AAPL bleeds record $97B in valuation over weekend [u]

Apple's shares have taken a hammering over the weekend in after-hours trading, with the share price set to open on Monday morning at about $20 below its value at the end of trading on Friday afternoon, its biggest drop in five years.

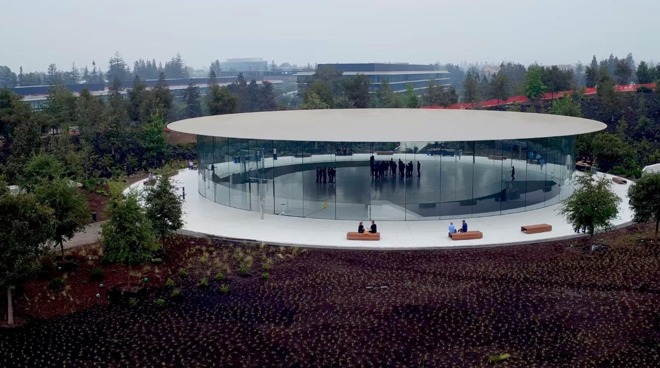

The Steve Jobs Theater at Apple Park

The ongoing coronavirus crisis is affecting the stocks and shares of major companies once more, as investors worry about how COVID-19 is going to affect their holdings. Over the weekend, stockmarkets saw the value of shares fall, with Apple among the injured parties.

On Friday, Apple ended its trading day at $289.03, up from its starting price of $282, but down from Thursday's closing price of $292.92. Trading over the weekend has seen Apple's price fall further, with pre-market reporting indicating it will open at between $268 and $269, over $20 down from its starting price the previous day.

For context, Apple's announcement on January 2, 2019 that it would miss revenue guidance resulted in an overnight intersession drop of $13.94 by the morning of January 3, representing a drop of 8.83%. If Apple's shares open at $269.03 on Monday, a full $20 down from Friday afternoon, it would be the equivalent share value fall of 6.92%.

The market capitaliztion of Apple itself is down $97 billion from its $1.26 trillion valuation on Friday. The drop is the highest between trading sessions for Apple, ever.

To put the drop into perspective, it is the equivalent market value of Charter Communications, Lockheed Martin, Texas Instruments, and approximately three-quarters of Tesla.

If it does commence trade at $20 below Friday's closure, it would be Apple's fourth-highest inter-session fall in a five-year period, according to historical data from Nasdaq. The highest was on August 24, 2015, where the price dropped 10.3% over a weekend.

Investors are concerned about oil pricing, and the continuing spread of the coronavirus around the world, an outbreak that is causing havoc to supply chains and retail operations in Asia and other regions.

In the case of Apple, it has led to production backlogs as supply chain partners work to mitigate the virus, while trying to retain production capacity. Apple has also instituted travel bans for its own staff, preventing its engineers from visiting suppliers for component testing, which may impact the production of the "iPhone 12."

Update: AAPL closed the day at $266.17, up from an opening price of $263.56.

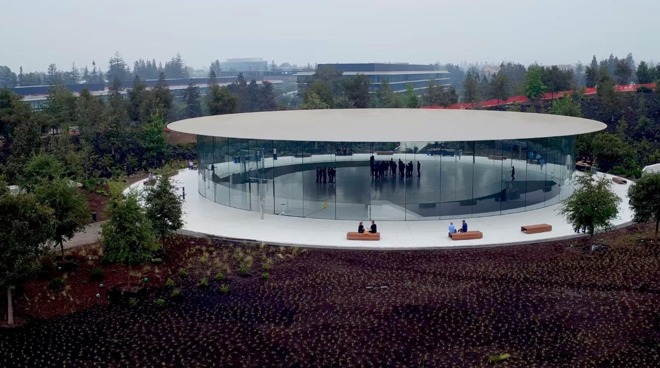

The Steve Jobs Theater at Apple Park

The ongoing coronavirus crisis is affecting the stocks and shares of major companies once more, as investors worry about how COVID-19 is going to affect their holdings. Over the weekend, stockmarkets saw the value of shares fall, with Apple among the injured parties.

On Friday, Apple ended its trading day at $289.03, up from its starting price of $282, but down from Thursday's closing price of $292.92. Trading over the weekend has seen Apple's price fall further, with pre-market reporting indicating it will open at between $268 and $269, over $20 down from its starting price the previous day.

For context, Apple's announcement on January 2, 2019 that it would miss revenue guidance resulted in an overnight intersession drop of $13.94 by the morning of January 3, representing a drop of 8.83%. If Apple's shares open at $269.03 on Monday, a full $20 down from Friday afternoon, it would be the equivalent share value fall of 6.92%.

The market capitaliztion of Apple itself is down $97 billion from its $1.26 trillion valuation on Friday. The drop is the highest between trading sessions for Apple, ever.

To put the drop into perspective, it is the equivalent market value of Charter Communications, Lockheed Martin, Texas Instruments, and approximately three-quarters of Tesla.

If it does commence trade at $20 below Friday's closure, it would be Apple's fourth-highest inter-session fall in a five-year period, according to historical data from Nasdaq. The highest was on August 24, 2015, where the price dropped 10.3% over a weekend.

Investors are concerned about oil pricing, and the continuing spread of the coronavirus around the world, an outbreak that is causing havoc to supply chains and retail operations in Asia and other regions.

In the case of Apple, it has led to production backlogs as supply chain partners work to mitigate the virus, while trying to retain production capacity. Apple has also instituted travel bans for its own staff, preventing its engineers from visiting suppliers for component testing, which may impact the production of the "iPhone 12."

Update: AAPL closed the day at $266.17, up from an opening price of $263.56.

Comments

🤮

I guess all your "hard earned" money made from owning stock in Apple will be gone soon. Maybe another huge tax break for the 1% would make it right?

Once upon a time a corrupt thieving group of mostly men who went to work at the tip of Manhattan to plot and scheme ways to create wealth without actually creating anything. The house of cards soon fell and it took a mighty nation down with it. That was 2008, twelve years later nobody on Earth believed it could possibly happen again so they removed the restrictions put in place to prevent another house of cards being built and believed again this wealth was real.

But of course people in California will never see those price drops at the pump due to the crushing levels of gas taxes there.

As someone up this year (and year over year) when most are down:

1- Good stocks get caught in downdrafts becuase of margin calls.

2- The disruption to the worldwide supply chain and consumer behavior due to Corona Virus is real and ongoing. The oil price war holds significant potential to destroy the financial viability of the shale oil business in the US. At the benchmarks for WTI Crude, they can not cover their debt and othe costs.

3- The market as a whole is grossly overpriced.

4- I personally feel that Apple is overpriced- your impression may be different. In a sharp and broad recession, Apple could be way out over its skis. Services can quickly be cancelled.