Allegations of discrimination spawn investigation into Apple Card credit lines

A series of angry tweets by the creator of Ruby on Rails alleging Apple Card approval discrimination has sparked a probe into Goldman Sachs credit card approval practices.

David Heinemeier Hansson, creator of Ruby on Rails, has alleged that Apple and Goldman Sachs is being gender-biased against women who apply for the Apple Card.

The Apple Card had recently had the most successful credit card launch ever, according to Goldman Sachs. Additionally, it was reported that the company would accept those with sub-prime credit scores.

It's not clear what has caused the wild difference in credit lines, though the statement has piqued the interest of Wall Street regulators.

"The department will be conducting an investigation to determine whether New York law was violated and ensure all consumers are treated equally regardless of sex," said a spokesman for Linda Lacewell, the superintendent of the New York Department of Financial Services, according to Bloomberg "Any algorithm, that intentionally or not results in discriminatory treatment of women or any other protected class of people violates New York law."

Goldman Sachs spokesperson, Andrew Williams, has released a statement regarding the situation.

"Our credit decisions are based on a customer's creditworthiness and not on factors like gender, race, age, sexual orientation or any other basis prohibited by law."

While not an exhaustive sample, there seems to be equivalency between the male and female members in the AppleInsider staff in regards to credit limits.

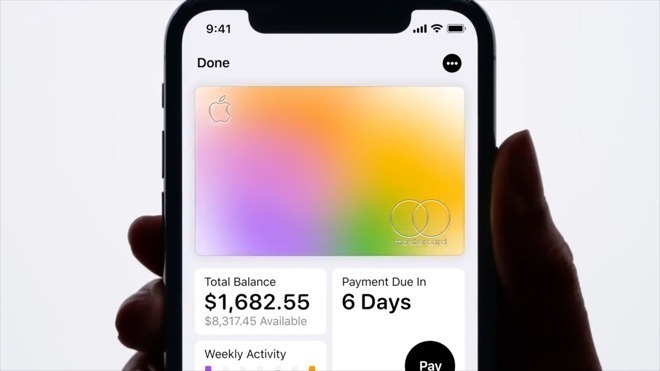

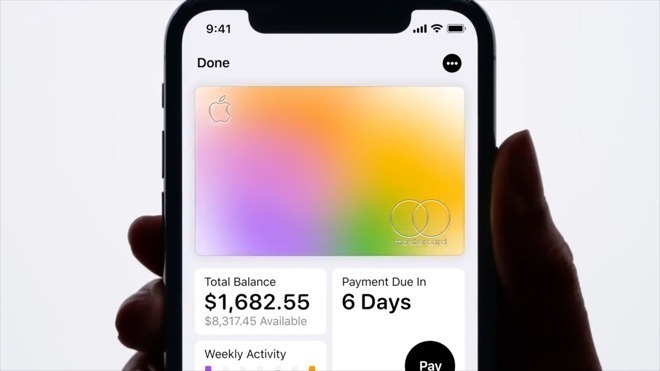

The Apple Card launched on August 20 in conjunction with Goldman Sachs. It has been designed primarily to be used with Apple Pay on the iPhone, Apple Watch, and Mac. The card features a cash-back reward system, called Daily Cash, that gives 3% back on all Apple purchases, 2% back on purchases made with Apple Pay, and 1% cash back on everything else.

David Heinemeier Hansson, creator of Ruby on Rails, has alleged that Apple and Goldman Sachs is being gender-biased against women who apply for the Apple Card.

The @AppleCard is such a fucking sexist program. My wife and I filed joint tax returns, live in a community-property state, and have been married for a long time. Yet Apple's black box algorithm thinks I deserve 20x the credit limit she does. No appeals work.

-- DHH (@dhh)

The Apple Card had recently had the most successful credit card launch ever, according to Goldman Sachs. Additionally, it was reported that the company would accept those with sub-prime credit scores.

It's not clear what has caused the wild difference in credit lines, though the statement has piqued the interest of Wall Street regulators.

"The department will be conducting an investigation to determine whether New York law was violated and ensure all consumers are treated equally regardless of sex," said a spokesman for Linda Lacewell, the superintendent of the New York Department of Financial Services, according to Bloomberg "Any algorithm, that intentionally or not results in discriminatory treatment of women or any other protected class of people violates New York law."

Goldman Sachs spokesperson, Andrew Williams, has released a statement regarding the situation.

"Our credit decisions are based on a customer's creditworthiness and not on factors like gender, race, age, sexual orientation or any other basis prohibited by law."

While not an exhaustive sample, there seems to be equivalency between the male and female members in the AppleInsider staff in regards to credit limits.

The Apple Card launched on August 20 in conjunction with Goldman Sachs. It has been designed primarily to be used with Apple Pay on the iPhone, Apple Watch, and Mac. The card features a cash-back reward system, called Daily Cash, that gives 3% back on all Apple purchases, 2% back on purchases made with Apple Pay, and 1% cash back on everything else.

Comments

Pretty sure GS is following the industry-standard law on this, but certainly it's worth looking into if there are some more detailed examples of sexist discrimination. One user who hasn't provided needed specifics is not nearly enough to treat this seriously.

is going to have any bearing on credit score when compared with past credit history. I doubt that their credit histories are anywhere near similar.

First, don't know the information credit agencies get. I'm pretty sure they don't get any tax information, or have any idea of our net worth. I'm not sure they have access to investment accounts.

In any case, except for a few special accounts, my wife and I have joint accounts.

So, when credit worthiness is determined, they are determining that decision based on our joint financial interests. I got the Apple Card.

Now, if my wife requests the Apple Card, they cannot determine her credit worthiness independent from the determination of our credit worthiness when I signed up, otherwise they would be, in some sense, doubling the estimate of our credit worthiness.

Because the Apple Card account is not issued to spouses jointly, it makes sense that the first to get the Apple Card, gets the max, while the second spouse might get denied or a minimal limit.

The solution for Apple-GS is to tie both cards together into one account by default.

There are many factors that go into a credit score, and there is no minus on your score for being a female and there is no secret conspiracy against females, and various companies, in this case, Goldman Sachs has whatever criteria they have for approving or not approving applicants.

What's his income, what's his wife's income? Just because somebody is married that doesn't mean that their credit scores or their credit limit or their history will be identical.

I've never heard of this guy before or Ruby on Rails, but I read a few of the whiny tweets and BS claims he makes and he sounds like a real SJW and he probably has a pink pussy hat in his closet.

Hilarious how much mansplaining is flowing in this thread.

I’d be surprised to learn if the team at Apple working on this wasn’t over-represented with men, or at least women who haven’t had to worry about credit approval.

So yeah, I completely stand by my original charge: @AppleCard is a sexist program.

I wasn’t even pessimistic to expect this outcome, but here we are: @AppleCard just gave my wife the VIP bump to match my credit limit, but continued to be an utter fucking failure of a customer service experience. Let me explain...

The only discrimination I see so far is that of regular users who are not "VIP", who are not able to go on twitter and whine and get Goldman Sachs to step in and give somebody a "VIP" bump.

Mansplaining (I wonder who invented *that* word; I'd be surprised… (CAUTION: You are in the no-fact zone); …a sexist program (I bet you say this a few times a day and are a really happy person).

Mike

It depends on many factors. Do they have the same amount of cards? What if the husband has 7 cards and the wife has 2?

It's not good to have too many cards and it's not good to have too few.

What if one of them uses 5% of their credit limit every month, while the other one uses 25%?

The person using 25% will have a lower score.

How many hard pulls has each of them had recently?

All of those things play into the score and the decisions when somebody applies for something.

I for one, did not know he was a VIP.