Apple nears 'Apple Car' deal with Kia, first model might be fully autonomous enterprise ve...

A report on Wednesday claims Apple's first foray into the automotive industry will be a fully autonomous vehicle designed to operate without a human driver, suggesting it might not be marketed as a consumer product.

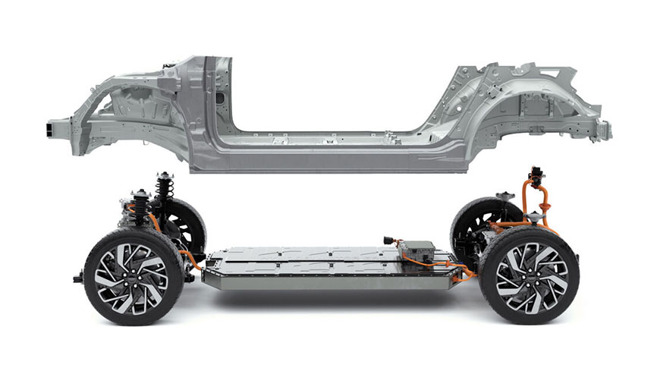

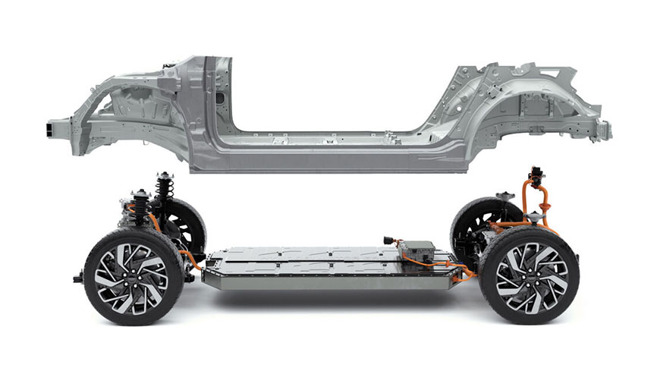

'Apple Car' is rumored to be built on Hyundai's E-GMP platform.

Citing sources familiar with Apple's plans, CNBC reports the first iteration of "Apple Car" will be be a good candidate for driverless food delivery businesses and companies operating robotaxis.

"The first Apple Cars will not be designed to have a driver," a source said. "These will be autonomous, electric vehicles designed to operate without a driver and focused on the last mile."

The suggestion upends current thinking about the much rumored car project. Industry watchers and pundits expect "Apple Car" to be a consumer product along the lines of Tesla's popular electric autos; a bold expansion into a completely new field. If CNBC's source is correct, Apple might first find its footing in enterprise before transitioning to personal mobility.

There is evidence that backs up the publication's claims. In 2019, Apple purchased self-driving shuttle and car kit startup Drive.ai, acquiring dozens of employees, cars and other assets to add to the ranks of its Project Titan autonomous vehicle development team. Prior to that, a report in 2018 said Apple signed a deal with Volkswagen to convert a number of T6 Transporter vans into autonomous shuttles for its Palo Alto to Infinite Loop (PAIL) pilot program.

Today's report echoes recent rumblings about a tie-up with Hyundai and Kia, saying Apple is close to reaching a manufacturing deal that will see branded electric vehicles assembled at Kia's U.S. facilities. Production is tentatively slated for 2024, though the timeline might be pushed back, according to sources. Apple might also tap other automakers to assist in the project separately or in cooperation with Hyundai.

Earlier in the day, South Korean news outlet Dong-A said Apple and Kia plan to sign a deal on Feb. 27 that will see the tech giant invest 4 trillion won to secure access to the automaker's U.S. plant in Georgia. That report also cited a 2024 start date and claimed initial capacity would be set at 100,000 cars per year with the potential to accelerate output to a maximum of 400,000 units a year.

On Tuesday, Apple analyst Ming-Chi Kuo predicted the so-called "Apple Car" will be built on Hyundai's E-GMP electric vehicle platform, with Hyundai Mobis offering assistance with component design and production. Kuo, like others, believes Kia's U.S. arm will handle production, with Apple in charge of self-driving hardware and software, semiconductors, battery technologies, form factor and user experience.

'Apple Car' is rumored to be built on Hyundai's E-GMP platform.

Citing sources familiar with Apple's plans, CNBC reports the first iteration of "Apple Car" will be be a good candidate for driverless food delivery businesses and companies operating robotaxis.

"The first Apple Cars will not be designed to have a driver," a source said. "These will be autonomous, electric vehicles designed to operate without a driver and focused on the last mile."

The suggestion upends current thinking about the much rumored car project. Industry watchers and pundits expect "Apple Car" to be a consumer product along the lines of Tesla's popular electric autos; a bold expansion into a completely new field. If CNBC's source is correct, Apple might first find its footing in enterprise before transitioning to personal mobility.

There is evidence that backs up the publication's claims. In 2019, Apple purchased self-driving shuttle and car kit startup Drive.ai, acquiring dozens of employees, cars and other assets to add to the ranks of its Project Titan autonomous vehicle development team. Prior to that, a report in 2018 said Apple signed a deal with Volkswagen to convert a number of T6 Transporter vans into autonomous shuttles for its Palo Alto to Infinite Loop (PAIL) pilot program.

Today's report echoes recent rumblings about a tie-up with Hyundai and Kia, saying Apple is close to reaching a manufacturing deal that will see branded electric vehicles assembled at Kia's U.S. facilities. Production is tentatively slated for 2024, though the timeline might be pushed back, according to sources. Apple might also tap other automakers to assist in the project separately or in cooperation with Hyundai.

Earlier in the day, South Korean news outlet Dong-A said Apple and Kia plan to sign a deal on Feb. 27 that will see the tech giant invest 4 trillion won to secure access to the automaker's U.S. plant in Georgia. That report also cited a 2024 start date and claimed initial capacity would be set at 100,000 cars per year with the potential to accelerate output to a maximum of 400,000 units a year.

On Tuesday, Apple analyst Ming-Chi Kuo predicted the so-called "Apple Car" will be built on Hyundai's E-GMP electric vehicle platform, with Hyundai Mobis offering assistance with component design and production. Kuo, like others, believes Kia's U.S. arm will handle production, with Apple in charge of self-driving hardware and software, semiconductors, battery technologies, form factor and user experience.

Comments

Check this out:

https://www.patentlyapple.com/patently-apple/2021/02/apple-wins-a-second-project-titan-patent-today-covering-a-next-gen-active-suspension-system.html

Though what doesn't make complete sense is their business model. They are going to produce 100,000 of these enterprise vehicles (and eventually 400,000/year as per the previous report). I doubt if the demand for enterprise is so high? The numbers don't make sense unless they want to enter the commercial taxi market with these vehicles. And even then, they might be at a disadvantage (as compared to Tesla Robotaxis), because unlike Tesla, they will be owning all these vehicles, which will make this business very capital intensive for them.

When your Apple Car arrives, it will already be setup for you the way you like it. You can continue watching your TV show or movie. Your favorite music will play or your workspace will appear if you need to send some messages or check your calendar.

Part one of my thinking about what Apple might be planning in terms of a self-driving electric vehicle is to to first evaluate the current state of the art in this realm. And that's Tesla.

There are several issues that exist in the current electric vehicles market.

1. Range anxiety. Imagine buying an $85,000 Tesla and being constantly worried about running out of juice before you can get home or to a charging station. Tesla has mitigated this issue to a large extent for the driver while the driver is actually driving the car, by using GPS and an estimate of remaining range to alert the driver before he gets near the point where he might be out of range. However, this still presents the potential that a driver will need to abandon his current destination for an out-of-the-way side trip to an available charging station. It'll take a lot more super charging stations to fully mitigate this issue. By comparison, there are very few occasions and locations where a person driving a gas-powered vehicle needs to worry about the availability of a gas station. Only the foolhardy driver who pushes the limits of their fuel range, as I've done on trips up and down the east coast in an effort to reduce stops, need worry about availability of fuel before the tank runs dry.

2. Charge time. When charging an electric vehicle at home, overnight, there's no concern that it might take hours to top up your vehicle's batteries. But this becomes a constant nuisance when away from home. Take a multi-day road trip with the kids in that Tesla and you're going to find yourself actively thinking about and managing your battery level. If you stop at a hotel, will there be parking spaces where you can plug in overnight? If you're commuting to attractions in an unfamiliar city, are you going to have to tell the kids to be patient while you drive out of your way to a charging station, and then tell the kids to entertain themselves in the waiting room for 20 - 30 minutes to get a charge on your battery? Not going to fly, I'm afraid.

3. Home charging infrastructure. Call your electrician... What about renters, condo owners, what about moving (now there's another significant task to add to the list if you want fast charging in your new home, plus you may need to give consideration to availability of charging stations around the area of your new home if you are moving to a new geographic area).

4. Implications of car sharing (within family). Will your teen be sure to plug back in or otherwise leave you sufficient charge after borrowing the family EV? No, it's not so likely you'll be lending them a model S, but I'm speaking of the day when there's a $30k EV in the family stable.

5. Cost of battery replacement, lack of service outlets and expertise. When that $85,000 Tesla's batteries start to age and not hold as much charge, the above two issues are going to become more pronounced. And it's going to be very expensive to replace a battery back that is essentially the equivalent of thousands of cellphone battery cells. Maybe $10k, maybe more. And if your electric vehicle needs service, you're going to have to wait for a Tesla rep to come to you, or tow it to him. There's not yet the buildout of service centers associated with gas-powered cars. (Edit: this issue is not so much a concern since I wrote this essay a few years ago.)

All of these issues are certainly on the minds of the executives at large auto makers. They will want to see substantially more infrastructure in place before migrating any meaningful portion of their businesses to EV. Remember Iriidum and the other satellite telecoms of a decade ago, whose plan was to spend billions to launch constellations of satellites under the 'if you build it they will come' business model? What happened to them is a lesson in this market. Supply does not create demand, but once demand exists, believe it, the automakers will be there taking their share. (It's the reason Apple is always seen to be late to new markets; Apple management knows that the time to jump in is when demand and infrastructure are already some ways along to allow a rapid entry into a big market. This is too poorly understood by too many.)

Each of these issues will diminish over time, but for now, the sweet spot for electrics is the short known commute for which the vehicle's range takes you there and back with battery charge to spare. And where you can get local service.

And that brings me to what I think would be an ideal market for Apple to step into. If Apple were interested in an electric vehicle...

Fleet vehicles drive at lower speeds, thus extending range and increasing efficiency through lower air resistance, which is exponential with respect to speed. Fleet vehicles can be task optimized, gaining additional efficiencies versus general purpose commuter vehicles.

Autonomous general purpose commuting vehicles (GPCV) will cost more, but there is a limit to how much more you can charge an individual for this capability. For an individual purchasing a GPCV the autonomous capability is a convenience. But for a fleet operator, it's a cost saver. In most cases, the vehicle will still have a driver, but the fleet operator can save on insurance costs by carefully controlling the way the vehicle is driven, which you can't do with a human driver. So a mail carrier will be aboard to perform the task of offloading the mail to each address, but will not be in charge of piloting the vehicle: a tired mail carrier is no more a risk than an alert one, because the vehicle, which knows the route and all applicable traffic safety laws that apply along that route, will strictly remain within speed limits and other restrictions.

In some cases, the vehicle, like a city transit minivan that carries passengers along a specified route, might not need a driver at all, saving both insurance costs and the cost of employment and benefits. It makes sense to sell autonomous vehicles into markets where the self-driving capabilities create the most value, and therefore can support a higher price. And that’s delivery fleets, point-to-point shuttle and ultimately bus services, and other fleets that drive well-known and mapped routes on a recurring basis. Apple’s first foray into electric vehicles may be autonomous, but it might not be an Uber-replacing robotaxi service. They may go for more well-defined autonomous vehicle applications; delivery fleets and point-to-point shuttles.