New German law mandates opening up Apple Pay NFC tech to rivals

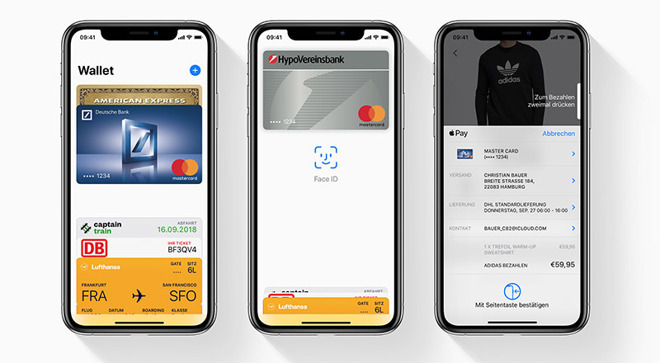

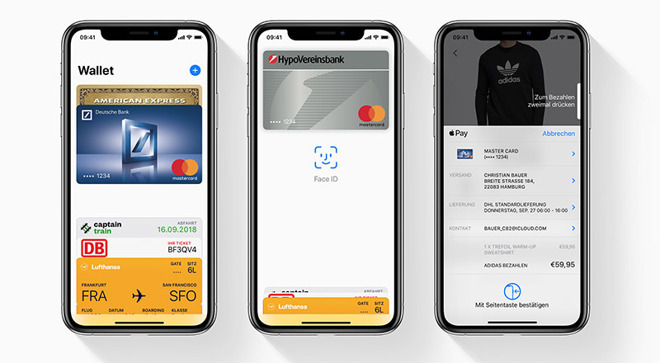

German legislators have rushed new legislation through that could force Apple to provide access to its NFC chip, allowing competitors to provide their own mobile payment platforms on the iPhone and Apple Watch.

In a late-night session on Wednesday, a German parliamentary committee suddenly voted to pressure Apple into to offering Apple Pay to rival providers in Germany.

It came in the form of an amendment to an anti-money laundering law that was adopted late Thursday and is set to come into effect early next year. While the law didn't specifically name Apple, it would require any operator or an electronic money infrastructure to offer access to rivals at a reasonable fee.

The legislation reflects Germany's increasing willingness to loosen U.S. technology companies' control on technology products and services.

"We are surprised at how suddenly this legislation was introduced," Apple said of the matter. "We fear that the draft law could be harmful to user friendliness, data protection and the security of financial information."

A person close to the government coalition had told Reuters that Chancellor Angela Merkel's office had pushed for the committee to withdraw the amendment.

The Chancellor's move had raised concerns from Germany's Social Democratic Party.

"It's quite unusual for the Chancellor's office to try and stop something in the last minute," said Jens Zimmermann, a senior lawmaker from the Social Democrats (SPD), junior coalition partners to Merkel's conservatives.

"It would be astonishing if they let themselves be reined back by an American company," he added. "We want fair competition between payment providers."

Apple Pay has been rapidly expanding across the globe in the last few years. Germany first saw Apple Pay in December of 2018.

Apple has also been targeted by an anti-competitive investigation by the European Commission regarding the choice to limit the NFC chip to Apple Pay.

In a late-night session on Wednesday, a German parliamentary committee suddenly voted to pressure Apple into to offering Apple Pay to rival providers in Germany.

It came in the form of an amendment to an anti-money laundering law that was adopted late Thursday and is set to come into effect early next year. While the law didn't specifically name Apple, it would require any operator or an electronic money infrastructure to offer access to rivals at a reasonable fee.

The legislation reflects Germany's increasing willingness to loosen U.S. technology companies' control on technology products and services.

"We are surprised at how suddenly this legislation was introduced," Apple said of the matter. "We fear that the draft law could be harmful to user friendliness, data protection and the security of financial information."

A person close to the government coalition had told Reuters that Chancellor Angela Merkel's office had pushed for the committee to withdraw the amendment.

The Chancellor's move had raised concerns from Germany's Social Democratic Party.

"It's quite unusual for the Chancellor's office to try and stop something in the last minute," said Jens Zimmermann, a senior lawmaker from the Social Democrats (SPD), junior coalition partners to Merkel's conservatives.

"It would be astonishing if they let themselves be reined back by an American company," he added. "We want fair competition between payment providers."

Apple Pay has been rapidly expanding across the globe in the last few years. Germany first saw Apple Pay in December of 2018.

Apple has also been targeted by an anti-competitive investigation by the European Commission regarding the choice to limit the NFC chip to Apple Pay.

Comments

Fair competition would mean other providers building their own hardware to compete or partnering with other hardware providers to compete. Not forcing a non-majority device maker to implement their competing software.

My take on the article was that Apple is concerned about how quickly this legislation was drafted and implemented and that it would take effect in just a few months. Is that the prudent way to make policy?

The bloc's tech-inferiority complex is shining through.

It is common for companies to license technologies to competitors in order to prevent a “Tower of Babel” of technical requirements. The wireless technology standards of 4GLTE include a large amount of intellectual property licensed to all. I think maybe lawmakers who are less than well informed expect that Apple should just share the secure transaction technology they have in a similar way.

Apple I think rightly guards this technology not so much for a trade advantage over competitors, but knowing that sharing it broadly will undermine the security of Apple Pay and that of the millions of people worldwide that use it every day.

I would imagine that the majority of lawmakers and staff involved in this possess at best a shallow and general understanding of the depth and potential harm from having insecure online transactions. Privacy and security of data is not only a big deal for consumers/customers, it is a huge point of differentiation for Apple. Why should Apple make proprietary technology developed at considerable cost to every maker of throwaway Android trash phones?

As for fair competition, these other companies are free to create their own platforms on their own time and at their own expense. The simple truth of it is they don’t have the competence to do so, but Apple is not obliged to give them a leg up. There’s nothing fair about profiting from another’s work!