Apple's cheaper iPhones are not the volume sellers pundits predicted: iPhone 8, X are

It's not news that Apple is grabbing all the profits in the smartphone industry. But new data shows that Apple's most expensive new iPhone flagships are accomplishing this largely on their own, indicating that analyst chatter about smartphone users really wanting cheaper devices is totally delusional.

A press release presenting model sales data from Counterpoint Research for May depicted Apple as being in a virtual tie with Samsung, supposedly wining back the top smartphone model crown after iPhone X had fallen behind Galaxy S9 Plus unit shipments in April. However, the firm's numbers actually present a very different picture.

Samsung has two flagship models that made it into the top ten (S9 and S9 Plus), but Apple has three (iPhone 8, X and 8 Plus). The other spots are taken by Xiaomi, Huawei and Vivo/OPPO (two brands within China's BKK).

So in reality, Apple's top flagships represented just over a 36 percent share of the world's top ten handsets by units, while Samsung's top models represented nearly 24 percent. It's actually not a close race in the high-end segment at all.

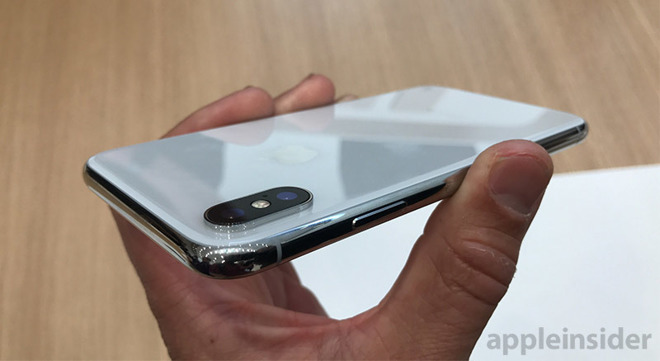

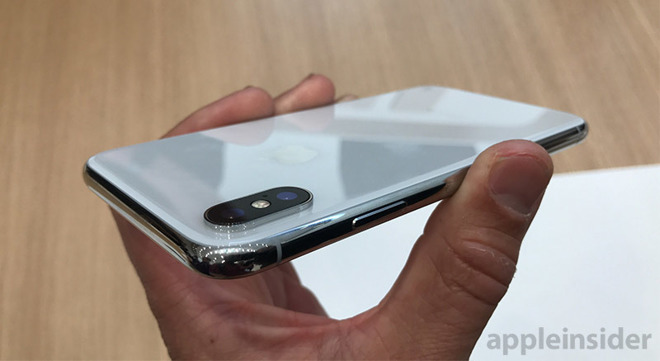

iPhone 8, X crushed global sales of much cheaper knockoffs. Source: Counterpoint Market Pulse

It's much more dramatic to single out a "winning" model number on a monthly basis, but the truth is that Apple is simply selling significantly more high-end units than Samsung, despite the latter's large volumes of other phones. That explains why Apple is earning so much more money that Samsung-- flagships are far more profitable than the middle-tier and lower-end volume sellers.

Also important in understanding market demand: these top ten models globally make up 18.8 percent of all smartphone shipments. This means Apple's most expensive three models made up 36.2 percent of top flagship sales worldwide even though the majority of the rest of these top selling flagship models were much cheaper.

Xiaomi's Redme 5A is priced at about $420; Huawei P20 Lite is $395; Vivo X21 is $520; and OPPO A83 is about $150. Counterpoint also noted, specific to the A83, that sales volumes were driven by "copious promotion and price cuts." Yet Apple overwhelmingly outgunned all their sales in unit volumes despite the much higher prices of its premium iPhone 8, 8 Plus and X models. It's pretty clear statistically that price is not the primary factor driving sales among the most popular models worldwide-- at least for Apple.

Outside of these top ten models, price is most certainly a competitive factor in sales among the models that make up the majority of the smartphone market (the nearly 82 percent of other models, by units). That's not controversial and is well known, due to the fact that the Average Selling Price of Androids is now below $200. This is resulting in low-price, volume sellers of phones to struggle in sustainable profitability. Scores of Chinese makers have simply gone out of business, even as Apple's premium models have maintained sales volumes and even edged higher.

It's useful to note that none of these models even made it into the top ten global units by volume. That means each of these older iPhones were outsold in sales volumes by the OPPO A83, which rounded out the top ten with a 1.2 percent share of global smartphone sales.

Even if iPhone 7 fell just outside of these top ten models at around 1 percent of global sales, it would still have to be a small minority of Apple's total sales. So much for the media narrative that customers were not buying iPhone X because of sticker shock and were increasingly buying cheaper iPhone models instead.

That story has been incessantly repeated by analysts and even newspapers including Japan's shamelessly false Nikkei, the Wall Street Journal, and Bloomberg. Their reports have continued to offhandedly claim as fact that buyers are actively shunning the premium priced iPhone X due to its price (and supposedly a "lack of compelling new features"), despite offering no proof that this is actually happening.

Counterpoint's data is quite clear-- there is no possible way this could be true.

Historical data is also very clear on this: despite achieving huge volumes to total iPhone sales (that at launch eclipsed even Samsung's global sales volumes in the December quarter) the majority of Apple's customers have always opted to buy the newest model year, regardless of discounts of $100, $200 or even more on previous generations of iPhone.

Remember too that nobody expected iPhone X to be Apple's volume sales leader. Apple itself positioned it as being a high-end "concept phone" showing its intent for the future, albeit one that users could opt to pay a premium to buy right now and experience the company's vision for the state of the art, which included facial tracking of poo Animoji.

Incredibly, even as sales data began indicating that iPhone X was wildly popular, journalists kept repeating the idea that iPhone X specifically was priced too high for even Apple's customers, and that a pitchfork revolution was underway and that Apple was scrambling to slash production.

Even immediately after Apple reported that iPhone X had in fact ended up being the most popular iPhone in weekly sales every week after its launch across quarter after quarter, reports continued to erect a pure fiction supported by nothing more than conjecture and rumors of supply chain cuts that boldly predicted an outcome that never actually occurred.

Even more ridiculously, these reports claimed that Apple had internally plotted to build incredible billions of dollars worth of iPhone X models that it supposedly realized it could not sell only months after launching, resulting in a "slashing" of production orders and desperate efforts to liquidate. If this had been true, Apple would have to have pulled the plug on 40 million units with an average retail price above $1,000--literally $40 billion of business that Apple penciled out in January, without causing a total collapse in Asia's supply chain. This complete and utter bullshit was repeated by every last corner of the tech media, without even any hint of suspicion or fact checking.

To date, the Nikkei, Wall Street Journal, and Bloomberg have still never acknowledged that their reporting was grossly in error nor even really changed their tune about the pricing or demand for iPhone X. They have all only offered the meekest of acknowledgments that iPhone X defied their predictions without ever admitting that their claims about what was happening at retail or within Apple's supply chain had been proven to be completely wrong and impossibly false.

A press release presenting model sales data from Counterpoint Research for May depicted Apple as being in a virtual tie with Samsung, supposedly wining back the top smartphone model crown after iPhone X had fallen behind Galaxy S9 Plus unit shipments in April. However, the firm's numbers actually present a very different picture.

Samsung has two flagship models that made it into the top ten (S9 and S9 Plus), but Apple has three (iPhone 8, X and 8 Plus). The other spots are taken by Xiaomi, Huawei and Vivo/OPPO (two brands within China's BKK).

So in reality, Apple's top flagships represented just over a 36 percent share of the world's top ten handsets by units, while Samsung's top models represented nearly 24 percent. It's actually not a close race in the high-end segment at all.

iPhone 8, X crushed global sales of much cheaper knockoffs. Source: Counterpoint Market Pulse

It's much more dramatic to single out a "winning" model number on a monthly basis, but the truth is that Apple is simply selling significantly more high-end units than Samsung, despite the latter's large volumes of other phones. That explains why Apple is earning so much more money that Samsung-- flagships are far more profitable than the middle-tier and lower-end volume sellers.

Also important in understanding market demand: these top ten models globally make up 18.8 percent of all smartphone shipments. This means Apple's most expensive three models made up 36.2 percent of top flagship sales worldwide even though the majority of the rest of these top selling flagship models were much cheaper.

Xiaomi's Redme 5A is priced at about $420; Huawei P20 Lite is $395; Vivo X21 is $520; and OPPO A83 is about $150. Counterpoint also noted, specific to the A83, that sales volumes were driven by "copious promotion and price cuts." Yet Apple overwhelmingly outgunned all their sales in unit volumes despite the much higher prices of its premium iPhone 8, 8 Plus and X models. It's pretty clear statistically that price is not the primary factor driving sales among the most popular models worldwide-- at least for Apple.

Outside of these top ten models, price is most certainly a competitive factor in sales among the models that make up the majority of the smartphone market (the nearly 82 percent of other models, by units). That's not controversial and is well known, due to the fact that the Average Selling Price of Androids is now below $200. This is resulting in low-price, volume sellers of phones to struggle in sustainable profitability. Scores of Chinese makers have simply gone out of business, even as Apple's premium models have maintained sales volumes and even edged higher.

Apple's cheaper iPhones are not top sellers!

Conversely, Apple also has lower priced iPhone models: the 7, 7 Plus, 6s, 6s Plus, and the cheapest model it has ever offered: iPhone SE, starting at $349 (or about $260US in India).It's useful to note that none of these models even made it into the top ten global units by volume. That means each of these older iPhones were outsold in sales volumes by the OPPO A83, which rounded out the top ten with a 1.2 percent share of global smartphone sales.

Even if iPhone 7 fell just outside of these top ten models at around 1 percent of global sales, it would still have to be a small minority of Apple's total sales. So much for the media narrative that customers were not buying iPhone X because of sticker shock and were increasingly buying cheaper iPhone models instead.

That story has been incessantly repeated by analysts and even newspapers including Japan's shamelessly false Nikkei, the Wall Street Journal, and Bloomberg. Their reports have continued to offhandedly claim as fact that buyers are actively shunning the premium priced iPhone X due to its price (and supposedly a "lack of compelling new features"), despite offering no proof that this is actually happening.

Counterpoint's data is quite clear-- there is no possible way this could be true.

Historical data is also very clear on this: despite achieving huge volumes to total iPhone sales (that at launch eclipsed even Samsung's global sales volumes in the December quarter) the majority of Apple's customers have always opted to buy the newest model year, regardless of discounts of $100, $200 or even more on previous generations of iPhone.

Remember too that nobody expected iPhone X to be Apple's volume sales leader. Apple itself positioned it as being a high-end "concept phone" showing its intent for the future, albeit one that users could opt to pay a premium to buy right now and experience the company's vision for the state of the art, which included facial tracking of poo Animoji.

Incredibly, even as sales data began indicating that iPhone X was wildly popular, journalists kept repeating the idea that iPhone X specifically was priced too high for even Apple's customers, and that a pitchfork revolution was underway and that Apple was scrambling to slash production

Incredibly, even as sales data began indicating that iPhone X was wildly popular, journalists kept repeating the idea that iPhone X specifically was priced too high for even Apple's customers, and that a pitchfork revolution was underway and that Apple was scrambling to slash production.

Even immediately after Apple reported that iPhone X had in fact ended up being the most popular iPhone in weekly sales every week after its launch across quarter after quarter, reports continued to erect a pure fiction supported by nothing more than conjecture and rumors of supply chain cuts that boldly predicted an outcome that never actually occurred.

Even more ridiculously, these reports claimed that Apple had internally plotted to build incredible billions of dollars worth of iPhone X models that it supposedly realized it could not sell only months after launching, resulting in a "slashing" of production orders and desperate efforts to liquidate. If this had been true, Apple would have to have pulled the plug on 40 million units with an average retail price above $1,000--literally $40 billion of business that Apple penciled out in January, without causing a total collapse in Asia's supply chain. This complete and utter bullshit was repeated by every last corner of the tech media, without even any hint of suspicion or fact checking.

To date, the Nikkei, Wall Street Journal, and Bloomberg have still never acknowledged that their reporting was grossly in error nor even really changed their tune about the pricing or demand for iPhone X. They have all only offered the meekest of acknowledgments that iPhone X defied their predictions without ever admitting that their claims about what was happening at retail or within Apple's supply chain had been proven to be completely wrong and impossibly false.

Comments

Apple set up a range of prices and the most popular weren't oriented to price, they were targeted at new styling and features. Surely you can piece that together.

Android offers tons of cheaper options, but those maker aren't earning any profits and will eventually go out of business just like Nokia, Motorola, HTC, HP, and all the other low end Android makers in China that have already failed.

It's not clear Apple could build phones much faster than it currently is. If it lowered prices to boost demand, how would it build more at a lower price? Right now, Apple can afford to spend on advanced equipment and tooling and shipping to get products to market. How does it lower prices? Why should it? It's already neck and neck with the volume leader. Production has natural limits.

But again, when you offer ideas, make sure they have some value beside cynical snark. And point to some company that's doing better. Google priced its phones very low and couldn't sell them. It then tried to sell phones like Apple, and couldn't sell them. It's not easy.

He wouldn’t want to spend iPhone X prices so it got me having a look at what Apple offers and I can’t see any justification for upgrading to anything but the X. And even then a sensible person would wait until October now.

Give it another year, and i expect 80% of iPhone sales to be X models, whatever they might call them.

To me that means my iPhone 7 may well have to be replaced by an 8 and that's it for me with Apple.

I wear protective headgear a lot. This is either a motorcycle crash helmet or one similar to a tree surgeon would wear.

TouchId (remember that?) allows me to open the phone with a fingerprint. Using FaceID means that I'd have to remove the headgear. This takes time and if a lot lower down the 'Ease of use' list when compared to the older phones. Removing a glove is an order of magnitude easier than removing the helmet. Yes I could enter the passcode but that defeats the whole object of TouchID and FaceID.

Sorry Apple, you have lost the plot here as well in many other areas especially wrt the Mac line-up.

It's clear though that Google isn't done with Pixel phones. More so, it looks like they're just getting started.

I don't think they are an outlier. If Apple wants to create a premium line, great. But yes, I do believe the price of the X has hurt sales. If Apple is perfectly happy with how many X's they have sold to date, so be it.

Also I've been using an X since November 3rd. I can't wait to move on to the 8. I find the X too large and heavy, and Face ID is slower than Touch ID 2.0. What I really want is an SE sized device that is all screen. Hopefully that will come in 2019.

An anecdotal example is myself. I didn't buy an X while I am very much financially capable of it. I simply could not justify a thousand dollars for what the X offers. Apple lost a sale entirely due to price in this anecdotal example. I look forward to a potential price drop this fall when I may be more open to entertaining a purchase (Unless they blow the doors off with new features that justifies a thousand dollars for a product I'm going to toss out after a couple years).

People buy at all sort of price points, and you would never buy a phone at the x price point even if it was made of gold. You were not a lost sale for Apple for the X, you were never a customer of the X in the first place. You most likely bought the phone at a cost you wanted to pay nothing Apple did would convince you to spend more.

One thing Apple is really good at better than any company, they know exactly what a customer is willing to pay for something, they do not need to convince them to spend money like up selling. This is why Apple make the most profits, since they know X number of people will buy a phone that cost Y and they then figure out how to make Y cost phone at Y x 60% so they can make their healthy margins. The competitor do it the other way, the make a phone, realize the cost, then realize they can not sell it for a price which makes a profit for them.

The 8 and X series were released late last year. There are only two quarters of official results to go by and Apple doesn't break numbers down so no one knows what is really happening. That's where analysts jump in with their numbers (estimates).

Not long ago, analysts were claiming that the low end made up a sizeable chunk of Apple unit sales. More than 20%. That's for old hardware. Not shabby at all and while they may not be the 'most' popular, they seem to be popular nevertheless. Obviously price is a factor.

Apple's sales remain flat. They have been for a long while. That doesn't look like its changing.

People talk about Android discounting but I keep reading about Apple promotions for 2x1 8 series phones. I haven't seen one myself, though. I haven't seen a 2x1 flagship promo for Android flagships.

People talk about small Android handset makers going out of business. That's consolidation. It happens in every mature market. What people don't see so clearly is that there are an unthinkably large amount of those handset makers still in business!

So where are the sales of failed business going? To other handset makers. Android handset makers!

Last year Huawei moved into second spot in unit sales, overtaking Apple. Apple clawed that position back with its peak quarters on its annual release cycle. Last year Huawei shipped 153,000,000 units. This year, their own goal is 200,000,000 units. That is massive growth and will put them into second spot again if they realise that growth.

Widespread opinion places the P20 Pro as the best handset of 2018 at several hundred dollars cheaper than an iPhone X.

You say that Android handset makers aren't making any money but Huawei is selling millions of phones, making billions and producing high quality innovative products.

Rumours point to Apple reducing prices this year. If that happens you'll have to ask yourself why.

Apple profits shows your view of price is an outlier, if it cost too much Apple would not be selling them and their profit and loss statement would have reflected this fact. Plus Apple ASP is raising meaning consumers are willing to pay more to get what they want. The problem is what we are taught in econ in school says this fact is wrong and counter intuitive. Past history says those who made a widget for less sells more, but does not mean they make more profit. Econ model only make sense when all supplier widgets are exactly the same and are simply interchangeable with one another then the purchase decision is base solely on price. The Econ model falls apart when a widget creates a emotional attachment in a personal buying decision. When people buy Apple, price is not in the top of the reason for the purchase.

BTW, people who only buy on price do not and can not understand this concept and they also believe everyone else make purchase decisions the same way they do which is only based on price.

Almost certainly not.; just carrier discounts to pick up a few switchers.

Betcha that Android OS device makers are quite likely to provide carrier incentives to drive share acquisition.

You make me laugh, yet again, with your avowed love of all things Huawei.

"Widespread Opinion place the P20 Pro as the best handset of 2018"

That's just fantasy.

Apple low end devices may be 20% of unit sales overall, but likely at about half the ASP, so as a contribution to revenues, about 10%,