davidw

About

- Username

- davidw

- Joined

- Visits

- 163

- Last Active

- Roles

- member

- Points

- 4,351

- Badges

- 1

- Posts

- 2,060

Reactions

-

New York City has a $10 million cybercrime lab to crack the iPhone

A warrant only requires Apple to turn over all the info requested, that is in Apple's possession and they have access to. And Apple has done that.Fred257 said:

This is about having a warrant. Nothing moredavidw said:

The same can be said about the US Constitution. Criminals also has protection under the US Constitution, that prevents the government from abusing its powers. It's the price paid, to ensure that everyone is protected from a government that is capable of abusing its powers.Fred257 said:Apple is helping criminals. Why?

With Apple, the only way they can help protect the private data of all their iPhone (and iPad) customers, is to not create a backdoor that the government can use to get into criminals locked iPhones. After all, if we never have to worry about the government abusing its powers, we would not need the US Constitution.

The iPhones that the FBI wants the info from, are not in Apple"s possession. Apple are not the owners of those iPhones. Apple do not have the info that are encrypted inside those iPhones. Apple do not have the passcode needed to access the info in those iPhones. A search warrant requesting that the info inside those iPhones be turned over, is served to the owners of the iPhones, not to the maker of the iPhones. How can a search warrant require Apple to turn over information they are not in possession of?

What the FBI have is a court order ordering Apple to unlock the iPhone. This is far from having a warrant. It's something that Apple can't do, without attempting to write new software to try to hack into the iPhone.

It's like if you are a landlord and your tenant changed the lock and never gave you a key. Law enforcement can show you a warrant to search the property but if you don't have the key, all you can do is allow the police to break in, any way they want. The police should hire their own locksmith and not require you to pick the lock. The police should provide their own axe to breakdown the door and not require you to supply them with one.

And since iPhones in question are evidence, the FBI will not allow Apple to have access to the iPhone that needs to be unlocked. So Apple has to show the FBI that any software they might develop to hack into an iPhone, can be use to unlock a similar iPhone first, without destroying the data inside it. The FBI will not allow Apple to use any software that has not been proven, on the iPhones that are evidence.

And the FBI must make sure that the data in the iPhone is not altered in any way, in case the info in the iPhone has to be used as evidence in court. This means that the FBI forensic team must know exactly how Apple software was used to gain access to the iPhone, so they can testify in court that there's no possibility that the data has been altered in the process. Otherwise, any info gotten using the software, might be considered tainted and not admissible in court.

-

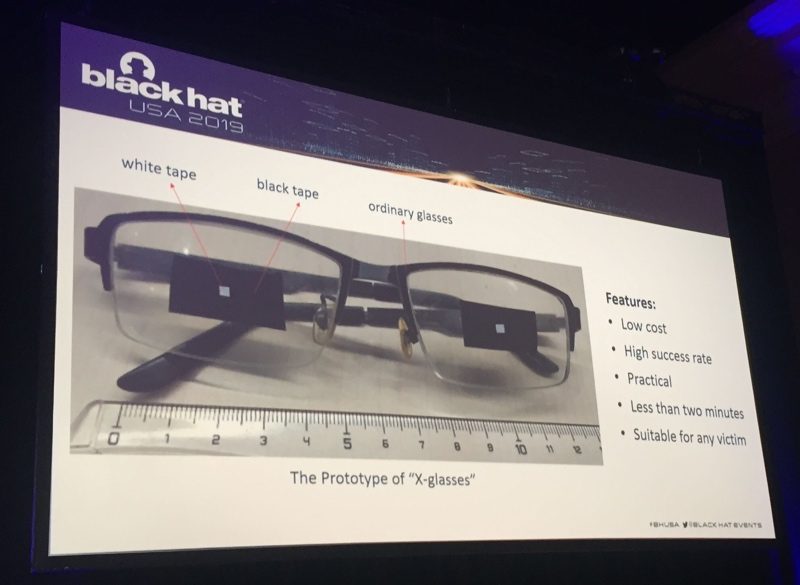

Face ID attention detection security defeated with glasses and tape

Obvious you haven't thunk this all the way through. The hack requires glasses that the iPhone owner wears or have worn before, to unlock their iPhone. Not just any pair of glasses. When the article states that ........... "If you are wearing glasses, it won't extract 3D information from the eye area when it recognizes the glasses." ...... it means that the software must recognize the glasses as ones that the iPhone owner wears or have worn before, before it will not require the 3D info around the eyes. Info like whether they are open or close.1STnTENDERBITS said:Their bypass consists of a cheap pair of glasses and two pieces of tape. Approx. $2 worth of material to bypass a billion dollar security system. Whodathunkit? ¯\_(ツ)_/¯

That negates your thunking that any $1.99 pair of Walgreen bifocals will work. If the iPhone owner have never unlocked their iPhone wearing glasses, then no cheap pair of glasses will ever work with this hack because the software will not recognize the glasses. And if the iPhone owner does wear glasses or worn glasses before to unlock the iPhone, then it requires the hacker to use those glasses, so the software can recognize them as the ones the iPhone owner wears or worn before. Even if they are cheap $1.99 glasses, not any cheap $1.99 gasses will work.

This is why placing tape over the lenses (not the frame) to cover the eyes only works if the software recognizes the glasses and thus bypassing the need for 3D info around the user's eyes when unlocking. If the software doesn't recognize the glasses, then it won't unlock without the 3D info around the eyes.

It is not ....... if the software determines the the user is wearing glasses ........ , that it will bypass gathering the 3D info around the users eyes. That's when the hack would work with a pair of $1.99 glasses and a bigger security threat.

The biggest security risk is if the iPhone owner falls asleep with their glasses on or left nearby, one can get hold of the glasses, place tape over the lens and place it back on the iPhone owner's face to unlock the iPhone. I can see iPhone owners kids doing this to add money into their iTunes accounts.

-

Samsung reports 56% profit decline in Q2 on weak memory chip sales

Soli said:

You don't make or lose money in the stock market until you sell.*Fatman said:So, I made an s-load of money today in my Apple stocks holdings

* Or the company is dissolved, you get dividends, etc., but putting all the cavers into this rule of thumb just adds too much clutter.That's not always true. If your stock holding was locked in an IRA, then yes, one isn't making (or losing) any real money until one sells.But the majority of my AAPL stock holding is in a Schwab stock portfolio and included is a margin account based on about 50% of the value of my portfolio. So when AAPL goes up, the amount of money that I can borrow from my margin account goes up. I can borrow 50% of AAPL upside without selling any AAPL shares and use the money to invest in other stocks or withdraw in cash. So long as the all money I've borrow from my margin account (plus the interest owe ) isn't over 50% of the value of my portfolio, I do not need to sell any of my stocks. But I do have to pay interest on the money I borrowed. Which is not a problem if my portfolio grows in value greater that what I have to pay in interest, every year. Figuring that if I sold any stock, my portfolio might not grow as much.With AAPL, I have borrowed against its upside since I've owned it, without selling any shares. And AAPL has gone up way more than the interest I had to pay on that borrowed money. Even when compounded over the years. AAPL is now paying about a 1.5% dividend, which I would lose on any shares sold, along with any upside gain. Plus the interest on the borrowed money can be deducted from any capital gains I have and carried over from year to year, if I don't have enough capital gains to deduct the whole amount in one year. Where CC and personal loans interest can not be tax deducted at all and home equity loans interest can only be tax deducted, in the same year, if one itemizes. (Which I haven't been able to do since paying off my home mortgage 5 years ago and even for 4 years before that because there was not enough interest paid toward the end on my home loan.) So I managed to make money from my AAPL shares without selling any of it, by borrowing against it in my margin account. Even with years of interest compounded.If I had sold any shares of AAPL ten years ago, in order to have the money needed to pay off my CC, I would have lost ten years of AAPL upside, plus 7 years of dividend on those sold shares. If you were to calculated the amount of that lost and compare it to ten years of compounded margin interest, it's a no brainer that borrowing the money from my margin account, without having to sell any AAPL, was the right way to go. If I were to sell those shares today, I would still have a big gain from those shares after deducting all the interest I had to pay to keep them for another ten years. And yet I was able to pay off a CC debt with it, ten years ago, without selling any of it.Of course, this is not true with all stocks and if i was anywhere near my 50% margin account limit, I might be forced to sell some stocks in my portfolio, on any big drop in AAPL share price. Plus one can't really say they made money on just one day of upside as that can disappear the next day or next week. But the point is that over the span of years, one can make money on a stock upside, without selling.

-

DOJ announces massive antitrust review examining Apple, Google & others

"GOOD" alternatives? That's not a goal nor guaranteed, when an anti trust violation suit breaks up a company. Anti trust laws are not meant to penalize a company for being good, better than its competitors or the best, at what they do. So long as the company don't use any illegal practices to prevent any alternatives, from fairly completing with them, GOOD alternatives will find its way into the marketplace. Who would have thought that a company with barely any telecommunication background could come up with a GOOD alternative to dethroned Nokia, which was by far the largest mobile phone maker in the World at the time? But Apple did just that with their iPhone and without the help of any anti trust suits.gutengel said:

I'd love to hear GOOD alternatives for Facebook and Amazon. Whatever the outcome, antitrust laws haven't been updated in ages. Every time the US Gov has broken up huge noncompetitive corporation it has proven to be positive for consumers and the industries for the most part.SpamSandwich said:I’d seriously question the motivation behind this investigation. Who complained? Competitors? Those who may or may not be politically disadvantaged? I don’t like it. None of these companies are monopolies.

I remember when they broke up ATT (in the early 80's) into all the "baby bells". Before the break up, my ATT land line made local, toll and long distance calls and conveniently billed me every month. After the break up, my now local "baby bell" no longer had long distance calling using ATT. I had to either paid a monthly fee to have a long distance carrier always attached to my land line or enter in (before the number) some 8-10 digit code of the long distance carrier that I wanted to use, every time I needed to make a long distance call and my local "baby bell" will collect the charges for them on my monthly bill. Even if long distance call charges dropped a, any savings didn't make up for the monthly fees of consumers that didn't make a lot of long distance calls nor any inconvenience. Plus local and toll calls became more expensive because the local "baby bells" could no longer count on the revenue from the very profitable long distance calls. ATT still owned all the network infrastructures for making long distance calls.

I'm now paying almost 3 times as much for what is now an ATT land line again, (because SBC bought out my PacBell, which in turn bought out the original ATT corp. but kept the ATT name.) as I was before the break up. And it still doesn't have any long distance calling ability, unless I pay a monthly fee for the option or enter in the code of a third party long distance carrier every time I need to make a long distance call.

If cellular phones hadn't come along and became as cheap to use as they are now, most consumers that would still be depending on a land line, would not consider the break up of ATT, as a positive. Though one can't consider what ATT might have become, if they weren't broken up.

-

EU to investigate Apple following Spotify anti-competition complaint

Do Amazon allow sellers advertising and selling in Amazon Marketplace, to place a link to pay for the item outside of Amazon? Do Amazon allow their Marketplace venders to advertise that they can get the same item cheaper on their eBay sellers account?Rayer said:

Your arguments are so flawed on just one point.davidw said:

The only time a developer has to pay Apple 30% of the sale price of an app, in the App Store, is if they want to allow their Apple iOS customers to pay with their Apple iTunes accounts. There is nothing and I mean nothing, that prevents a developer from having their customers pay by way of their own payment system, outside of the App Store.CheeseFreeze said:Good! I hope they rule in favor of Spotify. Not because of Spotify, but that the App Store model and monopoly needs to change. 70/30 is no longer sustainable to many developers as it was in 2007. Secondly it’s conceptually wrong to own an entire ecosystem - just one of two - and abuse that by taxing 30% and very specifically create exceptions to hurt competition (such as not allowing Siri to control Spotify)

If developers thinks paying Apple a 30% cut of the price of their app is too much, then let them host their own payment system. Let smaller developers require their customers to PayPal the money to their email account directly. Let them host their own web sites for payment purposes. Let them set up a business account with Visa and MasterCard, so they can accept CC payments and then pay the CC company 5% of each charge. Let them worry about securing their customers personal and account data from hackers on the internet. Let them have their customer mail them a check or money order. Let them handle any customers dispute with the payment.

Then they can still have their app in the App Store, without paying the "Apple tax". Apple will not "tax" them for having their app in the App Store if the payment is made outside of iTunes. How hard can that be for these developers complaining about the "Apple tax"? Surely, you must think that the cost for a developer to host, maintain and keep secure, their own payment systems, will easily be paid for by no longer having to pay the "Apple tax", if you're thinking Apple 30% cut is too much. ........ Right?

That's how I pay for my Netflix. I'm using Netflix auto pay, where Netflix directly bills by CC every month. Netflix do not have to pay the "Apple tax" with my subscription and yet, their app is available for me to use on my Apple devices.

What percentage of the their sales in the App Store, do you think it's going to cost developers to have their own payment system to handle the sales of their apps? Specially for the smaller ones. And that cost is the same whether they have any money coming in from the sales of their apps or not. At least with paying the "Apple tax", they are paying for a payment system with money that's coming in. If there's no money coming in from sales, there's no cost associated with maintaining a payment system outside the App Store.

Apple doesn't let developers include links to their website in the said app where the user can subscribe in the way you mention. So Apple is saying, "Use our payment method and take the 30% cut, OR hope that users are intrigued enough by your service that they go out of their way to find your website where they can subscribe on their own through your payment system."

I've on more than several occasion bought items I saw advertised on Amazon, for a lower price on eBay. And when the item is delivered, it comes in an Amazon box, from an Amazon warehouse. Evidently, the seller sells his stuff on Amazon Marketplace and eBay, with eBay being lower in price because eBay takes less of a cut. But you wouldn't know that the seller is also selling on eBay, because they are not allowed to advertise their eBay prices on Amazon. Nor can they provide a link for you to pay for the item sold through the Marketplace, outside of Amazon. Even though they can handle the payment without Amazon.

With Amazon Marketplace sellers, sellers pays Amazon 15% to 20% of the sale pice plus a $.99 listing fee of each item sold. Unless the seller pays a monthly fee of $40. There by they don't have to pay the $.99 listing fee but have to sell over 40 items a month to make up for the fee. So if a seller sells a $10 item and have to pay 15% of it to Amazon plus the $.99 listing fee, that's 25%. Of course the percent goes up and down depending on the price of the item sold, as the $.99 becomes more or less a factor.

But there's no way to list and advertise an item on Amazon, sell it and not pay Amazon a percentage. Where as with the App Store, developers can advertise their app in the App store and not have to pay Apple anything on a sale, by making it possible to pay for it, outside the App Store.

I've also bought items on eBay that shipped from an Amazon warehouse, without ever realizing that the seller is also sell the same item on Amazon, because they are not allowed to advertise that. And I had to pay with PayPal. I would love to had pay for those eBay items using my reward dollars from my Amazon CC, if i knew the seller also sold on Amazon. But neither eBay or Amazon would allow the sellers to provide such links on their sites or even mention that they also sell the same items on each others site.

If I'm shopping at a Target and just happens to see a TV on display, that got my interest, do Target allow BestBuy to advertise that they sell the same TV and provide a map to the nearest BestBuy, with a flyer right next to the TV?

Netflix had no problem with following Apple App Store rules and they still ended up being one largest video streaming service. Larger that Apple streaming service itself. And Netflix still follows the rules.

It's your thinking that is flawed.