Questionable analysis claims US iPhone user base growth has stalled

Apple's iPhone user base in the United States is slowing its growth, according to Consumer Intelligence Research Partners in a questionably-derived analysis, with iPhone retention rates and fewer Android switchers claimed to be the reason for the stalled growth.

Apple's most recent financial results on Wednesday revealed overall revenue for the quarter of $64 billion, with iPhone-specific earnings of $33.36 billion down 9% year-on-year. The slight drop in iPhone revenue was made up by improvements in other areas, with growth in Services, Wearables, and iPad more than making up for the shortfall.

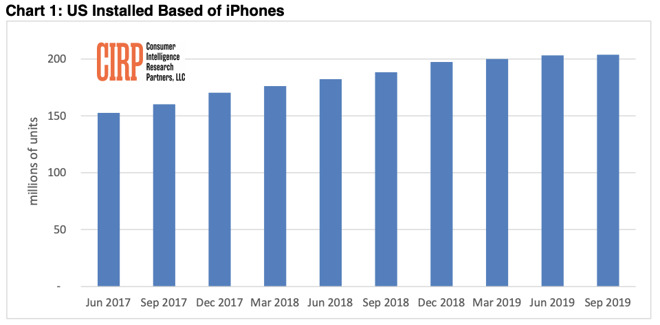

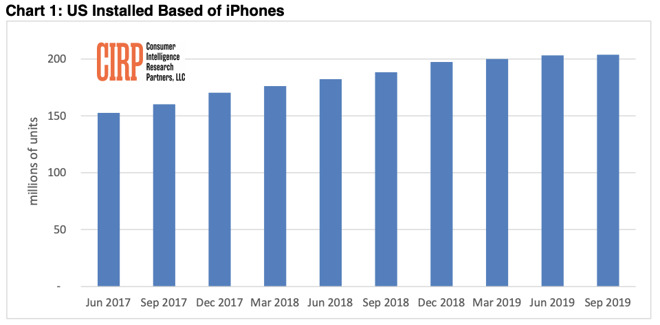

In a report from CIRP, Apple's continued growth of iPhone sales in the United States is slowly grinding to a halt, with minimal sequential-quarter improvements over the last year. It is estimated Apple's iPhone install base in the United States reached 204 million units for the September quarter.

"Apple added the fewest number of iPhones to the US install base in a quarter in six years," declared CIRP partner and co-founder Josh Lowitz. "Both quarterly and annual growth have slowed to the lowest levels since we started tracking iPhone sales and retirements in 2012."

Via CIRP

CIRP believes this is due to a number of reasons, including a lower pool of first-time smartphone buyers, and a lower number of Android switchers moving to iOS. "The trend toward keeping old phones longer protects the size of the installed base, however," CIRP adds, with older iPhones kept active and preventing switching from iOS to Android, though "platform switching in both directions is down."

CIRP's analysis is questionable, as the 204 million figure is based on estimated global sales of 43 million, which is in turn produced by combining the estimated average selling price of $783 with figures Apple disclosed. Apple's current reporting policy means it does not provide units figures for global iPhone sales, forcing analysts to make educated guesses based on data that has been officially provided, as well as acquiring more information from other third parties.

The last known average selling price was $783.87 in the fourth fiscal quarter of 2018. At the time, Apple had released the iPhone XS and iPhone XS Max. The iPhone XR had yet to be released, making it an impossible compare to the fourth fiscal quarter of 2019, with the entire iPhone 11 and iPhone 11 Pro line available for about two weeks at the end of the quarter.

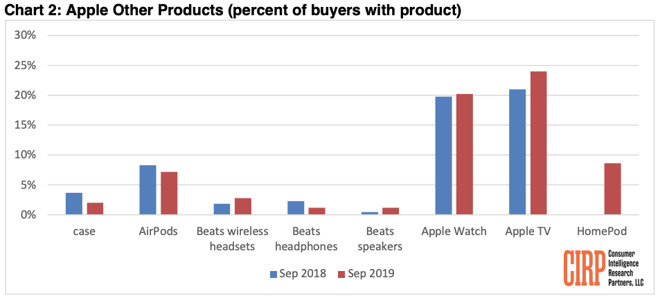

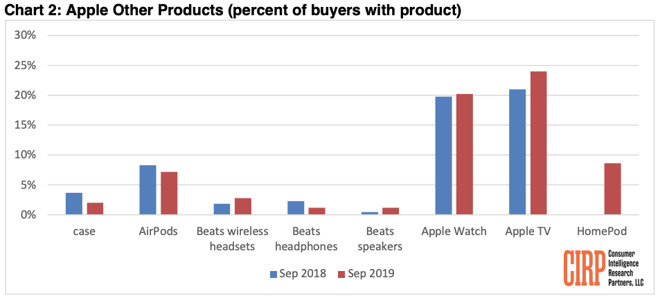

CIRP also provides analysis on different devices Apple classifies as "Other Products," including the AirPods, Apple Watch, Apple TV, HomePod, Beats headphones, Beats wireless headphones, Beats speakers, and cases.

Via CIRP

In its report, the Apple TV maintains its lead as the most-owned product among the group with close to 25% ownership among Apple customers, followed closely by Apple Watch with around 20%, then HomePod and AirPods between 5% and 10%. While most products on the list have comparable ownership rates as found in September 2018, with some growth in the Apple TV, the HomePod is seen to have outpaced cases, and Beats devices.

CIRP's results are based on a "survey of 500 US Apple customers" who purchased an iPhone, iPad, or Mac between July and September. This is a too-small pool to base general ownership trends in the United States, especially as it takes only the view of customers who bought more expensive items, and not existing iOS device or Mac owners buying the accessories.

Apple's most recent financial results on Wednesday revealed overall revenue for the quarter of $64 billion, with iPhone-specific earnings of $33.36 billion down 9% year-on-year. The slight drop in iPhone revenue was made up by improvements in other areas, with growth in Services, Wearables, and iPad more than making up for the shortfall.

In a report from CIRP, Apple's continued growth of iPhone sales in the United States is slowly grinding to a halt, with minimal sequential-quarter improvements over the last year. It is estimated Apple's iPhone install base in the United States reached 204 million units for the September quarter.

"Apple added the fewest number of iPhones to the US install base in a quarter in six years," declared CIRP partner and co-founder Josh Lowitz. "Both quarterly and annual growth have slowed to the lowest levels since we started tracking iPhone sales and retirements in 2012."

Via CIRP

CIRP believes this is due to a number of reasons, including a lower pool of first-time smartphone buyers, and a lower number of Android switchers moving to iOS. "The trend toward keeping old phones longer protects the size of the installed base, however," CIRP adds, with older iPhones kept active and preventing switching from iOS to Android, though "platform switching in both directions is down."

CIRP's analysis is questionable, as the 204 million figure is based on estimated global sales of 43 million, which is in turn produced by combining the estimated average selling price of $783 with figures Apple disclosed. Apple's current reporting policy means it does not provide units figures for global iPhone sales, forcing analysts to make educated guesses based on data that has been officially provided, as well as acquiring more information from other third parties.

The last known average selling price was $783.87 in the fourth fiscal quarter of 2018. At the time, Apple had released the iPhone XS and iPhone XS Max. The iPhone XR had yet to be released, making it an impossible compare to the fourth fiscal quarter of 2019, with the entire iPhone 11 and iPhone 11 Pro line available for about two weeks at the end of the quarter.

CIRP also provides analysis on different devices Apple classifies as "Other Products," including the AirPods, Apple Watch, Apple TV, HomePod, Beats headphones, Beats wireless headphones, Beats speakers, and cases.

Via CIRP

In its report, the Apple TV maintains its lead as the most-owned product among the group with close to 25% ownership among Apple customers, followed closely by Apple Watch with around 20%, then HomePod and AirPods between 5% and 10%. While most products on the list have comparable ownership rates as found in September 2018, with some growth in the Apple TV, the HomePod is seen to have outpaced cases, and Beats devices.

CIRP's results are based on a "survey of 500 US Apple customers" who purchased an iPhone, iPad, or Mac between July and September. This is a too-small pool to base general ownership trends in the United States, especially as it takes only the view of customers who bought more expensive items, and not existing iOS device or Mac owners buying the accessories.

Comments

LOL. I was reading through, trying to ascertain exactly where they got these numbers and why they were derided as questionable. Sort of buried the lede there, huh?

I also question the entire "other Apple products" figures, but since it's based on the 500 Apple customer survey, that's not surprising. GIGO.

Unfortunately, 500 people is too small considering Apple has about 1 billion iPhone users.

Including this one!!

This is about iPhones (as opposed to smartphones in general) and limited to the U.S.

The numbers are questionable for the reasons given but there is plenty of room for iPhone growth. The question is what Apple might be willing to do to achieve it. Clearly price would be a major factor. If a $399 'new' iPhone really does get released early next year, it might just be one of the ways to kick-start that growth.

Away from the U.S and other 'developed' markets, there is also plenty of room for growth (India and South America) as feature phones are still very common in those regions (especially in India).

I'm not sure I agree with that. I think both are problematic, but the first is at least based on hard data. The survey is clearly not large enough, as noted in the article. Surveys in general are notoriously inaccurate, for reasons we both probably know.

Mathematically, the sample size examined in a vacuum is okay. It isn't great, it's okay. More troublesome for that aspect is we don't know more about the when and the where the 500 folks were queried.

Show me in the text where Malcolm is "butt hurt."

The story is making the rounds elsewhere, without the contextualization, and with sensationalized headlines. Good journalism is about contextualization too.

1. Like I said, both are problematic. Good point on year-old data and market conditions.

2. I couldn't tell you whether the math is OK, but I'll take your word. It certainly seems small for the number of iPhone owners we're talking about. I agree completely about how the survey was constructed.

1. OK, surveys can be accurate. I agree. But they are, in general, notoriously unreliable. I use surveys myself. But there are so many variables, including time/place/method, construction of questions, for what purpose the data is used, etc.

2. I don't agree with that at all. The article uses the term "questionable," which I think actually may be an understatement.

3. You're confusing anecdotal evidence and what seem to be logical conclusions with empirical evidence.

There are fifty states. We are talking about 10 people per state, less if we include the District of Columbia and Puerto Rico. You have to be on drugs if you think ten randomly chosen people in your state are a worthy representation vis-a-vis the rest of the country.

Worse, they probably only surveyed adults despite the fact that many adolescents own cellphones and will be future decision makers on cellphone purchase decisions.

This whole survey is a complete farce.