IHS Markit: Apple shipped 43.8M iPhones in Q1, down 16% from 2018

Contradicting controversial smartphone shipment estimates from market research firm IDC, IHS Markit on Thursday released its own set of preliminary figures that fall in line with wider industry expectations. At least as far as Apple is concerned.

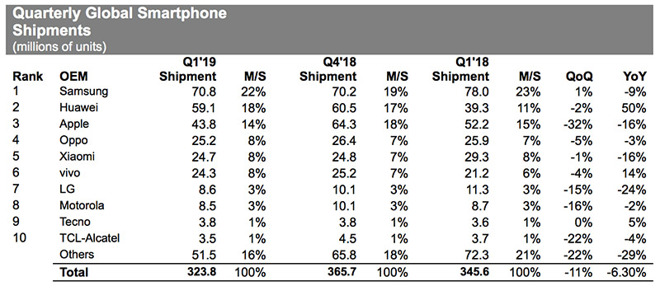

Source: IHS Markit

Earlier this week, IDC released estimates claiming Apple shipped 36.4 million iPhones in the first calendar quarter of 2019, down a shocking 30.2% year over year.

The report was subsequently panned by independent analysts and industry insiders including Neil Cybart, who characterized the results as "embarrassing" for IDC. Chinese smartphone maker Xiaomi also took issue with the data and on Thursday issued a statement saying IDC's estimates were at least 2.5 million units off.

Amid the hubbub, IHS Markit released its own findings, which are more conservative than those issued by fellow market research firms IDC and Canalys.

IHS estimates Apple shipped 43.8 million iPhones during the quarter to take a 14% share of the market, down 16% from 52.2 million units shipped the year prior. The performance landed Apple in third place, behind market leader Samsung and Huawei, which shipped 70.8 million and 59.1 million handsets over the same period, respectively.

"The fourth quarter likely left Apple with excess inventory, creating an incentive for the company to use more generous trade-in offers and more financing options in as many regions as possible," according to IHS analysts. "While slightly reducing prices in China might encourage some buyers, Apple faces the underlying challenge of charging premium pricing in a maturing smartphone market. As a result, Apple may not be able to find short-term fixes for its problems."

Oppo and Xiaomi rounded out the top five with a respective 25.2 million and 24.7 million units shipped, both good for about 8% of the market.

While IHS' iPhone numbers came close to expectations from Cybart and others, the firm's methodology resulted in the same IDC error that riled Xiaomi, but 300,000 units lower.

So far, Canalys estimates were nearest to Xiaomi's referenced range of above 27.5 million units for the quarter. The research firm overestimated at 27.8 million smartphones shipped, down 1.3% year over year.

With Apple no longer reporting unit sales of major product categories, research firms are left guessing and the results run the gamut.

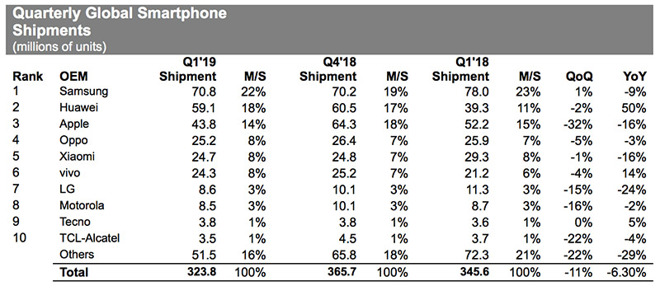

Source: IHS Markit

Earlier this week, IDC released estimates claiming Apple shipped 36.4 million iPhones in the first calendar quarter of 2019, down a shocking 30.2% year over year.

The report was subsequently panned by independent analysts and industry insiders including Neil Cybart, who characterized the results as "embarrassing" for IDC. Chinese smartphone maker Xiaomi also took issue with the data and on Thursday issued a statement saying IDC's estimates were at least 2.5 million units off.

Amid the hubbub, IHS Markit released its own findings, which are more conservative than those issued by fellow market research firms IDC and Canalys.

IHS estimates Apple shipped 43.8 million iPhones during the quarter to take a 14% share of the market, down 16% from 52.2 million units shipped the year prior. The performance landed Apple in third place, behind market leader Samsung and Huawei, which shipped 70.8 million and 59.1 million handsets over the same period, respectively.

"The fourth quarter likely left Apple with excess inventory, creating an incentive for the company to use more generous trade-in offers and more financing options in as many regions as possible," according to IHS analysts. "While slightly reducing prices in China might encourage some buyers, Apple faces the underlying challenge of charging premium pricing in a maturing smartphone market. As a result, Apple may not be able to find short-term fixes for its problems."

Oppo and Xiaomi rounded out the top five with a respective 25.2 million and 24.7 million units shipped, both good for about 8% of the market.

While IHS' iPhone numbers came close to expectations from Cybart and others, the firm's methodology resulted in the same IDC error that riled Xiaomi, but 300,000 units lower.

So far, Canalys estimates were nearest to Xiaomi's referenced range of above 27.5 million units for the quarter. The research firm overestimated at 27.8 million smartphones shipped, down 1.3% year over year.

With Apple no longer reporting unit sales of major product categories, research firms are left guessing and the results run the gamut.

Comments

Apple’s prices are up, for sure. I’m not happy about it, either.

Throughout most of my adult life, the seeking of short term profits has always been a criticism of American industry. Now, that industry has mostly moved to other countries. Apple, thankfully, has mostly resisted that urge to value profit over all else.

For myself, I have a 4 1/2 year old iPhone 6+ that is working just fine and meets my needs well. Why should I trade it for an Xs or Xr?

After years of non existent growth, Apple is down in two consecutive quarters (one of them, the blowout quarter).

Prices matter. In Apple's case much more, as its iPhone market seems to be contracting along with the wider smartphone market. The only player which is bucking the trend, and in a huge way, is Huawei.

A lot of Apple's services revenue also sits on top of an iPhone.

iPhone will become less relevant to Apple (post iPhone era for Apple - just like post iPod) but as of today, iPhone remains a huge revenue earner. Watching it slip, partly because of price, should be something of concern. Hence the price adjustments and trade in improvements over the last few months.

AFAIK, all the manufacturers named are making a profit too.

In terms of units, there is going to be a push in India. A local brand there may break out and be top 5, top 4 or 3 even, as India’s smartphone penetration hits mass market maturity. That’s a lot of phones, at some pretty low prices, to sell. The premium end in India seems too small, too impenetrable.

Price matters -- to low-end Android buyers, and people who don't live in Western-style economies. As plenty of evidence proves, price doesn't seem to matter that much to everyone else, especially Apple buyers, because we make more money than average and also see more value in the iPhone than we do in most other smartphones.

The real problem with Apple -- if it has one at all, being a trillion-dollar company and everything -- is that premium products (all premium products) are very dependent on a strong economy. All premium products suffer when the economy goes south, and the areas where Apple has done notably more poorly than usual are -- surprise! -- countries where the economy is suffering. Apple reported that iPhone sales picked up in China near the end of the quarter -- exactly at the same time as China reported better economic figures. So there's your vulnerability with Apple, and you can safely predict that if the US and/or European economy drops (and I think this quite likely within the next two years), Apple will suffer for it.

However, I think there is still plenty it can do to improve the situation.

The first move was twofold: open up the product spread and add a third model.

It was a necessary move and probably reduced the hemorrhaging they would have suffered without it.

Of course we now know it didn't really turn the situation around but they had to try something and it was the easiest option.

In fact, in spite of those moves things have actually got worse for iPhone.

Clearly, the next easiest step is to simply adjust pricing down.

Of course pricing itself won't save the day as Apple is now not only selling new models at prices that hit the price ceiling of more users than before but offers phones without compelling features.

Competitors have simply stepped ahead of Apple. It isn't that Apple can't compete. More that it simply chose not to and thought users would buy into the deal anyway. Call it arrogance, complacency or whatever you prefer but although Apple dropped the 'S' from the name, it still has an 'S' cycle. To make matters far, far worse, the that cycle sits within a yearly refresh cycle.

With regards to the competition, Apple has become a technological sloth. By the time Apple gets around to releasing a competitive product (assuming it is competitive) later this year, two years will have passed since the iPhone X.

To contrast that with Huawei, in the same period they released a flagship every quarter.

That's a heap of new technology for marketing to get their teeth into and keep the buzz going. On top of that, Huawei has a two brand strategy which allows it to do things Apple simply can't: experiment.

Apple spent a decade producing a maximum of two phones per year. Now there are three but that doesn't give them a great deal of legroom to experiment. It allowed them to try Face ID without running too many risks but Huawei moves in a different universe. It can try new ideas on shipping phones and limit them to specific geographies if needed. If those ideas are received well by users, they can quickly be propagated to other phones in record time. For example, Huawei is currently shipping notches, cutouts and sliding screens.

On another level, the two brand strategy allows them to differentiate for different areas of the market . Honor being the 'cheaper' brand focussed on the younger generation. This is the same as in the car industry.

I'm comparing to Huawei because it's in the news (for both wrong and right reasons), I know about them and their strategy is performing very well. Samsung is similar but without the dual brand strategy. They also have enough models to experiment with.

The good news is that it is entirely within Apple's reach to make changes to turn things around.

1. Adjust pricing

2. Eliminate 'S' cycles.

3. Change release cycle.

4. Move a 'two brand' strategy

With 80% of the smartphone market up for grabs and developing nations ripe for 'picking' there is definitely a lot to go for.

A 'two brand' strategy would scare Apple management due to possible cannibalism of such high revenue lines but they are already doing it in the iPad and laptop spaces via Pro and non Pro offerings.

People said (insisted even) that the iPad Mini was dead. They were wrong. Very wrong. Many of the same people insist the SE is dead. I think there is a large market for it.

I would break such a model out of the annual refresh and place it around February or March and price it attractively. Give marketing something extra to chew on and provide a platform for some experimentation.

The current strategy of offering lower priced phones which are old, really isn't going to keep users interested while they see all the advances coming to Android at attractive price points.

That's my master plan anyway. :-)

The limiting factor imo is that there are 7b people in the world and about 1b of them have a premium Apple product. As long as they can maintain 10% to 15% of the market, especially the higher end customers, they are in the best position.

Going downmarket is a philosophical and strategic question. They don’t have to. If they did, would it really help? Etc. If they are serious about their services play, they should have cheaper models, but then again, they essentially have the top 10% of the market. That’s where the vast majority of the money is made.

... So, Apple has to be cautious rather that constantly pushing the envelope as a Huawei can do.

And for using older to products to provide lower cost products:

I think that is necessary because a big part of Apple's cost is not just the hardware (as it is for Huawei & Samsung) but Apple's software and ecosystem that others don't need to pay for -- so exploiting older designs and manufacturing systems helps them put out a quality, price competitive product. Plus, as I mentioned, Apple has to protect their reputation because they are held to a higher standard - so selling proven older phones is less risky than one designed to be cheap.

There's no problem in that as long as there are sales (although the 'markets' want growth in addition to sales). However, when sales flatten for so long and then contract you have two options: Do nothing (or virtually nothing) and hope the situation corrects itself (we all remember the rumoured 'supercycle') or you make changes to adapt to a new reality (saturation among others).

I think the second option is the only way forward now, given how much the smartphone world has changed/advanced.

I follow what you say on the difficulties and risks though.

The changes are already here and started with the 2017 refresh (which I applauded). First with the simple, low risk, changes. Last year they should have taken that a step further IMO but they chose to play safe and try to squeeze more money out of people by increasing prices and shipping a simply iterative upgrade with the usual 'storage upsell' to annoy users.

Two quarters down the road, it has backfired in a big way.

Other factors have come into play such as the 5G misstep and the 'batterygate' problems which have accentuated the underlying issues.

Rumours say the Kirin 985 will have the Balong 5000 on the SoC. If that is true, it means that every model that uses it (it will be announced in around four months) will automatically and natively be a 5G phone. That is going to be a huge amount of phones.

Others, in the mid range, will ship with the Kirin 980 + Balong 5000, which will be another huge amount of phones.

I would introduce an SE style iPhone around MWC2020 with an A12, hole punch LCD, rear mounted TouchID (shock!), gradient finish and an attractive price.

Something with a fresh design and plenty of power while not being at the very top end if the line and released out of the traditional iPhone refresh window.

For you ASP's don't matter, but they do for corporations. Sooner than later, the Android OS Device Market will be saturated, and in decline. Do you really think that now is the time for Apple to reverse years of profitability to chase marketshare, when their iPhone user base keeps expanding.

For the record, I purchased a refurbished iPhone 8 for my brother yesterday for $349.00. I don't know if it was refurbished by Apple, or some third party, but I do know that that is a very good value. It is, interestingly enough, not much larger than the SE, and would certainly fulfill that position if and until Apple does create a replacement to the SE.

I am not concerned by Huawei's frequent product releases, nor Apple's lack of 5G for this fall. All they are doing is training customers to expect frequent new models, and price drops as they are replaced. You actually explained that to me as your "value" strategy.

Two, different, markets. Apple is an entire ecosystem including the iPhone, while Android OS device makers compete, for the most part, with each other based on hardware and UI. As the market saturates, there will be a race to the bottom until the device makers consolidate. That could begin, if it hasn't already, at any time.

The main Android market is already saturated and has been for a couple of years now.

We are seeing convergence as a result but it is some of the smaller non-niche players who are feeling the pinch. That said, much more effort is being put into other 'less developed' markets which have great potential. Obviously, without a change in business model, Apple will find it difficult to expand into those markets but has plenty of room to claim some of that 80% Android share.

Huawei isn't government funded. They've made that clear.

As for profit, they make more than enough to finance huge R&D budgets become more vertically integrated by the day and have huge plans for every rung on the tech ladder going forward. Some of those plans might seem scary to you:

https://thewest.com.au/technology/chinese-tech-giant-huawei-unveils-plan-for-intelligent-digital-world-ng-b881173963z

https://interestingengineering.com/how-ai-and-huawei-are-transforming-the-data-center

They also announced plans to open a chipset related development centre on Arm's doorstep:

http://www.cityam.com/277183/huawei-build-400-person-chip-plant-near-arm-holdings

Still, I'll post it again.

https://thechinacollection.org/huaweis-ownership-huaweis-statement-response/

Here's a response from a commenter of wrt the report and Huawei's response;

"Don: I think you know why Huawei objects so strongly to this English-language report, for which I congratulate you and Christopher. Huawei is fighting on multiple fronts what it views as a life-and-death struggle for markets in OECD countries where there seems to emerging a (excuse the expression) “united front” to keep Huawei out. The basis for this determination is the perceived domination of Huawei and every other PRC company by the Communist Party and their alignment with China’s geostrategic aims. Easily accessible commentary in English by knowledgeable foreign China experts which undermines the false narrative that Huawei is simply like every other private business corporation owned by its shareholders may defeat or hinder Huawei’s global ambition."