Apple lowers holiday quarter guidance on lower than expected iPhone sales

In a surprise move, Apple on Wednesday revised down revenue guidance for its current December quarter, with CEO Tim Cook blaming the performance on lower than expected iPhone sales.

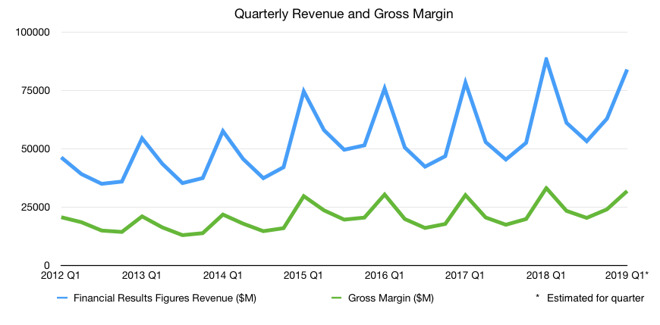

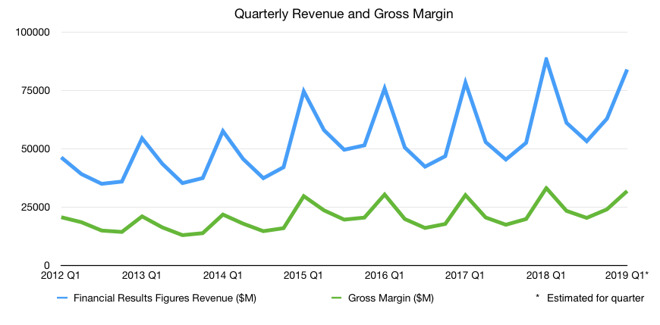

The company is now aiming for $84 billion in revenue, Cook wrote in a letter to investors. That's beneath a forecast issued in November, which anticipated numbers between $89 billion and $93 billion.

Supporting recent analyst concerns, Cook admitted that Apple has seen "fewer" iPhone upgrades than anticipated, blaming factors such "foreign exchange headwinds" from a strong U.S. dollar and "economic weakness in some emerging markets."

"Lower than anticipated iPhone revenue, primarily in Greater China, accounts for all of our revenue shortfall to our guidance and for much more than our entire year-over-year revenue decline," Cook said. "While Greater China and other emerging markets accounted for the vast majority of the year-over-year iPhone revenue decline, in some developed markets, iPhone upgrades also were not as strong as we thought they would be. While macroeconomic challenges in some markets were a key contributor to this trend, we believe there are other factors broadly impacting our iPhone performance, including consumers adapting to a world with fewer carrier subsidies, US dollar strength-related price increases, and some customers taking advantage of significantly reduced pricing for iPhone battery replacements."

Other figures are "broadly in line" with predictions, Cook continued, cautioning that it will be several weeks before the final data is presented.

Another factor hurting revenue was supply constraints for AirPods, the iPad Pro, the Apple Watch Series 4, and the redesigned MacBook Air.

"These last two points have led us to reduce our revenue guidance," Cook explained, specifically attributing all of the company's global revenue decline to a slowing Chinese economy and the trade war initiated by U.S. President Donald Trump. Shrinkage in the Chinese smartphone market has been "particularly sharp," to the point that the non-iPhone segments of Apple's worldwide business -- iPads, Macs, Watches, services and accessories -- cumulatively grew 19 percent.

Cook also cited low-cost battery replacements and fewer carrier subsidies for a lack of iPhone upgrades.

Trying to put on a positive spin on the situation, the letter claims "many positive results" for the December quarter, including an install base up 100 million units in 12 months, and over $10.8 billion in services revenue, achieving quarterly records in every region. The company is reportedly "on track" to doubling services revenue between 2016 and 2020.

Wearables revenue was up nearly 50 percent year-over year, and the company is poised to score all-time revenue records in the U.S., Canada, Germany, Italy, Spain, the Netherlands, and South Korea. Records have already been set in Mexico, Poland, Malaysia, and Vietnam, and Apple is predicting a best-ever earnings-per-share (EPS) figure.

Apple halted after-hours trading pending the release of Cook's note and the stock is currently down seven percent.

The company is now aiming for $84 billion in revenue, Cook wrote in a letter to investors. That's beneath a forecast issued in November, which anticipated numbers between $89 billion and $93 billion.

Supporting recent analyst concerns, Cook admitted that Apple has seen "fewer" iPhone upgrades than anticipated, blaming factors such "foreign exchange headwinds" from a strong U.S. dollar and "economic weakness in some emerging markets."

"Lower than anticipated iPhone revenue, primarily in Greater China, accounts for all of our revenue shortfall to our guidance and for much more than our entire year-over-year revenue decline," Cook said. "While Greater China and other emerging markets accounted for the vast majority of the year-over-year iPhone revenue decline, in some developed markets, iPhone upgrades also were not as strong as we thought they would be. While macroeconomic challenges in some markets were a key contributor to this trend, we believe there are other factors broadly impacting our iPhone performance, including consumers adapting to a world with fewer carrier subsidies, US dollar strength-related price increases, and some customers taking advantage of significantly reduced pricing for iPhone battery replacements."

Other figures are "broadly in line" with predictions, Cook continued, cautioning that it will be several weeks before the final data is presented.

Another factor hurting revenue was supply constraints for AirPods, the iPad Pro, the Apple Watch Series 4, and the redesigned MacBook Air.

"These last two points have led us to reduce our revenue guidance," Cook explained, specifically attributing all of the company's global revenue decline to a slowing Chinese economy and the trade war initiated by U.S. President Donald Trump. Shrinkage in the Chinese smartphone market has been "particularly sharp," to the point that the non-iPhone segments of Apple's worldwide business -- iPads, Macs, Watches, services and accessories -- cumulatively grew 19 percent.

Cook also cited low-cost battery replacements and fewer carrier subsidies for a lack of iPhone upgrades.

Trying to put on a positive spin on the situation, the letter claims "many positive results" for the December quarter, including an install base up 100 million units in 12 months, and over $10.8 billion in services revenue, achieving quarterly records in every region. The company is reportedly "on track" to doubling services revenue between 2016 and 2020.

Wearables revenue was up nearly 50 percent year-over year, and the company is poised to score all-time revenue records in the U.S., Canada, Germany, Italy, Spain, the Netherlands, and South Korea. Records have already been set in Mexico, Poland, Malaysia, and Vietnam, and Apple is predicting a best-ever earnings-per-share (EPS) figure.

Apple halted after-hours trading pending the release of Cook's note and the stock is currently down seven percent.

Comments

That’s a 7-10% revenue miss that Apple are expecting. Hopefully they’ve extrapolated correctly for the remainder of the quarter

Now just watch the Wall Scum anal-ysts twist Tim's statements around to look like "Apple is dead, sell sell sell!!!"

Yup, I see the typical suspects already issuing their hyperbolic headlines, so predictable.

Apple, if you're reading this, use it as an opportunity to buy back more AAPL!

It's millions of haters/losers/idiots all over the world having a collective orgasm at hearing this news. Seems they can only be happy when there's bad news about Apple.

I posted earlier about the ridiculous pricing of the latest iPads as an example. The iPhone is just as bad. Their greed is catching up with them.

So unit sales are down, and now revenue is a chunk below their own forecast too (not even the analysts can be blamed here). Increasing the prices to stupid levels only hurts the customer base in the long run.

It certainly put be off off upgrading my old MacBook Pro and iPad.

Stop defending Apple no matter what. Call them out when they screw up and celebrate their victories when they have them.

I refused to buy a 2018 iPhone due to pricing. Just as I refused the previous year's offerings.

When these last minute Apple promotions appeared, Apple got the sale but only by the skin of its teeth. I gave my reasons and millions of people probably share them. I definitely won't have orgasms over this news.

Who's defending Apple? I'm making fun of all the losers whose happiness depends on someone failing, whether it be Apple or someone else.

And how exactly did Apple "fuck up"? Is Tim Cook in charge of China/US relations regarding trade? Does he control the value of the US dollar related to other countries? Seems like the only thing Apple did was to slightly over estimate sales. That's hardly a "fuck up".

I've said all along iPhone sales will level off. They have to as there's not enough customers in the world to keep their growth going on indefinitely. Then Apple will be in the "terrible" position of having to settle with 200 million iPhone sales a year to people upgrading their older devices. The rest of the smartphone world would die to be in the same "predicament" that Apple is.

Meanwhile, Wall Street will punish Apple severely for this. Seems like a good time to buy stock (or for Apple to increase their buybacks).

when a company adopts an upmarket fashion pricing strategy, to only be surprised that such pricing strategies lead to reduced sales.