Apple Card Preview program invitation emails going out now in US

Apple has published a new webpage for Apple Card, and is providing early access to the soon-to-launch credit card to a small number of customers in a preview.

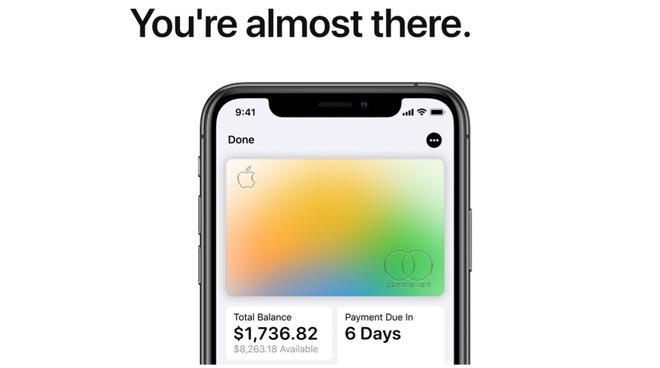

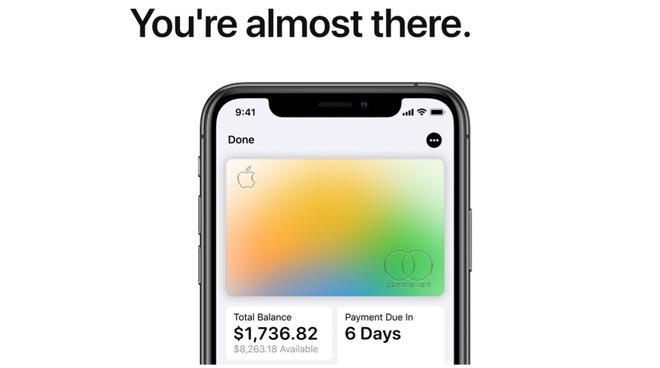

Accessing the Wallet subdomain of the Apple website takes users to a page headlined "You're almost there," complete with the Apple Card logo in the navigation bar and an image of the Wallet app's Apple Card interface on an iPhone display.

The page advises those who have "received an email invitation to the Apple Card Preview" can apply for Apple Card directly from within the Wallet app on the iPhone. Applications can also be made via the iPad, by using the Settings app then Wallet & Apple Pay.

Apple also offers a link to the main Apple Card page of the website, for users who want to be notified of when the card will be available generally.

Potential users of the preview are advised to check that they are a US citizen or lawful resident aged 18 or over, are using the latest version of iOS on their device, and have an iPhone that is compatible with Apple Pay before applying. The page also includes a step-by-step video explaining how to apply for Apple Card from within the app.

AppleInsider has confirmed with sources inside Apple not authorized to speak on behalf of the company that invitation emails have gone out to "a very, very small group" of "select iPhone owners." Beyond that, it isn't presently clear what criteria are being using for early invites.

It appears that the effort is the last phase of pre-launch testing. Apple may have chosen this "soft launch" for scale-testing, similar to how a popular mobile game that is expected to induce a heavy server load is launched in smaller markets prior to a US debut.

A firm launch date for all iPhone owners is not yet set. Apple CEO Tim Cook said in the conference call following the most recent earnings disclosure that the Apple Card would launch for all in August.

Goldman Sachs, Apple's partner for Apple Card, recently published details of its customer agreement for the card, advising of an APR of between 13.24% and 24.24%, a requirement for an Apple ID in good standing, and restrictions on cryptocurrency purchases.

It is likely that Apple will expand Apple Card into other territories if the US launch goes well. The iPhone maker has already been spotted filing trademarks in Canada for both Apple Card and Apple Pay Cash, making it a likely second market.

Accessing the Wallet subdomain of the Apple website takes users to a page headlined "You're almost there," complete with the Apple Card logo in the navigation bar and an image of the Wallet app's Apple Card interface on an iPhone display.

The page advises those who have "received an email invitation to the Apple Card Preview" can apply for Apple Card directly from within the Wallet app on the iPhone. Applications can also be made via the iPad, by using the Settings app then Wallet & Apple Pay.

Apple also offers a link to the main Apple Card page of the website, for users who want to be notified of when the card will be available generally.

Potential users of the preview are advised to check that they are a US citizen or lawful resident aged 18 or over, are using the latest version of iOS on their device, and have an iPhone that is compatible with Apple Pay before applying. The page also includes a step-by-step video explaining how to apply for Apple Card from within the app.

AppleInsider has confirmed with sources inside Apple not authorized to speak on behalf of the company that invitation emails have gone out to "a very, very small group" of "select iPhone owners." Beyond that, it isn't presently clear what criteria are being using for early invites.

It appears that the effort is the last phase of pre-launch testing. Apple may have chosen this "soft launch" for scale-testing, similar to how a popular mobile game that is expected to induce a heavy server load is launched in smaller markets prior to a US debut.

A firm launch date for all iPhone owners is not yet set. Apple CEO Tim Cook said in the conference call following the most recent earnings disclosure that the Apple Card would launch for all in August.

Goldman Sachs, Apple's partner for Apple Card, recently published details of its customer agreement for the card, advising of an APR of between 13.24% and 24.24%, a requirement for an Apple ID in good standing, and restrictions on cryptocurrency purchases.

It is likely that Apple will expand Apple Card into other territories if the US launch goes well. The iPhone maker has already been spotted filing trademarks in Canada for both Apple Card and Apple Pay Cash, making it a likely second market.

Comments

These are probably youtubers like iJustine, MKBHD, etc.

Good luck everybody!

Likely the same with Goldman Sachs senior management team.

The most reasonable guess is that members of the press -- some of those who get invited to Apple launch events -- were amongst those who received the preview e-mail for early access. Foreign journalists and those using Android handsets would be excluded of course.

The apocryphal story about Diana Spencer was that when she was trying to raise Will and Harry to be normal humans, one of them came home from school to ask her about the the funny pieces of paper his classmate had in his pocket with pictures of grand-mama on them. They had never seen money. I wonder how long since Tim or Warren has touched a bank note...or even their own credit card.

My guess would be somewhere in the high four figures, maybe low five figures.

It's not clear from the video if there are additional questions or requested data like income (taxable and non-taxable) as well as assets. For sure, a score from a credit rating agency is not a complete assessment of someone's financial status.

One can have a high credit score but relatively few assets. Conversely, one can have a lot of assets but a poor credit score.

They don't have a mob of personal assistants running around or hulking security guards.

Even though they can afford them, often those sort of entourages attract unwanted attention. A lot of these people want to be left alone and treated like everyone else in their daily lives.

Sure, they won't scrub their own toilets, weed their garden, nor spend Saturday afternoon cleaning out their garage. The vast majority of them drive their own cars.

My recollection was that AAPL disclosed the costs of Tim's security in their SEC filings.

I would agree many very wealthy people, a vast majority of them, in fact try to act like normal humans. But the very very top people simply can't.

I would really like to have a more realistic idea of what being very wealthy is like, preferable from an extended first hand experience.

MasterCard currently has about 100M. Goldman-Sachs has zero. Imagine opening up Apple Card to all 200M Apple users all at once. Ain't gone to happen I'd suggest.

We don't know who received the invitations and how many were sent out. My guess is that journalists (including many who are invited to Apple's product launch events) were sent invitations.

For sure Apple knows if any given Apple ID has a valid US credit card registered to the account and most likely if the person with that Apple ID has an Apple device that meets the Apple Card requirements (iPhone with Face ID, iPhone with Touch ID except the 5S, iPad with either Face ID or Touch ID).

Apple/Goldman Sachs can do a soft credit score pull to determine which Apple IDs have higher credit scores. Credit card companies already do this for their promotional mailings. They send premium card offers to those with higher credit scores. In fact, I bet in some cases, the advertising credit card issuer already knows that the recipient of the mailing would qualify. American Express isn't going to waste their time/money sending a Platinum Card invitation to some random schmuck with a secured credit card with a $500 limit and a 580 credit score.

Another tactic that Apple could use would be to focus attention by targeting certain billing address ZIP codes. There are plenty of databases that rank ZIP codes by income/housing prices/etc. It would not be difficult for Apple to identify Apple ID holders who have a billing address in a high income ZIP code.

Of course, Apple knows which App Store customers are using apps with a recurring subscription. Those are probably high value consumers that Apple would love to get using the Apple Card.

Note that Apple Card has a variable 13-25% APR. Someone with a lower credit score will get a smaller limit and a bigger rate; someone with a higher score will get a larger limit and lower rate. Goldman Sachs is a newcomer to the consumer credit card business; they are trying to build their customer base. From a customer growth standpoint, it is in Goldman Sachs' interest to not turn down many applicants. Hopefully those guys learned something about risk assessment from the subprime mortgage debacle.

The people most likely to get turned down would be first time credit card applicants.

I was so excited when I saw the notification pop up on my iPad screen.

I immediately clicked on it, and saw that Apple was telling me about how Apple Pay was now available and ready to use on select local transit subway and bus lines in my city.

Thats great and all, but Im disappointed, because I actually thought for a moment that it would be the credit card email.

Oh well. Yeah, its only a credit card, but damnit, i would like mine as soon as possible.

https://www.cnbc.com/2017/09/21/why-these-5-billionaires-still-drive-these-cheap-cars.html

Anyway, here's hoping someone works out how to implement Myst on the Apple Card.