AAPL hammered, bleeds 12.5% because of coronavirus once again

The opening of markets on Monday commenced with a bleak outlook for Apple's immediate future, as inter-session trading over the weekend dramatically cut the share price of the iPhone maker and other major stocks, caused through the ongoing coronavirus panic by investors.

Apple CEO Tim Cook

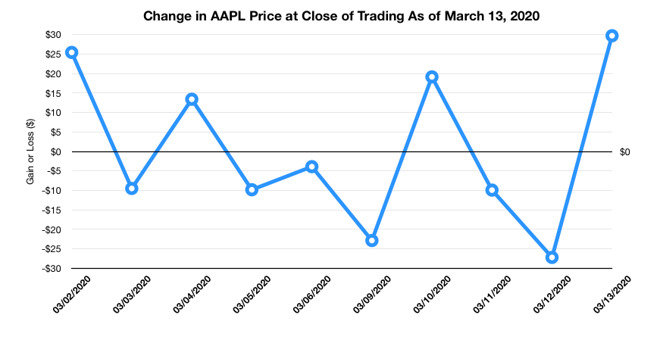

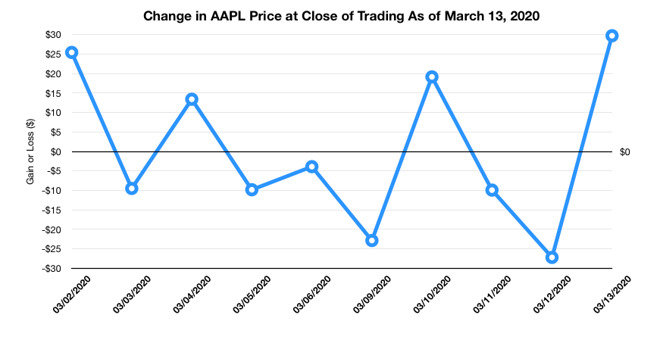

In a continuation of financial uncertainty that has plagued stock markets around the world in recent weeks, Apple's opening on Monday was dramatically different compared to its closing price before the weekend. On Friday, Apple closed the trading day at $277.97, a full $29.74 above the closing value on Thursday.

By Monday, after-market trading has effectively wiped out Friday's gains, with AAPL heading below $240 just before 9 am EDT. At $240, this would equate to a loss over the weekend of $37.97.

Apple opened on Monday at $243.34, representing a drop of $34.63 over Friday's closure. Its market capitalization is now down to $1.06 trillion.

The financial downturn is largely due to the coronavirus, which has led to a wave of canceled events, store closures, and production issues across most industries around the world. For Apple, this has led to delays in production for its Apple TV shows, the closure of all Apple Stores except those in China, and Apple offering assistance to Apple Card customers, among other events.

It remains to be seen if Apple will undergo a similar phenomenon as March 10, where its battered stock recovered from a sudden drop on Monday 9, itself following a weekend where Apple hemorrhaged $97 billion from its valuation in similar weekend trading initiatives.

On March 2, Apple's stock price saw a similar surge in value, again with the share price rebounding following dour weekend trading conditions.

If Apple's share price continues to spiral downward as markets continue to panic over COVID-19, there stands a good chance the price will go down below $232.56, the price where Apple's market capitalization is $1 trillion. If the price sinks to a level underneath that figure, Apple will no longer be a trillion-dollar company, at least until the share price returns to higher levels.

Apple CEO Tim Cook

In a continuation of financial uncertainty that has plagued stock markets around the world in recent weeks, Apple's opening on Monday was dramatically different compared to its closing price before the weekend. On Friday, Apple closed the trading day at $277.97, a full $29.74 above the closing value on Thursday.

By Monday, after-market trading has effectively wiped out Friday's gains, with AAPL heading below $240 just before 9 am EDT. At $240, this would equate to a loss over the weekend of $37.97.

Apple opened on Monday at $243.34, representing a drop of $34.63 over Friday's closure. Its market capitalization is now down to $1.06 trillion.

The financial downturn is largely due to the coronavirus, which has led to a wave of canceled events, store closures, and production issues across most industries around the world. For Apple, this has led to delays in production for its Apple TV shows, the closure of all Apple Stores except those in China, and Apple offering assistance to Apple Card customers, among other events.

It remains to be seen if Apple will undergo a similar phenomenon as March 10, where its battered stock recovered from a sudden drop on Monday 9, itself following a weekend where Apple hemorrhaged $97 billion from its valuation in similar weekend trading initiatives.

On March 2, Apple's stock price saw a similar surge in value, again with the share price rebounding following dour weekend trading conditions.

If Apple's share price continues to spiral downward as markets continue to panic over COVID-19, there stands a good chance the price will go down below $232.56, the price where Apple's market capitalization is $1 trillion. If the price sinks to a level underneath that figure, Apple will no longer be a trillion-dollar company, at least until the share price returns to higher levels.

Comments

France’s national competition regulator announced on Monday it has fined American tech giant Apple a record €1.1 billion ($1.23bn) for anti-competitive practices after nearly a decade of investigations.

The decision comes over Apple’s alleged anti-competitive behavior in its distribution and sales networks.

The authority said that two of Apple’s wholesalers, Tech Data and Ingram Micro, were fined €63 million and €76 million respectively for unlawfully agreeing on prices.

According to the French regulator, “Apple and its two wholesalers have agreed not to compete with each other and to prevent distributors from competing with each other, thereby sterilising the wholesale market for Apple products.”

Last month, the country’s Directorate-General for Competition, Consumption and the Suppression of Fraud fined Apple €25 million for the firm’s practice of slowing down iPhones after operating system updates. This followed Apple’s release of an iOS update several years ago that introduced a new feature for older devices.

From RT.com

AI has had an article up all morning. https://forums.appleinsider.com/discussion/215029/apple-fined-1-2-billion-by-french-antitrust-watchdog#latest

Yep!

All these companies aren't worth less suddenly, unless you're game is to make a quick buck.

My question is where are they putting the money while they wait to try and catch the upswing?

Oh gosh, I hope so! If it gets that low, I might even try to buy a few shares.

By legitimized, I meant they are trying to pretend they aren't gambling by using investment terminology.

If I had enough spare money, I might 'play' the Markets too... as I could have easily made a TON of $$$ over the years on AAPL.

AAPL reacts so predictably to the media, it is almost like shooting fish in a barrel.