How Apple's $1 billion Intel modem purchase happened

The swift change in fortunes for Intel's modem business in the months following Qualcomm's settlement with Apple may have taken some by surprise, but the processor producer has gone through quite the journey in the process. AppleInsider details how Intel's modem arm prospered then became an acquisition target.

Aside from the Apple connection, the purchase also gave Intel a leg up for many wireless technologies, including Wi-Fi, 3G, WiMAX, and LTE. Intel was quick to put the acquisition to work, creating modems that would end up being used in notebooks, netbooks, tablets and smartphones equipped with Intel processors.

At around the same time as the acquisition, Apple switched from using baseband chips from Infineon for modems supplied by Qualcomm in the iPhone 4S. For earlier models, Apple primarily used Infineon chips for communications, though it also used Qualcomm for the CDMA iPhone 4.

Qualcomm became the sole supplier of iPhone modems for Apple, up until the iPhone 7. For that model, Intel became one of two suppliers for the iPhone modem, alongside Qualcomm, with each providing roughly half of the modem orders.

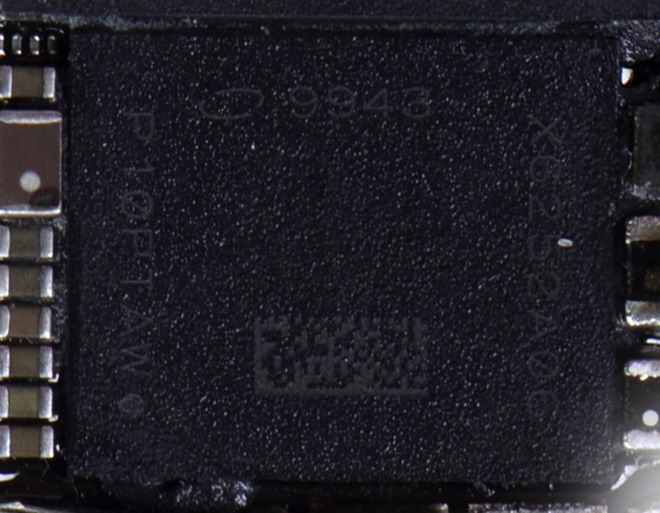

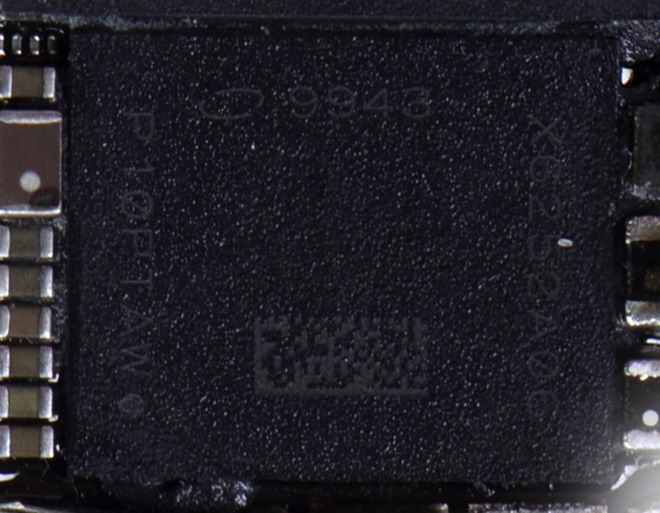

The Intel Baseband Processor PMB9943 discovered during an iPhone 7 teardown in 2016

Unexpectedly, for the 2018 iPhone releases, the iPhone XS, iPhone XS Max, and iPhone XR did not include Qualcomm modems at all. For Intel, this meant it was providing all of the modems destined for use in all three models for that year, though as it was later discovered, the decision wasn't one entirely made by Apple.

In 2016, the South Korean Fair Trade Commission hit Qualcomm with a fine of 1.03 trillion won ($853 million at the time), under the accusation the chip maker forced its clients to sign licensing contracts when selling chips, at the same time as not paying for the use of patents held by the device producers it is supplying.

A US Federal Trade Commission suit was filed in early 2017, alleging Qualcomm of forcing Apple into an exclusivity deal to buy its baseband chips. As Apple sought to lower patent royalty payments due to Qualcomm, the iPhone maker signed a deal with the firm to buy only its modems between 2011 and 2016, in order to secure the cheaper payments.

A few days after the FTC filing, Apple filed its own lawsuit against Qualcomm, claiming it was due nearly $1 billion in withheld payments from Qualcomm, a form of rebate on the patent licensing fees as part of the agreement. It was alleged the billion dollars was held in "retaliation for responding truthfully to law enforcement agencies," referring to the FTC complaint against Qualcomm.

The high-stakes legal action then turned into a world tour, with assorted suits and countersuits filed in multiple countries. Regulatory interest was also rising, with Qualcomm narrowly avoiding the majority of a fine in Taiwan by promising to invest $700 million into the country, while the European Union landed it with 997 million euros in fines.

While not a direct target of the lawsuits, Intel itself was dragged into the situation after Qualcomm accused Apple of handing trade secrets to Intel, by providing Qualcomm's source code and other confidential information to the rival chip producer.

The courtroom battles also led to limited sales bans for some models of iPhones in Germany and China, though Apple tried to work around them while legal action was ongoing.

During the FTC lawsuit against Qualcomm in January 2019, it was revealed Apple had intended to use Qualcomm modems alongside Intel's for the 2018 iPhones, but were flatly refused. Testimony from Apple COO Jeff Williams claimed Qualcomm did not want to provide support to Apple in terms of new designs since it filed its billion-dollar lawsuit against the chip company, to the level that Qualcomm CEO Steve Mollenkopf refused outright to Williams directly.

Qualcomm CEO Steve Mollenkopf

The refusal to work with Apple led to the use of just Intel modems in that generation of iPhone. "The strategy was to dual source in 2018 as well," Williams testified. "We were working toward doing that with Qualcomm, but in the end they would not support us or sell us chips."

The FTC lawsuit trial ended that same month, but a ruling was not issued until may, finding in favour of the FTC and ordering Qualcomm to remedy how it licenses its chips. Qualcomm has attempted to fight the orders and appeal, and despite seemingly failing to delay their implementation under its own initiative, it has seemingly been thrown a lifeline by the US Department of Justice, which has asked for a temporary halt on enforcement due to Qualcomm's expertise in 5G networking.

In July, it was reported the European Commission was considering levying a second fine against Qualcomm, again relating to its business practices in the modem market.

While the deal involved a payment from Apple to Qualcomm for an undisclosed amount, believed to be between $4.5 billion and $4.7 billion based on Qualcomm's regulatory filings, it also includes arrangements for ongoing royalty payments for components supplied to Apple. Crucially, Apple agreed to a modem licensing deal with Qualcomm for a six-year period effective from April 1, 2019, with options to extend the period.

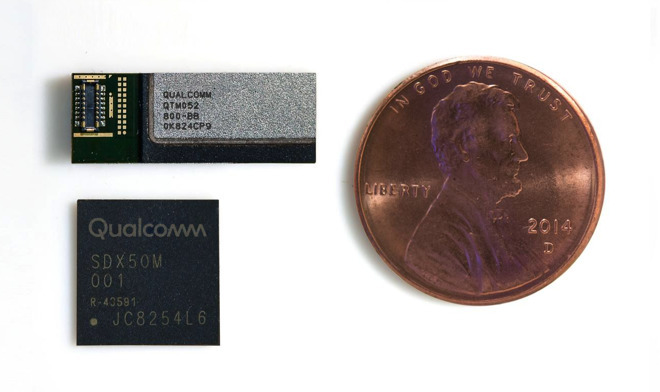

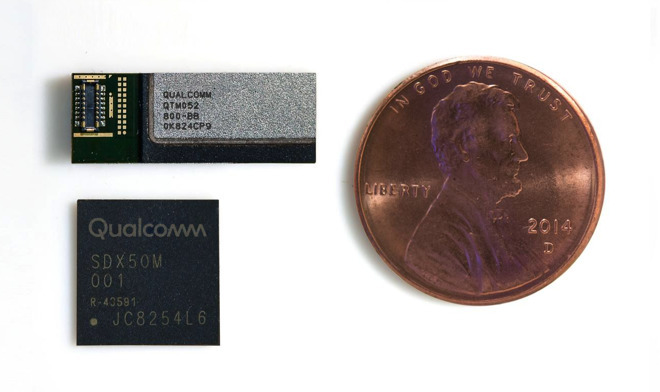

Qualcomm's 5G-supported hardware. Coin for scale.

The same day, Intel issued a statement advised it was exiting the 5G smartphone modem business, with an intention to examine the opportunities in adding 4G and 5G modems to PCs and Internet of Things devices, as well as its 5G network infrastructure business. As part of the announcement, Intel advised it would continue supplying 4G modems as part of existing commitments to customers, but did not anticipate launching 5G modems at all.

In an interview with Yahoo Finance at that time, Intel CEO Bob Swan explained the reasoning behind the exit. "We concluded that in the modem for the smartphone, where we really only had one customer, that the likelihood and the probability that we were going to be able to make money was just not there."

Swan's comment very likely refers to Apple as Intel's "one customer."

Based on the timing of the announcement and Apple's typical design and development cycle for the iPhone, it is likely that Intel modems will continue to be the modem of choice for the 2019 iPhones, as it is too late to integrate Qualcomm modems into the design.

There is the belief that Qualcomm will be providing 5G-capable modems for the 2020 iPhone range, and that Apple was evaluating Qualcomm's offerings in tandem with settlement negotiations.

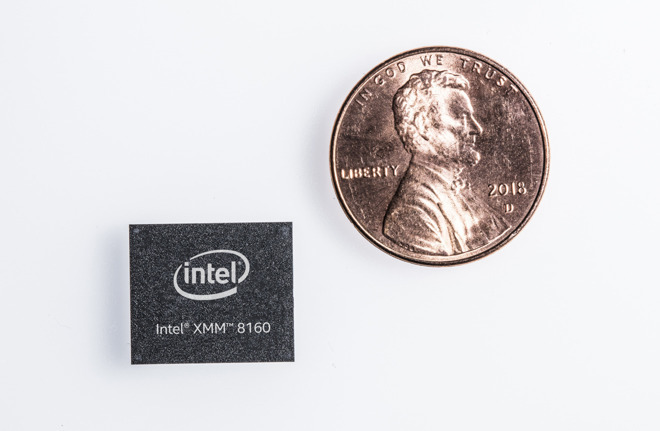

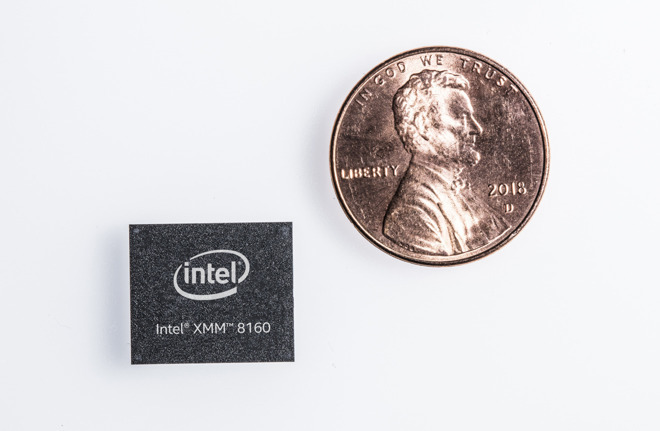

Intel's XMM 8160 5G modem. Coin for scale.

An April report suggested Apple was unhappy with Intel's progress on the modem, with the chip maker allegedly missing development deadlines and with it seemingly going to miss cutoff points for sample chips in the early summer. Apple was said to have "lost confidence" in Intel's ability to delivery on time.

If it did arrive in time, the Intel 5G modem would have given Apple the ability to market a 5G iPhone in 2020 without needing to rely on the courts finding in its favor and for legal action with Qualcomm to end. With the settlement, as well as Qualcomm's already-launched 5G modems, Apple has since secured itself with a supply of the component it needs for the model, and so it does not have to deal with Intel's missed deadlines at all.

The Qualcomm situation may only be a temporary measure for Apple, as it is believed to be in development of its own 5G-equipped baseband technology. Current speculation has Apple completing its development and producing the component itself by 2022 or 2023.

The cellular portfolio was said to include 6,000 patent assets associated with 3G, 4G, and 5G cellular standards, and 1,700 assets about wireless implementation technologies. The second portfolio covered just 500 patents with a "broad applicability" across both the semiconductor and electronics industries.

Barely a fortnight later, Intel withdrew plans for its asset auction, due to claims an unnamed buyer was attempting to acquire a "substantial portion" of the patent portfolio.

That buyer turned out to be Apple, which paid out an estimated $1 billion for more than 17,000 wireless technology patents, intellectual property, and key personnel. The transaction is expected to conclude before the end of 2019.

Apple was previously believed to have been attempting to acquire Intel's smartphone modem business for some time, with negotiations allegedly starting back in 2018. On July 22, reports suggested the discussions had reached an "advanced" stage, and that a deal could be struck within days, a report that evidently turned out to be true.

The purchase is expected to be extremely beneficial to Apple, considering its own internal 5G development effort. Owning Intel's IP asp will give it some extra defenses from patent infringement suits sprung by modem vendors, possibly including Qualcomm, while bringing onboard Intel's talent and modem knowledge could help accelerate Apple's existing efforts.

Part of these efforts included hiring luminaries in the modem world, including former Intel executive Umashankar Thyagarajan, an engineer thought to have played a key role in the development of Intel's XMM 8160 5G modem.

Intel jumping in

Intel's modem ambitions largely got started from the acquisition of the wireless arm of Infineon in 2011, which included engineers who previously worked on baseband chips used in the iPhone from 2007 until 2010. The german operation turned wholesale into an Intel outfit, but remained the main hub of operations for the company's modem work.Aside from the Apple connection, the purchase also gave Intel a leg up for many wireless technologies, including Wi-Fi, 3G, WiMAX, and LTE. Intel was quick to put the acquisition to work, creating modems that would end up being used in notebooks, netbooks, tablets and smartphones equipped with Intel processors.

At around the same time as the acquisition, Apple switched from using baseband chips from Infineon for modems supplied by Qualcomm in the iPhone 4S. For earlier models, Apple primarily used Infineon chips for communications, though it also used Qualcomm for the CDMA iPhone 4.

Qualcomm became the sole supplier of iPhone modems for Apple, up until the iPhone 7. For that model, Intel became one of two suppliers for the iPhone modem, alongside Qualcomm, with each providing roughly half of the modem orders.

The Intel Baseband Processor PMB9943 discovered during an iPhone 7 teardown in 2016

Unexpectedly, for the 2018 iPhone releases, the iPhone XS, iPhone XS Max, and iPhone XR did not include Qualcomm modems at all. For Intel, this meant it was providing all of the modems destined for use in all three models for that year, though as it was later discovered, the decision wasn't one entirely made by Apple.

Apple and Qualcomm Lawsuits

Apple and Qualcomm's business relationship has been the subject of legal action and regulatory intervention for a number of years, with the main focus being how Qualcomm handles its business deals.In 2016, the South Korean Fair Trade Commission hit Qualcomm with a fine of 1.03 trillion won ($853 million at the time), under the accusation the chip maker forced its clients to sign licensing contracts when selling chips, at the same time as not paying for the use of patents held by the device producers it is supplying.

A US Federal Trade Commission suit was filed in early 2017, alleging Qualcomm of forcing Apple into an exclusivity deal to buy its baseband chips. As Apple sought to lower patent royalty payments due to Qualcomm, the iPhone maker signed a deal with the firm to buy only its modems between 2011 and 2016, in order to secure the cheaper payments.

A few days after the FTC filing, Apple filed its own lawsuit against Qualcomm, claiming it was due nearly $1 billion in withheld payments from Qualcomm, a form of rebate on the patent licensing fees as part of the agreement. It was alleged the billion dollars was held in "retaliation for responding truthfully to law enforcement agencies," referring to the FTC complaint against Qualcomm.

The high-stakes legal action then turned into a world tour, with assorted suits and countersuits filed in multiple countries. Regulatory interest was also rising, with Qualcomm narrowly avoiding the majority of a fine in Taiwan by promising to invest $700 million into the country, while the European Union landed it with 997 million euros in fines.

While not a direct target of the lawsuits, Intel itself was dragged into the situation after Qualcomm accused Apple of handing trade secrets to Intel, by providing Qualcomm's source code and other confidential information to the rival chip producer.

The courtroom battles also led to limited sales bans for some models of iPhones in Germany and China, though Apple tried to work around them while legal action was ongoing.

During the FTC lawsuit against Qualcomm in January 2019, it was revealed Apple had intended to use Qualcomm modems alongside Intel's for the 2018 iPhones, but were flatly refused. Testimony from Apple COO Jeff Williams claimed Qualcomm did not want to provide support to Apple in terms of new designs since it filed its billion-dollar lawsuit against the chip company, to the level that Qualcomm CEO Steve Mollenkopf refused outright to Williams directly.

Qualcomm CEO Steve Mollenkopf

The refusal to work with Apple led to the use of just Intel modems in that generation of iPhone. "The strategy was to dual source in 2018 as well," Williams testified. "We were working toward doing that with Qualcomm, but in the end they would not support us or sell us chips."

The FTC lawsuit trial ended that same month, but a ruling was not issued until may, finding in favour of the FTC and ordering Qualcomm to remedy how it licenses its chips. Qualcomm has attempted to fight the orders and appeal, and despite seemingly failing to delay their implementation under its own initiative, it has seemingly been thrown a lifeline by the US Department of Justice, which has asked for a temporary halt on enforcement due to Qualcomm's expertise in 5G networking.

In July, it was reported the European Commission was considering levying a second fine against Qualcomm, again relating to its business practices in the modem market.

Settlements and departures

On April 16, an unexpected statement was released confirming Apple and Qualcomm had reached a deal to settle all ongoing litigation between the two companies globally, including suits by Qualcomm against Apple's contract manufacturers.While the deal involved a payment from Apple to Qualcomm for an undisclosed amount, believed to be between $4.5 billion and $4.7 billion based on Qualcomm's regulatory filings, it also includes arrangements for ongoing royalty payments for components supplied to Apple. Crucially, Apple agreed to a modem licensing deal with Qualcomm for a six-year period effective from April 1, 2019, with options to extend the period.

Qualcomm's 5G-supported hardware. Coin for scale.

The same day, Intel issued a statement advised it was exiting the 5G smartphone modem business, with an intention to examine the opportunities in adding 4G and 5G modems to PCs and Internet of Things devices, as well as its 5G network infrastructure business. As part of the announcement, Intel advised it would continue supplying 4G modems as part of existing commitments to customers, but did not anticipate launching 5G modems at all.

In an interview with Yahoo Finance at that time, Intel CEO Bob Swan explained the reasoning behind the exit. "We concluded that in the modem for the smartphone, where we really only had one customer, that the likelihood and the probability that we were going to be able to make money was just not there."

Swan's comment very likely refers to Apple as Intel's "one customer."

Based on the timing of the announcement and Apple's typical design and development cycle for the iPhone, it is likely that Intel modems will continue to be the modem of choice for the 2019 iPhones, as it is too late to integrate Qualcomm modems into the design.

There is the belief that Qualcomm will be providing 5G-capable modems for the 2020 iPhone range, and that Apple was evaluating Qualcomm's offerings in tandem with settlement negotiations.

5G or not 5G

Despite declaring it is exiting the 5G modem business entirely, Intel was reportedly working on a 5G modem. Originally intended to be ready to support consumer device launches in 2020, the XMM 8160 5G multimode modem was anticipated to be shipping in the second half of 2019, but this was pushed back to 2020.

Intel's XMM 8160 5G modem. Coin for scale.

An April report suggested Apple was unhappy with Intel's progress on the modem, with the chip maker allegedly missing development deadlines and with it seemingly going to miss cutoff points for sample chips in the early summer. Apple was said to have "lost confidence" in Intel's ability to delivery on time.

If it did arrive in time, the Intel 5G modem would have given Apple the ability to market a 5G iPhone in 2020 without needing to rely on the courts finding in its favor and for legal action with Qualcomm to end. With the settlement, as well as Qualcomm's already-launched 5G modems, Apple has since secured itself with a supply of the component it needs for the model, and so it does not have to deal with Intel's missed deadlines at all.

The Qualcomm situation may only be a temporary measure for Apple, as it is believed to be in development of its own 5G-equipped baseband technology. Current speculation has Apple completing its development and producing the component itself by 2022 or 2023.

Up for Sale

The sharp exit from the 5G modem business and a self examination led Intel to announce in June it would hold an auction for its cellular wireless intellectual property. The plan involved a two-part auction of assets, covering two subject areas cellular and connected devices.The cellular portfolio was said to include 6,000 patent assets associated with 3G, 4G, and 5G cellular standards, and 1,700 assets about wireless implementation technologies. The second portfolio covered just 500 patents with a "broad applicability" across both the semiconductor and electronics industries.

Barely a fortnight later, Intel withdrew plans for its asset auction, due to claims an unnamed buyer was attempting to acquire a "substantial portion" of the patent portfolio.

That buyer turned out to be Apple, which paid out an estimated $1 billion for more than 17,000 wireless technology patents, intellectual property, and key personnel. The transaction is expected to conclude before the end of 2019.

Apple was previously believed to have been attempting to acquire Intel's smartphone modem business for some time, with negotiations allegedly starting back in 2018. On July 22, reports suggested the discussions had reached an "advanced" stage, and that a deal could be struck within days, a report that evidently turned out to be true.

The purchase is expected to be extremely beneficial to Apple, considering its own internal 5G development effort. Owning Intel's IP asp will give it some extra defenses from patent infringement suits sprung by modem vendors, possibly including Qualcomm, while bringing onboard Intel's talent and modem knowledge could help accelerate Apple's existing efforts.

Part of these efforts included hiring luminaries in the modem world, including former Intel executive Umashankar Thyagarajan, an engineer thought to have played a key role in the development of Intel's XMM 8160 5G modem.

Comments

Intel: “Apple, we’re having trouble delivering on our cell phone modem promises...”

Apple: “Would you consider selling off your IP?”

Intel: “We’ll think about it... oh, hell, YES we’ll take anything!”

The cause is uncertain.

As with most of these stories, it's worth considering what we don't know before jumping to a conclusion that the engineering was at fault. I think an educated guess is that Apple asked for A,B,C,D and Intel wanted to produce A,B,C because they needed to meet specs for others in the market. It's easier for Apple to spec, design, and manufacture EXACTLY what they need and only what THEY need.

Of course not. He's the king of dragons.

Afaik, there were no other vendors using Intel modems. I think [think] Apple was their only modem customer. It's why they were losing money. Component manufacture only makes sense at volume. Apple alone wasn't enough volume for intel to be profitable. I believe Intel took the initial losses hoping to grow it mobile business to include other vendors... piggybacking of their relationship with Apple. Problem was, Intel has always had a reputation for missing deadlines. Well earned reputation. Crappy, but totally okay for PC's. Not so for mobile. Mobile is a yearly grind. Incessant and unforgiving. Deliver the new chip or GTFOH. That XMM 8160 was rumored to have problems from the get go and never got back on track. Hopefully for Apple, there's some wheat in that chaff from Intel.

They could make a great competing modem that they could license.

Can you imagine the shock of Fandroids discovering their super fast 5G modem in their Android device is made by Apple?

Does the current administration want to go easy on Qualcomm in exchange for 5G network hardware they will make? I never understood why they don’t want Qualcomm to get its comeuppance.

The US gov't doesn't want Qualcomm hindered because they fear harming Qualcomm harms the US' position in 5G infrastructure. Chinese companies like Huawei already have strong headway towards a dominant position in building out 5G infrastructure. The US gov't doesn't want the world's 5G backbone to be Chinese.

But then, his avatar has him holding the hammer backwards, so I guess it checks out.

So, while Trump's Trade War blocked the only viable competitor to Qualcomm (Huawei even offered its chips to Apple when it looked like they were stuck between a rock and a hard place) the so called U.S. Justice Department ran interference for Qualcomm, thus forcing Apple to capitulate to the criminals.

So much for Free Market competition. Thanks Trump! You screwed us again.

Apple lost the 5G battle, but it paid Intel $1 billion to win the war

https://www.cnbc.com/2019/07/26/apple-spends-1-billion-to-buy-intel-modem-business.html

That's neither entirely true nor exactly prescient. Apple agreed to a 6 year licensing agreement and a multi-year modem agreement. Afaik, that actual number of years wasn't mentioned.

The presumption here must be that Intel's tech just needs smarter people working on it. The 8160 could simply be poop that no amount of time will save. As Apple works to improve from where they are now, how long does it take for Apple to reach parity with Qualcomm's current tech? 1 year? 2? 3? While they're reaching parity with current tech, Qualcomm isn't standing still waiting. How long would it take for Apple to reach parity with Qualcomm's continued improvements? Who knows right? Only time will tell. But that headline won't tell anyone anything.

I can imagine that headline from CNBC being similar to the mLED headline from Monday:

Apple considering micro LED display for 2020 Apple Watch

That same headline was predicted in 2016, 2017, and 2018.Needs more HUGERer TEXT.

Joking apart, QC will not be too concerned about Apple's 5G chops for a while.

Both QC and Huawei will be on their 3rd, 4th or even 5th generation 5G hardware by the the time Apple releases anything and 5G means much more than 'phones'. The real 5G commercial success could actually be in the automobile industry but 5G will end up pretty much everywhere and QC will very much be in every sector where 5G is implemented (along with Huawei and Samsung). In fact, if this new product ships with 5G (we won't know until the second week of August), Samsung will be hot on its heels:

https://www.themobileindian.com/news/honor-announces-honor-vision-tv-with-a-new-honghu-818-chipset-smart-pop-up-camera-27318

Perhaps the biggest news was that those washer/driers were not removed after this intel deal. What does that tell you? ;-) (apart from that trio having the cleanest Y-fronts in the business)

So first you claim: "That headline says pretty much nothing and the article says even less. It's a clickbait recap of what we already know. "

Now you switch to: "There's nothing true about that headline or the article "

So, which one is it? Did you already know it? Or is it completely false?

You are obviously just making stuff up because, for some reason, the article seemed to offend you.