Tension over Trump's tariff tweet torpedoes $30B of Apple market cap

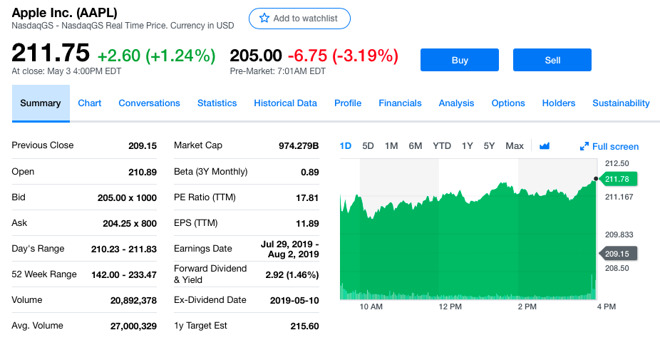

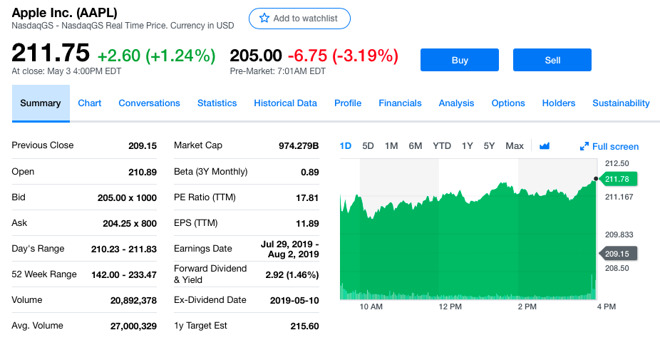

After President Donald Trump used Twitter to threaten a dramatic escalation of America's trade war with China, stocks tumbled in early trading. Apple was hit particularly hard, with shares dropping by more than 3%.

President Trump's tweet was enough to take more than $30 billion off the company's market capitalization, less than a week after better than expected earnings drove an over $10 per share climb.

"The president is, I think, issuing a warning here, that, you know, we bent over backwards earlier, we suspended the 25% tariff to 10 and then we've left it there. That may not be forever if the talks don't work out," White House economic adviser Larry Kudlow stated to the BBC.

The BBC cited Asia director Michael Hirson of Eurasia Group as saying that Trump's "move injects major uncertainty into negotiations, which now face a rising risk of an extended impasse - perhaps even through the US presidential election."

The tariffs Trump threatened to hike are assessed on the importing companies, and boil down to a tax that American buyers will pay on goods from China as the price of goods increase. In October, the Trump administration announced $200 billion of tariffs and China countered with $60 billion in tariffs of its own. Apple products were omitted from the original U.S. order, perhaps a consideration of the many letters of concern the administration received from Apple and other tech companies.

Reports last summer claimed the Trump administration promised Apple CEO Tim Cook that iPhone would not be included in the Chinese trade war, but reports have gone back-and-forth on this topic. Apple Watch escaped getting hit by tariffs in September.

While the Tweet doesn't specifically convey whether the tax hike would include any Apple products, the prospect of an endless trade war and the uncertainties raised is likely to have a destabilizing impact on the global economy. Beyond just buying power, Apple's first quarter results were hit hard by economic uncertainty in China, with a carry-on effect impacting Apple's sales domestically.

President Trump's tweet was enough to take more than $30 billion off the company's market capitalization, less than a week after better than expected earnings drove an over $10 per share climb.

For 10 months, China has been paying Tariffs to the USA of 25% on 50 Billion Dollars of High Tech, and 10% on 200 Billion Dollars of other goods. These payments are partially responsible for our great economic results. The 10% will go up to 25% on Friday. 325 Billions Dollars....

-- Donald J. Trump (@realDonaldTrump)

"The president is, I think, issuing a warning here, that, you know, we bent over backwards earlier, we suspended the 25% tariff to 10 and then we've left it there. That may not be forever if the talks don't work out," White House economic adviser Larry Kudlow stated to the BBC.

The BBC cited Asia director Michael Hirson of Eurasia Group as saying that Trump's "move injects major uncertainty into negotiations, which now face a rising risk of an extended impasse - perhaps even through the US presidential election."

The tariffs Trump threatened to hike are assessed on the importing companies, and boil down to a tax that American buyers will pay on goods from China as the price of goods increase. In October, the Trump administration announced $200 billion of tariffs and China countered with $60 billion in tariffs of its own. Apple products were omitted from the original U.S. order, perhaps a consideration of the many letters of concern the administration received from Apple and other tech companies.

Reports last summer claimed the Trump administration promised Apple CEO Tim Cook that iPhone would not be included in the Chinese trade war, but reports have gone back-and-forth on this topic. Apple Watch escaped getting hit by tariffs in September.

While the Tweet doesn't specifically convey whether the tax hike would include any Apple products, the prospect of an endless trade war and the uncertainties raised is likely to have a destabilizing impact on the global economy. Beyond just buying power, Apple's first quarter results were hit hard by economic uncertainty in China, with a carry-on effect impacting Apple's sales domestically.

Comments

I think China isn't the only country that would rather deal with a different negotiating style and new political representatives.

In my talks with people in the corridors of certain agencies in Europe, the feeling is that they've had enough.

Trump plays the bluster game.

My money is on China.

As one of the citizens of the U.S. you mention I am willing to take some hits if it means we get a better trade deal instead of the lopsided one we have now where China exports everything to us and we export nothing to them. Whatever they actually need from us, like technology and IP, they steal.

We have in #45 a person who is motivated by greed and revenge along with some other major human flaws. We all have gotten super comfy with zero inflation these past 10 years, low and stagnant wages and to keep the US population pacified, cheap, cheap consumer goods. This is more show-biz to entertain the reality tv fanbase and to distract us from what we are all losing, healthcare, the right to a decent public school education, protected national parks from strip mining, and the further oppression of the population which is really oppressed not those that look like #45.

Also, stories commenting on tweets and their effect on markets may not be the best use of everyone’s time. Markets go up and down all the time. Will there be follow up if the market bounces back after traders realize China will be affected more than the US due to the massive imbalance of trade?

I don't think there is really a factual basis for claiming Trump's tariffs are motivated by "greed and revenge along with some other major human flaws." I think you can certainly disagree with him on tariffs, but his motivation is clearly that he thinks it turns the screws on China to do more of what we want them to do. His position is they have been ripping us off in may ways for decades, and he's not wrong. Tariffs are a close call for me. In general, I don't support them. China is a different beast though. Their highly planned and controlled economy makes things different, as does their assault on our labor market, cybersecurity and forced tech transfers. So-called "free trade" as embraced by basically both major parties over the last 30 years has clearly had major downsides. First, it's not "free" in any respect. We simply calculated that their market and their manufacturing was worth being charged tariffs and non-tariff barriers while we gave them a pass. Clearly, Trump doesn't believe that. I think there is evidence to suggest his approach, however unorthodox, is working. He's not in love with tariffs for tariffs sake, I don't think. He's clearly using them as leverage, something that is likely to be effective given our trade deficit (they need us for their products, badly).

True American patriot here. Evil foreign country over a president he doesn't like.

Correct. China is still treated as a developing country at the WTO and given special treatment similar to a country like Papua New Guinea, meanwhile they have the 2nd largest economy in the world.

It hasn't cost us anything, my life hasn't changed one bit. Meanwhile the systematic export of the means of production of most of our economy to China has cost us immensely.

A true patriot calls out those that break our laws, we are a nation of laws, remember.