anantksundaram

About

- Username

- anantksundaram

- Joined

- Visits

- 526

- Last Active

- Roles

- member

- Points

- 8,970

- Badges

- 2

- Posts

- 20,421

Reactions

-

Apple and Ireland win appeal of $14.4B EU tax case

I just give up.crowley said:This has nothing to do with Ireland’s general tax rate, it has to do with special arrangements, where the accusation is that Apple were afforded circumstances that weren’t available to other companies.

-

EU announces new tax plan that clamps down on digital platforms

-

Apple and Ireland win appeal of $14.4B EU tax case

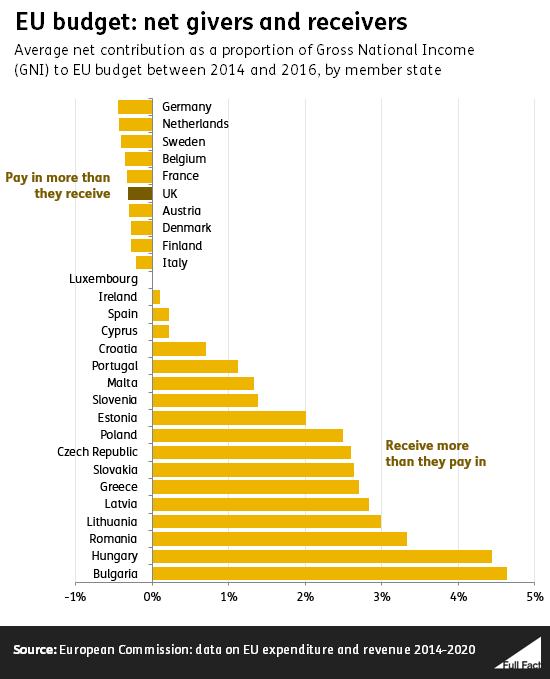

Ireland didn't turn positive in its net contributions to the EU until recently (2018, I think). During the period 2014-2016 (when the case was being brought), Ireland was a net recipient (see below for actual EU -- not Irish Times -- data). Ireland was even more of a net recipient during the period of the supposed "preferential tax treatment", i.e., the period that is actually being litigated (which I believe was the 2000s through the early 2010s).asdasd said:

Ireland is a net contributor to the EU, and has been for a while.anantksundaram said:

You're the one spreading misinformation, I am afraid. If the money gets credited to Ireland, that is money in the bank for the EU since they will have to send a smaller annual check to the country (Ireland is a net recipient of EU largesse).crowley said:

This has been gone over many times, there is no retroactive changing of the law, the law came into force in 1992 (I believe it was Maastricht) and Ireland should have adjusted its tax relationship with Apple at the time. Just because it has taken a number of years for the case to be brought doesn't mean the law has been changed in any way. It is Ireland that is accused of breaking EU law, not Apple; Apple was merely the beneficiary. Also, the EU will not "get" anything much from this - if Apple and Ireland loses the case then the money held in escrow is payable to the tax authorities in Ireland, not the EU.aderutter said:Good news, it was obvious that the EU were on a money grab and trying to retroactively change the law to do so imho.

I’m not saying Apple and Ireland will ultimately win even though I do not believe for a minute Apple broke the law.

I do believe the EU will more than ever given recent economic events do anything they can get to as much as they can from anywhere they can.

Again, this has been covered many times. Please stop spreading misinformation.Moreover, if Apple had lost, the long run consequences for Ireland, by making is less competitive as a destination for US tech investment, might have been for more onerous. You're ignoring some basic facts here.

https://www.irishtimes.com/news/ireland/irish-news/taoiseach-predicts-steep-rise-in-ireland-s-contribution-to-the-eu-budget-1.4084499

As for the comment you were replying to, the law used against Ireland was state aid, not that they had too low a taxation level. Which isn't something that is a competency of the EU.

I recall discussion in the media then about how, if the EU won the case, Ireland might have had to fork over the money to the EU because of its cumulative net recipient status. +

+

-

Apple and Ireland win appeal of $14.4B EU tax case

From the WSJ today: "In a stinging rebuke to the commission, the General Court said it annulled the decision because the commission had failed to meet the legal standards in showing that Apple was illegally given special treatment..... Apple and Ireland on Wednesday applauded the annulment of the tax case. Ireland reiterated that it gave no special treatment to Apple, and said that the company had paid taxes according to “normal Irish taxation rules.”gatorguy said:

That's not at all what was said Anant.anantksundaram said:

It was more than 'preparation.' The court ruled that Vesthager's claim that Apple had been given special treatment by Ireland -- treatment that was unavailable to other companies -- was not valid.gatorguy said:

The EU's case presentation was apparently less than stellar, losing on the preparation but not yet on the facts. I tend to agree with you that in the end Ireland (and by extension Apple) won't win this one.carnegie said:

I suspect the EU will ultimately win. I'm surprised Apple and Ireland even won at this stage though.zimmermann said:

Let’s wait to see if the EC goes to the Court of Justice for a final verdict.carnegie said:I think this was a no-brainer, Apple and Ireland should have won this appeal. The European Commission's decision never demonstrated what it claimed it did and what it needed to in order to justify the action it took.

That said, I'm quite surprised that Ireland and Apple did win.

In other words, The court said that there was no case here, to begin with. End of story.

From another article: "The court ruled not that the EU was wrong, but rather that it hadn’t proven its case ‘to the requisite legal standard.’ That’s a polite way for a judge to tell the losing side that they failed to properly prepare their case, and to imply that the outcome would have been different if they’d done their homework …"

It goes on to say: "The overturning of the Apple decision, while a loss for the commission, gives ammunition to tech-industry critics—including Ms. Vestager—who say current tax and competition laws must be updated to curb alleged abuses by large tech companies. European countries and the U.S. are currently at an impasse in international talks over how and whether to update the global tax system to make tech companies pay more levies where their customers are based."

The latter is the real issue that needs to be fixed. In other words, fussing around with only-vaguely-related contortions like "state aid" likely won't cut it.

-

Apple and Ireland win appeal of $14.4B EU tax case

It was more than 'preparation.' The court ruled that Vesthager's claim that Apple had been given special treatment by Ireland -- treatment that was unavailable to other companies -- was not valid.gatorguy said:

The EU's case presentation was apparently less than stellar, losing on the preparation but not yet on the facts. I tend to agree with you that in the end Ireland (and by extension Apple) won't win this one.carnegie said:

I suspect the EU will ultimately win. I'm surprised Apple and Ireland even won at this stage though.zimmermann said:

Let’s wait to see if the EC goes to the Court of Justice for a final verdict.carnegie said:I think this was a no-brainer, Apple and Ireland should have won this appeal. The European Commission's decision never demonstrated what it claimed it did and what it needed to in order to justify the action it took.

That said, I'm quite surprised that Ireland and Apple did win.

In other words, The court said that there was no case here, to begin with. End of story.