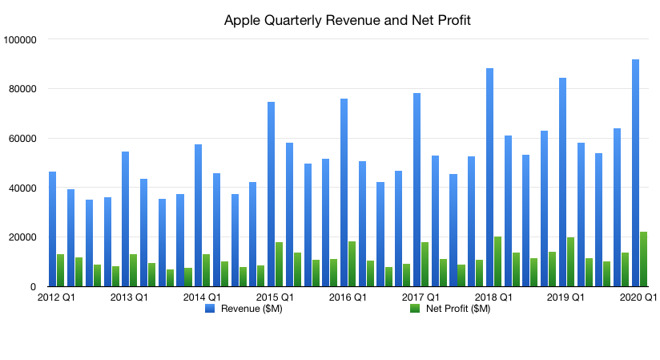

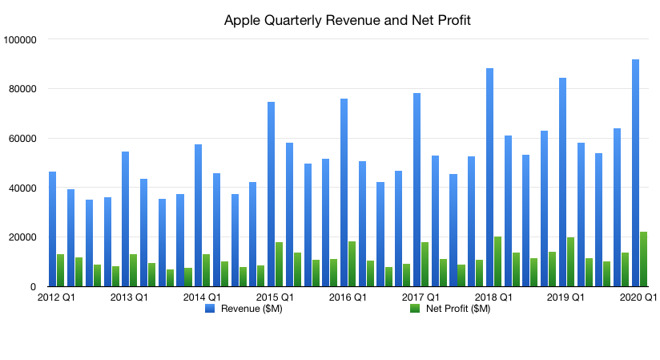

Apple earns record $91.8B in first quarter revenue on strong iPhone 11 sales

Apple generated $91.8 billion in revenue for the first quarter of its fiscal 2020 with an earnings per share of $4.99, financial results revealed on Tuesday, making for the company's best performance in history.

Apple CEO Tim Cook on stage at WWDC 2019

Overall earnings are up 9% from Q1 2019, when Apple earned $84.3 billion. That year-ago quarter was notable, as the tech giant revised its guidance downward over lower-than-expected sales of iPhones in the period.

Apple's own guidance from last quarter forecast revenue between $85.5 billion and $89.5 billion, with operating expenses between $9.6 billion and $9.8 billion, and a gross margin between 37.5% and 38.5%. For the quarter, Apple reports operating expenses of $9.6 billion and a gross margin of 38.4 percent.

Ahead of the results, the Wall Street consensus estimated revenue at around $88.4 billion, with an earnings per share of around $4.54.

"We are thrilled to report Apple's highest quarterly revenue ever, fueled by strong demand for our iPhone 11 and iPhone 11 Pro models, and all-time records for Services and Wearables," said Apple CEO Tim Cook. "During the holiday quarter our active installed base of devices grew in each of our geographic segments and has now reached over 1.5 billion. We see this as a powerful testament to the satisfaction, engagement and loyalty of our customers -- and a great driver of our growth across the board."

The iPhone earned $56 billion in the quarter, up from $52 billion last year. It was also the first full quarter of sales for the iPhone 11, iPhone 11 Pro, and iPhone 11 Pro Max, having been available for roughly two weeks at the end of the previous quarter.

The quarter is also the first full sales period for the seventh-generation 10.2-inch iPad and the Apple Watch Series 5, which launched in September. The AirPods Pro, 16-inch MacBook Pro, Mac Pro, and the Pro Display XDR were also launched during the quarter, but their smaller period of availability affects the impact they made on the results themselves.

Services revenue, a reliable growth sector for the company, saw revenue grow 17% to $12.7 billion, up year-on-year from $10.9 billion. The Wearables, Home, and Accessories category earned $10 billion, a nearly $3 billion rise from Q1 2019, iPad shrank 11% to $6 billion, and Mac contracted to 3% to $7.2 billion.

Guidance for the coming quarter is pegged at $63.0 billion to $67.0 billion with a gross margin between 38% and 39%. Operating expenses are expected to land between $9.6 billion and $9.7 billion.

Apple CEO Tim Cook on stage at WWDC 2019

Overall earnings are up 9% from Q1 2019, when Apple earned $84.3 billion. That year-ago quarter was notable, as the tech giant revised its guidance downward over lower-than-expected sales of iPhones in the period.

Apple's own guidance from last quarter forecast revenue between $85.5 billion and $89.5 billion, with operating expenses between $9.6 billion and $9.8 billion, and a gross margin between 37.5% and 38.5%. For the quarter, Apple reports operating expenses of $9.6 billion and a gross margin of 38.4 percent.

Ahead of the results, the Wall Street consensus estimated revenue at around $88.4 billion, with an earnings per share of around $4.54.

"We are thrilled to report Apple's highest quarterly revenue ever, fueled by strong demand for our iPhone 11 and iPhone 11 Pro models, and all-time records for Services and Wearables," said Apple CEO Tim Cook. "During the holiday quarter our active installed base of devices grew in each of our geographic segments and has now reached over 1.5 billion. We see this as a powerful testament to the satisfaction, engagement and loyalty of our customers -- and a great driver of our growth across the board."

The iPhone earned $56 billion in the quarter, up from $52 billion last year. It was also the first full quarter of sales for the iPhone 11, iPhone 11 Pro, and iPhone 11 Pro Max, having been available for roughly two weeks at the end of the previous quarter.

The quarter is also the first full sales period for the seventh-generation 10.2-inch iPad and the Apple Watch Series 5, which launched in September. The AirPods Pro, 16-inch MacBook Pro, Mac Pro, and the Pro Display XDR were also launched during the quarter, but their smaller period of availability affects the impact they made on the results themselves.

Services revenue, a reliable growth sector for the company, saw revenue grow 17% to $12.7 billion, up year-on-year from $10.9 billion. The Wearables, Home, and Accessories category earned $10 billion, a nearly $3 billion rise from Q1 2019, iPad shrank 11% to $6 billion, and Mac contracted to 3% to $7.2 billion.

Guidance for the coming quarter is pegged at $63.0 billion to $67.0 billion with a gross margin between 38% and 39%. Operating expenses are expected to land between $9.6 billion and $9.7 billion.

Comments

I wonder if AAPL continues to rise, will they be doing a split again sometime in the future?

It's crazy to think about that AAPL stock is actually worth over $2,000 a share now, pre-split number of course. Many people thought that it was insanely expensive and over valued when it was around 6-700 hundred, and look at where we are today. Those people and analysts were all dead wrong, which is nothing new when it comes to Apple.

AAPL more than doubled in the past 12 months. I guess we will see what happens in the future.

For purely psychological and selfish reasons, I'd like to see a split, simply because the amount of shares I own will multiply and it will look better on paper and I can have a bigger smile, even if the financials remain the same.

Now, as for your apparent annoyance at my opinions and intolerance for the naysayers and haters, you have the option to block me at any time and I’m gone from your radar. Or maybe if you complain hard enough to management they will ban me altogether. I’m about ready to can my membership in the various Apple tech blogs because of the constant negativity that pervades them all.

Vast improvement over previous generations in terms of hardware. Sweeping discounts from iPhone 11 down, and these results are still lower than Apple's maximum guidance for the year ago quarter (before it was adjusted down due to a profit warning).

Have you considered that the naysayers could have been right all along and that Apple's actions fall into line with what some here have actually gone on record as saying were necessary? And overdue.

Have you considered what a spring release, SE2 might represent?

That's without actually forgetting that the same proclamations you have just voiced - during Apple's blowout quarter - are basically a copy paste of what many say here every Q1 earnings call, and that for the last four years sales actually ended up being flat or falling?

Clearly something wasn't working, right? Apple has tried to remedy that on two important fronts. Will it be enough? Who knows but my bet is that if an affordable SE2 appears this spring, it could inject some spark into the iPhone business and be a move in the right direction.

If Apple saw everything as hunky dory, none of what has changed in its iPhone business since 2017 would have happened. Believe me, a lot has changed and it is because Apple knew it had to change things.

Terms are important and are not interchangeable based on the whims of the author. It affects the credibility and accuracy of the article and the site in general.