AppleInsider · Kasper's Automated Slave

About

- Username

- AppleInsider

- Joined

- Visits

- 52

- Last Active

- Roles

- administrator

- Points

- 10,949

- Badges

- 1

- Posts

- 66,634

Reactions

-

Tariffs not stopping Americans from wanting new iPhones with Apple Intelligence

Investment firm Morgan Stanley's latest US buyer survey shows record numbers intend to upgrade their iPhone -- and that they want Apple Intelligence, especially if they can also get a thin or foldable model.

Apple Intelligence is coming this fall

Morgan Stanley has been rapidly dropping its price target for Apple, starting 2025 at $275, then dropping to $252 in March because of fears of lower than expected iPhone upgrades. Then the company expected Apple to drop to between $200 and $210 because of tariffs, which were then so much worse than anticipated, that it predicted a drop to as little as $172.

So even while it maintained its own price target at $220, Morgan Stanley can't have been expecting a great response from buyers in its latest survey. But according to an investor note seen by AppleInsider, that's what it got.

From a survey of 3,300 US consumers, Morgan Stanley reports:- 51% of current users intend to upgrade in the next 12 months

- 40% are strongly interested in foldable or thin iPhones

- 80% of US users with Apple Intelligence have used it in the last six months

- 42% believe it's very or extremely important to have Apple Intelligence

That figure of 51% of current iPhone users intending to upgrade is an all-time high record for Morgan Stanley's surveys. While the survey presumably doesn't specify models, upgrading within the next year means users intending to buy new iPhones from any of the iPhone 16 range, the iPhone 17 range, or the expected iPhone 17e in February or March 2026.

Then 40% of US iPhone users said that they were "extremely interested" in foldable or thin iPhones.

The 42% of current users who think Apple Intelligence is very or extremely important, specifically think so for their next iPhone. Of the users intending to upgrade in the next 12 months, that figure rises to 54%.Apple Intelligence is a hit

While acknowledging the criticisms over Apple Intelligence, Morgan Stanley also reports that users are willing to put their money where their mouths are. Its survey said that if Apple monetized Apple Intelligence, on the average, users would be willing to pay up to $9.11 per month for it.

That's significant both because of how it's risen since the firm's September 2024 survey that said $8.17 per month, and for the breakdown of that average. Without detailing figures, Morgan Stanley says the average has risen because more users are willing to pay between $10 and $15 per month, and fewer users don't want to pay at all.

Morgan Stanley says it does not expect Apple to start charging for Apple Intelligence yet, but it believes a paywall will come. Its analysts now predict that monetizing Apple Intelligence could earn Apple tens of billions of dollars annually, at some point.

In the shorter term, Morgan Stanley expects an iPhone slim in September 2025, and says an iPhone Fold is increasingly likely for 2026. It expects that such form factor changes could bring Apple growth that is similar to what it had during the last major form redesigns with the iPhone X and iPhone 12.

That folding iPhone, though, is expected to cost $2000 or more. It's not clear if Morgan Stanley has incorporated this cost point into their survey or estimates.

Morgan Stanley does also note, though, that Apple is facing hurdles such as the unpredictability of Trump's "reciprocal" tariffs. There is also the issue of weakening demand for the iPhone in China.

Read on AppleInsider

-

Synology partially drops support for third-party drives in 2025 NAS range

Synology is pushing for consumers to buy its own brand of hard drives for its newest NAS appliances, with only certified drives getting the full suite of software support.

Older Synology NAS devices won't be affected by the drive changes

The cost of a network-attached storage (NAS) device could be split into two components, with the NAS itself as one part, while the drives that fill it make up the second. At higher capacities, the drives can be the more costly element to acquire, and often leads to users shopping around for deals on hard disks.

It appears that Synology is keen to earn more from users by getting them to purchase its own line of hard drives to go with the NAS.

Spotted by Hardwareluxx.de and confirmed by a press release on Synology's German-language website, the NAS maker is making changes to the way its drives software operates. For some models of NAS released in 2025, it will have a considerable preference to the use of Synology-branded or Synology-certified drives.

Synology says that its Plus series models shipping in 2025 will behave differently for third-party drives that haven't got the Synology certification. Officially sanctioned and deemed compatible drives will work with all of the features and support functions the NAS will offer, but others will not.

The limits of uncertified drives will include restrictions on pool creation, with them also missing out on volume-wide deduplication, lifespan analysis, and automatic hard drive firmware update features. The loss of these features for third-party drives could cause problems, such as users being unaware of issues until it's too late and data has already been lost.More warnings, more profits

While these features won't be available to uncertified third-party drives, the drives will still work with a NAS as storage. Warnings will be displayed about support, which could scare users into buying Synology's drives, but they should otherwise work fine.

The company adds that there won't be any changes to Plus models released in 2024 or in earlier years, with the exception of XS Plus models and rack-based editions.

The reason for the changes is put forward by Synology as a result of the success of its High-Performance series of drives. It's claimed that this will grant "the highest levels of security and performance, while also offering significantly more efficient support."

An alternative and fairly obvious reason for doing so is to earn more revenue from consumers kitting out the NAS. Rather than getting cheaper drives from another supplier, the changes will probably influence users into buying Synology's drives, so that they don't miss out on safety features.

Read on AppleInsider

-

iPhone & Mac tariff reprieve only temporary

Apple's reprieve from Trump's reciprocal tariffs against Chinese imports of iPhones and Macs is only temporary, as tariffs aimed at semiconductor imports will be arriving within a few months.

Tim Cook and Donald Trump in a meeting at the White House in 2018

Late on Friday, Apple was granted a massive benefit from President Donald Trump, in the form of tariff exemptions applying against imports from China. However, it seems that those exemptions will only be temporary, as other tariffs are on the way.

According to Commerce Secretary Howard Lutnick speaking to ABC News, it is only a temporary reprieve. While iPhone, iPad, and Mac imports won't be subject to the 145% reciprocal tariff that applies to Chinese imports, Lutnick says a "semiconductor tariff" will be applied instead.

All of the smartphones, computers, and other electronics that benefit from the reprieve will be hit by the semiconductor tariffs, Lutnick confirmed. However, while there is no word on what the actual tariff level will be, Lutnick insists it will arrive "in a month or two."

The commerce secretary explained that the semiconductor tariff is a way to try and make component producers and device manufacturers to set up factories in the United States. Lutnick insisted that the U.S. shouldn't be reliant on Southeast Asia for its electronics.New tariffs for old

Though the new semiconductor tariffs will apply to Apple's products, it remains to be seen how much lower they will be compared to all other products affected by the reciprocal tariff.

At the moment, the U.S. reciprocal tariff on Chinese imports is at 145%, as part of Trump's tit-for-tat battle with China. China, meanwhile, has a tariff on U.S. goods imports of 125%, rising after each U.S. increase.

China also said it would not raise tariffs further, but warned other countermeasures may be adopted instead.

The battle has caused big problems for Apple investors, who have observed a very turbulent week for the share price. While the tariff break news late on Friday would've given some peace of mind to shareholders, the revelation that more tariffs of an unknown level brings even more uncertainty.

Read on AppleInsider

-

Behind the scenes, Siri's failed iOS 18 upgrade was a decade-long managerial car crash

The long-delayed overhaul of Siri was hit by repeated failures to progress, with leadership problems making it harder to execute than it should've been.

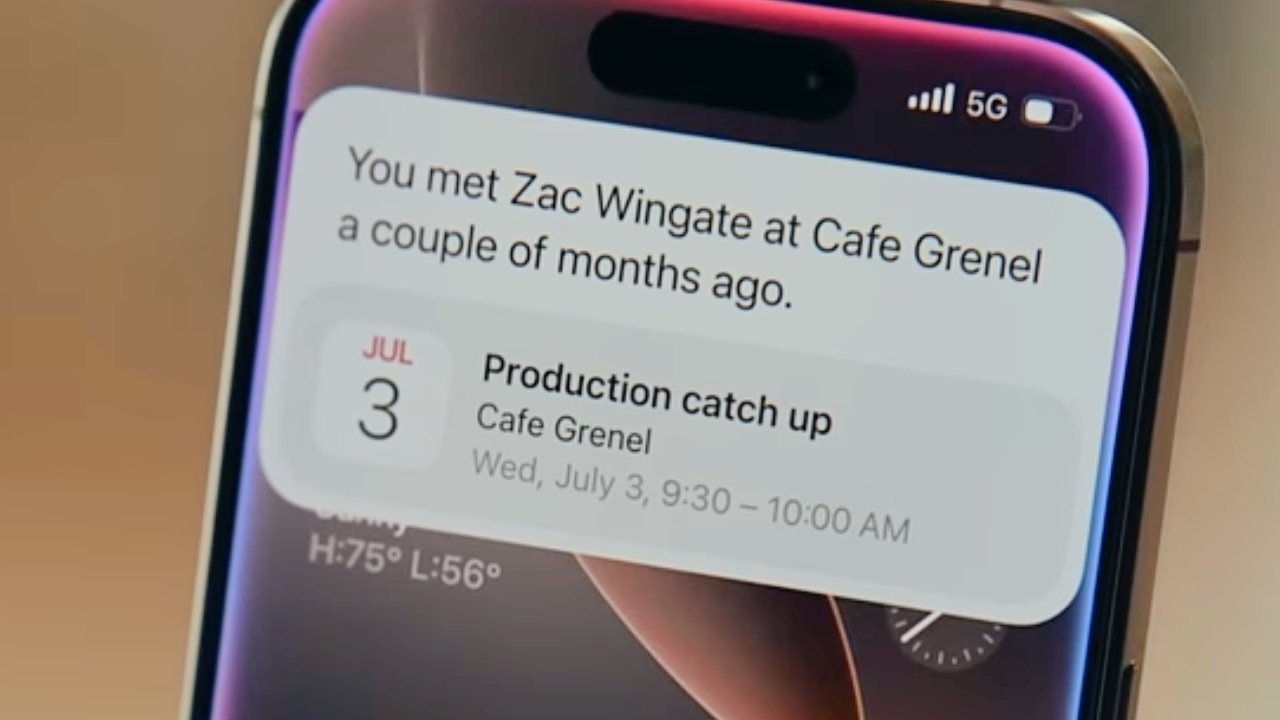

An example of a contextual query Siri will be able to answer, eventually. - Image Credit: Apple

In March, Apple admitted that its attempt to make Siri more personalized and up to date was far behind schedule. It confirmed that there were delays in getting Siri to the state where the company wanted it to be, and that it would be sorted out in the coming year.

Since that rare admittance from Apple, the company has done what it can to fix the situation. This included a managerial reshuffle, pushing John Giannandrea out of the top Siri role in favor of Mike Rockwell.

It was a major event in a situation that was extremely embarrassing to Apple. However, the entire affair is something that could have been avoided, reports The Information, had Siri not fallen victim to poor leadership choices.Siri hot potato

Multiple people who worked in the AI and software engineering groups within Apple told the report that conflicting personalities were a problem. Some, who worked under the AI and machine learning group under Giannandrea said that poor leadership was at play.

The sources also identified Robby Walker, who worked under Giannandrea, as being one of the reasons for the issues, due to an apparent lack of ambition and willingness to take risks on future Siri designs.

The employees also referred to Siri as a "hot potato" within Apple, due to it being passed between the different teams over the years. With the latest reshuffle putting Siri under the oversight of software boss Craig Federighi, they have some hope that favorable changes will be made.A lengthy Siri issue

The problems getting Siri modernized started years ago, in 2018, when Giannandrea moved from Google to work on Apple's new AI group. At a time when Siri was beginning to stagnate, Giannandrea took an interest in managing the digital assistant.

Before then, engineers working on Siri felt as if they were second-class citizens with Apple, with frustrations that the software engineering team's control over iOS updates failing to prioritize Siri fixes. Those software engineers also felt the Siri team weren't able to keep up with new features being developed in the group.

Giannandrea's plan was to make Apple's own AI-based voice assistant, using a playbook he gleaned from Google. He believed Apple had to get better training data, and to do better at web-scraping for answers.

However, when urged to shake up Siri's leadership, he declined to do so.Walker's safe work

The lack of risk-taking by Walker was a problem, the group of sources added. It was believed that Walker downplayed efforts to swing for the fences, and instead worked on other less meaningful metrics.

This apparently included celebrations of small wins, like reducing the response time for user queries. His work to remove "Hey" from "Hey Siri" also took more than two years to pull off, with little actual real benefit in the end.

Walker also dismissed one attempt in 2023 for one team to use LLMs for Siri to gain emotional sensitivity, such as to detect if a user is in distress. He said he would rather focus on the next Siri release instead of committing resources to the effort.

That team still went away to work on the project via the software engineering group's safety and location team, without his knowledge.Increased tension

The software engineering group and the AI team had a dysfunctional relationship, with respective leaders Federighi and Giannandrea having dramatically different managing styles.

Resentments also built up over difference in pay, the speed of promotions in the AI group, and vacation periods.

Eventually, Federighi's groups started to mass together hundreds of machine learning engineers to work on its own models, separate from the main AI team. This included building demos to voice-control apps without Siri, which the Siri team didn't appreciate.

An attempt to introduce voice control systems for apps on a headset that would become the Apple Vision Pro was also problem-filled. Hostility between Walker and others in the group, as well as the slowness of the Siri group in general, became a big point of friction once again.

When ChatGPT was released in 2022, the AI group didn't respond with any real urgency, the engineers claim. By contrast the software engineering group were far more interested, with demos presented to Federighi of what could be accomplished.

Eventually, Apple's managers said in 2023 that engineers couldn't include external models in Apple products. But, the responsibility to build the models was the responsibility of the AI group.

They also apparently didn't perform as well as OpenAI's offerings, employees explained.The current shakeup

Despite years of issues, the current situation where the Federighi-controlled software engineering groups would oversee the AI work led by Rockwell should be a fruitful one for Siri's progress.

Federighi is viewed as having more knowledge of technical details than many under his control. He has also told Siri's machine learning engineers to do whatever they need to make the best AI features, even if it's using open-source models from other companies.

Meanwhile Rockwell, who has a good track record in the company, is viewed as someone with vision, which Walker certainly lacked.

Read on AppleInsider

-

How and where Trump's new tariffs affect Apple

President Trump's new tariffs go far beyond China, and hit every nation in the world. Here's how badly Apple has been hit, and where it has been struck globally.

Donald Trump's signed tariff plan - Photo credit CNBC

In February 2025, the Bank of America said that the impact of tariffs on Apple would be significant. Before the extent of the tariffs were announced, Bank of America estimated that they would mean Apple may have to raise iPhone prices by 10%.

Apple has yet to make any announcements about price changes. It might have attempted to swallow small increases in component costs, but it is unlikely to absorb these massive ones. The company has previously made a point of how it has kept the iPhone costs the same for years -- although only in the US.

That means it has borne at least some inflation costs mostly because of smart buys of commodities like DRAM and NAND, and also any added expense of new technologies being added to the iPhone. But those costs will continue to rise anyway, and the addition of tariffs may mean even Apple cannot avoid raising its prices.

Previously Apple was able to negotiate a tariff exemption during President Trump's first term, but as yet it has failed to do so again. So at present, Apple will have to pay the tariffs on everything it imports into the US.

And, there is some double-dipping involved, perhaps. An iPad assembled in Vietnam will also incur a cost for having a processor manufactured in Taiwan.

It should be clear that a TSMC processor made in Arizona would face no tariff, but materials imported to make those chips will be impacted. And, for now, it appears those chips are completed in TSMC's facilities in Taiwan, at least until the AMKOR finishing plant comes completely on line.

Taking each country's tariffs separately, though, this is what CNBC says Apple now has to pay for devices or components from each of its biggest supply regions.China

China currently accounts for:- 80% of Apple's whole production capacity

- Assembly of 90% of all iPhones

- Assembly of 55% of Macs

- Assembly of 80% of iPads

Overall, it's estimated that around 40% of all of Apple's suppliers are based in China. Tariffs that Apple will have to pay to import goods from these suppliers are immediately set to 34%.India

Currently India assembles approximately 10% to 15% of iPhones, but has been expected to reach up to 20% by the end of 2025, helped by the country cutting import taxes for Apple and others.

Apple is now required to pay a tariff of 26% on imports from India.Vietnam

Vietnam has benefited from an increase in investment from Apple, partly to avoid the expected tariffs, and partly to avoid overall US/China trade tensions. It has also been intended to reduce Apple's over-dependence on China as a single supply source.

Now, however, Apple will have to pay an import tariff of 46%. This will affect:- Assembly of 20% of iPads

- Assembly of 90% of Apple Watch

Other major countries

Apple produces some Macs in Thailand, which now has a 36% tariff. Malaysia also manufacturers the Mac, and is facing a 25% tariff.

The vast majority of processors in all Apple devices, though, are manufactured by Taiwan's TSMC. And imports to the US from Taiwan now have a 32% tariff.The impact on Apple, and market sentiment

Analysts are starting to chime in on what they expect to see from these tariffs. Krish Sankar from TD Cowen believes that US sales account for about 31% of total revenues with about 75% coming from hardware products. He estimates that every 10% of tariffs would impact Apple's net income by about 3.5% in FY25 and FY26 EPS.

He also estimates that Apple will raise prices to offset tariffs, and estimates that every 10% of tariffs levied can be offset by an about 6% increase in product average selling price. Samik Chatterjee from JP Morgan has also come up with the 6% figure.

Analyst Daniel Ives from Wedbush calls the tariff plan "illogical," and "economic Armageddon" for the global economy, and specifically, the American consumer. Ives reiterates that when other countries are hit with tariffs, it's ultimately the American consumer that bears the entire brunt of the bill.

He still considers Apple a focus to own in a stock portfolio, but is expecting to see at least in the short term a 10% hit.

Trump's new tariffs immediately caused stocks in technology firms to fall. Apple saw the largest drop of any technology firm.

Apple's stocks fell almost 7.5% in extended trading as of 8 AM Eastern Time on April 3. It's not clear what the market sentiment will be when the market opens.

In comparison, Nvidia's shares dropped 4%, while Tesla lost approximately 4.5%. Amazon, Meta, and Google parent company Alphabet all lost between 2.5% and 5%, while Microsoft is down almost 2%.

Unless Apple stocks rebound during regular trading, this fall is the company's worst since September 2020. That was when the iPhone 12 launch was delayed because of COVID disruption.

Read on AppleInsider