TSMC says efforts to rebuild US semiconductor industry are doomed to fail

Apple supplier TSMC believes that US efforts to rebuild chip manufacturing at home are doomed to fail, as it finds itself caught between China and the United States in a tech cold war.

TSMC

Morris Chang founded TSMC in 1987 when Taiwan recruited him from the US to help build an electronics industry. The contract manufacturer rose to become the top chipmaker in the world, commanding 20% of global wafer fabrication and 92% of advanced chip capacity.

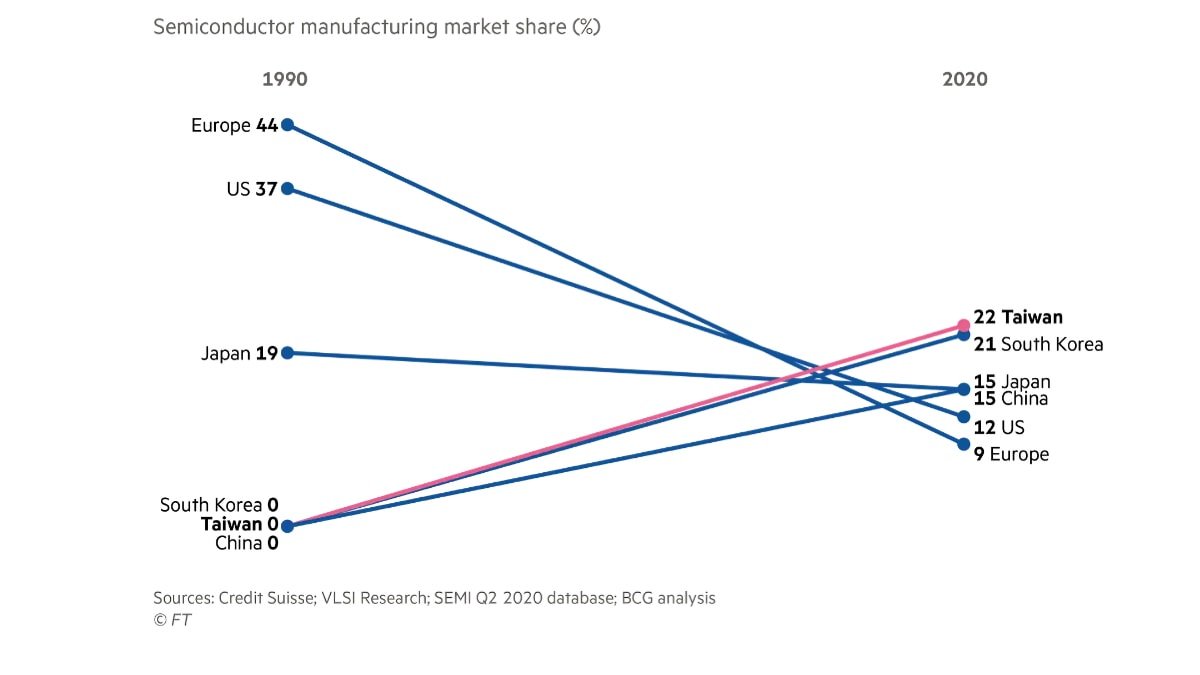

US share in global chip manufacturing shrunk from 37% in 1990 to 12% in 2020, but the country wants to regain its dominance. In particular, US Department of Defense is worried that the country's dependence on Taiwan could put chip supplies for the defense industry at risk.

In response, President Biden signed the CHIPS Act into law on August 9, 2022. It provides over $52 billion to help US companies build new semiconductor facilities, fund research, and expand existing manufacturing.

Taiwan isn't happy about the move because it sees its semiconductor dominance as a "silicon shield." The government believes that if China were to attack the country, the US would come to its aid to prevent China from seizing the industry.

Market share for countries in semiconductor manufacturing

When US House Speaker Nancy Pelosi visited Taiwan in August, she met with Morris Chang and Mark Liu, chair of TSMC. Chang told Pelosi that Washington's efforts to rebuild its chip manufacturing were doomed to fail, according to Taiwan's Financial Times.

But the United States may not have much choice. Analysts at investment bank Credit Suisse have estimated that if the world loses access to Taiwan's chip plants, it will disrupt the production for everything from computers to cars.

Apple would be impacted too, as it relies heavily on TSMC for chip production. While it has expanded some of its manufacturing to other countries such as Vietnam and India, those moves do not diversify Apple's chip supply at all.

Still, TSMC remains a major supplier for Apple and other companies, and its future between the US and China is uncertain.

"The monopoly in semiconductor production creates instability," said Brad Martin, director of the National Security Supply Chain Institute at the Rand Corporation. "If the US is faced with a need to make a decision between protecting its economy and defending Taiwan, that starts to become a very stark decision."

TSMC has made some efforts to help the US by planning a semiconductor facility in Arizona, the first such chip facility it will develop outside of its home country. TSMC expects it will reach its production start in early 2024.

Read on AppleInsider

TSMC

Morris Chang founded TSMC in 1987 when Taiwan recruited him from the US to help build an electronics industry. The contract manufacturer rose to become the top chipmaker in the world, commanding 20% of global wafer fabrication and 92% of advanced chip capacity.

US share in global chip manufacturing shrunk from 37% in 1990 to 12% in 2020, but the country wants to regain its dominance. In particular, US Department of Defense is worried that the country's dependence on Taiwan could put chip supplies for the defense industry at risk.

In response, President Biden signed the CHIPS Act into law on August 9, 2022. It provides over $52 billion to help US companies build new semiconductor facilities, fund research, and expand existing manufacturing.

Taiwan isn't happy about the move because it sees its semiconductor dominance as a "silicon shield." The government believes that if China were to attack the country, the US would come to its aid to prevent China from seizing the industry.

Market share for countries in semiconductor manufacturing

When US House Speaker Nancy Pelosi visited Taiwan in August, she met with Morris Chang and Mark Liu, chair of TSMC. Chang told Pelosi that Washington's efforts to rebuild its chip manufacturing were doomed to fail, according to Taiwan's Financial Times.

But the United States may not have much choice. Analysts at investment bank Credit Suisse have estimated that if the world loses access to Taiwan's chip plants, it will disrupt the production for everything from computers to cars.

Apple would be impacted too, as it relies heavily on TSMC for chip production. While it has expanded some of its manufacturing to other countries such as Vietnam and India, those moves do not diversify Apple's chip supply at all.

Still, TSMC remains a major supplier for Apple and other companies, and its future between the US and China is uncertain.

"The monopoly in semiconductor production creates instability," said Brad Martin, director of the National Security Supply Chain Institute at the Rand Corporation. "If the US is faced with a need to make a decision between protecting its economy and defending Taiwan, that starts to become a very stark decision."

TSMC has made some efforts to help the US by planning a semiconductor facility in Arizona, the first such chip facility it will develop outside of its home country. TSMC expects it will reach its production start in early 2024.

Read on AppleInsider

Comments

Except if China attacks Taiwan, win or lose the Taiwanese semiconductor industry would be obliterated. That’s the reality that the CHIPS Act is addressing.

https://www.linkedin.com/pulse/europe-didnt-have-44-global-chip-production-capacity-90s-kleinhans

TSMC has its own self interest to consider, but semiconductors are strategic national assets. If the outcome is more expensive electronics versus the potential of have none or an economy grinding to a halt if something happens to Taiwan, it's pretty obvious what course of action should be taken. The IRA and the CHIPS act should have 5x to 10x the money. Batteries, solar panels, semiconductors, recycling, electrification, energy efficiency, energy storage, environment preservation and restoration, who knows what else. It's a race now. Not against any one country, but really against ourselves.

I'll add that the story is really interesting and it involves both Samsung and Nintendo.

This is often misunderstood. Yes labor costs in the US are generally much higher than China and Taiwan, but those rate differentials do not impact the tech chip manufacturing industry much. Top chip plants along with their equipment are priceless and require high quality workers who demand top dollar. They are the type of workers that are sought after by top US companies and they'll gladly bend over backwards to recruit them. They're not stuffing teddy bears or stitching leather.

It’s not enough for TSM to built a final fabrication facility in the USA, they need to build “the entire supply chain in the USA.”

The CCP is acting belligerent. They could decide to be a “team player”, but no! They are the greatest benefactor of US led Bretton Woods and for what? To bite the US hand that they’ve been feeding from?

Fuck the CCP! Long live the Chinese people. The future looks bleak for them!

30 years ago, chip fab was cheap enough for smaller companies to have their fabs. A lot of people say Moore's Law this and Moore's Law that, where chip transistor densities double every 18 to 24 months due to economics of computing life cycles, but what's never said is that Moore also said the cost of designing and building a chip fab doubles every 18 to 24 months too. The cost to build a TSMC N3 fab is 2x the cost to build a TSMC N5 fab. A TSMC N3 fab is somewhere around a 20b USD.

As long as this cost of building advanced chip fabs is exponential like this, it sets up a Highlander situation where there can only be one. Only 2 or 3 companies will have enough money to get to 3nm. Maybe 1 or 2 companies for 2nm. To fund the next fab, it means you need to capture more and more of the market or create more markets to sell chips into in order to fund the next round. TSMC winning the smartphone chip vendor war, with Apple winning the revenue and profit game funding them, meant they could outspend Intel in getting to the next fab node.

What happens at 2nm, or 1.5nm or 1.2nm? Fabs at that level will probably cost 50b to 100b. Only huge nation-state economies will be afford it. So, the CHIPS act is a kind of a precursor to what will eventually happen. What the company is a US company or a foreign company really doesn't matter too much. It's really having a closed cycle capability locally that's free of global economic "headwinds" as it were.

They're clearly different, and the link will tell you why. Stop wasting my time.