Why did Apple buy up another $20B in stock at record highs?

Since 2012, Apple has been buying back its shares at an extraordinary rate, often exceeding $10 billion-- and frequently approaching $20 billion-- per quarter. Now that its stock has doubled across the last year, why is it continuing to snap up shares?

Apple's chief financial officer Luca Maestri just noted in the company's December quarter earnings call, "we returned nearly $25 billion to shareholders during the December quarter. We began a $10 billion accelerated share repurchase program in November, resulting in the initial delivery and retirement of 30.4 million shares. We also repurchased 40 million Apple shares for $10 billion through open market transactions. And we paid $3.5 billion in dividends and equivalents. As we have done for the last several years, we would share our plans for the next phase of our capital return program when we report results for the March quarter."

Apple's $10 billion spent on open market repurchases during the quarter erased 40 million shares at an average price of $250. That represents a steep discount over the current price of $320. Analysts who have been insisting that Apple's share repurchases were a waste of money are now looking particularly foolish.

Apple's executive team has explained for years why it was buying back its shares: it knew its shares were dramatically undervalued by investors in the market. It's pretty clear that they were right and that analysts looking at the company from the outside were dramatically wrong.

This delusional media narrative portrayed Apple as nothing more than a commodity hardware maker. Tech media blogger personalities have long latched on to numbers created by groups such as IDC, Gartner, and Strategy Analytics to suggest that Apple's sales were nothing special because another company was shipping similar or higher unit numbers of far cheaper products.

IDC-- after years of dreaming up Android tablet competition for iPad that was never real-- turned around and took the lead in inventing the same sort of ridiculous competition for Apple Watch: specifically including $13 Xiaomi activity bands.

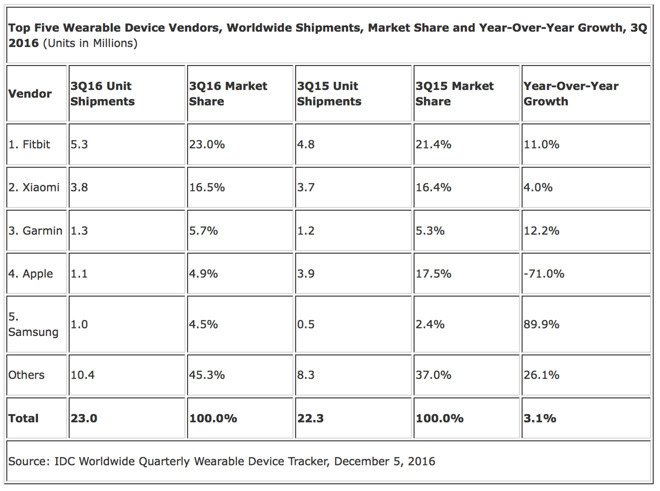

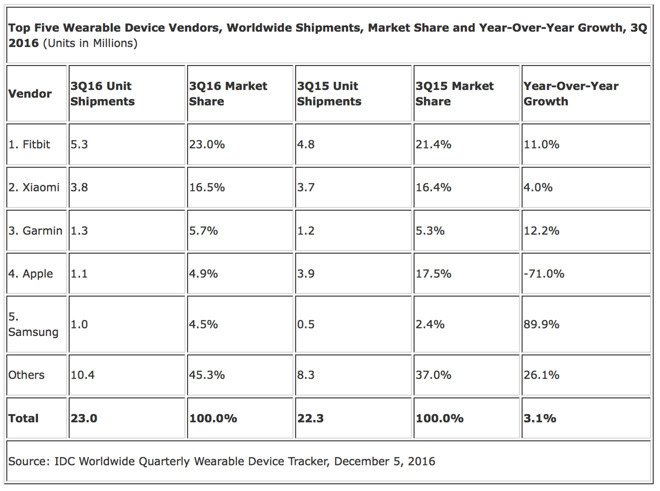

IDC generated figures like these that created the false impression Apple Watch was failing

At the end of 2016, IDC declared Fitbit the winner in wearables, and similarly put Xiaomi and Garmin ahead of Apple using estimates of units shipped. IDC's analyst (the report has since been deleted from IDC's website) even claimed that Apple Watch was suffering from an "aging lineup and an unintuitive user interface," helping to fuel clickbait artists such as Jay Yarow of Business Insider who wrote that "the Apple Watch is not the blockbuster people thought it was going to be."

IDC's data was wrong. So much so, in fact, that Apple's chief executive Tim Cook issued an usual comment refuting IDC's story and methodology portraying Apple Watch as a failure.

"Our data shows that Apple Watch is doing great and looks to be one of the most popular holiday gifts this year," Cook wrote to Reuters, shortly after IDC published its prediction of failure for what has since become the most successful watch of any kind, outselling the entire Swiss watch industry in addition to having no real competitors in the "smartwatch" category.

This winter Fitbit sold itself off for scrap to Google-- which had similarly gone nowhere with its own Android-based Wear OS despite jumping into the wearables market well ahead of Apple.

Media bloggers and the "research firms" suppling them with charts of made-up shipment numbers and their simpleton analysis of the consumer market created the expectation that cheap generic wristbands would derail Apple Watch--immediately after years of insisting that cheap generic tablets would kill iPad.

And of course, before that, they claimed that cheap Androids and Windows Phones were supposed to push iPhone out of relevance, that cheap MP3 players were supposed to crush iPod and that cheap netbooks were going to keep Macs from ever achieving significant sales.

Today, similar efforts to disparage AirPods or compare them to "challengers" have failed to take off. It's clear that global audiences love AirPods with the same kind of interest that attracted buyers to Apple Watch, to iPad, to iPhone, to iPod, and to Macs. And it hasn't mattered that cheaper knockoff products from other vendors are also selling, sometimes in similar or even greater volumes.

That's because Apple's success isn't based on its percentage of total market sales, including counterfeits and wildly different products similar only in their general outline.

Disneyland isn't threatened by every carnival erected in other towns. In fact, most kids who grow up riding a Tilt-A-Whirl or Wilde Maus aspire to visit Disney, and millions of visitors regularly pay breathtaking ticket prices to enjoy theme parks such as Disney's despite the availably of much cheaper small town carnivals and even the 25 cent rocking horses placed in front of K-Mart.

Ten years after Android began "winning" in unit sales, Apple now sells the majority of smartphones in affluent countries and makes virtually all of the profits from consumer electronics in a wide-open, global market with unfettered competition-- most of which is shamelessly ripping off Apple's work.

Investors have now figured this out. It took the world pretty much the entire span of the 2010s for many to grasp this, but now that it's impossible to argue against, trading of Apple's stock has jumped to an entirely new tier, one based on the company's ability to attract new customers and retain its existing customer base while offering all kinds of other attractive products and services.

"Customers over units shipped" is another way of saying that investors have let go of the notion that-- with apologies to Steve Jobs-- "for Apple to win, everyone else needs to lose," or the concern that Apple "may not be selling more devices than the rest of the world combined," or, in the words of a certain Bloomberg Apple critic, that "some people may not be able to afford" Apple's best products, even though they are clearly selling in massive volumes to the tens of millions who gleefully pay for the latest technology.

HomePod doesn't have to outsell every Alexa-partnered device, and Apple TV didn't have to outsell cheap loss leaders from Roku. Both only need to sustain their own success, as elements in Apple's larger ecosystem of devices. Apple appears to have the only profitable hardware in either category, despite lacking the "leading" unit sales volumes that have done nothing to establish Alexa or Assistant as important "voice app" development platforms or in generating the massive voice-based sales they were incorrectly predicted to drive.

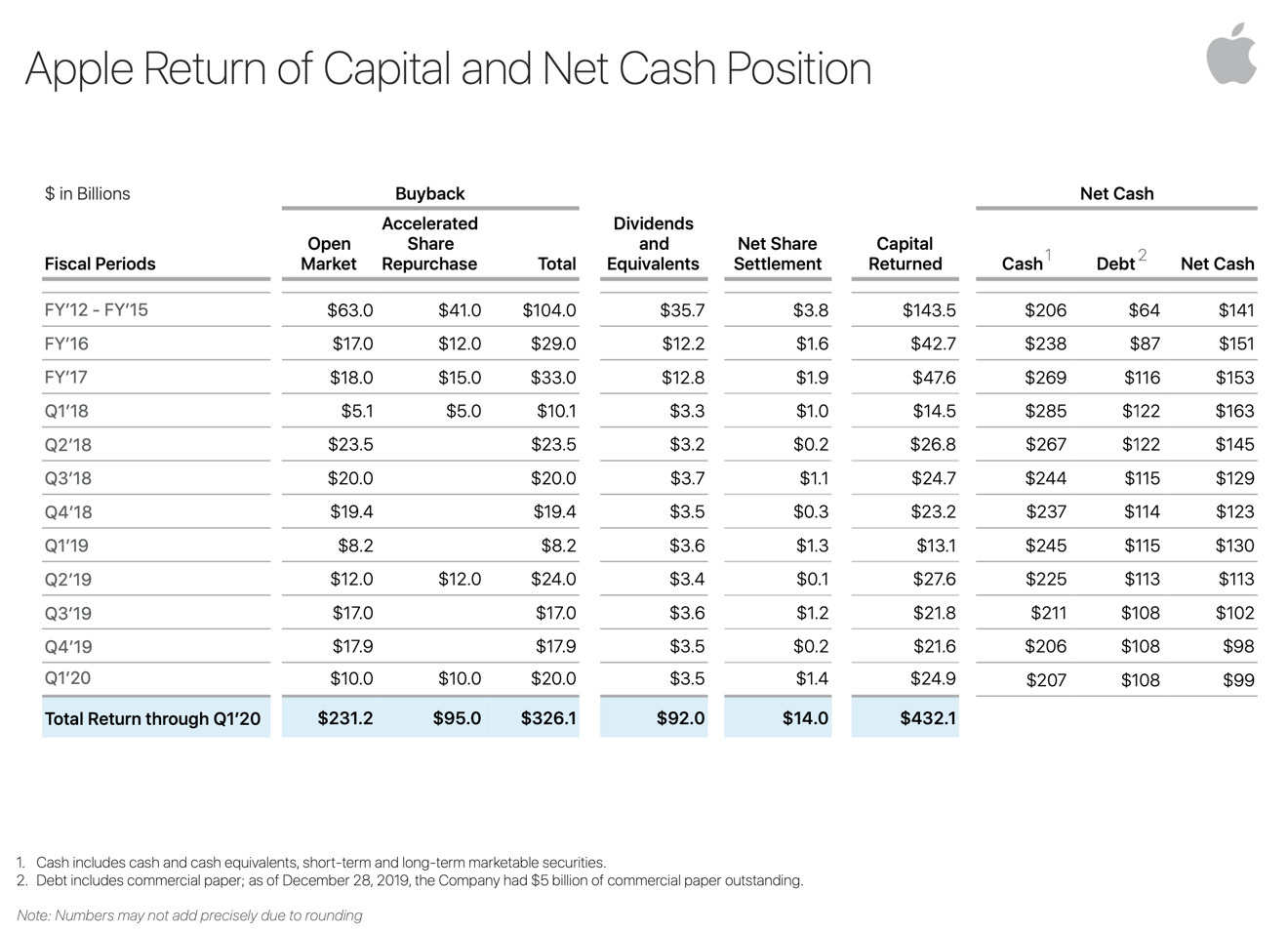

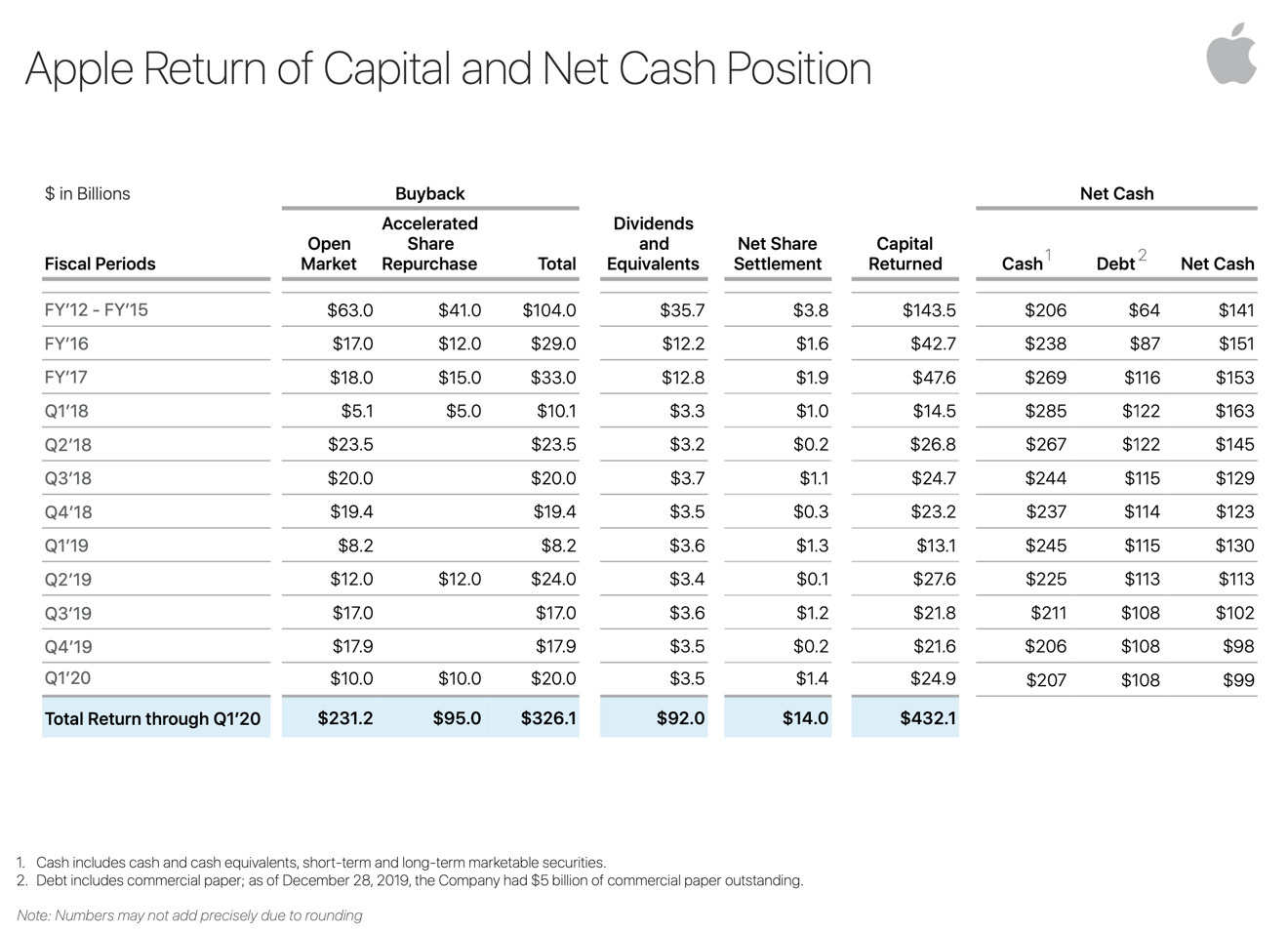

Since 2012, Apple has funded a total of $326.1 billion in stock buybacks. These shares were repurchased at an incredible discount to today's price. While analysts have occasionally picked out a given trough in Apple's stock price and declared that its buybacks were a huge mistake, it's hard to imagine in hindsight how Apple could have better invested $326 billion of its profits.

Effectively spending lots of money is hard work. Apple has been able to spend at most around $4 billion per quarter on highly effective R&D. Further, Apple's 10K noted that it "anticipates utilizing approximately $10.0 billion for capital expenditures during 2019, which includes product tooling and manufacturing process equipment; data centers; corporate facilities and infrastructure, including information systems hardware, software and enhancements; and retail store facilities."

Maintaining a cash pile of $99 billion -- actually $207 billion balanced with $108 billion in debt -- is a liability, as it is extremely difficult to effectively invest that much money in anything productive. Apple is already leading the tech industry while spending a mere $10 billion annually on Capex and historically less than $15 billion annually on R&D. Its cash holdings are mostly invested in government and corporate debt securities and other safe investments that do not pay out a high rate of return.

So, Apple's solution has been to buy up its own shares as rapidly as possible, effectively concentrating its value as a company for its shareholders. And at the same time, also paying out around $14 billion per year in dividends.

And yet, even as it funds $20 billion in share repurchases in the quarter, it also generated another $10 billion in net income in the quarter. Of all the problems that analysts invent for Apple, the most challenging thing the company faces is actually how to responsibly spend all of the money it is generating from leading the development of the world's consumer technology.

The executive team with the clearest picture of Apple's prospects is actively investing the company's cash resources as rapidly as effectively possible in the company's expansion, but the company is simply generating so much cash that it is effectively forced to return the excess to shareholders as efficiently as possible by increasing the value of their investment.

Apple's chief financial officer Luca Maestri just noted in the company's December quarter earnings call, "we returned nearly $25 billion to shareholders during the December quarter. We began a $10 billion accelerated share repurchase program in November, resulting in the initial delivery and retirement of 30.4 million shares. We also repurchased 40 million Apple shares for $10 billion through open market transactions. And we paid $3.5 billion in dividends and equivalents. As we have done for the last several years, we would share our plans for the next phase of our capital return program when we report results for the March quarter."

Apple's $10 billion spent on open market repurchases during the quarter erased 40 million shares at an average price of $250. That represents a steep discount over the current price of $320. Analysts who have been insisting that Apple's share repurchases were a waste of money are now looking particularly foolish.

Apple's executive team has explained for years why it was buying back its shares: it knew its shares were dramatically undervalued by investors in the market. It's pretty clear that they were right and that analysts looking at the company from the outside were dramatically wrong.

IDC and the unit sales delusion

One of the primary reasons why the market assigned such a low valuation to Apple-- despite years of consistent profitability and successful innovation unmatched by its rivals in the consumer electronics space-- was the false media narrative spun by market research groups that repeatedly focused on Apple's hardware unit shipments rather than the audience of loyal buyers Apple was attracting within its castle moat.This delusional media narrative portrayed Apple as nothing more than a commodity hardware maker. Tech media blogger personalities have long latched on to numbers created by groups such as IDC, Gartner, and Strategy Analytics to suggest that Apple's sales were nothing special because another company was shipping similar or higher unit numbers of far cheaper products.

IDC-- after years of dreaming up Android tablet competition for iPad that was never real-- turned around and took the lead in inventing the same sort of ridiculous competition for Apple Watch: specifically including $13 Xiaomi activity bands.

IDC generated figures like these that created the false impression Apple Watch was failing

At the end of 2016, IDC declared Fitbit the winner in wearables, and similarly put Xiaomi and Garmin ahead of Apple using estimates of units shipped. IDC's analyst (the report has since been deleted from IDC's website) even claimed that Apple Watch was suffering from an "aging lineup and an unintuitive user interface," helping to fuel clickbait artists such as Jay Yarow of Business Insider who wrote that "the Apple Watch is not the blockbuster people thought it was going to be."

IDC's data was wrong. So much so, in fact, that Apple's chief executive Tim Cook issued an usual comment refuting IDC's story and methodology portraying Apple Watch as a failure.

"Our data shows that Apple Watch is doing great and looks to be one of the most popular holiday gifts this year," Cook wrote to Reuters, shortly after IDC published its prediction of failure for what has since become the most successful watch of any kind, outselling the entire Swiss watch industry in addition to having no real competitors in the "smartwatch" category.

This winter Fitbit sold itself off for scrap to Google-- which had similarly gone nowhere with its own Android-based Wear OS despite jumping into the wearables market well ahead of Apple.

Media bloggers and the "research firms" suppling them with charts of made-up shipment numbers and their simpleton analysis of the consumer market created the expectation that cheap generic wristbands would derail Apple Watch--immediately after years of insisting that cheap generic tablets would kill iPad.

And of course, before that, they claimed that cheap Androids and Windows Phones were supposed to push iPhone out of relevance, that cheap MP3 players were supposed to crush iPod and that cheap netbooks were going to keep Macs from ever achieving significant sales.

Five times fooled, can't get fooled again

How many times can market firms, stock analysts, and clickbait bloggers be so wrong about a subject and still retain any semblance of credibility? Apparently, the answer is five, because across the last two decades the unit sales delusion has persisted-- almost without any criticism, outside of yours truly-- across five major generations of new Apple product releases.Today, similar efforts to disparage AirPods or compare them to "challengers" have failed to take off. It's clear that global audiences love AirPods with the same kind of interest that attracted buyers to Apple Watch, to iPad, to iPhone, to iPod, and to Macs. And it hasn't mattered that cheaper knockoff products from other vendors are also selling, sometimes in similar or even greater volumes.

That's because Apple's success isn't based on its percentage of total market sales, including counterfeits and wildly different products similar only in their general outline.

Disneyland isn't threatened by every carnival erected in other towns. In fact, most kids who grow up riding a Tilt-A-Whirl or Wilde Maus aspire to visit Disney, and millions of visitors regularly pay breathtaking ticket prices to enjoy theme parks such as Disney's despite the availably of much cheaper small town carnivals and even the 25 cent rocking horses placed in front of K-Mart.

Training wheels to Disneyland

In the same way, as I first noted over ten years ago, Android has largely served "as training wheels for Apple's iOS, a technological onramp for basic smartphone users to eventually trade up to a premium mobile experience."Ten years after Android began "winning" in unit sales, Apple now sells the majority of smartphones in affluent countries and makes virtually all of the profits from consumer electronics in a wide-open, global market with unfettered competition-- most of which is shamelessly ripping off Apple's work.

Investors have now figured this out. It took the world pretty much the entire span of the 2010s for many to grasp this, but now that it's impossible to argue against, trading of Apple's stock has jumped to an entirely new tier, one based on the company's ability to attract new customers and retain its existing customer base while offering all kinds of other attractive products and services.

"Customers over units shipped" is another way of saying that investors have let go of the notion that-- with apologies to Steve Jobs-- "for Apple to win, everyone else needs to lose," or the concern that Apple "may not be selling more devices than the rest of the world combined," or, in the words of a certain Bloomberg Apple critic, that "some people may not be able to afford" Apple's best products, even though they are clearly selling in massive volumes to the tens of millions who gleefully pay for the latest technology.

HomePod doesn't have to outsell every Alexa-partnered device, and Apple TV didn't have to outsell cheap loss leaders from Roku. Both only need to sustain their own success, as elements in Apple's larger ecosystem of devices. Apple appears to have the only profitable hardware in either category, despite lacking the "leading" unit sales volumes that have done nothing to establish Alexa or Assistant as important "voice app" development platforms or in generating the massive voice-based sales they were incorrectly predicted to drive.

Apple's frantic pace of stock buybacks

Apple has now spent eight years buying massive billions of dollars of its own stock at prices far below the current price. Of course, these buybacks have themselves concentrated the value of Apple's enterprise across a much smaller number of outstanding shares, driving the stock price up for shareholders.

Since 2012, Apple has funded a total of $326.1 billion in stock buybacks. These shares were repurchased at an incredible discount to today's price. While analysts have occasionally picked out a given trough in Apple's stock price and declared that its buybacks were a huge mistake, it's hard to imagine in hindsight how Apple could have better invested $326 billion of its profits.

Effectively spending lots of money is hard work. Apple has been able to spend at most around $4 billion per quarter on highly effective R&D. Further, Apple's 10K noted that it "anticipates utilizing approximately $10.0 billion for capital expenditures during 2019, which includes product tooling and manufacturing process equipment; data centers; corporate facilities and infrastructure, including information systems hardware, software and enhancements; and retail store facilities."

Maintaining a cash pile of $99 billion -- actually $207 billion balanced with $108 billion in debt -- is a liability, as it is extremely difficult to effectively invest that much money in anything productive. Apple is already leading the tech industry while spending a mere $10 billion annually on Capex and historically less than $15 billion annually on R&D. Its cash holdings are mostly invested in government and corporate debt securities and other safe investments that do not pay out a high rate of return.

So, Apple's solution has been to buy up its own shares as rapidly as possible, effectively concentrating its value as a company for its shareholders. And at the same time, also paying out around $14 billion per year in dividends.

And yet, even as it funds $20 billion in share repurchases in the quarter, it also generated another $10 billion in net income in the quarter. Of all the problems that analysts invent for Apple, the most challenging thing the company faces is actually how to responsibly spend all of the money it is generating from leading the development of the world's consumer technology.

The executive team with the clearest picture of Apple's prospects is actively investing the company's cash resources as rapidly as effectively possible in the company's expansion, but the company is simply generating so much cash that it is effectively forced to return the excess to shareholders as efficiently as possible by increasing the value of their investment.

Comments

And STILL all these research companies report on is “unit share”

Look whose laughing now

Hilarious

I'm a senior citizen (like Gmgravytrain) but I bought into AAPL @ $20 many years ago and held because they are a company that did, does, and will make superior products - and offer a great return on investment. From my perspective, dividends cannot compete. YMMV.

In 2004 the dividend was zero, because I don't believe that Apple started paying out a dividend again until late 2012.

Many companies that are struggling pay high dividends. Apple has never been known as a dividend stock. If somebody is setting up a dividend portfolio and they would like to rely on dividend income, then there are plenty of stocks out there that pay large dividends.

Look at Macy's for example, I believe that their current dividend is more than 9%, and they're closing down stores all over the place. I wouldn't touch Macy's stock though, way too risky in my opinion. They can keep their 9%+ dividend.

I own a few shares of AAPL, but I never bought into it because of any dividend.

I also own a few shares of AT&T, and that one I did buy into because of their dividend.

You also mentioned Microsoft, and yes they do payout a larger dividend than AAPL. I own a few shares of MSFT also, even though I will never use or own Windows in my entire life.

There are also tech stocks like FB which pays out zero in dividends.

If you bought at $10, as of today, you have made ~32 times that per share.Sounds like a good investment to me, why aren'r you selling some to realize your gains, putting that hypothetical dollar into your real pocket/savings plan/pension fund?

Is in the news - and are a very real threat to Apples business.

I do wonder what happens once they become cash neutral? That will probably happen by 2021.

By then they will be generating 70+ billion in cash flow.

EDIT: I should add that one of the reasons for doing these ASR agreements is that they are effectively hedges against short-term declines in the stock price. If the share price continues to go up, then Apple will end up paying a higher price for the shares than it would have had it just bought that much worth of shares at the time of the agreement. But if the stock price goes down for a while, Apple will end up paying a lower price for the shares than it would have had it just bought that much worth of shares at the time of the agreement.

Apple isn’t necessarily betting that the share price will go down in the short-term, as it’s also buying shares in the open market at or about the same time that it’s entering into the ASR agreement. It’s just effectively hedging the timing of those share buybacks.

If you were to look at AAPL 5 past dividend payout at the the time they announced the increase in dividend, during the 2nd quarter report after March, the payout was

2015 $2.08 with AAPL at about $124/share and 1.7%

2016 $2.28 with AAPL at about $108/share and 2.4%

2017 $2.52 with AAPL at about $143/share and 1.6%

2018 $2.92 with AAPL at about $167/share and 1.5%

2019 $3.08 with AAPL at about $190/share and 1.6%

It is only now with AAPL over $300 a share, that the 2019 dividend payout has dropped to 1%. But Apple only raises its dividend once a year, during the 2nd quarter earnings report. So we will have to wait until after March to see how much Apple will increase the dividend by. If Apple were to keep their average of about 1.6% and AAPL were to remain above $300 a share, then the dividend should increase to about $4.50 a share after this March. AAPL share price has risen more than 50%, since the last increase in March of 2019 and hopefully the dividend payout will do the same, to maintain a 1.5% dividend at the time of increase.

And hopefully, by March of 2021, the newly 2020 increased dividend to keep it at 1.5%, will once again be less than 1% of AAPL new share price.