Apple loses ground to Samsung in European smartphone market

Apple shipped 1.3 million fewer iPhones to Europe in the second quarter, analysis of the smartphone market has revealed, a fall of 17% year-on-year, meanwhile Android-based rivals Xiaomi and Samsung are seeing considerable shipment growth over the same period.

iPhone XS Max (left) with an iPhone XS

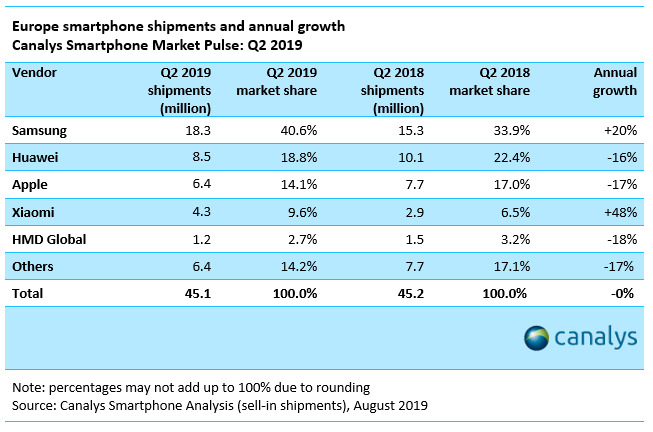

For the second quarter of 2019, data from Canalys claims Apple shipped 6.4 million iPhones, a drop of 17% from the 7.7 million shipments seen in the same quarter in 2018. For the market in general, Apple manages to remain in third place in terms of shipment volume, but occupies 14.1% of the market compared to the 17% it held last year.

Apple's dip in market share in this latest report echoes a similar sentiment offered by another round of analysis at the end of July, which claimed Apple shipped 36.4 million iPhones globally in the second quarter, down from 41.3 million in 2018. As a whole, the industry was down 1.2% in terms of shipments, to 360 million units.

In the Canalys report, European shipments for the industry are at 45.1 million units for the quarter, down approximately 100,000 from the 45.2 reported for the previous quarter, indicating the market is relatively stable versus the rest of the world.

The details of Apple's market share may not necessarily be a useful figure to examine in this case, as Canalys is monitoring all smartphone sales, regardless of price. This effectively puts Apple's premium smartphones against models that could cost a small fraction of the price of an iPhone, making it a relatively unfair comparison, unlike a comparison of revenue.

Canalys' report does not explain what happened to Apple for the market, but instead takes the time to talk about the Android market, including how there is a "lack of brand loyalty among users of low-end and mid-range Android smartphones." Most of the discussion is about Samsung, its mammoth growth in market share for the quarter, and its highest shipment figure from the last five years.

For the competition, Samsung is in the top spot with 18.3 million shipments, year-on-year growth of 20%, and a market share that swelled from 33.9% for Q2 2018 to 40.6% in Q2 2019. Canalys credits the improvement to a shift in Samsung's product strategy from focusing on operating profit to winning back market share, as well as capitalizing on Huawei's problems with the U.S. government.

Also ahead of Apple is the aforementioned Huawei, which saw shipments drop 16% to 8.5 million and market share go from 22.4% to 18.8%. Behind Apple is Xiaomi, which saw annual growth of 48% to achieve 4.3 million units shipped, giving it a market share boost from 6.5% to 9.6%.

Apple does appear in the list of top five smartphone shipments for the quarter, with the iPhone XR in fifth place with 1.8 million units. Samsung takes the first, second, and fourth place with the Galaxy A50 (3.2 million), Galaxy A40 (2.2 million) and Galaxy A20e (1.9 million,) while Xiaomi's Redmi Note 7 was third with 2.0 million units.

The top five list highlights the pricing issue of market share, as Apple is fighting against considerably cheaper devices. While the fifth-place iPhone XR costs from 749 GBP ($905) in the UK, the Samsung Galaxy A50 can be acquired for 288 GBP ($348), the A40 for 219 GBP ($264), the A20e for 158 GBP ($191), and the Xiaomi Redmi Note 7 for 123 GBP ($149).

In the most recent quarterly results, Apple reported it had seen a year-on-year drop in global iPhone revenue, down from $29.9 billion to $26 billion. Due to Apple's stance on no longer reporting unit shipments, it is unclear if the price was due to fewer units being shipped or a change in average selling price.

Also unclear is Canalys' data sources for the report.

iPhone XS Max (left) with an iPhone XS

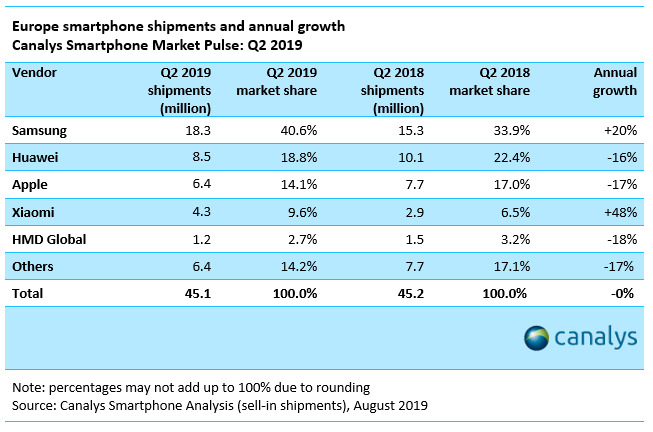

For the second quarter of 2019, data from Canalys claims Apple shipped 6.4 million iPhones, a drop of 17% from the 7.7 million shipments seen in the same quarter in 2018. For the market in general, Apple manages to remain in third place in terms of shipment volume, but occupies 14.1% of the market compared to the 17% it held last year.

Apple's dip in market share in this latest report echoes a similar sentiment offered by another round of analysis at the end of July, which claimed Apple shipped 36.4 million iPhones globally in the second quarter, down from 41.3 million in 2018. As a whole, the industry was down 1.2% in terms of shipments, to 360 million units.

In the Canalys report, European shipments for the industry are at 45.1 million units for the quarter, down approximately 100,000 from the 45.2 reported for the previous quarter, indicating the market is relatively stable versus the rest of the world.

The details of Apple's market share may not necessarily be a useful figure to examine in this case, as Canalys is monitoring all smartphone sales, regardless of price. This effectively puts Apple's premium smartphones against models that could cost a small fraction of the price of an iPhone, making it a relatively unfair comparison, unlike a comparison of revenue.

Canalys' report does not explain what happened to Apple for the market, but instead takes the time to talk about the Android market, including how there is a "lack of brand loyalty among users of low-end and mid-range Android smartphones." Most of the discussion is about Samsung, its mammoth growth in market share for the quarter, and its highest shipment figure from the last five years.

For the competition, Samsung is in the top spot with 18.3 million shipments, year-on-year growth of 20%, and a market share that swelled from 33.9% for Q2 2018 to 40.6% in Q2 2019. Canalys credits the improvement to a shift in Samsung's product strategy from focusing on operating profit to winning back market share, as well as capitalizing on Huawei's problems with the U.S. government.

Also ahead of Apple is the aforementioned Huawei, which saw shipments drop 16% to 8.5 million and market share go from 22.4% to 18.8%. Behind Apple is Xiaomi, which saw annual growth of 48% to achieve 4.3 million units shipped, giving it a market share boost from 6.5% to 9.6%.

Apple does appear in the list of top five smartphone shipments for the quarter, with the iPhone XR in fifth place with 1.8 million units. Samsung takes the first, second, and fourth place with the Galaxy A50 (3.2 million), Galaxy A40 (2.2 million) and Galaxy A20e (1.9 million,) while Xiaomi's Redmi Note 7 was third with 2.0 million units.

The top five list highlights the pricing issue of market share, as Apple is fighting against considerably cheaper devices. While the fifth-place iPhone XR costs from 749 GBP ($905) in the UK, the Samsung Galaxy A50 can be acquired for 288 GBP ($348), the A40 for 219 GBP ($264), the A20e for 158 GBP ($191), and the Xiaomi Redmi Note 7 for 123 GBP ($149).

In the most recent quarterly results, Apple reported it had seen a year-on-year drop in global iPhone revenue, down from $29.9 billion to $26 billion. Due to Apple's stance on no longer reporting unit shipments, it is unclear if the price was due to fewer units being shipped or a change in average selling price.

Also unclear is Canalys' data sources for the report.

Comments

Apple loses ground to Samsung in European smartphone market

Is this a fact?In a world where top-line Android phones are decent all-round machines, Apple is seen a being greedy. As a 30 year Apple user who has bought tens of thousands of pounds worth of Apple gear in that time, I'm getting totally fed up with the high prices and limited choice in each segment such as desktop Macs.

In the past, it was worth it as Windows was a nightmare world I didn't want to enter into. Now though Windows and Android have got to the point of being passable. I might just make the move.

Yeah, whatever you say. Go ahead and "make the move" and "enjoy" MS and Goophabet.

Similar situation and made the switch this year. Very happy with Windows 10 and my pixel phone.

Back in 2015 their top of the line 6S+ cost £619, now their top of the line costs £1099.

Apple jumped their price for the top of the line model by £480 in just three years.

That’s moved them from expensive, but affordable, to ridiculously overpriced territory.

With pretty decent Android handsets coming in in the £200-300 range, and the really good ones coming in at the £500-600 range I can see why so many people have dropped Apple this year.

Great. So competitors are selling more barely-good-enough products at... are they even making any money on those things? And where are they all winding up in 6-12mo? "everything drawers"? landfill? Being replaced with more cheap junk? Of course they're selling more. What are the true numbers on active user base? I think That's what Apple really cares about.

As mentioned above, Samsung makes some OK hardware. I guess they're working on their OS, but so far it's only installed on a couple watches. Apple makes A++ hardware AND the world's slickest OS that runs not only on phones & watches, but also tablets, laptops & desktops which all integrate seamlessly together without the user having to really even think about it.

And Samsung has? A folding phablet? Yay...

And if I also understand correctly, Apple's chips are better, the RAM they use is better, the storage they use is better, and do these $300 phones have the same quality cameras & screens as an iPhone? When you start breaking all these things down, comparing market share doesn't even make any sense.

Soo anyway, enjoy Windoze and Blandroid & getting all your contacts & calendars & reminders to sync up perfectly between those two OS's & Tizen. Good luck & much $avings to you!

EDIT: of course Samsung can put more storage in their phones for less -- They MAKE it!!! Apple has to Buy the Storage From Samsung!

The main problem is that next to the S10 (and especially note 10) the iPhone does look fairly boring. both in it's hardware and what is now becoming increasingly frustrating software; Apple need to open up iOS to compete; and they can do this and maintain privacy. But they want you locked in.

the openness of android phones makes them much more versatile and compelling.

personally - the iPhone suits me because i find a boring, reliable, solidly built phone with good after sales support a good buy.

but other people want the flashy features of a Samsung - gimmicky and unreliable yes, but they sell phones.

On the software innovation side, Apple pushes out updates so your phone of a few years ago gets many of the same features as a new phone. That cuts into iPhone sales but it also makes the iPhone have a longer life than many of the Android counter parts many of which don't get operating system upgrades. My first iPhone was the 5s I picked up in late 2013. I finally replaced it early this year because I needed, err wanted, a larger display for flying my drone. In the same period, my friends who own Android phones went through two or three phones. Going forward, there doesn't seem to be a lot of software innovation that needs new hardware so why buy new hardware and if you are going to upgrade, the hardware specs of a few years ago are going to be fine for what most people want to do right now which is centered on a few popular apps. Again, this leads to many people buying mid-range replacement phones because the high end isn't going to get you anything more except bragging rights.

I think Apple sees this which is why the focus on services. But this puts them in a quandary. Investors are used to Apple doing what business should be doing... making money. How do you transition from a hardware company to a service company while continuing to make the money investors expect of Apple but don't seem to require from many other companies? If you lower the phone price, you forfeit a lot of profit and it takes a while for the service income to catch up. If you keep the phone price high, you may slowly shed the installed base and your services income will drop. It is a fine line to dance.

One is that, generally speaking, you don't see switchers from Android to iOS but you do see switchers from iOS to Android. Android switching (to other Androids) is seen as a plus as users get a lot to choose from and choice is important. Most Apple retail stores are visited by Apple users, not Android users looking to switch. It means that they already have an iDevice but if what is on offer is not compelling enough or too expensive, Apple misses out on the sale (which could be temporary or permanent).

The other point is clearly the price of entry. Many (myself included) are simply turned off by the price tag. On top of that you don't get the 'value' that most of us look for in any purchase. The good news here is that the fix is easy as long as Apple decides to implement it.

Apart from that, Samsung and Huawei are traditional heavy hitters with something for everyone in every price band. And now, both Oppo and especially Xiaomi are establishing distribution, support and service here making them attractive propositions too. Huawei has its largest Huawei retail store outside China in Madrid.

For visibility Samsung takes the biscuit with Huawei not far behind. Apple isn't invisible but perhaps is overly reliant on the Apple retail operations. There are 'campaigns' but there isn't really much to 'sell'. We had the photography and battery duration campaigns but most people already take for granted that Huawei and Samsung are kings of the hill on those fronts, which in turn puts them on the radars of iOS users. Mainstream press has more news on Android technology simply because there is much more of it and the flow is constant.

With the possible exception of the UK, I think it's now harder for Apple in the EU.

The 'good enough' factor is very real and for good reason. However, it impacts all manufacturers and not just Apple.

In spite of everything, iPhones are a common sight but I still see more older iPhones (heads and chins) than newer notched variants. How old is hard to tell and it is impossible to know if those users will stay on iOS or switch when it comes to upgrading.

All I can say is that competition (for everyone) is very intense and if you have a limited product spread at high prices (factor in 21% sales tax to every phone) you will find it harder to sell your products.

Let's not forget either that I'm speaking about iPhones here, not other Apple products.

I think price drops across the iPhone line would definitely help more than any other course of action. Whether they happen or not is anybody's guess.

So Libertarians rejoice, the strong will survive and your favorite brand was the weaker.

That is why Apple invest in Watch and other areas because it is where growth will be.Watch + AirPods combo will become more and more capable not talking about health monitoring.

It will be difficult to compete against mid range Androids as they can make great pics nowadays and it is question how much are able older iPhone models keep up with them. We can not expect Apple will update say iPhone 8 or 7 with 2019 sensors.or at least 2018 ones.

the openness of android phones makes them much more versatile and compelling...