Apple TV+ predicted to hit 12M subscriptions in 2020, 21M by 2021

Apple TV+, the iPhone maker's upcoming video streaming service, is likely to achieve 12 million subscriptions by the end of 2020, analysts at Cowen suggest, with Apple breaking even in its original content production efforts if it reaches 10 million users.

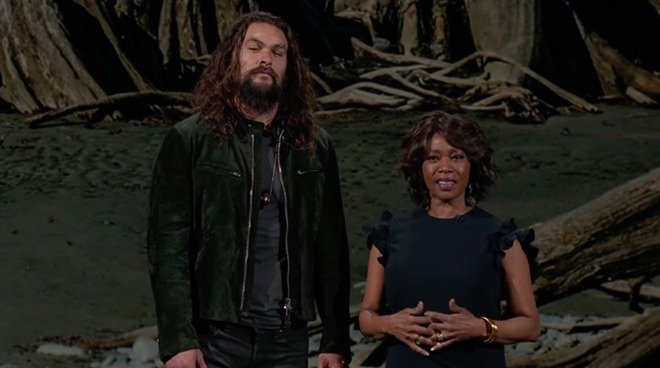

Jason Momoa and Alfre Woodard present "See" at an Apple special event in March.

The long-awaited video subscription offering is expected to arrive in November and is rumored to cost $9.99 per month. For that cost, subscribers will be able to watch a swathe of content produced for the service, including the news drama "The Morning Show," the Jason Momoa vehicle "See" and a reboot of Steven Spielberg's "Amazing Stories."

To fund the productions, of which Apple has reportedly earmarked more than $6 billion in investments for the content catalog, Apple needs to secure a decent amount of subscribers in order to cover the costs.

According to a Cowen investor note seen by AppleInsider, analysts conservatively forecast total Apple TV+ subscribers of around 12 million for the full year of 2020, rising to 21 million by 2021. This is far below the figures of Netflix and Amazon, at over 150 million and 100 million respectively, but those are established services that have been around for years, while Apple is a newcomer to the field.

As additional context, Cowen notes Apple Music achieved a 10% penetration of approximately 3 million subscribers in its inaugural year, growing to 29% or 16 million in the second, and may reach 37% or 65 million by the end of 2019.

The rumored $9.99 price is in the same ballpark of Cowen's estimates, which would be in line with Apple News+ as well as Amazon Prime Video's $8.99 cost, while undercutting Netflix's Standard and Premium offerings at $12.99 and $15.99, though higher than Hulu's commercial-supported service at $5.99.

While there are "limited details" on pricing and content structure, Cowen assumes the figures based on Apple providing only intellectual property it owns or has rights no. While it could license content and second-run movies and shows in a similar manner to Netflix or Amazon, it is believed TV+ will be "relatively more focused on original source material due to higher margins and differentiating the service with curated content."

Due to this assumption, it isn't expected that the price of Apple TV+ will go above $20 per month, which would be more Apple entering the territory of a "multi-channel video programming distributor" if it did. "We believe if Apple were to include licensed content within the TV subscription itself, it could be from small scale providers that license at an attractive fee to Apple," Cowen suggests, due to the 1.4 billion active devices that form Apple's potential audience.

Based on having over 40 original TV, video series, movies, and other programs under development, Cowen estimates ten could air at launch, with more offered throughout 2020. The current slate of projects, including production and marketing costs, is thought to cost in the region of $2.8 billion.

As Netflix previously commented that over 90% of its streaming content is expected to be amortized within 4 years of its original release, a similar concept could apply to Apple. Using the $2.8 billion figure as an annual content cost run rate, the break even point is said to be a "high-single digit M subscriber level."

For investors, Apple TV+ could help drive an incremental EPS rise of $0.20 to $0.25 for every 10 million additional subscribers on top of the conservative estimates. The baseline forecasts imply EPS contributions of $0.11 for 2020 and $0.32 for 2021.

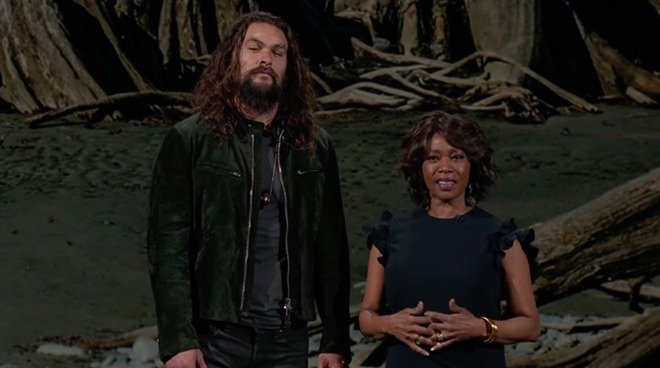

Jason Momoa and Alfre Woodard present "See" at an Apple special event in March.

The long-awaited video subscription offering is expected to arrive in November and is rumored to cost $9.99 per month. For that cost, subscribers will be able to watch a swathe of content produced for the service, including the news drama "The Morning Show," the Jason Momoa vehicle "See" and a reboot of Steven Spielberg's "Amazing Stories."

To fund the productions, of which Apple has reportedly earmarked more than $6 billion in investments for the content catalog, Apple needs to secure a decent amount of subscribers in order to cover the costs.

According to a Cowen investor note seen by AppleInsider, analysts conservatively forecast total Apple TV+ subscribers of around 12 million for the full year of 2020, rising to 21 million by 2021. This is far below the figures of Netflix and Amazon, at over 150 million and 100 million respectively, but those are established services that have been around for years, while Apple is a newcomer to the field.

As additional context, Cowen notes Apple Music achieved a 10% penetration of approximately 3 million subscribers in its inaugural year, growing to 29% or 16 million in the second, and may reach 37% or 65 million by the end of 2019.

The rumored $9.99 price is in the same ballpark of Cowen's estimates, which would be in line with Apple News+ as well as Amazon Prime Video's $8.99 cost, while undercutting Netflix's Standard and Premium offerings at $12.99 and $15.99, though higher than Hulu's commercial-supported service at $5.99.

While there are "limited details" on pricing and content structure, Cowen assumes the figures based on Apple providing only intellectual property it owns or has rights no. While it could license content and second-run movies and shows in a similar manner to Netflix or Amazon, it is believed TV+ will be "relatively more focused on original source material due to higher margins and differentiating the service with curated content."

Due to this assumption, it isn't expected that the price of Apple TV+ will go above $20 per month, which would be more Apple entering the territory of a "multi-channel video programming distributor" if it did. "We believe if Apple were to include licensed content within the TV subscription itself, it could be from small scale providers that license at an attractive fee to Apple," Cowen suggests, due to the 1.4 billion active devices that form Apple's potential audience.

Based on having over 40 original TV, video series, movies, and other programs under development, Cowen estimates ten could air at launch, with more offered throughout 2020. The current slate of projects, including production and marketing costs, is thought to cost in the region of $2.8 billion.

As Netflix previously commented that over 90% of its streaming content is expected to be amortized within 4 years of its original release, a similar concept could apply to Apple. Using the $2.8 billion figure as an annual content cost run rate, the break even point is said to be a "high-single digit M subscriber level."

For investors, Apple TV+ could help drive an incremental EPS rise of $0.20 to $0.25 for every 10 million additional subscribers on top of the conservative estimates. The baseline forecasts imply EPS contributions of $0.11 for 2020 and $0.32 for 2021.

Comments

Just look at Netflix. Still cash flow negative

Net Income and EPS are an illusion here

I think Apple realizes this and that's why they pushed it onto 3rd party hardware. Still, they can subsidize the cost from their own hardware sales.

Apple is trying to play nice with 3rd party services (even though they're accused of not being so) and charging a fair fee for the service. The fact is, they have so much money they could undercut everyone. It'll be interesting to see if they do in fact offer "X months free service" for those that buy Apple devices, specifically the Apple TV. However, they did not do the same for Apple Music on the HomePod. So probably unlikely.

Consider that if you charge so little that many subscribers to other streaming services sign on because it's such a small additional cost, your potential subscriber base is dramatically expanded. If instead of having to convince consumers to pick your streaming service instead of an alternative service like Netflix, you offer your service as a compliment, many more consumers would potentially sign up. Best of all, you are not forced to seek out additional content to justify a higher subscription cost. From the consumer's point of view, Apple is providing an appealing service at a great price, which is good for brand image.

Also, consumers already can have volume from established players in the streaming space. If all the participants struggle to produce a volume of offerings that justifies higher and higher subscription rates, the quality will be spread alarmingly thin. There is only so much quality production that can be conjured up. There is already a lot of junk served up as it is on services like Netflix. Lots of good content, sure, but a lot of filler, too. Apple shouldn't be looking to add to the junk pile.

Hahah!

i am not the maths, but according to my calculations, it will take them a little over 50yrs to make back the 6B investment all things being equal.

Obviously subscribers will increase over time, but so will investment. At least Apple has the hardware business to prop them up so ultimately I suppose it doesn’t matter if they only ever break-evesies on the streaming. Besides Apple Music and News are clearly easy money makers so I doubt Apple is horribly concerned about this. Probably drives Lucia bonkers though.

Apple won't ship junk (if they stay away from politics).

Your subscriber paragraph has me thinking... What IF Apple refuses to disclose their subscriber numbers? That would be interesting.

If you look at what companies spend to have their products seen by 100 million football fans for 4-5 months a year and look at what Apple could charge for getting the products in front of 100's of millions for several months, it becomes a no brainer.

The ad spend in the US was $151 billion in 2018. For the amount of eyes that might watch these new shows, Apple could easily take 10-20% of that total. Maybe more.

You couldn't handle 2-3 minutes? I think I'd rather save $120 and increase earnings tremendously.

At even just 3 minutes per hour, let's say someone watches only 5 hours of TV a week - that would be 13 hours of advertising in a year. I'd much rather pay $120 (although with only limited advertising you would still be paying some form of subscription) and save myself 13 hours of watching advertisements. Of course this is a very conservative estimate based on much lower than average advertising per episode.

I've got better things to do with my time than watch ads. I don't watch a lot of TV so when I do I want to spend it watching shows I'm interested in rather than waste it watching ads.

There are other services that offer an ad based approach if that's suits you. But there's no way this is the approach Apple will be taking.

I’m sure we’ll get some announcements of certain milestones at some point but maybe not for the first few years.

I'm purely looking at this from the stock price standpoint. I think ads could add $50-$75 on to the stock price. Maybe much more. Seems like it would take 150-200 million subscriptions for that model to do that. The numbers thrown around in this article scare me.

There has to be a plan that Tim had yet to reveal. As I just said ... maybe he's looking for a tax write off?

As a side note, it is amazing how far streaming has come, I remember trying to watch the early Apple live streams of Steve doing new product announcements.