tmay

About

- Username

- tmay

- Joined

- Visits

- 616

- Last Active

- Roles

- member

- Points

- 10,725

- Badges

- 2

- Posts

- 6,470

Reactions

-

Despite potshots, Intel & Samsung want to make Apple Silicon

TSMC will have a 5 nm capable plant in Arizona. All newer, higher density, nodes will be sourced thru TSMC Taiwancharlesatlas said:tmay said:I'd assume that Apple would be happy to get more leading edge fab capacity in the future, especially from Intel, to burnish its "made in U.S.A" credentials, if nothing else.

TSMC is building a fabrication plant in Arizona to be finished in a few years. And TSMC will have 3nm on the market before Intel even moves to 7nm. Which would you think Apple would consider "leading edge."

https://www.anandtech.com/show/16823/intel-accelerated-offensive-process-roadmap-updates-to-10nm-7nm-4nm-3nm-20a-18a-packaging-foundry-emib-foveros

https://images.anandtech.com/doci/16823/Intel Accelerated Briefings FINAL-page-006.jpgIntel Renames The Nodes: ‘Mine is Smaller’

The problem with simply posting Intel’s roadmap here is that the news is two-fold. Not only is Intel disclosing the state of its technology for the next several years, but the names of the technology are changing to better align with common industry norms.

It is no secret that having "Intel 10nm" being equivalent to "TSMC 7nm", even though the numbers actually have nothing to do with the physical implementation, has ground at Intel for a while. A lot of the industry, for whatever reason, hasn’t learned that these numbers aren’t actually a physical measurement. They used to be, but when we moved from 2D planar transistors to 3D FinFET transistors, the numbers became nothing more than a marketing tool. Despite this, every time there’s an article about the technology, people get confused. We’ve been talking about it for half a decade, but the confusion still remains.

To that end, Intel is renaming its future process nodes. Here’s the roadmap image, but I’ll be breaking it down piece by piece.

2020, Intel 10nm SuperFin (10SF): Current generation technology in use with Tiger Lake and Intel’s Xe-LP discrete graphics solutions (SG1, DG1). The name stays the same.

2021 H2, Intel 7: Previously known as 10nm Enhanced Super Fin or 10ESF. Alder Lake and Sapphire Rapids will now be known as Intel 7nm products, showcasing a 10-15% performance per watt gain over 10SF due to transistor optimizations. Alder Lake is currently in volume production. Intel’s Xe-HP will now be known as an Intel 7 product.

2022 H2, Intel 4: Previously known as Intel 7nm. Intel earlier this year stated that its Meteor Lake processor will use a compute tile based on this process node technology, and the silicon is now back in the lab being tested. Intel expects a 20% performance per watt gain over the previous generation, and the technology uses more EUV, mostly in the BEOL. Intel’s next Xeon Scalable product, Granite Rapids, will also use a compute tile based on Intel 4.

2023 H2, Intel 3: Previously known as Intel 7+. Increased use of EUV and new high density libraries. This is where Intel’s strategy becomes more modular – Intel 3 will share some features of Intel 4, but enough will be new enough to describe this a new full node, in particular new high performance libraries. Nonetheless, a fast follow on is expected. Another step up in EUV use, Intel expects a manufacturing ramp in the second half of 2023 with an 18% performance per watt gain over Intel 4.

2024, Intel 20A: Previously known as Intel 5nm. Moving to double digit naming, with the A standing for Ångström, or 10A is equal to 1nm. Few details, but this is where Intel will move from FinFETs to its version of Gate-All-Around (GAA) transistors called RibbonFETs. Also Intel will debut a new PowerVia technology, described below.

2025, Intel 18A: Not listed on the diagram above, but Intel is expecting to have an 18A process in 2025. 18A will be using ASML’s latest EUV machines, known as High-NA machines, which are capable of more accurate photolithography. Intel has stated to us that it is ASML’s lead partner when it comes to High-NA, and is set to receive the first production model of a High-NA machine. ASML recently announced High-NA was being delayed- when asked if this was an issue, Intel said no, as the timelines for High-NA and 18A are where Intel expects to intersect and have unquestioned leadership.

Intel has confirmed to us that Intel 3 and Intel 20A will be offered to foundry customers (but hasn’t stated if Intel 4 or Intel 7 will be).

To bring this altogether in a single table, with known products, we have the following:

Intel's Process Node Technology Old Name New Name Roadmap Products Features 10SF 10SF Today Tiger Lake

SG1

DG1

Xe-HPC Base Tile

Agilex-F/I FPGASuperMIM

Thin Film Barrier

Volume 10nm

On sale today10ESF Intel 7 2021 H2 products Alder Lake (21)

Raptor Lake (22)?

Sapphire Rapids (22)

Xe-HP

Xe-HPC IO Tile10-15% PPW

Upgraded FinFET

ADL in Ramp today7nm Intel 4 2022 H2 ramp

2023 H1 productsMeteor Compute Tile

Granite Compute Tile20% PPW vs 7

More EUV

Silicon in Lab7+ Intel 3 2023 H2 products - 18% PPW vs 4

Area Savings

More EUV

New Perf Libraries

Faster Follow On5nm Intel 20A 2024 - RibbonFET

PowerVia5+ Intel 18A 2025 Unquestioned Leadership 2nd Gen Ribbon

High NA EUV

It still may be the case that TSMC will remain the leader transitioning to "angstrom" nodes. I only point out that Intel isn't actually out of the competition; they were more correctly, unwilling to work with fabless customers like Apple, Qualcomm, and Nvidia, and they were known to have driven into a 10nm (7nm TSMC equivalent) ditch half a decade ago, that they are just now exiting.

-

China increases power cuts, 'scared' suppliers look to leave country

It's quite true that PRC needs to improve its productivity, especially since the population is aged and a proportionally smaller workforce is supporting the economy than 50 years ago when they joined the global economy. The PRC is also attempting population increases, allowing two, or possibly more births for the Majority Han population; Minorities not so much. There are predictions that the PRC economy will peak without "getting rich", and it is likely that they will see severe population declines.get serious said:I don't envy the Chinese leadership. Hard choices are being made trying to move 1 1/2 Billion people (5x the U.S.) from a 19th century agrarian society into the 21st century. Coal has to go. A hard choice but the poisoned air of northeast china is causing serious political challenges for the CCP. Just like the U.S. in the 1970's-1980's, China has decided to focus on "clean"and profitable industries that enhance the environment, while discouraging "dirty" low profit industries. If steel mills have to move so be it, a more efficient software industry or robotics plant can take it's place.

Steel production is likely the largest component of industrial energy use, and as a major component of China's economy is driven by infrastructure growth, it is unlikely to be reduced by much.

China shot itself in the foot by "boycotting" Australian coal, a result of broken diplomacy between the two. I would put this blunder squarely on Xi Xinping.

-

China increases power cuts, 'scared' suppliers look to leave country

https://syncretica.substack.com/p/rectification-campaign-to-energyRectification Campaign to Energy Crunch

How Chinese politics is leading to a chilly winter in Europe

Energy markets are a hot topic now with gas prices going vertical in Europe and coal prices breaking all time highs. There have been numerous hypotheses lodged online blaming some very plausible causes including reduced gas storage and nuclear and some where the causal link appears to be missing, like renewables. Renewables are variable, but without them Europe would undoubtedly need more gas and be in more strife.

Over the last year I’ve been working on a project with ANU on China’s coal markets and logistics and how domestic drivers lead to massive changes in imports. This focus has perhaps given me a different lens to look through recent energy market developments that I will briefly present here.

China’s energy markets and global markets, especially for LNG and pipeline gas have become increasingly integrated over the last five years.

...

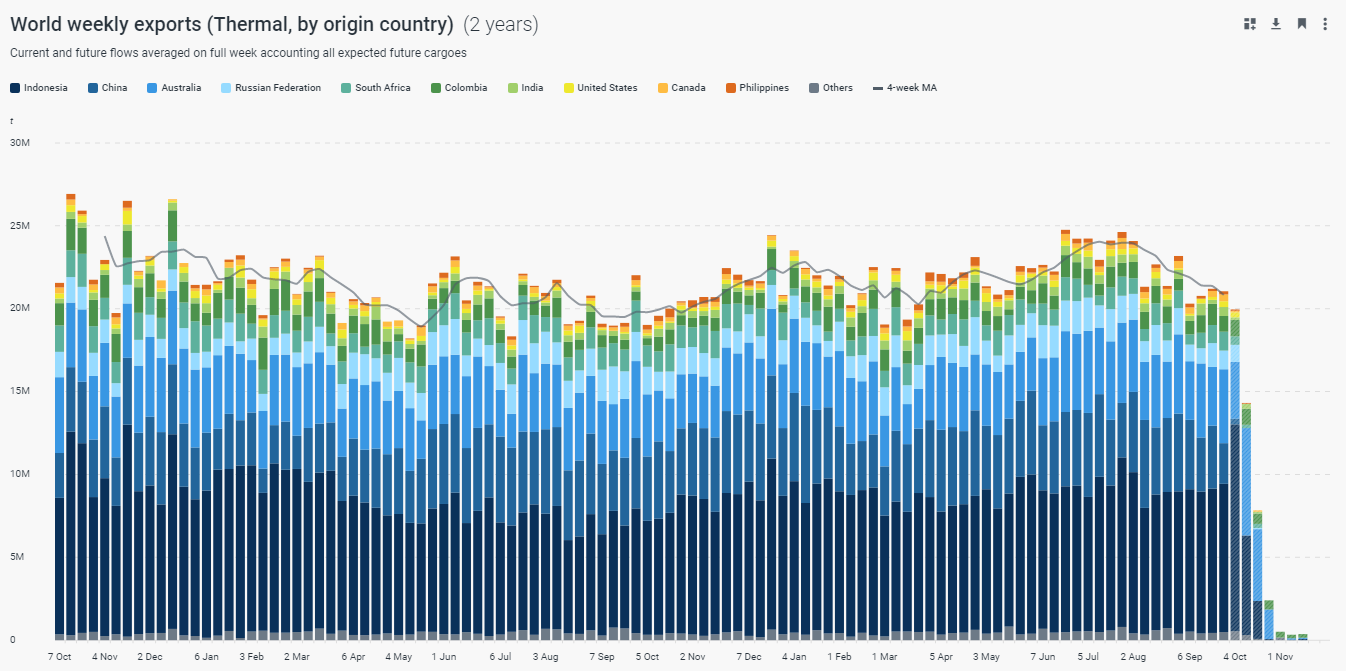

By mid to late 2020, coal was looking to be in serious trouble. Chinese inventories were high and shipping data showed that much of the supply of coal to southern China was now coming from Northern China ports squeezing leaving little room for thermal coal imports and not just from Australia which was singled out for special treatment. Then something strange happened.

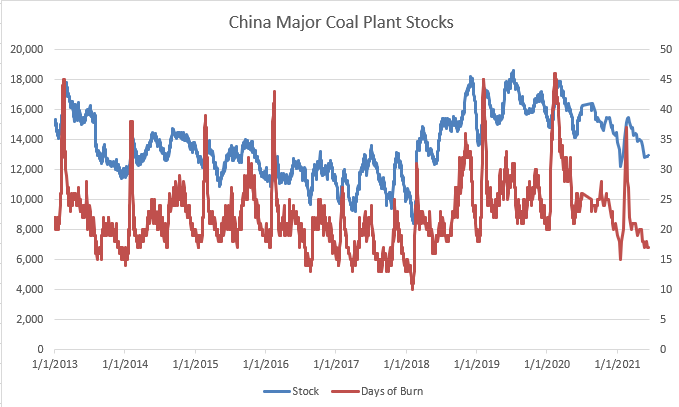

From early 2021 China started to draw its coal inventories down hard and deliveries from Northern Ports to Southern ports started to drop (red arrow above). This might not be a big deal, but China’s power demand was flying at the time with electricity consumption up ~14% yoy in April-June and steel output up 21%. Coal stocks started to decline rapidly as can be seen below.

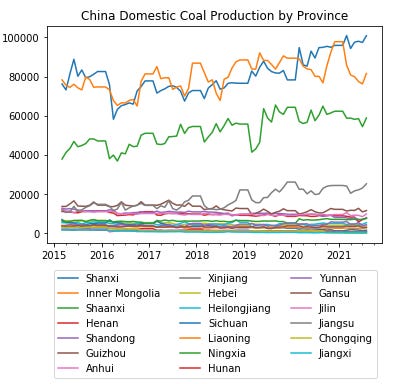

From early 2021 China started to draw its coal inventories down hard and deliveries from Northern Ports to Southern ports started to drop (red arrow above). This might not be a big deal, but China’s power demand was flying at the time with electricity consumption up ~14% yoy in April-June and steel output up 21%. Coal stocks started to decline rapidly as can be seen below. So demand was very strong but supply fell behind sharply both for domestic production and imports. China’s coal production is heavily concentrated in a few provinces as you can see below:

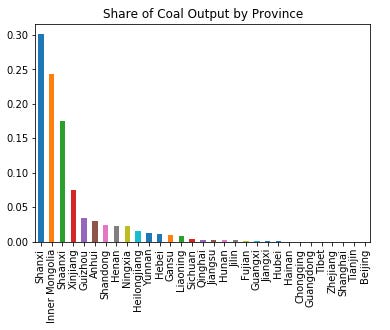

So demand was very strong but supply fell behind sharply both for domestic production and imports. China’s coal production is heavily concentrated in a few provinces as you can see below: Over this period Inner Mongolia and Shaanxi output was poor - especially in the context of surging electricity consumption driven by industrial output of metals.

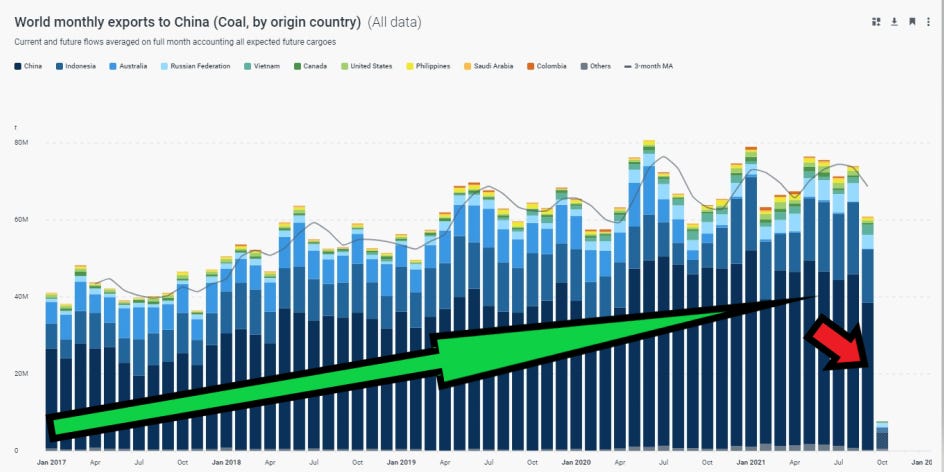

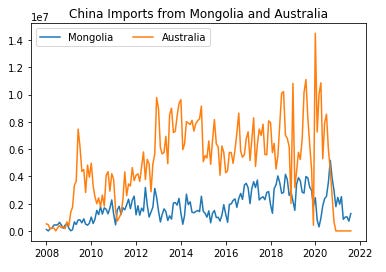

Over this period Inner Mongolia and Shaanxi output was poor - especially in the context of surging electricity consumption driven by industrial output of metals.  Imports were also weak from two major suppliers: Australia for political reasons, and Mongolia ostensibly for COVID reasons.

Imports were also weak from two major suppliers: Australia for political reasons, and Mongolia ostensibly for COVID reasons.

There is however another possible reason. During this period there was something of an anticorruption crackdown in Inner Mongolia which borders Mongolia. Decisions on mine approvals and the like are invariably contentious, especially during a period where the government is talking about greening the economy and commodity imports are often a source of graft. This article in Guancha may provide the answer.

You can run that via google translate, but circa March of this year Xi was making explicit reference to anticorruption measures around the coal sector in Inner Mongolia. The collapse in imports and production over this period likely led to a shortage of approximately 30MT attributable to lost production and another 12MT from Mongolian imports. If you look at global seaborne coal imports, that is about two months of global imports, including China.

-

Activists want Apple import ban over forced labor

FFS George.GeorgeBMac said:The night market in Hami, Xinjiang is filled with customers on July 16, with a young Uygur girl in traditional costumes performing folk dances. Photo: IC These poor people are obviously horribly oppressed.

These poor people are obviously horribly oppressed.

Happily pushing the PRC's propaganda, again.

-

EU proposing USB-C smartphone charger standard

The EU has only now updated the previous standard, which was Micro USB, to USB Type C, and the old standard is allowed until late 2024 during the transition.GeorgeBMac said:tmay said:

At the time the standard was released in 2010, Apple was still using the 30 pin connector. Apple was allowed a Micro USB to 30 pin adaptor to meet the EU standard.GeorgeBMac said:jungmark said:

They tried and failed. Since then lightning and usb-c were developed. It they were forced to use micro USB, Europe would be stuck using microUSB today.dowhilest said:Good Lord, I knew the ardent Apple lovers would oppose this.

You're all forgetting that the EU did the same thing for microUSB in 2008/2009. This isn't new.

Of course Apple will gripe and groan about it because their phones don't come with a charger and they want to sell you one.

Most phones sold today have a USB-C port. This stalwart, hold-out attitude from Apple for accepting industry standards is a carry over from Apple of the 90s. It's fascinating.

Why?

In late 2012, Apple introduced the Lightning connector, an innovation at the time, and this time Apple was allowed a Micro USB to Lightning adaptor, again meeting the standard.

Later in the decade, Android OS phones began appearing with USB Type C connectors, and met the EU requirement with, guess what, a Micro USB to USB Type C adaptor.

If the EU had not allowed the adaptor in 2010, there would have been no way for the USB Type C connector to be implemented in any smartphone with the existing standard.

As a practical matter, and given that iPhone is about a 30% user share of the EU market, it actually makes sense that there be multiple connection standards via an adaptor, to allow innovation, given that the adaptor is about a 2 gram item, so a minimal contributor to e-waste.

The irony of this is that Apple is almost certainly heading to a wireless charging future and a transition to USB Type C from Lightning doesn't make any sense to them, even given that the law doesn't come into effect until 2024.

In the meantime, Apple has eliminated the charger from its iPhone packaging, that being the by far the largest component of the e-waste stream.

I just wanted to reiterate that the Micro USB connector was, and is, unloved by the public.So you are assuming that the EU would not have upgraded to current technology.I don't see any reason to believe that.