the U.S. dollar, a strategy that results in higher prices in certain regions.

"When you look at foreign currencies and then particularly those markets that weakened over the last year, those [iPhone price] increases were obviously more," Cook said. "And so as we've gotten into January and assessed the macroeconomic condition in some of those markets we've decided to go back to [pricing that is] more commensurate with what our local prices were a year ago in hopes of helping the sales in those areas."

Cook spoke to Reuters as Apple made its legally-required earnings disclosures. He addressed the fact that the iPhone's revenue was affected in particular by economic weakness in China.

Looking ahead, Cook sees a thawing of tensions between the U.S. and China, a situation that Apple said impacted iPhone sales over the trailing half of 2018.

"As we've gotten down in to January," he said. "January looks better than December looked. And I think if you were to graph up trade tension it's clearly less. I'm optimistic that the two countries will be able to work things out."

In an interview with Reuters, Cook said that he believes the current trade tension between the United States and China has improved, suggesting an exacerbation of a contracting major economy might soon ease.

However, he also said that Apple is rethinking how it prices iPhones overseas after recent economic conditions in other markets. Apple in recent years has set the price of iPhone based on the U.S. dollar, a strategy that results in higher prices in certain regions.

"When you look at foreign currencies and then particularly those markets that weakened over the last year, those [iPhone price] increases were obviously more," Cook said. "And so as we've gotten into January and assessed the macroeconomic condition in some of those markets we've decided to go back to [pricing that is] more commensurate with what our local prices were a year ago in hopes of helping the sales in those areas."

Cook spoke to Reuters as Apple made its legally-required earnings disclosures. He addressed the fact that the iPhone's revenue was affected in particular by economic weakness in China.

Looking ahead, Cook sees a thawing of tensions between the U.S. and China, a situation that Apple said impacted iPhone sales over the trailing half of 2018.

"As we've gotten down in to January," he said. "January looks better than December looked. And I think if you were to graph up trade tension it's clearly less. I'm optimistic that the two countries will be able to work things out."

Comments

Apple can afford to make some adjustments to their pricing even if they take a slight hit on margins. The problem is by lowering prices an iPhone becomes an even more attractive alternative to someone looking at a Galaxy S or other flagship. Even a change of 99 dollars (or Euros) has a significant impact on the perceived value of an item. Suddenly an undecided consumer looking at an iPhone vs another device could be swayed to pick the iPhone because of the lowered price.

It would be more like rolling back the clock to how things were before the decline which wasn't showing any signs of growth anyway.

Better than how things are right now, yes. Better than the last three years, unlikely.

Apple needs to accompany the price adjustments with a compelling upgrade to the iPhone itself. Perhaps this year, that change will come but September is still a long way off.

Competing Android manufacturers have been pricing their flagships in the same band as Apple (today) but seeing success, so while price is obviously a factor in Apple's poor results (YoY) it isn't the whole story as the features on offer from rivals simply have more appeal (at every price point below the premium bands too).

Still, a tacit admission by Apple of setting pricing too high is also the beginning of the solution, so any reductions will be welcome.

I paid around 650€ for a 64GB XR after trade in and the iPhone 6 battery refund. That seems reasonable. If it hadn't been for the change in trade in value, Apple would have lost the sale to me.

I wonder how much of an impact that last minute change in policy had on the final numbers, which in spite of them being poor, perhaps could have been far worse.

Cook ignoring DED’s sage advice again.

He said "increasingly less common." Do you think he's lying? If you actually listened to the call, he specifically called out markets where this is a more recent change, ie Japan as an example where regulations have changed things. Turns out Apple operates in other markets than the US, who knew?

"Second, subsidies: For various reasons, iPhone subsidies are becoming increasingly less common. In Japan, for example, iPhone purchases were traditionally subsidized by carriers and bundled with service contracts. Competitive promotional activity frequently increased the amount of subsidy during key periods. Today, local regulations have significantly restricted those subsidies as well as related competition. As a result, we estimate that less than half of iPhones sold in Japan in Q1 of this year were subsidized compared to about three quarters a year ago and that the total value of those subsidies have come down as well."

If it works out to be about the same, then what's the psychological barrier? Because 2 is higher than 1? I don't understand direct numbers to numbers comparisons between markets, if A$2000 is the roughly the same as USD$1000.

Remember how Nokia reacted to downfall in sales but eventually it didn’t work?

Don't get me wrong. I'm not claiming that things are going well for Apple. The current lack of true innovation (sorry Tim) combined with insane pricing ideas (sorry Tim) certainly is a recipe for disaster.

However, Apple has a very strong foothold with iOS in the enterprise now. That too won't carry them forever, but they have time to make adjustments. No need to dramatize things.

The problem I see is that they didn't do price adjustments preemptively. Once a company has the public image of selling overpriced products, it's difficult to shake that. That will take time and damage to Apple's reputation has been done, I fear.

You won't buy a iPhone for yourself, and that is based on your constant pump of Huawei here with your posts on AI, and your dislike for iOS.

Ironic that part of the reason for this admission by TC was also due to the intense competition from the likes of Huawei, no less.

After so much insistence on defending Apple's pricing and pointing to ASP as the metric, now your only comment is on how I am 'mischaracterising' something (when in fact, I am not!).

Now rewind and take a look at my comments on why I wouldn't buy a 2018 iPhone. Are you surprised to see TC explain exactly that reason yesterday? I mean, to the letter!

It's okay not to like iOS, or the iPhone, but why even continue to pretend that you are a potential buyer?