Refurbished, high-end iPhones are suffocating the growth of cheap new Androids

The fastest growing segment in global smartphones isn't Google's vision for super-cheap, simple Android phones. Instead, according to new market data, it's refurbished high-quality phones that carry a desirable brand but can be sold at a more affordable price, a segment where Apple is "leading by a significant margin."

A report by Counterpoint Research noted that "the global market for refurbished smartphones grew 13 percent year over year in 2017, reaching close to 140 million units," and contrasted this against the larger market for new smartphones, which grew by barely 3 percent during the year, or just 33.8 million units.

Apple's unit sales of new iPhones last year were flat; in the December quarter, the number sold actually slipped slightly (-1 percent), although much less than the 5 percent drop suffered by the industry at large. However, despite shipping fewer boxes, Apple actually earned 13 percent higher revenues by selling more higher-tier products, including "super premium" iPhone 8 and iPhone X models priced starting at $699 and $999, respectively.

Among Android licensees, the retracting volume of unit sales was financially disastrous because most manufacturers were already making very little to nothing selling low-end and middle-tier phones. As sales become harder to sustain, competition among poorly-differentiated, commodity Androids gets increasingly cutthroat.

This has already forced over one hundred discount phone makers out of business in China, after pushing many PC makers such as HP out of the handset business. Analysts expect a further Battle Royale to occur among commodity Android smartphone makers this year.

While cheap commodity phone makers fight over scraps, the strength of Apple's premium devices is allowing them to return to the market to compete again in a second wave, following a trend that occurred among luxury carmakers selling their certified pre-owned vehicles directly in competition with new, entry-level economy cars.

However, those refurbished models are having a big impact on the market. Counterpoint Research Director Tom Kang stated, "with 13 percent growth, refurbished smartphones are now close to 10 percent of the total global smartphone market."

The extended lifespan and resale cycle of existing iPhones is commonly cited as a potential threat to Apple's future sales growth. However, Kang pointed out that "the low growth of the new smartphone market in 2017 can be partially attributed to the growth of the refurb market. The slowdown in innovation has made two-year-old flagship smartphones comparable in design and features with the most recent mid-range phones.

"Therefore, the mid low-end market for new smartphones is being cannibalized by refurbished high-end phones, mostly Apple iPhones and, to a lesser extent, Samsung Galaxy smartphones."

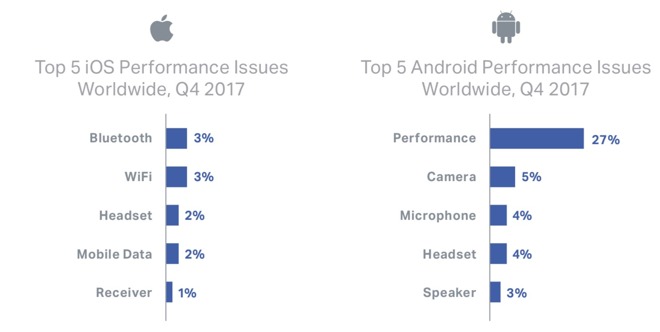

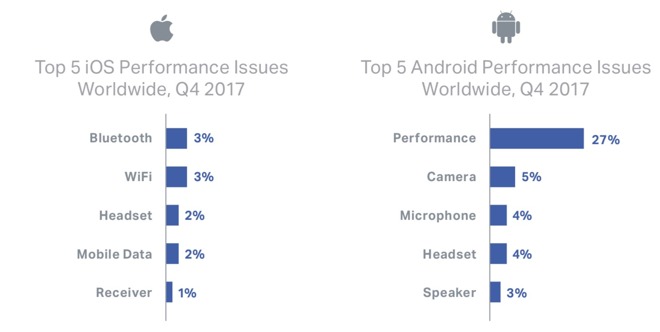

One factor that gives Apple an advantage in selling refurbished iPhones to users who might not be able to afford a brand new one, and would otherwise likely buy a lower-priced Android, is the fact that it supports its hardware with iOS updates for four or five years, rather than less than a year or two as is common among Android makers--even including Google itself.

New iPhones also ship with fast processors and a modern, efficient iOS. Androids, particularly low-priced models, are sold with underperforming chips and often ship with old versions of an OS that is already bad at managing memory and CPU tasks.

Android's resale potential is hurt by its poor performance even when brand new

By revenue, "the dominance grows further, as the two smartphone giants control more than 80 percent of the revenue in the refurbished smartphone market."

The firm's Research Director Peter Richardson stated, "it's a surprise to many that the fastest growing smartphone market in 2017 was not India or any other emerging market, but the refurb market. With refurb smartphones in play we think the market for new devices will slow further in 2018."

Richardson added, "regions seeing the highest volume include the US and Europe, while the fastest growing markets for refurbs include Africa, SE Asia and India. All have been seeing initiatives from the major operators (e.g. Verizon, Vodafone etc.), OEMs (e.g. Apple) and major distributors (e.g. Brightstar) who are adding full life-cycle services.

"The industry uses data analysis to predict future resale values of devices, which means consumers can be given a guaranteed buy-back value at various points during their ownership. This helps consumers to manage the high cost of the latest flagship smartphones - or at least to obtain a useful contribution to partially offset the cost of their next phone."

Read on AppleInsider

A report by Counterpoint Research noted that "the global market for refurbished smartphones grew 13 percent year over year in 2017, reaching close to 140 million units," and contrasted this against the larger market for new smartphones, which grew by barely 3 percent during the year, or just 33.8 million units.

Apple's unit sales of new iPhones last year were flat; in the December quarter, the number sold actually slipped slightly (-1 percent), although much less than the 5 percent drop suffered by the industry at large. However, despite shipping fewer boxes, Apple actually earned 13 percent higher revenues by selling more higher-tier products, including "super premium" iPhone 8 and iPhone X models priced starting at $699 and $999, respectively.

Among Android licensees, the retracting volume of unit sales was financially disastrous because most manufacturers were already making very little to nothing selling low-end and middle-tier phones. As sales become harder to sustain, competition among poorly-differentiated, commodity Androids gets increasingly cutthroat.

This has already forced over one hundred discount phone makers out of business in China, after pushing many PC makers such as HP out of the handset business. Analysts expect a further Battle Royale to occur among commodity Android smartphone makers this year.

While cheap commodity phone makers fight over scraps, the strength of Apple's premium devices is allowing them to return to the market to compete again in a second wave, following a trend that occurred among luxury carmakers selling their certified pre-owned vehicles directly in competition with new, entry-level economy cars.

"The Surprising Growth of Used Smartphones"

Counterpoint's report on the refurbished phone business highlighted that "only 25 percent of all pre-owned phones are sold back into the market," and added that "of these, only some are refurbished.""The mid low-end market for new smartphones is being cannibalized by refurbished high-end phones, mostly Apple iPhones"

However, those refurbished models are having a big impact on the market. Counterpoint Research Director Tom Kang stated, "with 13 percent growth, refurbished smartphones are now close to 10 percent of the total global smartphone market."

The extended lifespan and resale cycle of existing iPhones is commonly cited as a potential threat to Apple's future sales growth. However, Kang pointed out that "the low growth of the new smartphone market in 2017 can be partially attributed to the growth of the refurb market. The slowdown in innovation has made two-year-old flagship smartphones comparable in design and features with the most recent mid-range phones.

"Therefore, the mid low-end market for new smartphones is being cannibalized by refurbished high-end phones, mostly Apple iPhones and, to a lesser extent, Samsung Galaxy smartphones."

One factor that gives Apple an advantage in selling refurbished iPhones to users who might not be able to afford a brand new one, and would otherwise likely buy a lower-priced Android, is the fact that it supports its hardware with iOS updates for four or five years, rather than less than a year or two as is common among Android makers--even including Google itself.

New iPhones also ship with fast processors and a modern, efficient iOS. Androids, particularly low-priced models, are sold with underperforming chips and often ship with old versions of an OS that is already bad at managing memory and CPU tasks.

Android's resale potential is hurt by its poor performance even when brand new

Faster segment growth than India, and "Apple leads by a significant margin"

Counterpoint stated that Apple and Samsung's dominance "is more obvious in the refurb market than in the new smartphone market," noting that the two companies account for "close to three-fourths of the refurbished smartphone market [by unit volume], with Apple leading by a significant margin.""It's a surprise to many that the fastest growing smartphone market in 2017 was not India or any other emerging market, but the refurb market"

By revenue, "the dominance grows further, as the two smartphone giants control more than 80 percent of the revenue in the refurbished smartphone market."

The firm's Research Director Peter Richardson stated, "it's a surprise to many that the fastest growing smartphone market in 2017 was not India or any other emerging market, but the refurb market. With refurb smartphones in play we think the market for new devices will slow further in 2018."

Richardson added, "regions seeing the highest volume include the US and Europe, while the fastest growing markets for refurbs include Africa, SE Asia and India. All have been seeing initiatives from the major operators (e.g. Verizon, Vodafone etc.), OEMs (e.g. Apple) and major distributors (e.g. Brightstar) who are adding full life-cycle services.

"The industry uses data analysis to predict future resale values of devices, which means consumers can be given a guaranteed buy-back value at various points during their ownership. This helps consumers to manage the high cost of the latest flagship smartphones - or at least to obtain a useful contribution to partially offset the cost of their next phone."

Read on AppleInsider

Comments

-MAS

Edit* - it's actually just £124 with cashback offer and a refurbished iPhone SE 16gb (with 12month warranty again) is just £94 on the same offer. madness

Bottom line, not suprised by this news.😉

Apple may disappoint analysts with very slightly less sales volume year-on-year (negligible, IMO), but the pool of perfectly usable second-hand iPhones in-use must be growing substantially, posing a big threat to new Android sales. This article is spot-on.

2017 total smartphone unit sales: 1550 million

2017 total refurbished smartphone unit sales: 140 million

Am I reading the numbers right?

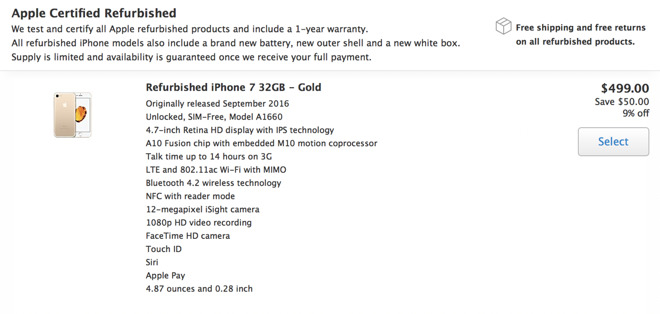

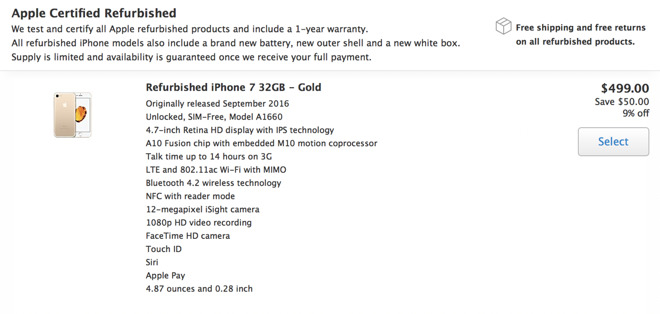

And, $50 savings on an iPhone refurb? I'll take NEW for that extra $50, thank you. Who would buy a refurb just to save $50?

My wife and I upgrade every year or two and always give away our iPhones. We used to give them away to family, however all of them now either have a functioning iPhone from us or are now upgrading to newer iPhones on their own accord. The vast majority of these iPhones replaced their junk Android phone they first got sold on from their carrier. Now we have run out of family so we have started giving them away to close friends. Not sure what to do when we runout of friends. Once these out live their use as smartphones (too old or battery no longer holds a charge) they almost always end up repurposed in a dock as a music player or other such scenario where they are always plugged in. This represents a lot of people being indoctrinated into the Apple ecosystem even if this would not have been their choice due to: cost concerns, ignorance of the experience differential, believing technology to be too difficult to use. I think once the smartphone market stops growing Apples going to be just fine, Android not so much.

Apple's iPhone user base appears to have gained a growth spurt that will lead to sustained sales in this mature market. Yet more revenue and profit share for you, Apple!

I still have an iPhone 4 .It is from 2010.

it still feels faster than a lot of cheap Android phones from today.Good products remain good. Even $700 Galaxys slow down terribly after 2-3 years.The actual culprit is Android.

iPhone 7: $332

iPhone 6S: $179

iPhone 5S: $81

All of these will run better, work better, and be supported longer than a $300 Android.

Daniel is spot on.

I got my iPhone 2G in 2009 this way.I was in love. All Androids ,including high end ones felt like trash from then. Then I got the 3G in 2011. The build quality felt worse. Then I got the 4 ,in 2014 .Then was the 6 Plus in 2016. Then finally in December 2017 , I finally got a new 32GB iPhone SE.Then I got the AirPods. I have been really satisfied over the years.

Same goes for Smartphones...

Oh and most Kia/Chevy drivers don't read high end automotive magazines/blogs just as MOST smartphone owners never read a tech blog.

It would be interesting to read the responses if DED wrote this for an Android blog or a General tech blog versus an Apple blog!